Certified Semi-annual Shareholder Report for Management Investment Companies (n-csrs)

06 Julho 2021 - 11:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSRS

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22005

Wells Fargo Global Dividend Opportunity Fund

(Exact name of registrant as specified in charter)

525 Market

St., San Francisco, CA 94105

(Address of principal executive offices) (Zip code)

Catherine Kennedy

Wells

Fargo Funds Management, LLC

525 Market St., San Francisco, CA 94105

(Name and address of agent for service)

Registrant’s telephone number, including area code:

800-222-8222

Date of fiscal year end: October 31

Date of reporting period: April 30, 2021

ITEM 1. REPORT TO STOCKHOLDERS

Semi-Annual Report

April 30, 2021

Wells Fargo Global

Dividend Opportunity Fund

(EOD)

Reduce

clutter.

Save trees.

Sign up for

electronic delivery of prospectuses and shareholder reports at wellsfargo.com/ advantagedelivery

The views expressed and any forward-looking

statements are as of April 30, 2021, unless otherwise noted, and are those of the Fund's portfolio managers and/or Wells Fargo Asset Management. Discussions of individual securities or the markets generally are not intended as individual

recommendations. Future events or results may vary significantly from those expressed in any forward-looking statements. The views expressed are subject to change at any time in response to changing circumstances in the market. Wells Fargo Asset

Management and the Fund disclaim any obligation to publicly update or revise any views expressed or forward-looking statements.

INVESTMENT

PRODUCTS: NOT FDIC INSURED ■ NO BANK GUARANTEE ■ MAY LOSE VALUE

Wells Fargo Global Dividend Opportunity

Fund | 1

Letter to shareholders

(unaudited)

Andrew Owen

President

Wells Fargo Funds

Dear Shareholder:

We are pleased to offer you this

semi-annual report for the Wells Fargo Global Dividend Opportunity Fund for the six-month period that ended April 30, 2021. Global stocks continued to rally as the global economy continued to work through the haze of COVID-19. Tailwinds were

provided by global stimulus programs, a rapid vaccination rollout, and recovering consumer and corporate sentiment. Bonds were mixed during the period, with global bonds, municipal bonds, and high-yield bonds delivering positive returns.

For the six-month period, U.S. stocks,

based on the S&P 500 Index,1 gained 28.85%. International stocks, as measured by the MSCI ACWI ex USA Index (Net),2 returned 27.40%, while the MSCI EM Index (Net),3 trailed its developed market counterparts with a 22.95% gain. Among bond indexes, the Bloomberg Barclays U.S. Aggregate Bond Index,4 returned -1.52%, the Bloomberg Barclays Global Aggregate ex-USD Index (unhedged),5 returned 0.68%, the Bloomberg Barclays Municipal Bond Index,6 returned 2.62%, and the ICE BofA U.S. High Yield Index,7 returned 8.12%.

Hope drove the stock markets to new

highs.

Global stocks rallied in

November, propelled by optimism over three promising COVID-19 vaccines. Reversing recent trends, value stocks outperformed growth stocks and cyclical stocks outpaced information technology (IT) stocks. However, U.S. unemployment remained elevated,

with a net job loss of 10 million since February. The eurozone services Purchasing Managers’ Index, a monthly survey of purchasing managers, contracted sharply while the region’s manufacturing activity grew. The U.S. election results

added to the upbeat mood as investors anticipated more consistent policies in the new administration.

Financial markets ended the year with

strength on high expectations for a rapid rollout of the COVID-19 vaccines, the successful passage of a $900 billion stimulus package, and rising expectations of additional economic support from a Democratic-led Congress. U.S. economic data were

mixed with still-elevated unemployment and weak retail sales but growth in manufacturing output. In contrast, China’s economic expansion continued in both manufacturing and nonmanufacturing. U.S. COVID-19 infection rates continued to rise even

as new state and local lockdown measures were implemented.

“Global stocks rallied in November, propelled by optimism over three promising COVID-19

vaccines.”

|

1

|

The S&P 500 Index

consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index.

|

|

2

|

The Morgan Stanley Capital

International (MSCI) All Country World Index (ACWI) ex USA Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets, excluding the United

States. Source: MSCI. MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other

indices or any securities or financial products. This report is not approved, reviewed, or produced by MSCI. You cannot invest directly in an index.

|

|

1

|

The S&P 500 Index

consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index.

|

|

3

|

The MSCI Emerging Markets

(EM) Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market performance of emerging markets. You cannot invest directly in an index.

|

|

1

|

The S&P 500 Index

consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index.

|

|

4

|

The Bloomberg Barclays U.S.

Aggregate Bond Index is a broad-based benchmark that measures the investment-grade, U.S. dollar-denominated, fixed-rate taxable bond market, including Treasuries, government-related and corporate securities, mortgage-backed securities (agency

fixed-rate and hybrid adjustable-rate mortgage pass-throughs), asset-backed securities, and commercial mortgage-backed securities. You cannot invest directly in an index.

|

|

1

|

The S&P 500 Index

consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index.

|

|

5

|

The Bloomberg Barclays Global

Aggregate ex-USD Index (unhedged) is an unmanaged index that provides a broad-based measure of the global investment-grade fixed-income markets excluding the U.S. dollar-denominated debt market. You cannot invest directly in an index.

|

|

1

|

The S&P 500 Index

consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index.

|

|

6

|

The Bloomberg Barclays

Municipal Bond Index is an unmanaged index composed of long-term tax-exempt bonds with a minimum credit rating of Baa. You cannot invest directly in an index.

|

|

1

|

The S&P 500 Index

consists of 500 stocks chosen for market size, liquidity, and industry group representation. It is a market-value-weighted index with each stock's weight in the index proportionate to its market value. You cannot invest directly in an index.

|

|

7

|

The ICE BofA U.S. High Yield

Index is a market-capitalization-weighted index of domestic and Yankee high-yield bonds. The index tracks the performance of high-yield securities traded in the U.S. bond market. You cannot invest directly in an index. Copyright 2021. ICE Data

Indices, LLC. All rights reserved.

|

2 | Wells Fargo Global Dividend

Opportunity Fund

Letter to shareholders

(unaudited)

The calendar year 2021 began with emerging market stocks

leading all major asset classes in January, driven by China’s strong economic growth and a broad recovery in corporate earnings, which propelled China’s stock market higher. In the U.S., positive news on vaccine trials and January's

expansion in both the manufacturing and services sectors were offset by a weak December monthly jobs report. This was compounded by technical factors as some hedge funds were forced to sell stocks to protect themselves against a well-publicized

short squeeze coordinated by a group of retail investors. Eurozone sentiment and economic growth were particularly weak, reflecting the impact of a new lockdown with stricter social distancing along with a slow vaccine rollout.

February saw major domestic equity indexes driven higher on the

hope of a new stimulus bill, improving COVID-19 vaccination numbers, and the gradual reopening of the economy. Most S&P 500 companies reported better-than-expected earnings, with positive surprises coming from the financials, IT, health care,

and materials sectors. Japan saw its economy strengthen as a result of strong export numbers. Meanwhile, crude-oil prices continued their climb, rising more than 25% for the year. Domestic government bonds experienced a sharp sell-off in late

February as markets priced in a more robust economic recovery and higher future growth and inflation expectations.

