Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

27 Novembro 2024 - 1:14PM

Edgar (US Regulatory)

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2024

Portfolio of Investments (Unaudited)

| Security

| Shares

| Value

|

| Aerospace & Defense — 2.2%

|

| Airbus SE(1)

|

| 56,122

| $ 8,213,805

|

| General Dynamics Corp.(1)

|

| 5,823

| 1,759,710

|

| L3Harris Technologies, Inc.(1)

|

| 6,745

| 1,604,433

|

| Northrop Grumman Corp.(1)

|

| 1,439

| 759,893

|

| Rolls-Royce Holdings PLC(2)

|

| 342,522

| 2,424,196

|

| RTX Corp.(1)

|

| 32,105

| 3,889,842

|

| Safran SA

|

| 12,871

| 3,028,840

|

| Textron, Inc.(1)

|

| 16,487

| 1,460,418

|

|

|

|

| $ 23,141,137

|

| Air Freight & Logistics — 0.4%

|

| Deutsche Post AG(1)

|

| 74,966

| $ 3,343,982

|

| Expeditors International of Washington, Inc.(1)

|

| 3,871

| 508,650

|

| Yamato Holdings Co. Ltd.

|

| 35,200

| 400,844

|

|

|

|

| $ 4,253,476

|

| Automobile Components — 0.3%

|

| Denso Corp.

|

| 114,600

| $ 1,722,597

|

| Yokohama Rubber Co. Ltd.

|

| 48,000

| 1,078,842

|

|

|

|

| $ 2,801,439

|

| Automobiles — 2.5%

|

| Bayerische Motoren Werke AG

|

| 35,862

| $ 3,171,508

|

| Honda Motor Co. Ltd.

|

| 74,400

| 794,320

|

| Isuzu Motors Ltd.

|

| 58,000

| 790,839

|

| Mazda Motor Corp.

|

| 26,000

| 198,654

|

| Mercedes-Benz Group AG(1)

|

| 53,889

| 3,491,961

|

| Mitsubishi Motors Corp.

|

| 123,300

| 335,465

|

| Stellantis NV

|

| 274,035

| 3,794,842

|

| Tesla, Inc.(1)(2)

|

| 45,800

| 11,982,654

|

| Toyota Motor Corp.

|

| 64,500

| 1,159,324

|

|

|

|

| $ 25,719,567

|

| Banks — 5.2%

|

| Bank of America Corp.(1)

|

| 50,000

| $ 1,984,000

|

| BNP Paribas SA(1)

|

| 94,000

| 6,450,434

|

| Credit Agricole SA(1)

|

| 88,088

| 1,347,118

|

| Fifth Third Bancorp(1)

|

| 28,506

| 1,221,197

|

| HSBC Holdings PLC(1)

|

| 700,000

| 6,279,712

|

| Huntington Bancshares, Inc.(1)

|

| 87,053

| 1,279,679

|

| ING Groep NV(1)

|

| 301,212

| 5,464,890

|

| Intesa Sanpaolo SpA

|

| 2,042,702

| 8,744,182

|

| JPMorgan Chase & Co.(1)

|

| 30,325

|

6,394,330

|

| Security

| Shares

| Value

|

| Banks (continued)

|

| KBC Group NV

|

| 22,722

| $ 1,807,716

|

| KeyCorp(1)

|

| 64,715

| 1,083,976

|

| Lloyds Banking Group PLC

|

| 2,000,000

| 1,572,585

|

| NatWest Group PLC

|

| 464,285

| 2,149,339

|

| Nordea Bank Abp

|

| 90,000

| 1,062,470

|

| PNC Financial Services Group, Inc.(1)

|

| 6,406

| 1,184,149

|

| Resona Holdings, Inc.

|

| 55,000

| 385,390

|

| Standard Chartered PLC

|

| 160,392

| 1,701,113

|

| Truist Financial Corp.(1)

|

| 21,845

| 934,311

|

| UniCredit SpA

|

| 70,000

| 3,073,112

|

|

|

|

| $ 54,119,703

|

| Beverages — 1.4%

|

| Coca-Cola Co.(1)

|

| 24,571

| $ 1,765,672

|

| Constellation Brands, Inc., Class A(1)

|

| 22,494

| 5,796,479

|

| Heineken Holding NV

|

| 24,773

| 1,871,617

|

| Heineken NV

|

| 7,692

| 682,820

|

| Kirin Holdings Co. Ltd.

|

| 54,100

| 824,476

|

| PepsiCo, Inc.(1)

|

| 24,025

| 4,085,451

|

|

|

|

| $ 15,026,515

|

| Biotechnology — 1.1%

|

| AbbVie, Inc.(1)

|

| 26,528

| $ 5,238,750

|

| Amgen, Inc.(1)

|

| 16,600

| 5,348,686

|

| BioMarin Pharmaceutical, Inc.(1)(2)

|

| 9,584

| 673,659

|

|

|

|

| $ 11,261,095

|

| Broadline Retail — 3.3%

|

| Amazon.com, Inc.(1)(2)

|

| 154,718

| $ 28,828,605

|

| Mercari, Inc.(2)

|

| 14,900

| 260,076

|

| Next PLC(1)

|

| 41,584

| 5,447,359

|

|

|

|

| $ 34,536,040

|

| Building Products — 0.3%

|

| Daikin Industries Ltd.

