This Post-Effective Amendment No. 1 to the Registration Statement

on Form N-2 (File No. 333-255148) of Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (the “Registration Statement”)

is being filed pursuant to Rule 462(d) under the Securities Act of 1933, as amended (the “Securities Act”), solely for the

purpose of filing exhibits to the Registration Statement. Accordingly, this Post-Effective Amendment No. 1 consists only of a facing page,

this explanatory note and Part C of the Registration Statement on Form N-2 setting forth the exhibits to the Registration Statement. This

Post-Effective Amendment No. 1 does not modify any other part of the Registration Statement. Pursuant to Rule 462(d) under the Securities

Act, this Post-Effective Amendment No. 1 shall become effective immediately upon filing with the Securities and Exchange Commission. The

contents of the Registration Statement are hereby incorporated by reference.

Financial Highlights.

Registrant’s Certified Shareholder Report

on Form N-CSR filed February 25, 2021 (Accession No. 0001193125-21-056988)

and incorporated herein by reference.

See Form of Distribution Agreement with respect to the Rule 415 shelf

offering.

See Form of Sub-Placement Agent Agreement.

|

|

ITEM 27.

|

OTHER EXPENSES OF ISSUANCE AND DISTRIBUTION

|

The approximate expenses in connection with the offering are as follows:

|

Registration and Filing Fees

|

$ 15,431

|

|

FINRA Fees

|

$ 500

|

|

New York Stock Exchange Fees

|

$ 44,841

|

|

Costs of Printing and Engraving

|

$ 0

|

|

Accounting Fees and Expenses

|

$ 2,050

|

|

Legal Fees and Expenses

|

$ 5,000

|

|

Total

|

$ 67,822

|

|

|

|

|

*The Adviser will pay expenses of the offering (other than the applicable commissions).

|

|

|

ITEM 28.

|

PERSONS CONTROLLED BY OR UNDER COMMON CONTROL

|

None.

|

|

ITEM 29.

|

NUMBER OF HOLDERS OF SECURITIES

|

Set forth below is the number of record holders as of May 31, 2021,

of each class of securities of the Registrant:

|

Title of Class

|

|

Number of Record Holders

|

|

Common Shares of Beneficial interest, par value $0.01 per share

|

|

48,480

|

The Registrant's Amended and Restated By-Laws and the Form of Distribution

Agreement contain provisions limiting the liability, and providing for indemnification, of the Trustees and officers under certain circumstances.

The Registrant's Trustees and officers are insured under a standard

investment company errors and omissions insurance policy covering loss incurred by reason of negligent errors and omissions committed

in their official capacities as such. Insofar as indemnification for liabilities arising under the Securities Act of 1933, as amended

(the “Securities Act”), may be permitted to directors, officers and controlling persons of the Registrant pursuant to the

provisions described in this Item 30, or otherwise, the Registrant has been advised that in the opinion of the Securities and Exchange

Commission such indemnification is against public policy as expressed in the Securities Act and is therefore unenforceable. In the event

that a claim for indemnification against such liabilities (other than the payment by the Registrant of expenses incurred or paid by a

director, officer or controlling person of the Registrant in the successful defense of any action, suit or proceeding) is

asserted by such director, officer or controlling person in connection

with the securities being registered, the Registrant will, unless in the opinion of its counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed

in the Securities Act and will be governed by the final adjudication of such issue.

|

|

ITEM 31.

|

BUSINESS AND OTHER CONNECTIONS OF INVESTMENT ADVISER

|

Reference is made to: (i) the information set forth under the caption

“Investment advisory and other services” in the Statement of Additional Information; (ii) the Eaton Vance Corp. 10-K filed

under the Securities Exchange Act of 1934 (File No. 001-8100); and (iii) the Form ADV of Eaton Vance Management (File No. 801-15930) and

Parametric Portfolio Associates LLC (File No. 801-60485) filed with the Commission, all of which are incorporated herein by reference.