The passage of the massive domestic stimulus bill highlighted

March activity, leading to increased forecasts for U.S. growth in 2021. Domestic employment surged as COVID-19 vaccinations and an increasingly open economy spurred hiring. A majority of U.S. small companies reported they were operating at

pre-pandemic capacity or higher. Value continued its outperformance of growth in the month, continuing the trend that started in late 2020. Meanwhile, most major developed global equity indexes were up month to date on the back of rising optimism

regarding the outlook for global growth. While the U.S. and the U.K. have been the most successful in terms of the vaccine rollout, even within markets where the vaccine has lagged, such as the eurozone and Japan, equity indexes in many of those

countries are also in positive territory this year.

Equity markets produced another strong showing in April.

Domestically, the continued reopening of the economy had a strong impact on positive equity performance as people started leaving their households and jobless claims continued to fall. Domestic corporate bonds performed well and the U.S. dollar

weakened. Meanwhile, the U.S. government continued to seek to invest in the recovery, this time by outlining a package of over $2 billion to improve infrastructure. The primary headwind in April was inflation, as investors tried to determine the

breadth and longevity of recent price increases. Developed Europe has been supported by a meaningful increase in the pace of vaccinations. Unfortunately many emerging market countries have not been as successful. India in particular has seen

COVID-19 cases surge, serving as an example of the need to get vaccinations rolled out to less developed nations.

Don’t let short-term uncertainty derail long-term

investment goals.

Periods of investment uncertainty can

present challenges, but experience has taught us that maintaining long-term investment goals can be an effective way to plan for the future. Although diversification cannot guarantee an investment profit or prevent losses, we believe it can be an

effective way to manage investment risk and potentially smooth out overall portfolio performance. We encourage investors to know their investments and to understand that appropriate levels of risk-taking may unlock opportunities.

Thank you for choosing to invest with Wells Fargo Funds. We

appreciate your confidence in us and remain committed to helping you meet your financial needs.

Sincerely,

Andrew Owen

President

Wells Fargo Funds

“The passage of the massive domestic stimulus bill highlighted March activity, leading to

increased forecasts for U.S. growth in 2021.”

For further information about your Fund,

contact your investment professional, visit our website at wfam.com or call us directly at 1-800-222-8222.

Wells Fargo Global Dividend Opportunity

Fund | 3

Letter to shareholders

(unaudited)

Notice to Shareholders

|

■

|

On November 17, 2020, the Fund

announced a renewal of its open-market share repurchase program (the “Buyback Program”). Under the renewed Buyback Program, the Fund may repurchase up to 10% of its outstanding shares in open market transactions during the period

beginning on January 1, 2021 and ending on December 31, 2021. The Fund’s Board of Trustees has delegated to Wells Fargo Funds Management, LLC, the Fund’s adviser, discretion to administer the Buyback Program, including the determination

of the amount and timing of repurchases in accordance with the best interests of the Fund and subject to applicable legal limitations.

|

|

■

|

The

Fund’s managed distribution plan provides for the declaration of quarterly distributions to common shareholders of the Fund at an annual minimum fixed rate of 10% based on the Fund’s average monthly net asset value per share over the

prior 12 months. Under the managed distribution plan, quarterly distributions may be sourced from income, paid-in capital, and/or capital gains, if any. To the extent that sufficient investment income is not available on a quarterly basis, the Fund

may distribute paid-in capital and/or capital gains, if any, in order to maintain its managed distribution level. You should not draw any conclusions about the Fund’s investment performance from the amount of the Fund’s distributions or

from the terms of the managed distribution plan. Shareholders may elect to reinvest distributions received pursuant to the managed distribution plan in the Fund under the existing dividend reinvestment plan, which is described later in this report.

|

Preparing for LIBOR Transition

The global financial industry is preparing

to transition away from the London Interbank Offered Rate (LIBOR), a key benchmark interest rate, to new alternative rates. LIBOR underpins more than $350 trillion of financial contracts. It is the benchmark rate for a wide spectrum of products

ranging from residential mortgages to corporate bonds to derivatives. Regulators have called for a market-wide transition away from LIBOR to successor reference rates by the end of 2021 (expected to be extended through June 30, 2023 for most tenors

of the U.S. dollar LIBOR), which requires proactive steps be taken by issuers, counterparties, and asset managers to identify impacted products and adopt new reference rates.

The Fund holds at least one security that

uses LIBOR as a floating reference rate and has a maturity date after December 31, 2021.

Although the transition process away from

LIBOR has become increasingly well-defined in advance of the anticipated discontinuation date, there remains uncertainty regarding the nature of successor reference rates, and any potential effects of the transition away from LIBOR on investment

instruments that use it as a benchmark rate. The transition process may result in, among other things, increased volatility or illiquidity in markets for instruments that currently rely on LIBOR and could negatively impact the value of certain

instruments held by the Fund.

Wells

Fargo Asset Management is monitoring LIBOR exposure closely and has put resources and controls in place to manage this transition effectively. The Fund’s portfolio management team is evaluating LIBOR holdings to understand what happens to

those securities when LIBOR ceases to exist, including examining security documentation to identify the presence or absence of fallback language identifying a replacement rate to LIBOR.

While the pace of transition away from LIBOR

will differ by asset class and investment strategy, the portfolio management team will monitor market conditions for those holdings to identify and mitigate deterioration or volatility in pricing and liquidity and ensure appropriate actions are

taken in a timely manner.

4 | Wells Fargo Global Dividend

Opportunity Fund

This page is intentionally left blank.

Performance highlights

(unaudited)

|

Investment

objective

|

The Fund's primary investment

objective is to seek a high level of current income. The Fund's secondary objective is long-term growth of capital.

|

|

Strategy

summary

|

The Fund allocates its assets

between two separate investment strategies, or sleeves. Under normal market conditions, the Fund allocates approximately 80% of its total assets to an equity sleeve comprised primarily of common stocks and other equity securities that offer

above-average potential for current and/or future dividends. This sleeve invests normally in approximately 60 to 80 securities, broadly diversified among major sectors and regions. The sector and region weights are typically within +/- 5 percent of weights in the MSCI ACWI Index (Net). The remaining 20% of the Fund's total assets is allocated to a sleeve consisting of below investment grade (high yield) debt. The Fund also employs

an option strategy in an attempt to generate gains on call options written by the Fund.

|

|

Adviser

|

Wells Fargo Funds Management,

LLC

|

|

Subadviser

|

Wells Capital Management

Incorporated

|

|

Portfolio

managers

|

Dennis

Bein, CFA®‡, Justin P. Carr, CFA®‡*, Harindra de Silva, Ph.D, CFA®‡*, Vince Fioramonti, CFA®‡, Chris Lee, CFA®‡*, Megan Miller, CFA®‡, Michael J. Schueller, CFA®‡

|

|

Average

annual total returns (%) as of April 30, 20211

|

|

|

6

months

|

1

year

|

5

year

|

10

year

|

|

Based

on market value

|

40.88

|

50.68

|

9.39

|

4.94

|

|

Based

on net asset value (NAV)

|

29.26

|

45.71

|

7.95

|

5.24

|

|

Global

Dividend Opportunity Blended Index2

|

24.06

|

40.34

|

11.85

|

8.72

|

|

MSCI

ACWI Index (Net)3

|

28.29

|

45.75

|

13.85

|

9.17

|

|

ICE

BofA U.S. High Yield Constrained Index4

|

8.13

|

20.01

|

7.31

|

6.26

|

Figures quoted represent past

performance, which is no guarantee of future results, and do not reflect taxes that a shareholder may pay on an investment in a fund. Investment return and principal value of an investment will fluctuate so that an

investor’s shares, when sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted, which assumes the reinvestment of dividends and capital gains. Performance figures

of the Fund do not reflect brokerage commissions that a shareholder would pay on the purchase and sale of shares. If taxes and such brokerage commissions had been reflected, performance would have been lower. To obtain performance information

current to the most recent month-end, please call 1-800-222-8222.

