Revenue of $74.2 billion for the Third Quarter,

a 10.9 Percent Increase Year-Over-Year

Third Quarter GAAP Diluted EPS of $2.42 and

Adjusted Diluted EPS of $3.34

Adjusted Diluted EPS Guidance Range Raised to

$13.55 to $13.65 for Fiscal 2024

Cencora, Inc. (NYSE: COR) today reported that in its fiscal year

2024 third quarter ended June 30, 2024, revenue increased 10.9

percent year-over-year to $74.2 billion. On the basis of U.S.

generally accepted accounting principles (GAAP), diluted earnings

per share (EPS) was $2.42 for the third quarter of fiscal 2024

compared to $2.35 in the prior year third quarter. Adjusted diluted

EPS, which is a non-GAAP financial measure that excludes items

described below, increased 14.4 percent to $3.34 in the fiscal

third quarter from $2.92 in the prior year third quarter.

Cencora is updating its outlook for fiscal year 2024. The

Company does not provide forward-looking guidance on a GAAP basis,

as discussed below in Fiscal Year 2024 Expectations. Adjusted

diluted EPS guidance has been raised from the previous range of

$13.35 to $13.55 to a range of $13.55 to $13.65.

“We are pleased to raise our fiscal 2024 guidance following

Cencora’s strong third quarter results, as our purpose-driven team

members exhibited another quarter of solid execution against our

pharmaceutical-centric strategy,” said Steven H. Collis, Chairman,

President & Chief Executive Officer of Cencora.

“Throughout my time as Cencora’s CEO, our strategic positioning

at the center of healthcare has allowed our company to capitalize

on market growth and innovation while enhancing our capabilities to

help our customers navigate the complexity of the ever-changing

healthcare environment," Mr. Collis continued. “As I move into my

new role as Executive Chairman of the Board on October 1st, I am

incredibly proud of the growth and evolution of our enterprise, and

as COO Bob Mauch concurrently transitions into his new role of CEO,

I am confident that Cencora will continue to drive long-term value

creation for its partners and stakeholders.”

Third Quarter Fiscal Year 2024 Summary

Results

GAAP

Adjusted (Non-GAAP)

Revenue

$74.2B

$74.2B

Gross Profit

$2.4B

$2.4B

Operating Expenses

$1.7B

$1.5B

Operating Income

$672M

$878M

Interest Expense, Net

$31M

$31M

Effective Tax Rate

22.4%

21.0%

Net Income Attributable to Cencora,

Inc.

$483M

$668M

Diluted Earnings Per Share

$2.42

$3.34

Diluted Shares Outstanding

200.0M

200.0M

Below, Cencora presents descriptive summaries of the Company’s

GAAP and adjusted (non-GAAP) quarterly results. In the tables that

follow, GAAP results and GAAP to non-GAAP reconciliations are

presented. For more information related to non-GAAP financial

measures, including adjustments made in the periods presented,

please refer to the “Supplemental Information Regarding Non-GAAP

Financial Measures” following the tables.

Third Quarter GAAP

Results

- Revenue: In the third quarter of

fiscal 2024, revenue was $74.2 billion, up 10.9 percent compared to

the same quarter in the previous fiscal year, primarily due to a

12.2 percent increase in revenue within the U.S. Healthcare

Solutions segment.

- Gross Profit: Gross profit in the

third quarter of fiscal 2024 was $2.4 billion, a 6.5 percent

increase compared to the same period in the previous fiscal year,

due primarily to the increase in gross profit in the U.S.

Healthcare Solutions segment and a lower Turkey highly inflationary

impact on inventory, offset in part by lower gains from antitrust

litigation settlements. Gross profit as a percentage of revenue was

3.25 percent, a decrease of 13 basis points from the prior year

quarter due to the decline in U.S. Healthcare Solutions gross

profit margin primarily due to increased sales of products labeled

for diabetes and/or weight loss in the GLP-1 class, which have

lower profit margins.

- Operating Expenses: In the third

quarter of fiscal 2024, operating expenses were $1.7 billion, a 9.0

percent increase compared to the same quarter in the previous

fiscal year, primarily due to a litigation and opioid-related

expense in the current year period compared to a credit in the

prior year quarter, and an increase in distribution, selling, and

administrative expenses to support revenue growth.

- Operating Income: In the third

quarter of fiscal 2024, operating income of $672.5 million was

essentially flat compared to the same period in the previous fiscal

year due to the increase in gross profit, offset by the increase in

operating expenses. Operating income as a percentage of revenue was

0.91 percent in the third quarter of fiscal 2024, a decrease of 9

basis points when compared to the prior year quarter due to the

decline in gross profit margin.

- Interest Expense, Net: In the

third quarter of fiscal 2024, net interest expense of $31.3 million

decreased 45.9 percent compared to the same quarter in the previous

fiscal year due to an increase in interest income as a result of

higher investment interest rates and higher average investment cash

balances, and a decrease in interest expense driven by decreased

variable-rate borrowings and the September 2023 divestiture of our

less-than-wholly-owned subsidiary in Egypt.

- Effective Tax Rate: The effective

tax rate was 22.4 percent for the third quarter of fiscal 2024. The

effective tax rate was 21.3 percent in the prior year quarter.

- Diluted Earnings Per Share:

Diluted earnings per share was $2.42 in the third quarter of fiscal

2024, a 3.0 percent increase compared to $2.35 in the previous

fiscal year’s third quarter.

- Diluted Shares Outstanding:

Diluted weighted average shares outstanding for the third quarter

of fiscal 2024 were 200.0 million, a decrease of 2.1 percent versus

the prior fiscal year third quarter primarily due to share

repurchases.

Third Quarter Adjusted (non-GAAP)

Results

- Revenue: No adjustments were made

to the GAAP presentation of revenue. In the third quarter of fiscal

2024, revenue was $74.2 billion, up 10.9 percent compared to the

same quarter in the previous fiscal year, primarily due to a 12.2

percent increase in revenue within the U.S. Healthcare Solutions

segment.

- Adjusted Gross Profit: Adjusted

gross profit in the third quarter of fiscal 2024 was $2.4 billion,

a 6.2 percent increase compared to the same period in the previous

fiscal year due to the increase in gross profit in the U.S.