|

| 24,000

| $ 3,368,665

|

|

|

|

| $ 3,368,665

|

| Capital Markets — 1.5%

|

| 3i Group PLC

|

| 112,500

| $ 4,983,579

|

| CME Group, Inc.(1)

|

| 1,503

| 331,637

|

| Deutsche Boerse AG

|

| 2,000

| 469,537

|

| Moody's Corp.(1)

|

| 6,881

| 3,265,654

|

| S&P Global, Inc.(1)

|

| 7,842

| 4,051,334

|

| UBS Group AG

|

| 90,256

| 2,792,886

|

|

|

|

| $ 15,894,627

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Chemicals — 2.1%

|

| Air Liquide SA

|

| 40,125

| $ 7,748,538

|

| Air Products and Chemicals, Inc.(1)

|

| 14,809

| 4,409,232

|

| BASF SE(1)

|

| 10,000

| 530,028

|

| Corteva, Inc.(1)

|

| 4,706

| 276,666

|

| Daicel Corp.

|

| 20,000

| 186,657

|

| Dow, Inc.(1)

|

| 4,706

| 257,089

|

| Eastman Chemical Co.(1)

|

| 20,943

| 2,344,569

|

| Mitsubishi Gas Chemical Co., Inc.

|

| 9,200

| 179,379

|

| Nitto Denko Corp.

|

| 101,500

| 1,708,069

|

| Shin-Etsu Chemical Co. Ltd.

|

| 83,500

| 3,489,497

|

| Tosoh Corp.

|

| 51,600

| 690,907

|

|

|

|

| $ 21,820,631

|

| Commercial Services & Supplies — 0.2%

|

| SECOM Co. Ltd.

|

| 49,400

| $ 1,827,259

|

| Waste Management, Inc.(1)

|

| 3,330

| 691,308

|

|

|

|

| $ 2,518,567

|

| Communications Equipment — 1.0%

|

| Cisco Systems, Inc.(1)

|

| 181,723

| $ 9,671,298

|

| Nokia OYJ

|

| 200,000

| 873,234

|

|

|

|

| $ 10,544,532

|

| Construction & Engineering — 0.2%

|

| Ferrovial SE

|

| 60,990

| $ 2,621,167

|

|

|

|

| $ 2,621,167

|

| Construction Materials — 0.3%

|

| CRH PLC

|

| 29,332

| $ 2,684,509

|

|

|

|

| $ 2,684,509

|

| Consumer Finance — 0.4%

|

| American Express Co.(1)

|

| 13,280

| $ 3,601,536

|

| Navient Corp.(1)

|

| 28,416

| 443,005

|

|

|

|

| $ 4,044,541

|

| Consumer Staples Distribution & Retail — 1.4%

|

| Costco Wholesale Corp.(1)

|

| 8,600

| $ 7,624,072

|

| Koninklijke Ahold Delhaize NV

|

| 94,107

| 3,253,140

|

| Seven & i Holdings Co. Ltd.

|

| 101,100

| 1,522,329

|

| Target Corp.(1)

|

| 7,168

| 1,117,204

|

| Walmart, Inc.(1)

|

| 16,551

| 1,336,493

|

|

|

|

| $ 14,853,238

|

| Security

| Shares

| Value

|

| Containers & Packaging — 0.2%

|

| Smurfit WestRock PLC(1)

|

| 44,508

| $ 2,199,585

|

|

|

|

| $ 2,199,585

|

| Distributors — 0.1%

|

| LKQ Corp.(1)

|

| 34,009

| $ 1,357,639

|

|

|

|

| $ 1,357,639

|

| Diversified Telecommunication Services — 0.8%

|

| Deutsche Telekom AG(1)

|

| 244,879

| $ 7,191,907

|

| United Internet AG(3)

|

| 32,975

| 678,311

|

|

|

|

| $ 7,870,218

|

| Electric Utilities — 1.5%

|

| Acciona SA

|

| 8,786

| $ 1,246,528

|

| Chubu Electric Power Co., Inc.

|

| 31,500

| 370,193

|

| Edison International(1)

|

| 39,098

| 3,405,045

|

| Iberdrola SA(1)

|

| 652,321

| 10,084,311

|

| Tokyo Electric Power Co. Holdings, Inc.(2)

|

| 40,600

| 180,063

|

|

|

|

| $ 15,286,140

|

| Electrical Equipment — 1.6%

|

| ABB Ltd.(1)

|

| 103,575

| $ 6,008,966

|

| Accelleron Industries AG

|

| 5,372

| 278,726

|

| Fujikura Ltd.

|

| 69,000

| 2,344,622

|

| Legrand SA(1)

|

| 47,726

| 5,498,311

|

| Schneider Electric SE

|

| 11,000

| 2,899,684

|

|

|

|

| $ 17,030,309

|

| Electronic Equipment, Instruments & Components — 1.1%

|

| Alps Alpine Co. Ltd.