Please keep in mind that high double-digit returns were

primarily achieved during favorable market conditions. You should not expect that such favorable returns can be consistently achieved. A fund’s performance, especially for short time periods, should not be the sole factor in making your

investment decision.

The Fund’s annualized expense

ratio for the six months ended April 30, 2021, was 1.37% which includes 0.16% of interest expense.

|

1

|

Total

returns based on market value are calculated assuming a purchase of common stock on the first day and a sale on the last day of the period reported. Total returns based on NAV are calculated based on the NAV at the beginning of the period and at the

end of the period. Dividends and distributions, if any, are assumed for the purposes of these calculations to be reinvested at prices obtained under the Fund’s Automatic Dividend Reinvestment Plan.

|

|

2

|

Source:

Wells Fargo Funds Management, LLC. The Global Dividend Opportunity Blended Index is composed of 80% Morgan Stanley Capital International (MSCI) All Country World Index (ACWI) Index (Net) and 20% ICE BofA U.S. High Yield Constrained Index. Prior to

October 15, 2019, the Global Dividend Opportunity Blended Index was composed 65% of the MSCI ACWI Index (Net), 20% of the ICE BofA U.S. High Yield Constrained Index, and 15% of the ICE BofA Core Fixed Rate Preferred Securities Index. Prior to May 1,

2017, the Global Dividend Opportunity Blended Index was composed 65% of the MSCI ACWI Index (Net) and 35% of the ICE BofA Core Fixed Rate Preferred Securities Index. You cannot invest directly in an index.

|

|

3

|

The MSCI

ACWI Index (Net) is a free-float-adjusted market-capitalization-weighted index that is designed to measure the equity market performance of developed and emerging markets. Source: MSCI. MSCI makes no express or implied warranties or representations

and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved,

reviewed, or produced by MSCI. You cannot invest directly in an index.

|

|

4

|

The

ICE BofA U.S. High Yield Constrained Index is a market-value-weighted index of all domestic and Yankee high-yield bonds, including deferred interest bonds and payment-in-kind securities. Issues included in the index have maturities of one year or

more and have a credit rating lower than BBB-/Baa3 but are not in default. The ICE BofA U.S. High Yield Constrained Index limits any individual issuer to a maximum of 2% benchmark exposure. You cannot invest directly in an index. Copyright 2021. ICE

Data Indices, LLC. All rights reserved.

|

|

‡

|

CFA® and Chartered

Financial Analyst® are trademarks owned by CFA Institute.

|

* Mr. Bein and Mr. de Silva became portfolio managers of the

Fund on May 3, 2021.

6 | Wells Fargo Global Dividend

Opportunity Fund

Performance highlights

(unaudited)

|

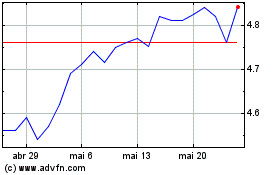

Comparison

of NAV vs. market value1

|

|

1

|

This chart does not reflect

any brokerage commissions charged on the purchase and sale of the Fund’s common stock. Dividends and distributions paid by the Fund are included in the Fund’s average annual total returns but have the effect of reducing the Fund’s

NAV.

|

More

detailed information about the Fund’s investment objective, principal investment strategies and the principal risks associated with investing in the Fund can be found on page 12.

Risk summary

This closed-end fund is no longer available as an initial

public offering and is only offered through broker-dealers on the secondary market. A closed-end fund is not required to buy its shares back from investors upon request. Shares of the Fund may trade at either a premium or discount relative to the

Fund’s net asset value, and there can be no assurance that any discount will decrease. The values of, and/or the income generated by, securities held by the Fund may decline due to general market conditions or other factors, including those

directly involving the issuers of such securities. Equity securities fluctuate in value in response to factors specific to the issuer of the security. Small and mid-cap securities may be subject to special risks associated with narrower product

lines and limited financial resources compared with their large-cap counterparts, and, as a result, small- and mid-cap securities may decline significantly in market downturns and may be more volatile than those of larger companies due to their

higher risk of failure. Debt securities are subject to credit risk and interest rate risk, and high yield securities and unrated securities of similar credit quality have a much greater risk of default and their values tend to be more volatile than

higher-rated securities with similar maturities. Foreign investments may contain more risk due to the inherent risks associated with changing political climates, foreign market instability, and foreign currency fluctuations. Risks of foreign

investing are magnified in emerging or developing markets. Derivatives involve risks, including interest-rate risk, credit risk, the risk of improper valuation, and the risk of non-correlation to the relevant instruments they are designed to hedge

or closely track. There are numerous risks associated with transactions in options on securities and/or indices. As a writer of an index call option, the Fund forgoes the opportunity to profit from increases in the values of securities held by the

Fund. However, the Fund has retained the risk of loss (net of premiums received) should the price of the Fund’s portfolio securities decline. Similar risks are involved with writing call options or secured put options on individual securities

and/or indices held in the Fund’s portfolio. This combination of potentially limited appreciation and potentially unlimited depreciation over time may lead to a decline in the net asset value of the Fund. The Fund is leveraged through a

revolving credit facility and also may incur leverage by issuing preferred shares in the future. The use of leverage results in certain risks, including, among others, the likelihood of greater volatility of the net asset value and the market value

of common shares.

Wells

Fargo Global Dividend Opportunity Fund | 7

Performance highlights

(unaudited)

MANAGER'S DISCUSSION

The Fund’s return based on market value was 40.88% for the six-month

period that ended April 30, 2021. During the same period, the Fund’s return based on its net asset value (NAV) was 29.26%. Based on its NAV return, the Fund outperformed the Global Dividend Opportunities Blended Index for the six-month period

that ended April 30, 2021.

Overview

The Fund’s equity sleeve outperformed the MSCI ACWI Index

(Net) for the period.

|

■

|

For the six-month period,

holdings within the information technology (IT), financials, and health care sectors contributed to relative performance.

|

|

■

|

Holdings

within the communication services, consumer staples, and energy sectors detracted from relative performance.

|

Global equities surged higher as the economy recovered from the COVID-19

recession.

Over the past six months, the resolution to

the 2020 U.S. election, the rollout of COVID-19 vaccines, and monetary and fiscal stimulus have strengthened both the economic recovery and the rally in risk assets. Cumulatively, these events have made what we call the “reflation” trade

a successful one. Themes arising from the reflation trade include: 1) rising long-term Treasury yields, 2) a recovery in the price of oil, and 3) the nearly complete normalization in valuations in COVID-19-affected sectors. By early fall of last

year, the portfolio repositioned to capture opportunities arising from reflation.