Healthcare Solutions segment. Adjusted gross profit as a percentage

of revenue was 3.19 percent in the fiscal 2024 third quarter, a

decrease of 14 basis points from the prior year quarter due to the

decline in U.S. Healthcare Solutions gross profit margin primarily

due to increased sales of products labeled for diabetes and/or

weight loss in the GLP-1 class, which have lower profit

margins.

- Adjusted Operating Expenses: In

the third quarter of fiscal 2024, adjusted operating expenses were

$1.5 billion, a 5.9 percent increase compared to the same period in

the previous fiscal year, primarily driven by an increase in

distribution, selling, and administrative expenses to support

revenue growth.

- Adjusted Operating Income: In the

third quarter of fiscal 2024, adjusted operating income was $877.7

million, a 6.7 percent increase compared to the same period in the

prior fiscal year, driven by a 9.9 percent increase in U.S.

Healthcare Solutions, partially offset by a 4.1 percent decrease in

International Healthcare Solutions. Adjusted operating income as a

percentage of revenue was 1.18 percent in the fiscal 2024 third

quarter, a decrease of 5 basis points when compared to the prior

year quarter.

- Interest Expense, Net: No

adjustments were made to the GAAP presentation of net interest

expense. In the third quarter of fiscal 2024, net interest expense

of $31.3 million decreased 45.9 percent compared to the same

quarter in the previous fiscal year due to an increase in interest

income as a result of higher investment interest rates and higher

average investment cash balances, and a decrease in interest

expense driven by decreased variable-rate borrowings and the

September 2023 divestiture of our less-than-wholly-owned subsidiary

in Egypt.

- Adjusted Effective Tax Rate: The

adjusted effective tax rate was 21.0 percent for the third quarter

of fiscal 2024 compared to 21.5 percent in the prior year

quarter.

- Adjusted Diluted Earnings Per

Share: Adjusted diluted earnings per share was $3.34 in the

third quarter of fiscal 2024, a 14.4 percent increase compared to

$2.92 in the previous fiscal year’s third quarter.

- Diluted Shares Outstanding: No

adjustments were made to the GAAP presentation of diluted shares

outstanding. Diluted weighted average shares outstanding for the

third quarter of fiscal 2024 were 200.0 million, a decrease of 2.1

percent versus the prior fiscal year third quarter primarily due to

share repurchases.

Segment Discussion

The Company is organized geographically based upon the products

and services it provides to its customers under two reportable

segments: U.S. Healthcare Solutions and International Healthcare

Solutions.

U.S. Healthcare Solutions

U.S. Healthcare Solutions revenue was $67.2 billion in the third

quarter of fiscal 2024, an increase of 12.2 percent compared to the

same quarter in the previous fiscal year due to overall market

growth primarily driven by unit volume growth, including increased

sales of products labeled for diabetes and/or weight loss in the

GLP-1 class and increased sales of specialty products to physician

practices and health systems. Segment operating income of $698.3

million in the third quarter of fiscal 2024 was up 9.9 percent

compared to the same period in the previous fiscal year reflecting

an increase in gross profit, partially offset by an increase in

operating expenses.

International Healthcare

Solutions

International Healthcare Solutions revenue of $7.1 billion in

the third quarter of fiscal 2024 was flat compared to the previous

fiscal year’s third quarter. Segment operating income in the third

quarter of fiscal 2024 was $179.4 million, a decrease of 4.1

percent, primarily due to higher information technology expenses in

our European distribution business and lower operating income at

our global specialty logistics business, partially offset by the

positive results of our Canadian business. On a constant currency

basis, International Healthcare Solutions revenue and operating

income increased by 5.8 percent and 0.8 percent, respectively.

Recent Company Highlights &

Milestones

- Cencora hosted its inaugural ThinkLive Cell and Gene Therapy

Summit, assembling leaders from across the healthcare and

biopharmaceutical industries to explore the latest developments in

Cell and Gene Therapy and strategies to drive commercial success

and enhance patient access.

- Good Neighbor Pharmacy, a national franchise for independent

pharmacies offered through Cencora, announced that it has been

ranked “#1 in Customer Satisfaction with Chain Drug Store

Pharmacies” in the J.D. Power 2024 U.S. Pharmacy Study. This is the

thirteenth time that Good Neighbor Pharmacy has earned this

recognition in the last 15 years and the network's eighth

consecutive win. In July, Good Neighbor Pharmacy hosted its annual

ThoughtSpot tradeshow conference, which provided members the

opportunity to collaborate, learn and discover new resources to

help them deliver patient care and advance the health of their

communities.

- Disability:IN announced that Cencora earned the recognition of

a “Best Place to Work for Disability Inclusion” for the second year

in a row based on the company’s score on the Disability Equality

Index.

Fiscal Year 2024

Expectations

The Company does not provide forward-looking guidance on a GAAP

basis as certain financial information, the probable significance

of which cannot be determined, is not available or cannot be

reasonably estimated. Please refer to the Supplemental Information

Regarding Non-GAAP Financial Measures following the tables for

additional information.

Fiscal Year 2024 Expectations on an

Adjusted (non-GAAP) Basis

Cencora is updating its fiscal year 2024 financial guidance to

reflect expected continued strong business performance in the U.S.

Healthcare Solutions segment, tapered expectations in the

International Healthcare Solutions segment and a lower net interest

expense. The Company now expects:

- Revenue growth to be approximately 12 percent, from the

previous range of 10 to 12 percent;

- U.S. Healthcare Solutions revenue growth to be in the range of

12 to 13 percent, from the previous range of 11 to 13 percent;

- International Healthcare Solutions revenue growth to be in the

range of 4 to 6 percent, from the previous range of 4 to 7

percent;

- Adjusted diluted earnings per share to be in the range of

$13.55 to $13.65, up from the previous range of $13.35 to

$13.55.

Additional expectations now include:

- Adjusted consolidated operating income growth to be in the

range of 10 to 11 percent, from the previous range of 9 to 11

percent;

- U.S. Healthcare Solutions segment operating income growth to be

in the range of 11 to 12 percent, from the previous range of 10 to

12 percent;

- International Healthcare Solutions segment operating income

growth to be in the range of 5 to 7 percent, from the previous

range of 5 to 8 percent;

- Net interest expense to be in the range of $170 million to $190

million, from the previous range of $185 million to $215

million;

- Adjusted free cash flow to be in the range of $2.5 billion to

$3.0 billion, up from the previous expectation of approximately

$2.5 billion; and

- Weighted average diluted shares outstanding are expected to be

under 201 million, from the previous range of approximately 201 to

202 million;

For additional details regarding updated guidance expectations

on a constant currency basis, please refer to our slide

presentation for investors.