|

|

ITEM 32.

|

LOCATION OF ACCOUNTS AND RECORDS

|

All applicable accounts, books and documents required to be maintained

by the Registrant by Section 31(a) of the Investment Company Act of 1940 and the Rules promulgated thereunder are in the possession and

custody of the Registrant's custodian, State Street Bank and Trust Company, State Street Financial Center, One Lincoln Street, Boston,

MA 02111, and its transfer agent, American Stock Transfer & Trust Company, LLC, 6201 15th Avenue, Brooklyn, NY 11219, with

the exception of certain corporate documents and portfolio trading documents which are in the possession and custody of Eaton Vance Management,

Two International Place, Boston, MA 02110. Registrant is informed that all applicable accounts, books and documents required to be maintained

by registered investment advisers are in the custody and possession of Eaton Vance Management located at Two International Place, Boston

MA 02110 and Parametric Portfolio Associates LLC located at 800 Fifth Avenue, Suite 2800, Seattle, WA 98101 and 518 Riverside Avenue,

Westport, CT 06880.

|

|

ITEM 33.

|

MANAGEMENT SERVICES

|

Not applicable.

1. The

Registrant undertakes to suspend the offering of Common Shares until the prospectus is amended if (1) subsequent to the effective date

of this Registration Statement, the net asset value declines more than 10 percent from its net asset value as of the effective date of

this Registration Statement or (2) the net asset value increases to an amount greater than its net proceeds as stated in the prospectus.

2. Not

applicable.

3. The

Registrant undertakes to

(a) file,

during any period in which offers or sales are being made, a post-effective amendment to the registration statement:

(1) to

include any prospectus required by Section 10(a)(3) of the Securities Act;

(2) to

reflect in the prospectus any facts or events after the effective date of the registration statement (or the most recent post-effective

amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities

offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume

and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration

Fee” table in the effective registration statement;

(3) to

include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any

material change to such information in the registration statement.

(b) that,

for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new

registration statement relating to the securities offered therein, and the offering of those securities at that time shall be deemed to

be the initial bona fide offering thereof;

(c) to

remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination

of the offering;

(d) that,

for the purpose of determining liability under the Securities Act to any purchaser:

(1) if the Registrant is relying on Rule

430B [17 CFR 230.430B]:

(A) Each prospectus filed by the Registrant

pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part

of and included in the registration statement; and

(B) Each prospectus required to be filed

pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made

pursuant to Rule 415(a)(1)(i), (x), or (xi) for the purpose of providing the information required by Section 10(a) of the Securities Act

shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first

used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided

in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be

a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates,

and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that

no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated

or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as

to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date;

or

(2) if the Registrant is subject to Rule

430C [17 CFR 230.430C]: each prospectus filed pursuant to Rule 424(b) under the Securities Act as part of a registration statement relating

to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall

be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided, however,

that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated

or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as

to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration

statement or prospectus that was part of the registration statement or made in any such document immediately prior to such date of first

use.

(e) that

for the purpose of determining liability of the Registrant under the Securities Act to any purchaser in the initial distribution of securities:

The undersigned Registrant undertakes that in a primary offering of securities of the undersigned Registrant pursuant to this registration

statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to

such purchaser by means of any of the following communications, the undersigned Registrant will be a seller to the purchaser and will

be considered to offer or sell such securities to the purchaser:

(1) any

preliminary prospectus or prospectus of the undersigned Registrant relating to the offering required to be filed pursuant to Rule 424

under the Securities Act;

(2) free

writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrant or used or referred to by the undersigned

Registrants;

(3) the

portion of any other free writing prospectus or advertisement pursuant to Rule 482 under the Securities Act relating to the offering containing

material information about the undersigned Registrant or its securities provided by or on behalf of the undersigned Registrant; and

(4) any

other communication that is an offer in the offering made by the undersigned Registrant to the purchaser.