U.S. and international equities advanced on improving economic

data, reopening momentum, broadening vaccine distribution, and continued tailwinds from massive fiscal and monetary stimulus. Although the global health crisis persists, overall activity reaccelerated in the U.S. as restrictions were scaled back and

vaccinations neared a critical mass. International and emerging markets lagged the U.S. in terms of growth, reopening, and vaccination rollouts, tempering optimism over their recovery. Beginning last November, investors began a rotation into

cyclical value stocks and out of the secular growth, stay-at-home stocks that dominated most of 2020. This rotation was supported by challenging year-over-year comparables in the strongest-performing growth stocks, a weaker dollar, and a steepening

yield curve.

|

Ten

largest holdings (%) as of April 30, 20211

|

|

Microsoft

Corporation

|

3.27

|

|

Apple

Incorporated

|

2.93

|

|

JPMorgan

Chase & Company

|

1.90

|

|

Target

Corporation

|

1.84

|

|

Amazon.com

Incorporated

|

1.77

|

|

Verizon

Communications Incorporated

|

1.76

|

|

Texas

Instruments Incorporated

|

1.75

|

|

AbbVie

Incorporated

|

1.74

|

|

QUALCOMM

Incorporated

|

1.69

|

|

CVS

Health Corporation

|

1.65

|

|

1

|

Figures represent the

percentage of the Fund's net assets. Holdings are subject to change and may have changed since the date specified.

|

The Fund adapted to market volatility and an improving

environment for dividend-paying stocks.

To deliver a

higher dividend relative to the benchmark, the strategy had a higher exposure to dividend payers and a lower exposure to growth companies that do not pay dividends. The outperformance of cyclical value provided a favorable environment for

dividend-paying stocks, as many companies that suspended dividends in 2020 restored their dividend policy. The strategy’s turnover increased as market volatility required an elevated emphasis on risk controls, particularly as it relates to

interest rates, oil, and credit risk. Within sectors, investors favored stocks with positive economic exposure, and we were rewarded by overweighting financials and underweighting health care.

After seeing West Texas Intermediate (WTI) oil fall to

unprecedented lows, the Organization of Petroleum Exporting Countries agreed to supply reductions, which has gradually reduced oversupply and led to a dramatic recovery in WTI and energy bond prices. As a result, investments in the energy sector

proved to be the best performers for the past six months within the high yield fixed income portion of the strategy.

8 | Wells Fargo Global Dividend

Opportunity Fund

Performance highlights

(unaudited)

Long-term Treasury bond yields have also undergone a dramatic repricing in the

past six months with the 10-year yield rising from 0.88% to 1.63%. Just as the rapidly improving economic outlook pushed the 10-year Treasury yield higher, so too has it driven high-yield spreads tighter. The option-adjusted spread in the high-yield

market stood at 527 basis points (bps; 100 bps equal 1.00%) six months ago; it stood at 330 bps on April 30, 2021.

The option overlay* is a short-call strategy written on a

portion of the Fund’s global equity portfolio. The combined global equity and short option portfolio create a global covered call portfolio. Over the long run, a covered call strategy targets additional yield and lower risk compared with a

passive allocation to equity. The option overlay is expected to add value in flat-to-down markets and also in above-average-volatility environments. For the six-month period that ended April 30, 2021, the option overlay returned -1.32% to the Fund.

Over the same time period, the associated benchmarks, BXM Index** -adjusted and BXY Index** -adjusted, returned -4.94% and -2.84%, respectively.

Global equity markets performed strongly during the last

quarter of 2020 and first quarter of 2021, with the MSCI ACWI Index (Net) returning 28.29% over the six-month period that ended April 30, 2021. As a result of the increased price levels, average volatility declined to end the six-month period near

long-run averages at 18.61%. We saw a record-breaking global equity rally in November 2020, followed by persistently positive outlooks and new local highs across developed markets in April 2021. As expected, the option overlay detracted from Fund

performance during this time period when equity markets outperformed expectations, returning nearly 30%, and volatility declined, detracting value from the Fund by slightly capping the equity returns. We expect volatility to remain elevated compared

with long-run averages as the world grapples with the longer-run impact of the pandemic and newly elevated concerns in emerging markets. Higher levels of volatility should present a good opportunity for the option overlay strategy in the Fund.

Stock selection was strongest in the IT, industrials, and financials

sectors.

Within the IT sector, Lenovo Group Limited

shares surged on positive earnings trends from strong personal computer demand for remote work and e-learning. In the industrials sector, TFI International Incorporated shares rose significantly after the Canadian trucking company announced solid

earnings and the acquisition of UPS’s freight division. ING Groep N.V., a long-term financial holding, restored its dividend policy, benefiting from growth in fee income, digital banking trends, and a steepening yield curve.

|

Sector

allocation as of April 30, 20211

|

|

1

|

Figures represent the

percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified.

|

|

*

|

The option overlay is

compared with the option-only returns of the U.S. based covered call benchmarks, BXM Index and BXY Index. We adjust the benchmark to assume 50% written on equity and report only the option return. The unadjusted BXM Index and BXY Index returned

18.97% and 23.17%, respectively, from October 31, 2020, to April 30, 2021.

|

|

**

|

The Chicago Board Options

Exchange (CBOE) S&P 500 BuyWrite (BXM) Index is a benchmark index designed to track the performance of a hypothetical buy-write strategy on the S&P 500 Index. The CBOE S&P 500 2% OTM BuyWrite (BXY) Index is a new index that uses the same

methodology as BXM, but is calculated using out-of-the-money S&P 500 Index (SPX) call options, rather than at-the-money SPX call options. You cannot invest directly in an index.

|

Wells Fargo Global Dividend Opportunity

Fund | 9

Performance highlights

(unaudited)

|

Credit

quality as of April 30, 20211

|

|

1

|

The credit quality

distribution of portfolio holdings reflected in the chart is based on ratings from Standard & Poor’s, Moody’s Investors Service, and/ or Fitch Ratings Ltd. Credit quality ratings apply to the underlying holdings of the Fund and not

to the Fund itself. The percentages of the Fund’s portfolio with the ratings depicted in the chart are calculated based on the market value of fixed income securities held by the Fund. If a security was rated by all three rating agencies, the

middle rating was utilized. If rated by two of the three rating agencies, the lower rating was utilized, and if rated by one of the rating agencies, that rating was utilized. Standard & Poor’s rates the creditworthiness of bonds, ranging

from AAA (highest) to D (lowest). Ratings from A to CCC may be modified by the addition of a plus (+) or minus (-) sign to show relative standing within the rating categories. Standard &

Poor’s rates the creditworthiness of short-term notes from SP-1 (highest) to SP-3 (lowest). Moody’s rates the creditworthiness of bonds, ranging from Aaa (highest) to C (lowest). Ratings Aa to B may be modified by the addition of a

number 1 (highest) to 3 (lowest) to show relative standing within the ratings categories. Moody’s rates the creditworthiness of short-term U.S. tax-exempt municipal securities from MIG 1/VMIG 1 (highest) to SG (lowest). Fitch rates the

creditworthiness of bonds, ranging from AAA (highest) to D (lowest). Credit quality distribution is subject to change and may have changed since the date specified.

|

Selection within energy in the high-yield sleeve added to

performance.

Last fall, there was lingering uncertainty

regarding the length and severity of the COVID-19 crisis and the extent to which businesses would suffer from it. Companies directly affected by COVID-19 had inverted credit curves (near-term maturities trading at higher yields than longer ones) and

traded at a significant discount to minimally disrupted companies. Today, while businesses anticipate a full recovery, the recovery in valuations in the capital markets is nearly complete. Credit curves have now normalized and the discount one earns

for investing in directly affected companies is very slight. Capturing this compression in several key investments in the leisure, air transportation, automotive, and media sectors contributed to outperformance. The Fund’s use of leverage had

a positive impact on total return performance during this reporting period.