Dividend Declaration

The Company’s Board of Directors declared a quarterly cash

dividend of $0.51 per common share, payable August 26, 2024, to

stockholders of record at the close of business on August 9,

2024.

Conference Call & Slide

Presentation

The Company will host a conference call to discuss its operating

results at 8:30 a.m. ET on July 31, 2024. A slide presentation for

investors has also been posted on the Company’s website at

investor.cencora.com. Participating in the conference call will

be:

- Steven H. Collis, Chairman, President & Chief Executive

Officer

- James F. Cleary, Executive Vice President & Chief Financial

Officer

- Robert P. Mauch, Executive Vice President & Chief Operating

Officer

The dial-in number for the live call will be (833) 470-1428.

From outside the United States and Canada, dial +1 (404) 975-4839.

The access code for the call will be 393872. The live call will

also be webcast via the Company’s website at investor.cencora.com.

Users are encouraged to log on to the webcast approximately 10

minutes in advance of the scheduled start time of the call.

Replays of the call will be made available via telephone and

webcast. A replay of the webcast will be posted on

investor.cencora.com approximately one hour after the completion of

the call and will remain available for one year. The telephone

replay will also be available approximately one hour after the

completion of the call and will remain available for seven days. To

access the telephone replay from within the U.S. and Canada, dial

(866) 813-9403. From outside the United States, dial +1 (929)

458-6194. The access code for the replay is 371683.

Upcoming Investor Event

Cencora management will be attending the following investor

events in the coming months:

- Morgan Stanley Global Healthcare Conference, September 5,

2024;

- Wells Fargo Healthcare Conference, September 6, 2024; and

- Baird Healthcare Conference, September 11, 2024.

Please check the website for updates regarding the timing of the

live presentation webcasts, if any, and for replay information.

About Cencora

Cencora is a leading global pharmaceutical solutions

organization centered on improving the lives of people and animals

around the world. We partner with pharmaceutical innovators across

the value chain to facilitate and optimize market access to

therapies. Care providers depend on us for the secure, reliable

delivery of pharmaceuticals, healthcare products, and solutions.

Our 46,000+ worldwide team members contribute to positive health

outcomes through the power of our purpose: We are united in our

responsibility to create healthier futures. Cencora is ranked #10

on the Fortune 500 and #24 on the Global Fortune 500 with more than

$250 billion in annual revenue. Learn more at

investor.cencora.com

Cencora’s Cautionary Note Regarding Forward-Looking

Statements

Certain of the statements contained in this press release are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Securities

Exchange Act”). Words such as “aim,” “anticipate,” “believe,”

“can,” “continue,” “could,”, “estimate,” "expect," “intend,” “may,”

“might,” “on track,” “opportunity,” “plan,” “possible,”

“potential,” “predict,” “project,” “seek,” “should,” “strive,”

“sustain,” “synergy,” “target,” “will,” “would” and similar

expressions are intended to identify forward-looking statements,

but the absence of these words does not mean that a statement is

not forward-looking. These statements are based on management’s

current expectations and are subject to uncertainty and changes in

circumstances and speak only as of the date hereof. These

statements are not guarantees of future performance and are based

on assumptions and estimates that could prove incorrect or could

cause actual results to vary materially from those indicated. A

more detailed discussion of the risks and uncertainties that could

cause our actual results to differ materially from those indicated

is included in (i) the “Risk Factors” and “Management’s Discussion

and Analysis” sections in the Company’s Annual Report on Form 10-K

for the fiscal year ended September, 30, 2023 and elsewhere in that

report and (ii) other reports filed by the Company pursuant to the

Securities Exchange Act. The Company undertakes no obligation to

publicly update or revise any forward-looking statements, except as

required by the federal securities laws.

CENCORA, INC.

FINANCIAL SUMMARY

(in thousands, except per share

data)

(unaudited)

Three Months Ended June

30, 2024

% of

Revenue

Three Months Ended June

30, 2023

% of

Revenue

%

Change

Revenue

$

74,241,353

$

66,947,043

10.9%

Cost of goods sold

71,830,576

64,682,397

11.1%

Gross profit 1

2,410,777

3.25%

2,264,646

3.38%

6.5%

Operating expenses:

Distribution, selling, and

administrative

1,383,206

1.86%

1,304,141

1.95%

6.1%

Depreciation and amortization

272,595

0.37%

274,272

0.41%

(0.6)%

Litigation and opioid-related expenses

(credit), net 2

14,485

(67,102

)

Acquisition-related deal and integration

expenses

25,758

19,283

Restructuring and other expenses

42,257

63,924

Total operating expenses

1,738,301

2.34%

1,594,518

2.38%

9.0%

Operating income

672,476

0.91%

670,128

1.00%

0.4%

Other loss, net

12,814

3,436

Interest expense, net

31,328

57,864

(45.9)%

Income before income taxes

628,334

0.85%

608,828

0.91%

3.2%

Income tax expense

140,740

129,615

Net income

487,594

0.66%

479,213

0.72%

1.7%

Net (income) loss attributable to

noncontrolling interests

(4,131

)

368

Net income attributable to Cencora,

Inc.

$

483,463

0.65%

$

479,581

0.72%

0.8%

Earnings per share:

Basic

$

2.44

$

2.37

3.0%

Diluted

$

2.42

$

2.35

3.0%

Weighted average common shares

outstanding:

Basic

198,260

202,349

(2.0)%

Diluted

200,047

204,375

(2.1)%

________________________

1

Includes a $51.6 million gain

from antitrust litigation settlements, a $6.8 million LIFO expense,

and Turkey foreign currency remeasurement expense of $3.6 million

in the three months ended June 30, 2024. Includes a $118.6 million

gain from antitrust litigation settlements, a $35.0 million LIFO

expense, and Turkey foreign currency remeasurement expense of $50.6

million in the three months ended June 30, 2023.

2

Includes the receipt of $83.4

million from the H.D. Smith opioid litigation indemnity escrow in

the three months ended June 30, 2023.

