Equity LifeStyle Properties, Inc. Announces Fourth Quarter 2023 Earnings Release and Conference Call

22 Janeiro 2024 - 12:59PM

Business Wire

Equity LifeStyle Properties, Inc. (NYSE:ELS) (referred to herein

as the “Company,” “we,” “us,” and “our”) announced today that the

Company’s fourth quarter 2023 earnings will be released on Monday,

January 29, 2024 after market close. The Company’s executive

management team will host a conference call and audio webcast on

Tuesday, January 30, 2023 at 11:00 a.m. Eastern Time to discuss the

Company’s operating and financial results.

The live audio webcast and replay of the conference call will be

available on our website at www.equitylifestyleproperties.com in

the Investor Relations section under Events.

Research analysts and other interested parties who wish to

participate in the conference call must register through this link

at least fifteen minutes prior to the scheduled start of the call

to receive the dial-in details.

This press release includes certain “forward-looking statements”

within the meaning of the Private Securities Litigation Reform Act

of 1995. When used, words such as “anticipate,” “expect,”

“believe,” “project,” “intend,” “may be” and “will be” and similar

words or phrases, or the negative thereof, unless the context

requires otherwise, are intended to identify forward-looking

statements and may include, without limitation, information

regarding our expectations, goals or intentions regarding the

future, and the expected effect of our acquisitions.

Forward-looking statements, by their nature, involve estimates,

projections, goals, forecasts and assumptions and are subject to

risks and uncertainties that could cause actual results or outcomes

to differ materially from those expressed in a forward-looking

statement due to a number of factors, which include, but are not

limited to the following: (i) the mix of site usage within the

portfolio; (ii) yield management on our short-term resort and

marina sites; (iii) scheduled or implemented rate increases on

community, resort and marina sites; (iv) scheduled or implemented

rate increases in annual payments under membership subscriptions;

(v) occupancy changes; (vi) our ability to attract and retain

membership customers; (vii) change in customer demand regarding

travel and outdoor vacation destinations; (viii) our ability to

manage expenses in an inflationary environment; (ix) our ability to

integrate and operate recent acquisitions in accordance with our

estimates; (x) our ability to execute expansion/development

opportunities in the face of supply chain delays/shortages; (xi)

completion of pending transactions in their entirety and on assumed

schedule; (xii) our ability to attract and retain property

employees, particularly seasonal employees; (xiii) ongoing legal

matters and related fees; and (xiv) costs to restore property

operations and potential revenue losses following storms or other

unplanned events.

For further information on these and other factors that could

impact us and the statements contained herein, refer to our filings

with the Securities and Exchange Commission, including the “Risk

Factors” and “Forward-Looking Statements” sections in our most

recent Annual Report on Form 10-K and any subsequent Quarterly

Reports on Form 10-Q.

These forward-looking statements are based on management’s

present expectations and beliefs about future events. As with any

projection or forecast, these statements are inherently susceptible

to uncertainty and changes in circumstances. We are under no

obligation to, and expressly disclaim any obligation to, update or

alter our forward-looking statements whether as a result of such

changes, new information, subsequent events or otherwise.

We are a fully integrated owner of lifestyle-oriented properties

and own or have an interest in 450 properties located predominantly

in the United States consisting of 171,707 sites as of October 16,

2023. We are a self-administered, self-managed, real estate

investment trust with headquarters in Chicago.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240122181938/en/

Paul Seavey, (800) 247-5279

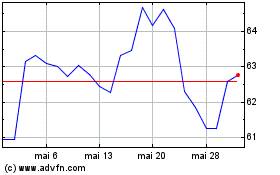

Equity Lifestyle Propert... (NYSE:ELS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Equity Lifestyle Propert... (NYSE:ELS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024