|

| 82,200

| $ 893,125

|

| Citizen Watch Co. Ltd.

|

| 104,800

| 671,825

|

| Corning, Inc.(1)

|

| 7,504

| 338,806

|

| Halma PLC

|

| 50,000

| 1,748,273

|

| Kyocera Corp.

|

| 135,200

| 1,580,109

|

| Taiyo Yuden Co. Ltd.

|

| 51,500

| 1,060,568

|

| TDK Corp.

|

| 394,000

| 5,033,086

|

|

|

|

| $ 11,325,792

|

| Entertainment — 1.8%

|

| Electronic Arts, Inc.(1)

|

| 30,496

| $ 4,374,346

|

| Konami Group Corp.

|

| 12,400

| 1,264,533

|

| Netflix, Inc.(1)(2)

|

| 13,806

| 9,792,182

|

| Nintendo Co. Ltd.

|

| 22,400

| 1,197,311

|

| Walt Disney Co.(1)

|

| 20,692

| 1,990,363

|

|

|

|

| $ 18,618,735

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Financial Services — 1.5%

|

| Berkshire Hathaway, Inc., Class B(1)(2)

|

| 8,108

| $ 3,731,788

|

| Fidelity National Information Services, Inc.(1)

|

| 30,170

| 2,526,738

|

| M&G PLC

|

| 286,752

| 795,408

|

| Mastercard, Inc., Class A(1)

|

| 11,297

| 5,578,459

|

| ORIX Corp.

|

| 42,300

| 989,771

|

| Visa, Inc., Class A(1)

|

| 5,797

| 1,593,885

|

|

|

|

| $ 15,216,049

|

| Food Products — 2.6%

|

| Kikkoman Corp.

|

| 60,400

| $ 687,143

|

| Mondelez International, Inc., Class A(1)

|

| 101,663

| 7,489,513

|

| Nestle SA(1)

|

| 176,215

| 17,708,271

|

| Nissin Foods Holdings Co. Ltd.

|

| 30,000

| 838,328

|

| Toyo Suisan Kaisha Ltd.

|

| 5,000

| 328,275

|

|

|

|

| $ 27,051,530

|

| Gas Utilities — 0.1%

|

| Italgas SpA

|

| 35,014

| $ 211,662

|

| Snam SpA

|

| 152,501

| 776,801

|

|

|

|

| $ 988,463

|

| Ground Transportation — 0.5%

|

| Canadian Pacific Kansas City Ltd.(1)

|

| 8,498

| $ 726,919

|

| Central Japan Railway Co.

|

| 17,000

| 392,531

|

| CSX Corp.(1)

|

| 117,095

| 4,043,290

|

| East Japan Railway Co.

|

| 17,100

| 339,366

|

|

|

|

| $ 5,502,106

|

| Health Care Equipment & Supplies — 1.7%

|

| Abbott Laboratories(1)

|

| 59,052

| $ 6,732,519

|

| Boston Scientific Corp.(1)(2)

|

| 20,000

| 1,676,000

|

| ConvaTec Group PLC(4)

|

| 80,454

| 244,355

|

| EssilorLuxottica SA

|

| 12,248

| 2,901,847

|

| Olympus Corp.

|

| 51,100

| 971,375

|

| Teleflex, Inc.(1)

|

| 3,995

| 988,044

|

| Terumo Corp.

|

| 205,200

| 3,887,408

|

|

|

|

| $ 17,401,548

|

| Health Care Providers & Services — 1.0%

|

| McKesson Corp.(1)

|

| 7,905

| $ 3,908,390

|

| UnitedHealth Group, Inc.(1)

|

| 11,955

| 6,989,850

|

|

|

|

| $ 10,898,240

|

| Hotels, Restaurants & Leisure — 1.7%

|

| Amadeus IT Group SA

|

| 24,489

| $ 1,773,554

|

| Booking Holdings, Inc.(1)

|

| 1,737

|

7,316,453

|

| Security

| Shares

| Value

|

| Hotels, Restaurants & Leisure (continued)

|

| Compass Group PLC

|

| 91,736

| $ 2,941,027

|

| Flutter Entertainment PLC(2)

|

| 6,119

| 1,438,891

|

| InterContinental Hotels Group PLC

|

| 9,889

| 1,076,913

|

| Yum! Brands, Inc.(1)

|

| 22,953

| 3,206,764

|

|

|

|

| $ 17,753,602

|

| Household Durables — 0.8%

|

| Casio Computer Co. Ltd.

|

| 63,200

| $ 525,292

|

| Nikon Corp.

|

| 31,200

| 323,142

|

| PulteGroup, Inc.(1)

|

| 37,562

| 5,391,274

|

| Sekisui Chemical Co. Ltd.

|

| 61,000

| 953,780

|

| Sony Group Corp.