4. The

Registrant undertakes that:

(a) for

the purpose of determining any liability under the Securities Act, the information omitted from the form of prospectus filed as part of

this Registration Statement in reliance upon Rule 430A and contained in the form of prospectus filed by the Registrant under the Securities

Act shall be deemed to be part of the Registration Statement as of the time it was declared effective; and

(b) for

the purpose of determining any liability under the Securities Act, each post- effective amendment that contains a form of prospectus shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

5. Not

applicable.

6. Not

applicable.

7. The

Registrant undertakes to send by first class mail or other means designed to ensure equally prompt delivery, within two business days

of receipt of an oral or written request, its Statement of Additional Information.

NOTICE

A copy of the Agreement and Declaration of Trust of

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund is on file with the Secretary of State of The Commonwealth of Massachusetts

and notice is hereby given that this instrument is executed on behalf of the Registrant by an officer of the Registrant as an officer

and not individually and that the obligations of or arising out of this instrument are not binding upon any of the Trustees, officers

or shareholders individually, but are binding only upon the assets and property of the Registrant.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended

and the Investment Company Act of 1940, as amended the Registrant has duly caused this Amendment to the Registration Statement to be signed

on its behalf by the undersigned, thereunto duly authorized in the City of Boston and the Commonwealth of Massachusetts, on the 28th

day of June, 2021.

|

|

EATON VANCE TAX-MANAGED GLOBAL BUY-WRITE OPPORTUNITIES FUND

|

|

|

|

|

|

By:

|

Edward J. Perkin*

|

|

|

|

Edward J. Perkin, President

|

Pursuant to the requirements of the Securities Act of 1933, as amended

this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

Signature

|

Title

|

|

|

|

|

Edward J. Perkin*

|

President (Chief Executive Officer)

|

|

Edward J. Perkin

|

|

|

|

|

|

James F. Kirchner*

|

Treasurer (Principal Financial and Accounting Officer)

|

|

James F. Kirchner

|

|

|

|

|

|

Signature

|

Title

|

Signature

|

Title

|

|

|

|

|

|

|

Thomas E. Faust Jr.*

|

Trustee

|

Helen Frame Peters*

|

Trustee

|

|

Thomas E. Faust Jr.

|

|

Helen Frame Peters

|

|

|

|

|

|

|

|

Mark R. Fetting*

|

Trustee

|

Keith Quinton*

|

Trustee

|

|

Mark R. Fetting

|

|

Keith Quinton

|

|

|

|

|

|

|

|

Cynthia E. Frost*

|

Trustee

|

Marcus L. Smith*

|

Trustee

|

|

Cynthia E. Frost

|

|

Marcus L. Smith

|

|

|

|

|

|

|

|

George J. Gorman*

|

Trustee

|

Susan J. Sutherland*

|

Trustee

|

|

George J. Gorman

|

|

Susan J. Sutherland

|

|

|

|

|

|

|

|

Valerie A. Mosley*

|

Trustee

|

Scott E. Wennerholm*

|

Trustee

|

|

Valerie A. Mosley

|

|

Scott E. Wennerholm

|

|

|

|

|

|

|

|

William H. Park*

|

Trustee

|

|

|

|

William H. Park

|

|

|

|

|

|

|

|

|

|

*By:

|

/s/ Maureen A. Gemma

|

|

|

|

Maureen A. Gemma (As attorney-in-fact)

|

|

|

|

|

|

|

|

INDEX TO EXHIBITS

|

Exhibit No.

|

Description

|

|

(l)

|

|

Opinion of Internal Counsel

|

|

|

|

|

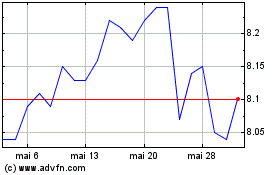

Eaton Vance Tax Managed ... (NYSE:ETW)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Eaton Vance Tax Managed ... (NYSE:ETW)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025