Stock selection was weakest in the communication services, consumer staples,

and energy sectors.

Within the communication services

sector, Verizon Communications Incorporated produced earnings that beat expectations, but shares traded sideways due to growing wireless competition and delays in the 5G smartphone upgrade cycle. Despite strong earnings, Nintendo Company, Limited,

shares were weak as investors took a pause on some of the gaming stay-at-home stocks and moved into the cyclical recovery theme. Two consumer staples holdings, Walmart Incorporated and The Procter & Gamble Company, detracted from results as

investors rotated out of companies perceived to be significant beneficiaries of the pandemic.

Underweights to the metals and mining and the food and

beverage sectors detracted from high-yield sleeve performance.

The main detractors from performance over the past year came

from the Fund’s underweights to the metals and mining and the food and beverage sectors. While credit quality in both sectors is improving, the longer duration of the bonds in these sectors make them less attractive total-return opportunities

as spread compression is susceptible to being offset by rising long-term rates.

|

Geographic

allocation as of April 30, 20211

|

|

1

|

Figures represent the

percentage of the Fund's long-term investments. These amounts are subject to change and may have changed since the date specified.

|

10 | Wells Fargo Global Dividend

Opportunity Fund

Performance highlights

(unaudited)

Management outlook: Accommodative monetary and fiscal policy could rapidly

shift the economy into mid-cycle dynamics.

The recovery

from the pandemic will likely be unique and uneven as the world grapples with the repercussions of sacrificing economic health to preserve public health. A global economic reboot can occur quickly with ongoing tailwinds from prodigious monetary and

fiscal support, but not without a growing risk of inflation. Central banks acknowledge the risk of inflation, but most believe that any rise in inflation will be transitory.

Early-stage cyclical themes like small caps, value, and

emerging markets could continue to do well, but the market could also abruptly shift to higher-quality, lower-volatility, and more defensive names if the burst of post-pandemic growth leads to some excesses. The strongest gains within value have

likely already occurred, driven by short covering and investor repositioning. Growth is no longer scarce in this part of the economic cycle, and investors typically become more selective as the cycle matures. We expect the market environment that

transformed major equity factors into extreme bets for or against value will fade and our quantitative research model to exhibit stronger performance.

Rising inflation historically provides a tailwind for value-oriented firms,

which typically benefits our investment process. As we monitor the macroeconomic environment, we will continue to diligently focus on company fundamentals and disciplined portfolio risk management.

The current high-yield landscape features early-cycle fiscal

and monetary policies coupled with late-cycle valuations. The former makes us constructive on further improvement in issuer fundamentals, but the latter tempers return expectations. We believe the majority of the systemic spread tightening is behind

us and it’s critically important to get idiosyncratic credit issues correct to outperform. Always the hallmark of our investment process, security selection, comprehensive research, and tactical portfolio management will be ever more salient

in capitalizing on opportunities in these evolving credit markets.

Wells Fargo Global Dividend Opportunity

Fund | 11

Objective, strategies and risks

(unaudited)

Investment objective

The Fund’s primary investment objective is to seek a high level of

current income. The Fund’s secondary objective is long-term growth of capital. The Fund’s investment objectives are non-fundamental policies and may be changed by the Trustees without prior approval of the Fund’s

shareholders.

Principal investment strategies

The Fund allocates its assets between two separate investment strategies, or

sleeves, equity and high yield. Under normal market conditions, the Fund allocates approximately 80% of its total assets to an equity sleeve comprised primarily of a diversified portfolio of common stocks of U.S. and non-U.S. companies and other

equity securities that offer above-average potential for current and/or future dividends. The remaining 20% of the Fund’s total assets is allocated to a sleeve consisting of below investment-grade (high yield) debt securities, loans, and

preferred stocks. The Fund also employs an option strategy in an attempt to generate gains on call options written by the Fund.

Equity Sleeve. The

Fund’s equity sleeve invests normally in approximately 60 to 80 securities, broadly diversified among major sectors and regions. The sector and region weights are typically within +/- 5 percent of weights in the MSCI ACWI Index. Region weights are managed according to Wells Capital Management’s proprietary region

classification. We target an overall portfolio dividend yield higher than that of the MSCI ACWI Index. The equity sleeve of the Fund may hold equity securities of companies of any size, including companies with large, medium, and small market

capitalizations. The equity sleeve of the Fund may hold equity securities issued by domestic or foreign issuers, including emerging market issuers. The equity sleeve of the Fund will likely include primarily common stocks, although the Fund may also

invest in preferred stocks, and securities convertible into or exchangeable for common stock, such as convertible preferred stocks.

Our approach is to lever the best attributes of quantitative

tools and fundamental analysis. Our quantitative model casts a wide net to identify buy and sell candidates in our investment universe. Our fundamental overlay gives us the conviction that we need to build a portfolio that both targets high levels

of income while still maintaining a broad-based, well-diversified exposure.

We employ a proprietary, quantitative model to evaluate all

companies in the investment universe. The model draws from a factor library containing both cross-sectional and sector-specific factors. It seeks to identify companies that provide attractive dividend yields, but also have favorable quality

characteristics and growth potential. The model is comprised of three unique factor groupings: valuation, quality and momentum. The valuation factors identify companies that are undervalued relative to their peers; the quality factors identify

companies with strong management and profitability; and the momentum factors identify companies that have market support and positive investor sentiment. The factor composition of the model is reviewed and refreshed each quarter through a dynamic

process called re-specification. The process enhances the predictive power of the model by considering recent changes in the underlying drives of stock price movement.

As previously mentioned, the investment approach combines the

objectivity and repeatability of quantitative modeling with a qualitative review and validation of every stock that is added to the portfolio. The qualitative review helps us build conviction in the positions that we put into the portfolio by

considering data that is more difficult to process and consume systematically in a timely fashion. We use additional sources of information such as news sentiment data, research reports, short interest data and a multitude of other resources to

uncover nuances within companies that a traditional systematic strategy may not identify. Through this analysis we seek to verify that the financials driving the quantitative model reflect the true prospects of the business, identify

non-quantifiable opportunities and the risks in companies, and avoid value traps (which are ever-present risk in dividend strategies).

Material Changes During the Fiscal Year: As of the date of this

report, there have been no material changes made to the equity sleeve of the Fund during this fiscal year.

High Yield Sleeve. Under

normal market conditions, the Fund allocates approximately 20% of its total assets to an investment strategy that focuses on U.S. dollar-denominated below investment-grade bonds (including convertible bonds), debentures, and other income

obligations, including loans and preferred stocks (often called “high yield” securities or “junk bonds”). We may invest in below investment-grade debt securities of any credit quality, however, we may not purchase securities

rated CCC or below if 20% of the sleeve’s assets are already held with such a rating. We are not required to sell securities rated CCC or below if the 20% limit is exceeded due to security downgrades.

The sleeve will not invest more than 20% of its total assets in

convertible instruments (convertible bonds and preferred stocks). The sleeve may invest up to 10% of its total assets in U.S. dollar–denominated securities of foreign issuers, excluding emerging markets securities.