|

| 66,000

| 1,282,220

|

|

|

|

| $ 8,475,708

|

| Household Products — 0.4%

|

| Clorox Co.(1)

|

| 9,542

| $ 1,554,487

|

| Henkel AG & Co. KGaA, PFC Shares

|

| 8,309

| 781,044

|

| Procter & Gamble Co.(1)

|

| 2,881

| 498,989

|

| Reckitt Benckiser Group PLC

|

| 20,566

| 1,258,314

|

|

|

|

| $ 4,092,834

|

| Industrial Conglomerates — 1.9%

|

| Honeywell International, Inc.(1)

|

| 19,811

| $ 4,095,132

|

| Nisshinbo Holdings, Inc.

|

| 82,000

| 550,339

|

| Siemens AG(1)

|

| 76,879

| 15,553,225

|

|

|

|

| $ 20,198,696

|

| Insurance — 3.5%

|

| Ageas SA

|

| 22,500

| $ 1,200,579

|

| Allianz SE(1)

|

| 55,814

| 18,358,281

|

| Allstate Corp.(1)

|

| 14,109

| 2,675,772

|

| Chubb Ltd.(1)

|

| 1,376

| 396,825

|

| Cincinnati Financial Corp.(1)

|

| 5,091

| 692,987

|

| Hannover Rueck SE

|

| 5,000

| 1,427,296

|

| Hartford Financial Services Group, Inc.(1)

|

| 14,283

| 1,679,824

|

| Legal & General Group PLC

|

| 250,000

| 757,696

|

| Lincoln National Corp.(1)

|

| 17,183

| 541,436

|

| Marsh & McLennan Cos., Inc.(1)

|

| 13,642

| 3,043,394

|

| MS&AD Insurance Group Holdings, Inc.

|

| 96,300

| 2,263,453

|

| Principal Financial Group, Inc.(1)

|

| 17,247

| 1,481,517

|

| Prudential PLC(1)

|

| 224,243

| 2,080,357

|

|

|

|

| $ 36,599,417

|

| Interactive Media & Services — 5.0%

|

| Alphabet, Inc., Class A(1)

|

| 91,246

| $ 15,133,149

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Interactive Media & Services (continued)

|

| Alphabet, Inc., Class C(1)

|

| 82,327

| $ 13,764,251

|

| Meta Platforms, Inc., Class A(1)

|

| 40,045

| 22,923,360

|

|

|

|

| $ 51,820,760

|

| IT Services — 0.7%

|

| Capgemini SE(1)

|

| 23,097

| $ 4,986,654

|

| NTT Data Group Corp.

|

| 63,800

| 1,148,253

|

| Obic Co. Ltd.

|

| 11,500

| 403,468

|

| Otsuka Corp.

|

| 31,200

| 770,543

|

|

|

|

| $ 7,308,918

|

| Leisure Products — 0.1%

|

| Bandai Namco Holdings, Inc.

|

| 33,000

| $ 752,999

|

| Hasbro, Inc.(1)

|

| 6,865

| 496,477

|

|

|

|

| $ 1,249,476

|

| Life Sciences Tools & Services — 0.8%

|

| Revvity, Inc.(1)

|

| 6,547

| $ 836,379

|

| Thermo Fisher Scientific, Inc.(1)

|

| 11,503

| 7,115,411

|

|

|

|

| $ 7,951,790

|

| Machinery — 1.7%

|

| Daimler Truck Holding AG

|

| 13,462

| $ 505,462

|

| Dover Corp.(1)

|

| 7,424

| 1,423,478

|

| Ebara Corp.

|

| 62,500

| 1,024,429

|

| FANUC Corp.

|

| 93,435

| 2,744,224

|

| IHI Corp.

|

| 3,800

| 199,288

|

| Kawasaki Heavy Industries Ltd.

|

| 8,200

| 336,111

|

| Komatsu Ltd.

|

| 29,200

| 817,445

|

| Makita Corp.

|

| 7,700

| 260,118

|

| Mitsui E&S Co. Ltd.

|

| 35,800

| 288,214

|

| Parker-Hannifin Corp.(1)

|

| 7,147

| 4,515,618

|

| SMC Corp.

|

| 1,500

| 670,831

|

| Snap-on, Inc.(1)

|

| 5,378

| 1,558,060

|

| Stanley Black & Decker, Inc.(1)

|

| 21,567

| 2,375,174

|

| Toyota Industries Corp.

|

| 6,400

| 496,272

|

|

|

|

| $ 17,214,724

|

| Marine Transportation — 0.0%(5)

|

| Kawasaki Kisen Kaisha Ltd.

|

| 19,800

| $ 308,672

|

|

|

|

| $ 308,672

|

| Media — 0.4%

|

| Comcast Corp., Class A(1)

|

| 96,531

| $ 4,032,100

|

| Security

| Shares

| Value

|

| Media (continued)

|

| Hakuhodo DY Holdings, Inc.