CENCORA, INC.

FINANCIAL SUMMARY

(in thousands, except per share

data)

(unaudited)

Nine Months Ended June

30, 2024

% of

Revenue

Nine Months Ended June

30, 2023

% of

Revenue

%

Change

Revenue

$

214,908,493

$

193,251,080

11.2%

Cost of goods sold

207,490,881

186,545,039

11.2%

Gross profit 1

7,417,612

3.45%

6,706,041

3.47%

10.6%

Operating expenses:

Distribution, selling, and

administrative

4,170,763

1.94%

3,916,156

2.03%

6.5%

Depreciation and amortization

814,930

0.38%

687,678

0.36%

18.5%

Litigation and opioid-related expenses

(credit), net 2

161,553

(38,583

)

Acquisition-related deal and integration

expenses

69,431

99,392

Restructuring and other expenses

152,325

177,608

Total operating expenses

5,369,002

2.50%

4,842,251

2.51%

10.9%

Operating income

2,048,610

0.95%

1,863,790

0.96%

9.9%

Other loss (income), net

33,790

(18,612

)

Interest expense, net

136,022

167,989

(19.0)%

Income before income taxes

1,878,798

0.87%

1,714,413

0.89%

9.6%

Income tax expense

366,991

330,817

Net income

1,511,807

0.70%

1,383,596

0.72%

9.3%

Net (income) loss attributable to

noncontrolling interests

(6,069

)

11,132

Net income attributable to Cencora,

Inc.

$

1,505,738

0.70%

$

1,394,728

0.72%

8.0%

Earnings per share:

Basic

$

7.56

$

6.87

10.0%

Diluted

$

7.49

$

6.80

10.1%

Weighted average common shares

outstanding:

Basic

199,253

202,908

(1.8)%

Diluted

201,025

204,995

(1.9)%

________________________

1

Includes a $108.6 million gain

from antitrust litigation settlements, a $64.4 million LIFO credit,

and Turkey foreign currency remeasurement expense of $43.9 million

in the nine months ended June 30, 2024. Includes a $168.5 million

gain from antitrust litigation settlements, a $114.3 million LIFO

expense, and Turkey foreign currency remeasurement expense of $59.0

million in the nine months ended June 30, 2023.

2

The nine months ended June 30,

2024 includes a $214.0 million opioid litigation accrual, offset in

part by a $92.2 million opioid settlement accrual reduction

primarily as a result of the Company's prepayment of the net

present value of a future obligation as permitted under its opioid

settlement agreements. The nine months ended June 30, 2023 includes

the receipt of $83.4 million from the H.D. Smith opioid litigation

indemnity escrow.

CENCORA, INC.

GAAP TO NON-GAAP

RECONCILIATIONS

(in thousands, except per share

data)

(unaudited)

Three Months Ended June 30,

2024

Gross Profit

Operating Expenses

Operating Income

Income Before Income

Taxes

Income Tax

Expense

Net Income

Attributable

to Cencora

Diluted Earnings Per

Share

GAAP

$

2,410,777

$

1,738,301

$

672,476

$

628,334

$

140,740

$

483,463

$

2.42

Gains from antitrust litigation

settlements

(51,605

)

—

(51,605

)

(51,605

)

(12,095

)

(39,510

)

(0.20

)

LIFO expense

6,839

—

6,839

6,839

2,499

4,340

0.02

Turkey highly inflationary impact

3,636

—

3,636

4,535

—

4,535

0.02

Acquisition-related intangibles

amortization

—

(163,850

)

163,850

163,850

36,729

126,687

0.63

Litigation and opioid-related expenses

—

(14,485

)

14,485

14,485

4,811

9,674

0.05

Acquisition-related deal and integration

expenses

—

(25,758

)

25,758

25,758

5,438

20,320

0.10

Restructuring and other expenses

—

(42,257

)

42,257

42,257

9,706

32,551

0.16

Loss on remeasurement of equity

investment

—

—

—

13,321

—

13,321

0.07

Other, net

—

—

—

4,638

820

3,818

0.02

Tax reform 1

—

—

—

(536

)

(9,753

)

9,217

0.05

Adjusted Non-GAAP

$

2,369,647

$

1,491,951

$

877,696

$

851,876

$

178,895

$

668,416

$

3.34

Adjusted Non-GAAP % change vs. prior

year

6.2

%

5.9

%

6.7

%

12.1

%

9.5

%

12.1

%

14.4

%

Percentages of Revenue:

GAAP

Adjusted

Non-GAAP

Gross profit

3.25%

3.19%

Operating expenses

2.34%

2.01%

Operating income

0.91%

1.18%

________________________

1

Includes tax expense relating to

2020 Swiss tax reform and the currency remeasurement of the related

deferred tax assets, the latter of which is recorded within Other

Loss, Net.

Note: For more information related to

non-GAAP financial measures, refer to the section titled

“Supplemental Information Regarding Non-GAAP Financial Measures” of

this release.

CENCORA, INC.

GAAP TO NON-GAAP

RECONCILIATIONS

(in thousands, except per share

data)

(unaudited)

Three Months Ended June 30,

2023

Gross Profit

Operating Expenses

Operating Income

Income Before Income

Taxes

Income Tax

Expense

Net Income

Attributable

to Cencora

Diluted Earnings Per

Share

GAAP

$

2,264,646

$

1,594,518

$

670,128

$

608,828

$

129,615

$

479,581

$

2.35

Gains from antitrust litigation

settlements

(118,611

)

—

(118,611

)

(118,611

)

(27,518

)

(91,093

)

(0.45

)

LIFO expense

34,952

—

34,952

34,952

8,037

26,915

0.13

Turkey highly inflationary impact

50,580

—

50,580

57,581

—

57,581

0.28

Acquisition-related intangibles

amortization

—

(169,154

)

169,154

169,154

39,087

129,098

0.63

Litigation and opioid-related credit, net

1

—

67,102

(67,102

)

(67,102

)

3,750

(70,852

)

(0.35

)

Acquisition-related deal and integration

expenses

—

(19,283

)

19,283

19,283

4,393

14,890

0.07

Restructuring and other expenses

—

(63,924

)

63,924

63,924

14,733

49,191

0.24

Recovery of non-customer note

receivable

—

—

—

(3,000

)

—

(3,000

)

(0.01

)

Tax reform 2

—

—

—

(4,823

)

(8,748

)

3,925

0.02

Adjusted Non-GAAP

$

2,231,567

$

1,409,259

$

822,308

$

760,186

$

163,349

$

596,236

$

2.92

3

Percentages of Revenue:

GAAP

Adjusted

Non-GAAP

Gross profit

3.38%

3.33%

Operating expenses

2.38%

2.11%

Operating income

1.00%

1.23%

________________________

1

Includes the receipt of $83.4 million from

the H.D. Smith opioid litigation indemnity escrow.