For purposes of the Fund’s credit quality policies, if a

security receives different ratings from nationally recognized securities rating organizations, the Fund will use the rating that the portfolio managers believe is most representative of the security’s

12 | Wells Fargo Global Dividend

Opportunity Fund

Objective, strategies and risks

(unaudited)

credit quality. The Fund’s high yield securities may have fixed or

variable principal payments and all types of interest rate and dividend payment and reset terms, including fixed rate, adjustable rate, contingent, deferred, payment in kind and auction rate features. The sleeve may invest in securities with a broad

range of maturities.

The Fund’s high yield sleeve

is managed following a rigorous investment process that emphasizes both quality and value. The research driven approach includes both a top-down review of macroeconomic factors and intensive, bottom-up scrutiny of individual securities. We consider

both broad economic and issuer specific factors in selecting securities for the high yield sleeve. In assessing the appropriate maturity and duration for the Fund’s high yield sleeve and the credit quality parameters and weighting objectives

for each sector and industry in this portion of the Fund’s portfolio, we consider a variety of factors that are expected to influence the economic environment and the dynamics of the high yield market. These factors include fundamental

economic indicators, such as interest rate trends, the rates of economic growth and inflation, the performance of equity markets, commodities prices, Federal Reserve monetary policy and the relative value of the U.S. dollar compared to other

currencies. Once we determine the preferable portfolio characteristics, we conduct further evaluation to determine capacity and inventory levels in each targeted industry. We also identify any circumstances that may lead to improved business

conditions, thus increasing the attractiveness of a particular industry. We select individual securities based upon the terms of the securities (such as yields compared to U.S. Treasuries or comparable issues), liquidity and rating, sector and

issuer diversification. We also employ due diligence and fundamental research to assess an issuer’s credit quality, taking into account financial condition and profitability, future capital needs, potential for change in rating, industry

outlook, the competitive environment and management ability.

The analysis of issuers may include, among other things,

historic and current financial conditions, current and anticipated cash flow and borrowing requirements, value of assets in relation to historical costs, strength of management, responsiveness to business conditions, credit standing, the

company’s leverage versus industry norms and current and anticipated results of operations. While we consider as one factor in our credit analysis the ratings assigned by the rating services, we perform our own independent credit analysis of

issuers.

In making decisions for the high yield sleeve,

we rely on the knowledge, experience and judgment of our team who have access to a wide variety of research. We apply a strict sell discipline, which is as important as purchase criteria in determining the performance of this portion of this

portfolio. We routinely meet to review profitability outlooks and discuss any deteriorating business fundamentals, as well as consider changes in equity valuations and market perceptions before selling securities.

We regularly review the investments of the portfolio and may

sell a portfolio holding when it has achieved its valuation target, there is deterioration in the underlying fundamental of the business, or we have identified a more attractive investment opportunity.

Material Changes During the Fiscal Year: As of the date of this

report, there have been no material changes made to the high yield sleeve of the Fund during this fiscal year.

Option Strategy. The Fund also

employs an option strategy in an attempt to generate gains from the premiums on call options written by it on selected U.S. and non-U.S.-based securities indices, on exchange-traded funds providing returns based on certain indices, countries, or

market sectors, and, to a lesser extent, on futures contracts and individual securities. The Fund may write covered call options or secured put options on individual securities and/or indexes. The Fund may also purchase call or put

options.

The Fund may write call options with an

aggregate net notional amount of up to 50% of the value of the equity sleeve’s total assets. The extent of the Fund’s use of written call options will vary over time based, in part, on our assessment of market conditions, pricing of

options, related risks, and other factors. The Fund will limit option writing to an aggregate net notional amount less than the value of the Fund’s equity securities in order to allow the Fund potentially to benefit from capital gains on its

equity sleeve. The aggregate net notional amount of the open option positions sold by the Fund will never exceed the market value of the Fund’s equity investments. For these purposes, the Fund treats options on indices as being written on

securities having an aggregate value equal to the face or notional amount of the index subject to the option. At any time we may limit, or temporarily suspend, the option strategy.

We will attempt to maintain for the Fund written call option

positions on equity indices whose price movements, taken in the aggregate, correlate to some degree with the price movements of some or all of the equity securities held in the Fund’s equity sleeve. The Fund may write index call options that

are “European style” options, meaning that the options may be exercised only on the expiration date of the option. The Fund also may write index call options that are “American style” options, meaning that the options may be

exercised at any point up to and including the expiration date. The Fund expects to use primarily listed/ exchange-traded options contracts and may also use unlisted (or “over-the-counter”) options.

Wells Fargo Global Dividend Opportunity

Fund | 13

Objective, strategies and risks

(unaudited)

We will actively manage the Fund’s options positions

using a proprietary quantitative and statistical analysis in an attempt to identify option transactions for the Fund that produce attractive current income for the Fund with appropriate limitations on the potential losses to the Fund from those

transactions. We may attempt to preserve for the Fund the potential to realize a portion of any increases in the values of its portfolio securities by writing options that are out-of-the-money (that is, whose strike price is higher than the current

market value or level of the underlying index), by limiting the amount of options the Fund writes, and by attempting, through use of quantitative and statistical analysis, to identify options that are likely to provide current income without undue

risk of an untimely exercise.

Material Changes During the

Fiscal Year: As of the date of this report, there have been no material changes made to the option sleeve of the Fund during this fiscal year.

The Fund’s Overall Portfolio. We monitor the weighting of each investment strategy within the Fund’s portfolio on an ongoing basis and rebalance the Fund’s assets when we determine that such a rebalancing is necessary to align the

portfolio in accordance with the investment strategies described above. From time to time, we may make adjustments to the weighting of each investment strategy. Such adjustments would be based on our review and consideration of the expected returns

for each investment strategy and would factor in the stock, bond and money markets, interest rate and corporate earnings growth trends, and economic conditions which support changing investment opportunities.

The Fund may enter into transactions including, among others,

options, futures and forward contracts, loans of portfolio securities, swap contracts, and other derivatives, as well as when-issued, delayed delivery, or forward commitment transactions, that may in some circumstances give rise to a form of

leverage. The Fund may use some or all of these transactions from time to time in the management of its portfolio, for hedging purposes, to adjust portfolio characteristics, or more generally for purposes of attempting to increase the Fund’s

investment return. There can be no assurance that the Fund will enter into any such transactions at any particular time or under any specific circumstances. The Fund expects to issue preferred shares or debt securities, or to borrow money, for

leveraging purposes. By using leverage, the Fund seeks to obtain a higher return for holders of common shares than if it did not use leverage. Leveraging is a speculative technique, and there are special risks involved. There can be no assurance

that any leveraging strategies, if employed by the Fund, will be successful, and such strategies can result in losses to the Fund.

The investment policies of the Fund described above are

non-fundamental and may be changed by the Board of Trustees of the Fund so long as shareholders are provided with at least 60 days prior written notice of any change to the extent required by the rules under the 1940 Act.

Other investment techniques and strategies

As part of or in addition to the principal investment strategies discussed

above, the Fund may at times invest a portion of its assets in the investment strategies and may use certain investment techniques as described below.

Preferred Shares. The Fund may

invest in preferred shares. Preferred shares are equity securities, but they have many characteristics of fixed income securities, such as a fixed dividend payment rate and/or a liquidity preference over the issuer’s common shares. However,

because preferred shares are equity securities, they may be more susceptible to risks traditionally associated with equity investments than the Fund’s fixed income securities.