|

| 20,900

| $ 171,260

|

|

|

|

| $ 4,203,360

|

| Metals & Mining — 0.9%

|

| Glencore PLC(2)

|

| 948,599

| $ 5,432,295

|

| Rio Tinto PLC(1)

|

| 54,826

| 3,891,966

|

|

|

|

| $ 9,324,261

|

| Multi-Utilities — 0.8%

|

| CMS Energy Corp.(1)

|

| 75,009

| $ 5,297,886

|

| NiSource, Inc.(1)

|

| 42,420

| 1,469,853

|

| Veolia Environnement SA

|

| 37,663

| 1,239,989

|

|

|

|

| $ 8,007,728

|

| Oil, Gas & Consumable Fuels — 3.1%

|

| BP PLC

|

| 193,968

| $ 1,011,647

|

| Chevron Corp.(1)

|

| 33,237

| 4,894,813

|

| ConocoPhillips(1)

|

| 2,940

| 309,523

|

| Exxon Mobil Corp.(1)

|

| 2,600

| 304,772

|

| Idemitsu Kosan Co. Ltd.

|

| 31,000

| 224,792

|

| Marathon Petroleum Corp.(1)

|

| 19,800

| 3,225,618

|

| Phillips 66(1)

|

| 22,983

| 3,021,115

|

| Shell PLC

|

| 253,138

| 8,212,234

|

| TotalEnergies SE(1)

|

| 165,699

| 10,759,711

|

|

|

|

| $ 31,964,225

|

| Paper and Forest Products — 0.0%(5)

|

| Nippon Paper Industries Co. Ltd.

|

| 11,100

| $ 75,898

|

|

|

|

| $ 75,898

|

| Personal Care Products — 1.1%

|

| Estee Lauder Cos., Inc., Class A(1)

|

| 16,077

| $ 1,602,716

|

| Kao Corp.

|

| 28,554

| 1,411,327

|

| Unilever PLC

|

| 128,549

| 8,334,253

|

|

|

|

| $ 11,348,296

|

| Pharmaceuticals — 6.4%

|

| Astellas Pharma, Inc.

|

| 141,000

| $ 1,629,588

|

| AstraZeneca PLC(1)

|

| 56,549

| 8,809,565

|

| Chugai Pharmaceutical Co. Ltd.

|

| 71,400

| 3,460,836

|

| Daiichi Sankyo Co. Ltd.

|

| 59,600

| 1,968,727

|

| Eisai Co. Ltd.

|

| 14,646

| 545,929

|

| Eli Lilly & Co.(1)

|

| 9,490

| 8,407,571

|

| Johnson & Johnson(1)

|

| 13,558

| 2,197,209

|

| Merck & Co., Inc.(1)

|

| 25,250

| 2,867,390

|

| Novartis AG(1)

|

| 123,663

|

14,238,841

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Pharmaceuticals (continued)

|

| Pfizer, Inc.(1)

|

| 14,458

| $ 418,415

|

| Roche Holding AG(1)

|

| 37,256

| 11,922,559

|

| Sandoz Group AG

|

| 24,732

| 1,030,654

|

| Sanofi SA(1)

|

| 63,182

| 7,274,722

|

| UCB SA

|

| 9,177

| 1,656,603

|

|

|

|

| $ 66,428,609

|

| Professional Services — 1.2%

|

| Equifax, Inc.(1)

|

| 11,910

| $ 3,499,873

|

| Experian PLC

|

| 79,133

| 4,167,904

|

| Recruit Holdings Co. Ltd.

|

| 39,700

| 2,411,870

|

| RELX PLC

|

| 5,000

| 236,082

|

| Robert Half, Inc.(1)

|

| 26,747

| 1,803,015

|

| Wolters Kluwer NV

|

| 961

| 162,093

|

|

|

|

| $ 12,280,837

|

| Real Estate Management & Development — 0.6%

|

| CBRE Group, Inc., Class A(1)(2)

|

| 33,984

| $ 4,230,328

|

| Daito Trust Construction Co. Ltd.

|

| 5,500

| 669,933

|

| Heiwa Real Estate Co. Ltd.

|

| 26,700

| 764,526

|

| Sumitomo Realty & Development Co. Ltd.

|

| 13,500

| 456,982

|

|

|

|

| $ 6,121,769

|

| Residential REITs — 0.1%

|

| UNITE Group PLC

|

| 62,903

| $ 792,211

|

|

|

|

| $ 792,211

|

| Semiconductors & Semiconductor Equipment — 12.6%

|

| Advantest Corp.

|

| 122,200

| $ 5,747,217

|

| Analog Devices, Inc.(1)

|

| 20,099

| 4,626,187

|

| ASML Holding NV(1)

|

| 24,587

| 20,452,938

|

| Broadcom, Inc.(1)

|

| 88,260

| 15,224,850

|

| Infineon Technologies AG

|

| 85,739

| 3,010,116

|

| Lam Research Corp.(1)

|

| 4,179

| 3,410,398

|

| Marvell Technology, Inc.(1)

|

| 60,650

| 4,374,078

|

| Micron Technology, Inc.(1)

|

| 41,033

| 4,255,532

|

| NVIDIA Corp.(1)

|

| 367,418

| 44,619,242

|

| NXP Semiconductors NV(1)

|

| 22,890

| 5,493,829

|

| Socionext, Inc.

|

| 18,100

| 360,022

|

| STMicroelectronics NV

|

| 35,000

| 1,045,252

|

| SUMCO Corp.

|

| 27,900

| 301,765

|

| Texas Instruments, Inc.(1)

|

| 44,924

| 9,279,950

|

| Tokyo Electron Ltd.