2

Includes tax expense relating to 2020

Swiss tax reform and the currency remeasurement of the related

deferred tax assets, the latter of which is recorded within Other

Loss, Net.

3

The sum of the components does not equal

the total due to rounding.

Note: For more information related to

non-GAAP financial measures, refer to the section titled

“Supplemental Information Regarding Non-GAAP Financial Measures” of

this release.

CENCORA, INC.

GAAP TO NON-GAAP

RECONCILIATIONS

(in thousands, except per share

data)

(unaudited)

Nine Months Ended June 30,

2024

Gross Profit

Operating Expenses

Operating Income

Income Before Income

Taxes

Income Tax

Expense

Net Income

Attributable

to Cencora

Diluted Earnings Per

Share

GAAP

$

7,417,612

$

5,369,002

$

2,048,610

$

1,878,798

$

366,991

$

1,505,738

$

7.49

Gains from antitrust litigation

settlements

(108,567

)

—

(108,567

)

(108,567

)

(26,810

)

(81,757

)

(0.41

)

LIFO credit

(64,441

)

—

(64,441

)

(64,441

)

(15,914

)

(48,527

)

(0.24

)

Turkey highly inflationary impact

43,915

—

43,915

44,664

—

44,664

0.22

Acquisition-related intangibles

amortization

—

(494,373

)

494,373

494,373

122,086

370,985

1.85

Litigation and opioid-related expenses,

net 1

—

(161,553

)

161,553

161,553

43,876

117,677

0.59

Acquisition-related deal and integration

expenses

—

(69,431

)

69,431

69,431

17,146

52,285

0.26

Restructuring and other expenses

—

(152,325

)

152,325

152,325

33,622

118,703

0.59

Loss on remeasurement of equity

investment

—

—

—

24,752

—

24,752

0.12

Other, net

—

—

—

11,010

1,627

9,383

0.05

Tax reform and discrete tax items 2

—

—

—

(3,991

)

14,989

(18,980

)

(0.09

)

Adjusted Non-GAAP

$

7,288,519

$

4,491,320

$

2,797,199

$

2,659,907

$

557,613

$

2,094,923

$

10.42

3

Adjusted Non-GAAP % change vs. prior

year

8.6

%

6.4

%

12.4

%

14.4

%

20.9

%

12.0

%

14.1

%

Percentages of Revenue:

GAAP

Adjusted

Non-GAAP

Gross profit

3.45%

3.39%

Operating expenses

2.50%

2.09%

Operating income

0.95%

1.30%

________________________

1

Includes a $214.0 million opioid

litigation accrual, offset in part by a $92.2 million opioid

settlement accrual reduction primarily as a result of the Company's

prepayment of the net present value of a future obligation as

permitted under its opioid settlement agreements.

2

Includes a tax benefit attributable to an

adjustment of the Swiss valuation allowance (due to an increase in

projected Swiss income and DTA utilization), tax expense relating

to 2020 Swiss tax reform, and the currency remeasurement of the

related deferred tax assets, the latter of which is recorded within

Other Loss (Income), Net.

3

The sum of the components does not equal

the total due to rounding.

Note: For more information related to

non-GAAP financial measures, refer to the section titled

“Supplemental Information Regarding Non-GAAP Financial Measures” of

this release.

CENCORA, INC.

GAAP TO NON-GAAP

RECONCILIATIONS

(in thousands, except per share

data)

(unaudited)

Nine Months Ended June 30,

2023

Gross Profit

Operating Expenses

Operating Income

Income Before Income

Taxes

Income Tax Expense

Net Income

Attributable

to Cencora

Diluted Earnings

Per Share

GAAP

$

6,706,041

$

4,842,251

$

1,863,790

$

1,714,413

$

330,817

$

1,394,728

$

6.80

Gains from antitrust litigation

settlements

(168,510

)

—

(168,510

)

(168,510

)

(39,175

)

(129,335

)

(0.63

)

LIFO expense

114,272

—

114,272

114,272

26,566

87,706

0.43

Turkey highly inflationary impact

59,019

—

59,019

66,022

—

66,022

0.32

Acquisition-related intangibles

amortization

—

(381,146

)

381,146

381,146

88,609

289,426

1.41

Litigation and opioid-related credit, net

1

—

38,583

(38,583

)

(38,583

)

10,412

(48,995

)

(0.24

)

Acquisition-related deal and integration

expenses

—

(99,392

)

99,392

99,392

23,107

76,285

0.37

Restructuring and other expenses

—

(177,608

)

177,608

177,608

41,290

136,318

0.66

Foreign currency gain

—

—

—

(5,663

)

—

(5,663

)

(0.03

)

Recovery of non-customer note

receivable

—

—

—

(4,148

)

—

(4,148

)

(0.02

)

Tax reform 2

—

—

—

(11,462

)

(20,356

)

8,894

0.04

Adjusted Non-GAAP

$

6,710,822

$

4,222,688

$

2,488,134

$

2,324,487

$

461,270

$

1,871,238

$

9.13

3

Percentages of Revenue:

GAAP

Adjusted

Non-GAAP

Gross profit

3.47%

3.47%

Operating expenses

2.51%

2.19%

Operating income

0.96%

1.29%

________________________

1

Includes the receipt of $83.4 million from

the H.D. Smith opioid litigation indemnity escrow.

2

Tax expense relating to 2020 Swiss tax

reform and the currency remeasurement of the related deferred tax

assets, the latter of which is recorded within Other Loss (Income),

Net.

3

The sum of the components does not equal

the total due to rounding.

Note: For more information related to

non-GAAP financial measures, refer to the section titled

“Supplemental Information Regarding Non-GAAP Financial Measures” of

this release.

CENCORA, INC.