Real Estate Investment Trusts.

The Fund may invest a portion of its assets in REITs. REITs primarily invest in income-producing real estate or real estate related loans or interests. REITs are generally classified as equity REITs, mortgage REITs, or a combination of equity and

mortgage REITs. Equity REITs invest the majority of their assets directly in real property and derive income primarily from the collection of rents. Equity REITs can also realize capital gains by selling properties that have appreciated in value.

Mortgage REITs invest the majority of their assets in real estate mortgages and derive income from the collection of interest payments. The Fund will indirectly bear its proportionate share of any management and other expenses paid by REITs in which

it invests in addition to the expenses paid by the Fund. Distributions received by the Fund from REITs may consist of dividends, capital gains, and/or return of capital.

Loans. The high yield sleeve

of the Fund may invest in direct debt instruments which are interests in amounts owed to lenders by corporate or other borrowers. The loans in which the sleeve invests primarily consist of direct obligations of a borrower. The high yield sleeve of

the Fund may invest in a loan at origination as a co-lender or by acquiring in the secondary market participations in, assignments of or novations of a corporate loan. By purchasing a participation, the high yield sleeve of the Fund acquires some or

all of the interest of a bank or other lending institution in a loan to a borrower. The participations typically will result in the Fund having a contractual relationship only with the lender, not the borrower. The Fund will have the right to

receive payments of principal, interest and any fees to which it is entitled only from the lender selling the participation and only upon receipt by the lender of the payments from the borrower. Many such loans are secured, although some may

be

14 | Wells Fargo Global Dividend

Opportunity Fund

Objective, strategies and risks

(unaudited)

unsecured. Loans that are fully secured offer the Fund more protection than an

unsecured loan in the event of non-payment of scheduled interest or principal. However, there is no assurance that the liquidation of collateral from a secured loan would satisfy the corporate borrower’s obligation, or that the collateral can

be liquidated. Direct debt instruments may involve a risk of loss in case of default or insolvency of the borrower and may offer less legal protection to the Fund in the event of fraud or misrepresentation. In addition, loan participations involve a

risk of insolvency of the lending bank or other financial intermediary. The markets in loans are not regulated by federal securities laws or the U.S. Securities and Exchange Commission.

Asset-backed securities: The

high-yield sleeve may invest in asset-backed securities but will not invest in mortgage-backed securities. Asset-backed securities represent participations in and are secured by and payable from assets such as installment sales or loan contracts,

leases, credit card receivables and other categories of receivables.

Derivatives. The Fund may

purchase and sell derivative instruments such as exchange-listed and over-the-counter put and call options on securities, financial futures, equity, fixed-income and interest rate indices, and other financial instruments, purchase and sell financial

futures contracts and options thereon, and enter into various interest rate transactions such as swaps, caps, floors or collars. The Fund also may purchase derivative instruments that combine features of these instruments. Collectively, all of the

above are referred to as “derivatives.” The Fund generally seeks to use derivatives as a portfolio management or hedging technique to seek to protect against possible adverse changes in the market value of securities held in or to be

purchased for the Fund’s portfolio, protect the value of the Fund’s portfolio, facilitate the sale of certain securities for investment purposes, manage the effective interest rate exposure of the Fund, manage the effective maturity or

duration of the Fund’s portfolio, or establish positions in the derivatives markets as a temporary substitute for purchasing or selling particular securities.

The Fund may use a variety of other derivative instruments

(including both long and short positions) for hedging purposes, to adjust portfolio characteristics, or more generally for purposes of attempting to increase the Fund’s investment return, including, for example, buying and selling call and put

options, buying and selling futures contracts and options on futures contracts, and entering into forward contracts and swap agreements with respect to securities, indices, and currencies. There can be no assurance that the Fund will enter into any

such transaction at any particular time or under any specific circumstances.

With respect to the high yield sleeve, investments in

derivatives are limited to 10% of the sleeve’s total assets in futures and options on securities and indices and in other derivatives. In addition, the sleeve may enter into interest rate swap transactions with respect to the total amount the

high yield sleeve is leveraged in order to hedge against adverse changes in interest rates affecting dividends payable on any preferred shares or interest payable on borrowings constituting leverage. In connection with any such swap transaction, the

Fund will segregate liquid securities in the amount of its obligations under the transaction.

The high yield sleeve does not use derivatives as a primary

investment technique and generally does not anticipate using derivatives for non-hedging purposes. In the event the sleeve uses derivatives for non-hedging purposes, no more than 3% of the sleeve’s total assets will be committed to initial

margin for derivatives for such purposes. The sleeve may use derivatives for a variety of purposes, including as a hedge against adverse changes in securities market prices or interest rates and as a substitute for purchasing or selling

securities.

Futures Contracts. In addition to the strategies described above, the Fund may purchase or sell futures contracts on foreign securities indices and other assets. The Fund may use futures contracts for hedging purposes, to adjust portfolio

characteristics, or more generally for purposes of attempting to increase the Fund’s investment return.

Other Investment Companies.

The Fund may invest in shares of other affiliated or unaffiliated open-end investment companies (i.e., mutual funds), closed-end funds, exchange-traded funds (“ETFs”), UCITS funds (pooled investment

vehicles established in accordance with the Undertaking for Collective Investment in Transferable Securities adopted by European Union member states) and business development companies. The Fund may invest in securities of other investment companies

up to the limits prescribed in Section 12(d) under the 1940 Act, the rules and regulations thereunder and any exemptive relief currently or in the future available to a Fund.

Repurchase Agreements. The

Fund may enter into repurchase agreements with broker-dealers, member banks of the Federal Reserve System and other financial institutions. Repurchase agreements are arrangements under which the Fund purchases securities and the seller agrees to

repurchase the securities within a specific time and at a specific price. We review and monitor the creditworthiness of any institution which enters into a repurchase agreement with the Fund. The counterparty’s obligations under the repurchase

agreement are collateralized with U.S. Treasury and/or agency obligations with a market value of not less than 100% of the obligations, valued daily. Collateral is held by the Fund’s custodian in a segregated, safekeeping account for the

benefit of the Fund. Repurchase agreements afford the Fund an opportunity to earn income on temporarily available cash

Wells Fargo Global Dividend Opportunity

Fund | 15

Objective, strategies and risks

(unaudited)

at low risk. In the event that the counterparty to a repurchase agreement is

unwilling or unable to fulfill its contractual obligations to repurchase the underlying security, the Fund may lose money, suffer delays, or incur costs arising from holding or selling the underlying security.

Reverse Repurchase Agreements.

The Fund may enter into reverse repurchase agreements under which the Fund sells portfolio securities and agrees to repurchase them at an agreed-upon future date and price. Use of a reverse repurchase agreement may be preferable to a regular sale

and later repurchase of securities, because it avoids certain market risks and transaction costs. At the time the Fund enters into a reverse repurchase agreement, it will segregate cash or other liquid assets having a value equal to or greater than

the repurchase price (including accrued interest), and will subsequently monitor the account to ensure that the value of such segregated assets continues to be equal to or greater than the repurchase price. In the event that the buyer of securities

under a reverse repurchase agreement files for bankruptcy or becomes insolvent, the Fund’s use of proceeds from the agreement may be restricted pending a determination by the other party, or its trustee or receiver, whether to enforce the

Fund’s obligation to repurchase the securities. Reverse repurchase agreements may be viewed as a form of borrowing.