|

| 52,000

| 9,273,453

|

|

|

|

| $ 131,474,829

|

| Security

| Shares

| Value

|

| Software — 6.8%

|

| Adobe, Inc.(1)(2)

|

| 16,657

| $ 8,624,661

|

| Crowdstrike Holdings, Inc., Class A(1)(2)

|

| 11,401

| 3,197,639

|

| Dassault Systemes SE

|

| 40,765

| 1,619,217

|

| Datadog, Inc., Class A(1)(2)

|

| 20,556

| 2,365,173

|

| Microsoft Corp.(1)

|

| 110,383

| 47,497,805

|

| Oracle Corp.(1)

|

| 31,932

| 5,441,213

|

| Sage Group PLC

|

| 46,259

| 635,424

|

| Trend Micro, Inc.

|

| 14,097

| 837,014

|

|

|

|

| $ 70,218,146

|

| Specialized REITs — 0.4%

|

| American Tower Corp.(1)

|

| 17,793

| $ 4,137,940

|

|

|

|

| $ 4,137,940

|

| Specialty Retail — 2.6%

|

| Fast Retailing Co. Ltd.

|

| 47,100

| $ 15,627,645

|

| Home Depot, Inc.(1)

|

| 9,972

| 4,040,654

|

| Industria de Diseno Textil SA

|

| 15,379

| 910,843

|

| Lowe's Cos., Inc.(1)

|

| 17,893

| 4,846,319

|

| Nitori Holdings Co. Ltd.

|

| 7,100

| 1,057,065

|

| USS Co. Ltd.

|

| 54,400

| 516,363

|

|

|

|

| $ 26,998,889

|

| Technology Hardware, Storage & Peripherals — 5.0%

|

| Apple, Inc.(1)

|

| 216,322

| $ 50,403,026

|

| Hewlett Packard Enterprise Co.(1)

|

| 63,759

| 1,304,509

|

| HP, Inc.(1)

|

| 10,589

| 379,828

|

|

|

|

| $ 52,087,363

|

| Textiles, Apparel & Luxury Goods — 2.3%

|

| adidas AG

|

| 2,732

| $ 723,943

|

| Kering SA(1)

|

| 7,380

| 2,124,348

|

| LVMH Moet Hennessy Louis Vuitton SE(1)

|

| 23,302

| 17,869,732

|

| NIKE, Inc., Class B(1)

|

| 33,397

| 2,952,295

|

|

|

|

| $ 23,670,318

|

| Tobacco — 0.5%

|

| Altria Group, Inc.(1)

|

| 15,000

| $ 765,600

|

| British American Tobacco PLC(1)

|

| 81,683

| 2,978,005

|

| Japan Tobacco, Inc.

|

| 34,000

| 991,397

|

|

|

|

| $ 4,735,002

|

| Trading Companies & Distributors — 0.6%

|

| Ferguson Enterprises, Inc.

|

| 20,627

| $ 4,053,859

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Security

| Shares

| Value

|

| Trading Companies & Distributors (continued)

|

| Mitsubishi Corp.

|

| 64,200

| $ 1,334,066

|

| Sumitomo Corp.

|

| 49,400

| 1,109,329

|

|

|

|

| $ 6,497,254

|

| Transportation Infrastructure — 0.1%

|

| Aeroports de Paris SA

|

| 6,667

| $ 856,224

|

|

|

|

| $ 856,224

|

| Wireless Telecommunication Services — 0.9%

|

| KDDI Corp.

|

| 103,400

| $ 3,312,677

|

| SoftBank Group Corp.

|

| 94,296

| 5,593,283

|

|

|

|

| $ 8,905,960

|

Total Common Stocks

(identified cost $298,188,647)

|

|

| $1,053,059,519

|

| Short-Term Investments — 0.2%

|

| Security

| Shares

| Value

|

| Morgan Stanley Institutional Liquidity Funds - Government Portfolio, Institutional

Class, 4.83%(6)

|

| 1,952,851

| $ 1,952,851

|

Total Short-Term Investments

(identified cost $1,952,851)

|

|

| $ 1,952,851

|

Total Investments — 101.5%

(identified cost $300,141,498)

|

|

| $1,055,012,370

|

Total Written Call Options — (1.6)%

(premiums received $8,376,558)

|

|

| $ (16,627,505)

|

| Other Assets, Less Liabilities — 0.1%

|

|

| $ 1,538,273

|

| Net Assets — 100.0%

|

|

| $1,039,923,138

|

| The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

|

| (1)

| Security (or a portion thereof) has been pledged as collateral for written options.

|

| (2)

| Non-income producing security.

|

| (3)

| Security exempt from registration under Regulation S of the Securities Act of 1933, as amended, which exempts from registration securities offered and sold outside the United States.