SUMMARY SEGMENT INFORMATION

(in thousands)

(unaudited)

Three Months Ended June

30,

Revenue

2024

2023

% Change

U.S. Healthcare Solutions

$

67,191,598

$

59,900,199

12.2%

International Healthcare Solutions

7,051,876

7,047,777

0.1%

Intersegment eliminations

(2,121

)

(933

)

Revenue

$

74,241,353

$

66,947,043

10.9%

Three Months Ended June

30,

Operating income

2024

2023

% Change

U.S. Healthcare Solutions

$

698,305

$

635,176

9.9%

International Healthcare Solutions

179,391

187,132

(4.1)%

Total segment operating income

877,696

822,308

6.7%

Gains from antitrust litigation

settlements

51,605

118,611

LIFO expense

(6,839

)

(34,952

)

Turkey highly inflationary impact

(3,636

)

(50,580

)

Acquisition-related intangibles

amortization

(163,850

)

(169,154

)

Litigation and opioid-related (expenses)

credit, net

(14,485

)

67,102

Acquisition-related deal and integration

expenses

(25,758

)

(19,283

)

Restructuring and other expenses

(42,257

)

(63,924

)

Operating income

$

672,476

$

670,128

0.4%

Percentages of Revenue:

U.S. Healthcare Solutions

Gross profit

2.30

%

2.36

%

Operating expenses

1.26

%

1.29

%

Operating income

1.04

%

1.06

%

International Healthcare Solutions

Gross profit

11.68

%

11.65

%

Operating expenses

9.14

%

8.99

%

Operating income

2.54

%

2.66

%

Cencora, Inc. (GAAP)

Gross profit

3.25

%

3.38

%

Operating expenses

2.34

%

2.38

%

Operating income

0.91

%

1.00

%

Cencora, Inc. (Non-GAAP)

Adjusted gross profit

3.19

%

3.33

%

Adjusted operating expenses

2.01

%

2.11

%

Adjusted operating income

1.18

%

1.23

%

Note: For more information related to

non-GAAP financial measures, refer to the section titled

“Supplemental Information Regarding Non-GAAP Financial Measures” of

this release.

CENCORA, INC.

SUMMARY SEGMENT INFORMATION

(in thousands)

(unaudited)

Nine Months Ended June

30,

Revenue

2024

2023

% Change

U.S. Healthcare Solutions

$

193,668,297

$

172,830,234

12.1%

International Healthcare Solutions

21,245,488

20,423,990

4.0%

Intersegment eliminations

(5,292

)

(3,144

)

Revenue

$

214,908,493

$

193,251,080

11.2%

Nine Months Ended June

30,

Operating income

2024

2023

% Change

U.S. Healthcare Solutions

$

2,237,493

$

1,963,729

13.9%

International Healthcare Solutions

559,706

524,405

6.7%

Total segment operating income

2,797,199

2,488,134

12.4%

Gains from antitrust litigation

settlements

108,567

168,510

LIFO credit (expense)

64,441

(114,272

)

Turkey highly inflationary impact

(43,915

)

(59,019

)

Acquisition-related intangibles

amortization

(494,373

)

(381,146

)

Litigation and opioid-related (expenses)

credit, net

(161,553

)

38,583

Acquisition-related deal and integration

expenses

(69,431

)

(99,392

)

Restructuring and other expenses

(152,325

)

(177,608

)

Operating income

$

2,048,610

$

1,863,790

9.9%

Percentages of Revenue:

U.S. Healthcare Solutions

Gross profit

2.48

%

2.52

%

Operating expenses

1.32

%

1.38

%

Operating income

1.16

%

1.14

%

International Healthcare Solutions

Gross profit

11.73

%

11.57

%

Operating expenses

9.10

%

9.00

%

Operating income

2.63

%

2.57

%

Cencora, Inc. (GAAP)

Gross profit

3.45

%

3.47

%

Operating expenses

2.50

%

2.51

%

Operating income

0.95

%

0.96

%

Cencora, Inc. (Non-GAAP)

Adjusted gross profit

3.39

%

3.47

%

Adjusted operating expenses

2.09

%

2.19

%

Adjusted operating income

1.30

%

1.29

%

Note: For more information related to

non-GAAP financial measures, refer to the section titled

“Supplemental Information Regarding Non-GAAP Financial Measures” of

this release.

CENCORA, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands)

(unaudited)

June 30,

September 30,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

3,306,200

$

2,592,051

Accounts receivable, net

24,051,478

20,911,081

Inventories

18,301,546

17,454,768

Right to recover assets

1,143,731

1,314,857

Prepaid expenses and other

504,307

526,069

Total current assets

47,307,262

42,798,826

Property and equipment, net

2,080,879

2,135,171

Goodwill and other intangible assets

13,624,563

14,005,900

Deferred income taxes

229,653

200,667

Other long-term assets

3,530,066

3,418,182

Total assets

$

66,772,423

$

62,558,746

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

49,883,049

$

45,836,037

Accrued expenses and other

2,525,710

2,353,817

Short-term debt

565,108

641,344

Total current liabilities

52,973,867

48,831,198

Long-term debt

4,165,910

4,146,113

Accrued income taxes

332,364

310,676

Deferred income taxes

1,607,661

1,657,944

Accrued litigation liability

4,697,695

5,061,795

Other long-term liabilities

1,934,423

1,884,733

Total equity

1,060,503

666,287

Total liabilities and stockholders’

equity

$

66,772,423

$

62,558,746

CENCORA, INC.