Private Placements. The Fund

may invest in private placements and other “restricted” securities. Private placement securities are securities sold in offerings that are exempt from registration under the Securities Act of 1933, as amended (the “1933

Act”). They are generally eligible for sale only to certain eligible investors. Private placements often may offer attractive opportunities for investment not otherwise available on the open market. However, private placement and other

restricted securities typically cannot be resold without registration under the 1933 Act or the availability of an exemption from registration (such as Rules 144A), and may not be readily marketable because they are subject to legal or contractual

delays in or restrictions on resale. Because there may be relatively few potential qualified purchasers for such securities, especially under adverse market or economic conditions, or in the event of adverse changes in the financial condition of the

issuer, the Fund could find it more difficult to sell such securities when it may be advisable to do so or it may be able to sell such securities only at prices lower than if such securities were more widely held and traded. Delay or difficulty in

selling such securities may result in a loss to the Fund.

Securities Lending. The Fund

may lend its securities from time to time in order to earn additional income in the form of fees or interest on securities received as collateral or the investment of any cash received as collateral. When securities are on loan, the Fund receives

interest or dividends on those securities. In a securities lending transaction, the net asset value of the Fund is affected by an increase or decrease in the value of the securities loaned and by an increase or decrease in the value of the

instrument in which collateral is invested. The amount of securities lending activity undertaken by the Fund fluctuates from time to time. The Fund has the right under the lending agreement to recover the securities from the borrower on demand. In

the event of default or bankruptcy by the borrower, the Fund may be prevented from recovering the loaned securities or gaining access to the collateral or may experience delays or costs in doing so. In such an event, the terms of the agreement

allows the unaffiliated securities lending agent to use the collateral to purchase replacement securities on behalf of the Fund or pay the Fund the market value of the loaned securities. The Fund bears the risk of loss with respect to depreciation

of its investment of the cash collateral.

Defensive and Temporary Investments. The Fund may hold some of its assets in cash or in money market instruments, including U.S. Government obligations, shares of other mutual funds and repurchase agreements, or make other short-term investments for

purposes of maintaining liquidity or for short-term defensive purposes when we believe it is in the best interests of the shareholders to do so. During these periods, the Fund may not achieve its objective.

Portfolio Turnover. It is the

policy of the Fund not to engage in trading for short-term profits although portfolio turnover is not considered a limiting factor in the execution of investment decisions for the Fund.

Principal risks

An investment in the Fund may lose money, is not a deposit of Wells Fargo

Bank, N.A. or its affiliates, is not insured or guaranteed by the Federal Deposit Insurance Corporation or any other governmental agency, and is primarily subject to the risks briefly summarized below.

Market Risk. The values of,

and/or the income generated by, securities held by a Fund may decline due to general market conditions or other factors, including those directly involving the issuers of such securities. Securities markets are volatile and may decline significantly

in response to adverse issuer, regulatory, political, or economic developments. Different sectors of the market and different security types may react differently to such developments. Political, geopolitical, natural and other events, including

war, terrorism, trade disputes, government shutdowns, market closures, natural and environmental disasters, epidemics, pandemics and other public health crises and related events have led, and in the future may lead, to economic uncertainty,

decreased economic activity, increased market volatility and other disruptive effects on U.S. and global economies and markets. Such events may have significant adverse direct or indirect effects on a Fund and its investments. In

addition,

16 | Wells Fargo Global Dividend

Opportunity Fund

Objective, strategies and risks

(unaudited)

economies and financial markets throughout the world are becoming increasingly

interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions.

Equity Securities Risk. The

values of equity securities may experience periods of substantial price volatility and may decline significantly over short time periods. In general, the values of equity securities are more volatile than those of debt securities. Equity securities

fluctuate in value and price in response to factors specific to the issuer of the security, such as management performance, financial condition, and market demand for the issuer’s products or services, as well as factors unrelated to the

fundamental condition of the issuer, including general market, economic and political conditions. Different parts of a market, industry and sector may react differently to adverse issuer, market, regulatory, political, and economic

developments.

Foreign Investment Risk. Foreign investments may be subject to lower liquidity, greater price volatility and risks related to adverse political, regulatory, market or economic developments. Foreign companies may be subject to significantly higher

levels of taxation than U.S. companies, including potentially confiscatory levels of taxation, thereby reducing the earnings potential of such foreign companies. Foreign investments may involve exposure to changes in foreign currency exchange rates.

Such changes may reduce the U.S. dollar value of the investments. Foreign investments may be subject to additional risks such as potentially higher withholding and other taxes, and may also be subject to greater trade settlement, custodial, and

other operational risks than domestic investments. Certain foreign markets may also be characterized by less stringent investor protection and disclosure standards.

Debt Securities Risk. Debt

securities are subject to credit risk and interest rate risk. Credit risk is the possibility that the issuer or guarantor of a debt security may be unable, or perceived to be unable, to pay interest or repay principal when they become due. In these

instances, the value of an investment could decline and the Fund could lose money. Credit risk increases as an issuer’s credit quality or financial strength declines. Interest rate risk is the possibility that interest rates will change over

time. When interest rates rise, the value of debt securities tends to fall. The longer the terms of the debt securities held by a Fund, the more the Fund is subject to this risk. If interest rates decline, interest that the Fund is able to earn on

its investments in debt securities may also decline, which could cause the Fund to reduce the dividends it pays to shareholders, but the value of those securities may increase. Very low or negative interest rates may magnify interest rate

risk.

High Yield Securities Risk. High yield securities and unrated securities of similar credit quality (commonly known as “junk bonds”) have a much greater risk of default (or in the case of bonds currently in default, of not returning

principal) and their values tend to be more volatile than higher-rated securities with similar maturities. Additionally, these securities tend to be less liquid and more difficult to value than higher-rated securities.

Growth/Value Investing Risk.

Securities that exhibit growth or value characteristics tend to perform differently and shift into and out of favor with investors depending on changes in market and economic sentiment and conditions. As a result, a Fund’s performance may at

times be worse than the performance of other mutual funds that invest more broadly or in securities of a different investment style.

Leverage Risk. The use of

leverage through the issuance of preferred shares and/or debt securities, or from borrowing money, may result in certain risks to the Fund as described below. Certain transactions, such as derivatives, also may give rise to a form of economic

leverage. Leveraging is a speculative technique, and there are special risks involved, including the risk that downside outcomes for common shareholders are magnified as a result of losses and declines in value of portfolio securities purchased with

borrowed money. In addition, the costs of the financial leverage may exceed the income from investments made with such leverage, interest rates or dividends payable on the financial leverage may affect the yield and distributions to the common

shareholders, and the net asset value and market value of common shares may be more volatile than if the Fund had not been leveraged. The use of leverage may cause the Fund to have to liquidate portfolio positions when it may not be advantageous to

do so. There can be no assurance that any leveraging strategies will be successful.

Because many derivatives have a leverage component (i.e., a

notional value in excess of the assets needed to establish and/or maintain the derivative position), adverse changes in the value or level of the underlying asset, rate or index may result in a loss substantially greater than the amount invested in

the derivative itself.

Options Risk. A Fund that purchases options, which are a type of derivative, is subject to the risk that gains, if any, realized on the position, will be less than the amount paid as premiums to the writer of the option. A Fund that