Security may not be offered or sold in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act of 1933, as amended. At September

30, 2024, the aggregate value of these securities is $678,311 or 0.1% of the Fund's net assets.

|

| (4)

| Security exempt from registration under Rule 144A of the Securities Act of 1933, as amended. These securities may be sold in certain transactions in reliance on an exemption from

registration (normally to qualified institutional buyers). At September 30, 2024, the aggregate value of these securities is $244,355 or less than 0.05% of the Fund's net assets.

|

| (5)

| Amount is less than 0.05%.

|

| (6)

| May be deemed to be an affiliated investment company. The rate shown is the annualized seven-day yield as of September 30, 2024.

|

| Country Concentration of Portfolio

|

| Country

| Percentage of

Total Investments

| Value

|

| United States

| 60.3%

| $636,271,639

|

| Japan

| 11.4

| 119,925,278

|

| France

| 7.1

| 74,644,768

|

| Germany

| 5.6

| 59,236,601

|

| United Kingdom

| 5.4

| 56,604,300

|

| Netherlands

| 3.0

| 31,887,498

|

| Switzerland

| 2.3

| 24,350,073

|

| Spain

| 1.3

| 14,015,236

|

| Italy

| 1.2

| 12,805,757

|

| Australia

| 0.9

| 9,324,261

|

| China

| 0.5

| 5,493,829

|

| Belgium

| 0.4

| 4,664,898

|

| Hong Kong

| 0.2

| 2,080,357

|

| Finland

| 0.2

| 1,935,704

|

| Singapore

| 0.1

| 1,045,252

|

| Canada

| 0.1

| 726,919

|

| Total Investments

| 100.0%

| $1,055,012,370

|

| Written Call Options (Exchange-Traded) — (1.6)%

|

| Description

| Number of

Contracts

| Notional

Amount

| Exercise

Price

| Expiration

Date

| Value

|

| Dow Jones Euro Stoxx 50 Index

| 940

| EUR

| 47,004,230

| EUR

| 4,925

| 10/11/24

| $ (1,099,522)

|

| Dow Jones Euro Stoxx 50 Index

| 920

| EUR

| 46,004,140

| EUR

| 5,000

| 10/18/24

| (709,058)

|

| Dow Jones Euro Stoxx 50 Index

| 910

| EUR

| 45,504,095

| EUR

| 5,150

| 10/25/24

| (178,717)

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Written Call Options (Exchange-Traded) (continued)

|

| Description

| Number of

Contracts

| Notional

Amount

| Exercise

Price

| Expiration

Date

| Value

|

| FTSE 100 Index

| 710

| GBP

| 58,482,345

| GBP

| 8,400

| 10/18/24

| $ (221,450)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 19,400

| 10/2/24

| (584,730)

|

| NASDAQ 100 Index

| 10

| USD

| 20,060,690

| USD

| 19,150

| 10/4/24

| (918,750)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 19,100

| 10/7/24

| (876,420)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 19,200

| 10/9/24

| (809,280)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 19,900

| 10/11/24

| (334,260)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 19,800

| 10/14/24

| (405,540)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 19,900

| 10/16/24

| (366,750)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 20,200

| 10/18/24

| (231,120)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 20,200

| 10/21/24

| (249,345)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 20,400

| 10/23/24

| (187,515)

|

| NASDAQ 100 Index

| 10

| USD

| 20,060,690

| USD

| 20,500

| 10/25/24

| (194,250)

|

| NASDAQ 100 Index

| 9

| USD

| 18,054,621

| USD

| 20,400

| 10/28/24

| (204,801)

|

| Nikkei 225 Index

| 410

| JPY

| 15,547,015,500

| JPY

| 37,750

| 10/11/24

| (2,331,022)

|

| S&P 500 Index

| 48

| USD

| 27,659,904

| USD

| 5,610

| 10/2/24

| (720,960)

|

| S&P 500 Index

| 48

| USD

| 27,659,904

| USD

| 5,580

| 10/4/24

| (883,920)

|

| S&P 500 Index

| 48

| USD

| 27,659,904

| USD

| 5,560

| 10/7/24

| (988,320)

|

| S&P 500 Index

| 48

| USD

| 27,659,904

| USD

| 5,550

| 10/9/24

| (1,055,280)

|

| S&P 500 Index

| 48

| USD

| 27,659,904

| USD

| 5,700

| 10/11/24

| (485,040)

|

| S&P 500 Index

| 48

| USD

| 27,659,904

| USD

| 5,710

| 10/14/24

| (450,480)

|

| S&P 500 Index

| 48

| USD

| 27,659,904

| USD

| 5,725

| 10/16/24

| (424,800)

|

| S&P 500 Index

| 47

| USD

| 27,083,656

| USD

| 5,780

| 10/18/24

| (285,290)

|

| S&P 500 Index

| 47

| USD

| 27,083,656

| USD

| 5,790

| 10/21/24

| (269,780)

|

| S&P 500 Index

| 47

| USD

| 27,083,656

| USD

| 5,810

| 10/23/24

| (240,640)

|

| S&P 500 Index

| 47

| USD

| 27,083,656

| USD

| 5,825

| 10/25/24

| (230,300)

|

| S&P 500 Index

| 48

| USD

| 27,659,904

| USD

| 5,810

| 10/28/24

| (237,436)

|

| SMI Index

| 360

| CHF

| 43,807,932

| CHF

| 12,200

| 10/18/24

| (452,729)

|

| Total

|

|

|

|

|

|

| $(16,627,505)

|

| Abbreviations:

|

| PFC Shares

| – Preference Shares

|

| REITs

| – Real Estate Investment Trusts

|

| Currency Abbreviations:

|

| CHF

| – Swiss Franc

|

| EUR

| – Euro

|

| GBP

| – British Pound Sterling

|

| JPY

| – Japanese Yen

|

| USD

| – United States Dollar

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

At September 30, 2024, the Fund had

sufficient cash and/or securities to cover commitments under open derivative contracts.