CONDENSED CONSOLIDATED STATEMENTS

OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended June

30,

2024

2023

Operating Activities:

Net income

$

1,511,807

$

1,383,596

Adjustments to reconcile net income to net

cash provided by operating activities

897,333

899,803

Changes in operating assets and

liabilities, excluding the effects of acquisitions:

Accounts receivable

(3,085,563

)

(2,249,881

)

Inventories

(835,633

)

(1,369,977

)

Accounts payable

4,112,542

3,513,686

Other, net

(116,180

)

(92,704

)

Net cash provided by operating

activities

2,484,306

2,084,523

Investing Activities:

Capital expenditures

(304,849

)

(282,862

)

Cost of acquired companies, net of cash

acquired 1

(24,487

)

(1,409,681

)

Cost of equity investments 2

(14,981

)

(737,025

)

Non-customer note receivable

(50,000

)

—

Other, net

18,106

10,544

Net cash used in investing activities

(376,211

)

(2,419,024

)

Financing Activities:

Net debt repayments

(31,921

)

(581,557

)

Purchases of common stock

(986,388

)

(907,214

)

Exercises of stock options

31,560

50,078

Cash dividends on common stock

(315,223

)

(300,413

)

Employee tax withholdings related to

restricted share vesting

(60,121

)

(71,059

)

Other, net

(11,641

)

(5,099

)

Net cash used in financing activities

(1,373,734

)

(1,815,264

)

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

(10,854

)

104,479

Increase (decrease) in cash, cash

equivalents, and restricted cash

723,507

(2,045,286

)

Cash, cash equivalents, and restricted

cash at beginning of period 3

2,752,889

3,593,539

Cash, cash equivalents, and restricted

cash at end of period 3

$

3,476,396

$

1,548,253

________________________

1

Includes $1,406.3 million for the

acquisition of PharmaLex in the nine months ended June 30,

2023.

2

Includes a $718.4 million

investment in OneOncology in the nine months ended June 30,

2023.

3

The following represents a

reconciliation of cash and cash equivalents in the Condensed

Consolidated Balance Sheets to cash, cash equivalents, and

restricted cash used in the Condensed Consolidated Statements of

Cash Flows:

June 30, 2024

September 30,

2023

June 30, 2023

September 30,

2022

Cash and cash equivalents

$

3,306,200

$

2,592,051

$

1,389,345

$

3,388,189

Restricted cash (included in Prepaid

Expenses and Other)

104,463

97,722

96,623

144,980

Restricted cash (included in Other

Long-Term Assets)

65,733

63,116

62,285

60,370

Cash, cash equivalents, and restricted

cash

$

3,476,396

$

2,752,889

$

1,548,253

$

3,593,539

SUPPLEMENTAL INFORMATION REGARDING

NON-GAAP FINANCIAL MEASURES

To supplement the financial measures prepared in accordance with

U.S. generally accepted accounting principles (GAAP), the Company

uses the non-GAAP financial measures described below. The non-GAAP

financial measures should be viewed in addition to, and not in lieu

of, financial measures calculated in accordance with GAAP. These

supplemental measures may vary from, and may not be comparable to,

similarly titled measures by other companies.

The non-GAAP financial measures are presented because management

uses non-GAAP financial measures to evaluate the Company’s

operating performance, to perform financial planning, and to

determine incentive compensation. Therefore, the Company believes

that the presentation of non-GAAP financial measures provides

useful supplementary information to, and facilitates additional

analysis by, investors. The presented non-GAAP financial measures

exclude items that management does not believe reflect the

Company’s core operating performance because such items are outside

the control of the Company or are inherently unusual,

non-operating, unpredictable, non-recurring, or non-cash. We have

included the following non-GAAP earnings-related financial measures

in this release:

- Adjusted gross profit and adjusted gross profit margin:

Adjusted gross profit is a non-GAAP financial measure that excludes

gains from antitrust litigation settlements, LIFO expense (credit),

and Turkey highly inflationary impact. Adjusted gross profit margin

is the ratio of adjusted gross profit to total revenue. Management

believes that these non-GAAP financial measures are useful to

investors as a supplemental measure of the Company’s ongoing

operating performance. Gains from antitrust litigation settlements,

LIFO expense (credit), and Turkey highly inflationary impact are

excluded because the Company cannot control the amounts recognized

or timing of these items. Gains from antitrust litigation

settlements relate to the settlement of lawsuits that have been

filed against brand pharmaceutical manufacturers alleging that the

manufacturer, by itself or in concert with others, took improper

actions to delay or prevent generic drugs from entering the market.

LIFO expense (credit) is affected by changes in inventory

quantities, product mix, and manufacturer pricing practices, which

may be impacted by market and other external influences.

- Adjusted operating expenses and adjusted operating expense

margin: Adjusted operating expenses is a non-GAAP financial measure

that excludes acquisition-related intangibles amortization;

litigation and opioid-related expenses, net; acquisition-related

deal and integration expenses; and restructuring and other

expenses. Adjusted operating expense margin is the ratio of

adjusted operating expenses to total revenue. Acquisition-related

intangibles amortization is excluded because it is a non-cash item

and does not reflect the operating performance of the acquired

companies. We exclude acquisition-related deal and integration

expenses and restructuring and other expenses that relate to

unpredictable and/or non-recurring business activities. We exclude

the amount of litigation and opioid-related expenses, net that is

unusual, non-operating, unpredictable, non-recurring or non-cash in

nature because we believe these exclusions facilitate the analysis

of our ongoing operational performance.

- Adjusted operating income and adjusted operating income margin:

Adjusted operating income is a non-GAAP financial measure that

excludes the same items that are described above and excluded from

adjusted gross profit and adjusted operating expenses. Adjusted

operating income margin is the ratio of adjusted operating income

to total revenue. Management believes that these non-GAAP financial

measures are useful to investors as a supplemental way to evaluate

the Company’s performance because the adjustments are unusual,

non-operating, unpredictable, non-recurring or non-cash in

nature.

- Adjusted income before income taxes: Adjusted income before

income taxes is a non-GAAP financial measure that excludes the same

items that are described above and excluded from adjusted operating

income. In addition, the loss on remeasurement of an equity

investment, the recovery of a non-customer note receivable, a

foreign currency gain, and the gain (loss) on the currency

remeasurement of the deferred tax asset relating to 2020 Swiss tax

reform are excluded from adjusted income before income taxes

because these amounts are unusual, non-operating, and

non-recurring. Management believes that this non-GAAP financial

measure is useful to investors because it facilitates the

calculation of the Company’s adjusted effective tax rate.

- Adjusted income tax expense: Adjusted income tax expense is a

non-GAAP financial measure that excludes the income tax expense

associated with the same items that are described above and

excluded from adjusted income before income taxes. Certain discrete

tax expense (benefits) are also excluded from adjusted income tax

expense. Further, certain expenses relating to 2020 Swiss tax

reform are excluded from adjusted income tax expense for the nine

months ended June 30, 2024 and 2023. Management believes that this

non-GAAP financial measure is useful to investors as a supplemental

way to evaluate the Company’s performance because the adjustments

are unusual, non-operating, unpredictable, non-recurring or

non-cash in nature.

- Adjusted effective tax rate: Adjusted effective tax rate is a

non-GAAP financial measure that is determined by dividing adjusted

income tax expense by adjusted income before income taxes.

Management believes that this non-GAAP financial measure is useful

to investors because it presents an effective tax rate that does

not reflect unusual, non-operating, unpredictable, non-recurring,

or non-cash amounts or items that are outside the control of the

Company.

- Adjusted net income attributable to Cencora: Adjusted net

income attributable to the Company is a non-GAAP financial measure

that excludes the same items that are described above. Management

believes that this non-GAAP financial measure is useful to

investors as a supplemental way to evaluate the Company’s

performance because the adjustments are unusual, non-operating,

unpredictable, non-recurring or non-cash in nature.

- Adjusted diluted earnings per share: Adjusted diluted earnings

per share excludes the per share impact of adjustments including

gains from antitrust litigation settlements; LIFO expense (credit);

Turkey highly inflationary impact; acquisition-related intangibles

amortization; litigation and opioid-related expenses, net;

acquisition-related deal and integration expenses; restructuring

and other expenses; the loss on remeasurement of an equity

investment; recovery of a non-customer note receivable; a foreign

currency gain; and the gain (loss) on the currency remeasurement

related to 2020 Swiss tax reform, in each case net of the tax

effect calculated using the applicable effective tax rate for those

items. In addition, the per share impact of certain discrete tax

items, and the per share impact of certain expenses relating to

2020 Swiss tax reform for the nine months ended June 30, 2024 and

2023 are also excluded from adjusted diluted earnings per share.

Management believes that this non-GAAP financial measure is useful

to investors because it eliminates the per share impact of the

items that are outside the control of the Company or that we

consider to not be indicative of our ongoing operating performance

due to their inherent unusual, non-operating, unpredictable,

non-recurring, or non-cash nature.

- Adjusted Free Cash Flow: Adjusted free cash flow is a non-GAAP

financial measure defined as net cash provided by operating

activities, excluding significant unpredictable or non-recurring

cash payments or receipts relating to legal settlements, minus

capital expenditures. Adjusted free cash flow is used internally by

management for measuring operating cash flow generation and setting

performance targets and has historically been used as one of the

means of providing guidance on possible future cash flows. For the

nine months ended June 30, 2024, adjusted free cash flow of

$2,308.6 million consisted of net cash provided by operating

activities of $2,484.3 million plus $237.7 million for the

prepayment of a future obligation as permitted under our opioid

settlement agreements, minus capital expenditures of $304.8 million

and gains from antitrust litigation settlements of $108.6 million.

The Company does not provide forward looking guidance on a GAAP

basis for free cash flow because the timing and amount of favorable

and unfavorable settlements excluded from this metric, the probable

significance of which cannot be determined, are unavailable and

cannot be reasonably estimated.

The Company also presents certain information related to current

period operating results in “constant currency,” which is a

non-GAAP financial measure. These amounts are calculated by

translating current period results at the foreign currency exchange

rates used in the comparable period in the prior year. The Company

presents such constant currency financial information because it

has significant operations outside of the United States reporting

in currencies other than the U.S. dollar and this presentation

provides a framework to assess how its business performed excluding

the impact of foreign currency exchange rate fluctuations. For the

third quarter of fiscal 2024, (i) revenue of $74.2 billion was

negatively impacted by foreign currency translation of $407.8

million, resulting in revenue on a constant currency basis of $74.6

billion, and (ii) operating income of $877.7 million was negatively

impacted by foreign currency translation of $9.2 million, resulting

in operating income on a constant currency basis of $886.9 million.

For the third quarter of fiscal 2024 in the International

Healthcare Solutions segment, (i) revenue of $7.1 billion was

negatively impacted by foreign currency translation of $407.8

million, resulting in revenue on a constant currency basis of $7.5

billion, and (ii) operating income of $179.4 million was negatively

impacted by foreign currency translation of $9.2 million, resulting

in operating income on a constant currency basis of $188.6 million.

For the nine months ended June 30, 2024 (i) revenue of $214.9

billion was negatively impacted by foreign currency translation of

$831.4 million, resulting in revenue on a constant currency basis

of $215.7 billion, and (ii) operating income of $2,797.2 million

was negatively impacted by foreign currency translation of $37.7

million, resulting in operating income on a constant currency basis

of $2,835.0 million. For the nine months ended June 30, 2024, in

the International Healthcare Solutions segment, (i) revenue of

$21.2 billion was negatively impacted by foreign currency

translation of $831.4 million, resulting in revenue on a constant

currency basis of $22.1 billion, and (ii) operating income of

$559.7 million was negatively impacted by foreign currency

translation of $37.7 million, resulting in operating income on a

constant currency basis of $597.4 million.

In addition, the Company has provided non-GAAP fiscal year 2024

guidance for diluted earnings per share, operating income,

effective income tax rate, and free cash flow that excludes the

same or similar items as those that are excluded from the

historical non-GAAP financial measures, as well as significant

items that are outside the control of the Company or inherently

unusual, non-operating, unpredictable, non-recurring or non-cash in

nature. The Company does not provide forward looking guidance on a

GAAP basis for such metrics because certain financial information,

the probable significance of which cannot be determined, is not

available and cannot be reasonably estimated. For example, LIFO

expense (credit) is largely dependent upon the future inflation or

deflation of brand and generic pharmaceuticals, which is out of the

Company’s control, and acquisition-related intangibles amortization

depends on the timing and amount of future acquisitions, which

cannot be reasonably estimated. Similarly, the timing and amount of

favorable and unfavorable settlements, the probable significance of

which cannot be determined, are unavailable and cannot be

reasonably estimated.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731316967/en/

Bennett S. Murphy Senior Vice President, Head of

Investor Relations and Treasury 610-727-3693

bennett.murphy@cencora.com

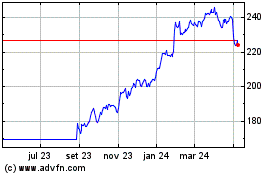

Cencora (NYSE:COR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

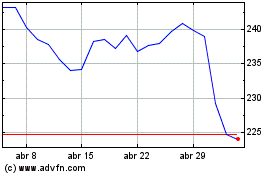

Cencora (NYSE:COR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025