The Fund is subject to equity price

risk in the normal course of pursuing its investment objectives. The Fund writes index call options above the current value of the index to generate premium income. In writing index call options, the Fund in effect,

sells potential appreciation in the value of the applicable index above the exercise price in exchange for the option premium received. The Fund retains the risk of loss, minus the premium received, should the value

of the underlying index decline.

Affiliated Investments

At September 30, 2024, the value of

the Fund's investment in funds that may be deemed to be affiliated was $1,952,851, which represents 0.2% of the Fund's net assets. Transactions in such investments by the Fund for the fiscal year to date ended

September 30, 2024 were as follows:

| Name

| Value,

beginning

of period

| Purchases

| Sales

proceeds

| Net realized

gain (loss)

| Change in

unrealized

appreciation

(depreciation)

| Value, end

of period

| Dividend

income

| Shares,

end of period

|

| Short-Term Investments

|

| Liquidity Fund, Institutional Class(1)

| $3,342,440

| $121,222,454

| $(122,612,043)

| $ —

| $ —

| $1,952,851

| $123,085

| 1,952,851

|

| (1)

| Represents investment in Morgan Stanley Institutional Liquidity Funds - Government Portfolio.

|

Fair Value Measurements

Under generally accepted accounting

principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is

summarized in the three broad levels listed below.

| •

|

Level 1 – quoted prices in active markets for identical investments

|

| •

|

Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.)

|

| •

| Level 3 – significant unobservable inputs (including a fund's own assumptions in determining the fair value of investments)

|

In cases where the inputs used to

measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs

or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

At September 30, 2024, the hierarchy

of inputs used in valuing the Fund’s investments and open derivative instruments, which are carried at fair value, were as follows:

| Asset Description

| Level 1

| Level 2

| Level 3

| Total

|

| Common Stocks:

|

|

|

|

|

| Communication Services

| $ 72,009,751

| $ 19,409,282

| $ —

| $ 91,419,033

|

| Consumer Discretionary

| 70,419,134

| 72,143,544

| —

| 142,562,678

|

| Consumer Staples

| 33,636,676

| 43,470,739

| —

| 77,107,415

|

| Energy

| 11,755,841

| 20,208,384

| —

| 31,964,225

|

| Financials

| 49,717,433

| 76,156,904

| —

| 125,874,337

|

| Health Care

| 53,398,273

| 60,543,009

| —

| 113,941,282

|

| Industrials

| 38,768,672

| 77,023,162

| —

| 115,791,834

|

| Information Technology

| 220,508,024

| 62,451,556

| —

| 282,959,580

|

| Materials

| 9,487,141

| 26,617,743

| —

| 36,104,884

|

| Real Estate

| 8,368,268

| 2,683,652

| —

| 11,051,920

|

| Utilities

| 10,172,784

| 14,109,547

| —

| 24,282,331

|

| Total Common Stocks

| $578,241,997

| $474,817,522*

| $ —

| $1,053,059,519

|

Eaton Vance

Tax-Managed Global Buy-Write

Opportunities Fund

September 30, 2024

Portfolio of Investments

(Unaudited) — continued

| Asset Description (continued)

| Level 1

| Level 2

| Level 3

| Total

|

| Short-Term Investments

| $ 1,952,851

| $ —

| $ —

| $ 1,952,851

|

| Total Investments

| $580,194,848

| $474,817,522

| $ —

| $1,055,012,370

|

| Liability Description

|

|

|

|

|

| Written Call Options

| $(11,635,007)

| $ (4,992,498)

| $ —

| $ (16,627,505)

|

| Total

| $(11,635,007)

| $ (4,992,498)

| $ —

| $ (16,627,505)

|

| *

| Includes foreign equity securities whose values were adjusted to reflect market trading of comparable securities or other correlated instruments that occurred after the close of

trading in their applicable foreign markets.

|

For information on the Fund's policy

regarding the valuation of investments and other significant accounting policies, please refer to the Fund's most recent financial statements included in its semi-annual or annual report to shareholders.

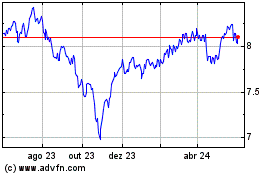

Eaton Vance Tax Managed ... (NYSE:ETW)

Gráfico Histórico do Ativo

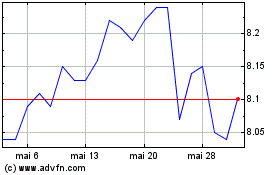

De Nov 2024 até Dez 2024

Eaton Vance Tax Managed ... (NYSE:ETW)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024