Franklin BSP Realty Trust, Inc. (NYSE: FBRT) (“FBRT” or the

“Company”) today announced financial results for the quarter ended

March 31, 2024.

Reported GAAP net income of $35.8 million for the three months

ended March 31, 2024, compared to $30.0 million for the three

months ended December 31, 2023. Reported diluted earnings per share

("EPS") to common stockholders of $0.35 for the three months ended

March 31, 2024, compared to $0.28 for the three months ended

December 31, 2023.

Reported Distributable Earnings (a non-GAAP financial measure)

of $41.0 million, or $0.41 per diluted common share on a fully

converted basis(1), for the three months ended March 31, 2024,

compared to $39.3 million, or $0.39 per diluted common share on a

fully converted basis(1), for the three months ended December 31,

2023.

First Quarter 2024 Summary

- Produced a first quarter GAAP and Distributable Earnings ROE (a

non-GAAP financial measure) of 8.9% and 10.4%, respectively

- Book value of $15.68 per diluted common share on a fully

converted basis(1)

- Declared first quarter common stock cash dividend of $0.355,

representing an annualized 9.1% yield on book value per share,

fully converted(1)

- GAAP and Distributable Earnings dividend coverage of 99% and

115%, respectively

- Closed $591 million of new loan commitments at a weighted

average spread of 464 basis points

- Core portfolio principal balance of $5.2 billion, an increase

of $199 million

- Total liquidity of $1.0 billion, which includes $240 million in

cash and cash equivalents

- Repurchased 151,123 shares of common stock at a net average

price of $12.42 per share for an aggregate of $1.9 million, which

represents a $0.01 per share increase to book value

Richard Byrne, Chairman and Chief Executive Officer of FBRT,

said, “We are very pleased with the Company's distributable

earnings growth versus last quarter. Importantly, our

multifamily-focused portfolio continues to demonstrate stability

which positions us to deliver consistent performance over the long

term.”

Further commenting on the Company's results, Michael Comparato,

President of FBRT, added, “We have been actively originating loans,

and have committed to $756 million of originations year-to-date.

This has fueled net growth in our portfolio. With our robust

pipeline and ample liquidity, we are well-positioned to further

grow our portfolio and capitalize on market opportunities, all

while keeping an active eye on the existing legacy portfolio and

working through issues as needed.”

Core Portfolio

For the quarter ended March 31, 2024, the Company closed $591

million of new loan commitments, funded $487 million of principal

balance on new and existing loans, and received loan repayments of

$252 million. The Company's core portfolio at the end of the

quarter consisted of 145 loans with an aggregate principal balance

of approximately $5.2 billion. The average loan size was

approximately $36 million. Over 99% of the aggregate principal

balance of the Company's portfolio is in senior mortgage loans with

approximately 97% in floating rate loans and approximately 75% of

the portfolio is collateralized by multifamily properties. The

Company's exposure to office loans is only 6%. As of March 31,

2024, the Company had six loans on its watch list, all of which are

risk rated a four.

Conduit

For the quarter ended March 31, 2024, the Company closed $131

million of fixed rate loans that were sold or will be sold through

FBRT's conduit program. During the same period, the Company sold

$101 million of conduit loans for a gain of $5.5 million, gross of

related derivatives.

Allowance for Credit Losses

During the quarter, the Company recognized an additional

incremental provision for credit losses of approximately $2.9

million, with $0.7 million of the increase related to an

asset-specific provision.

Book Value

As of March 31, 2024, book value was $15.68 per diluted common

share on a fully converted basis(1).

Share Repurchase Program

During the quarter, the Company repurchased 151,123 shares of

the Company's common stock under the Company's $65 million share

repurchase program. These shares were repurchased at an average

price of $12.42 per share, inclusive of any broker's fees or

commissions, for an aggregate of $1.9 million. As of April 19,

2024, $32.1 million remains available under the $65 million share

repurchase plan.

Distributable Earnings and Distributable Earnings to

Common

Distributable Earnings is a non-GAAP measure, which the Company

defines as GAAP net income (loss), adjusted for (i) non-cash CLO

amortization acceleration and amortization over the expected useful

life of the Company's CLOs, (ii) unrealized gains and losses on

loans, derivatives and ARMs, including CECL reserves and

impairments, (iii) non-cash equity compensation expense, (iv)

depreciation and amortization, (v) subordinated performance fee

accruals/(reversal), (vi) realized gains and losses on debt

extinguishment and CLO calls, and (vii) certain other non-cash

items. Further, Distributable Earnings to Common, a non-GAAP

measure, presents Distributable Earnings net of (i) perpetual

preferred stock dividend payments and (ii) non-controlling

interests in joint ventures.

The Company believes that Distributable Earnings and

Distributable Earnings to Common provide meaningful information to

consider in addition to the disclosed GAAP results. The Company

believes Distributable Earnings and Distributable Earnings to

Common are useful financial metrics for existing and potential

future holders of its common stock as historically, over time,

Distributable Earnings to Common has been an indicator of common

dividends per share. As a REIT, the Company generally must

distribute annually at least 90% of its taxable income, subject to

certain adjustments, and therefore believes dividends are one of

the principal reasons stockholders may invest in its common stock.

Further, Distributable Earnings to Common helps investors evaluate

performance excluding the effects of certain transactions and GAAP

adjustments that the Company does not believe are necessarily

indicative of current loan portfolio performance and the Company's

operations and is one of the performance metrics the Company's

board of directors considers when dividends are declared.

Distributable Earnings and Distributable Earnings to Common do

not represent net income (loss) and should not be considered as an

alternative to GAAP net income (loss). The methodology for

calculating Distributable Earnings and Distributable Earnings to

Common may differ from the methodologies employed by other

companies and thus may not be comparable to the Distributable

Earnings reported by other companies.

Please refer to the financial statements and reconciliation of

GAAP Net Income to Distributable Earnings and Distributable

Earnings to Common included at the end of this release for further

information.

1 Fully converted per share information in this press release

assumes applicable conversion of our series of outstanding

convertible preferred stock into common stock and the vesting of

our outstanding equity compensation awards.

Supplemental Information

The Company published a supplemental earnings presentation for

the quarter ended March 31, 2024 on its website to provide

additional disclosure and financial information. These materials

can be found on the Company’s website at http://www.fbrtreit.com

under the Presentations tab.

Conference Call and Webcast

The Company will host a conference call and live audio webcast

to discuss its financial results on Tuesday, April 30, 2024, at

9:00 a.m. ET. Participants are encouraged to pre-register for the

call and webcast at

https://dpregister.com/sreg/10187136/fbca98b380. If you are unable

to pre-register, the conference call may be accessed by dialing

(844) 701-1166 (Domestic) or (412) 317-5795 (International). Ask to

join the Franklin BSP Realty Trust conference call. Participants

should call in at least five minutes prior to the start of the

call.

The call will also be accessible via live webcast at

https://ccmediaframe.com?id=2vxLzVHs. Please allow extra time prior

to the call to download and install audio software, if needed. A

slide presentation containing supplemental information may also be

accessed through the Company’s website in advance of the call.

An audio replay of the live broadcast will be available

approximately one hour after the end of the conference call on

FBRT’s website. The replay will be available for 90 days on the

Company’s website.

About Franklin BSP Realty Trust, Inc.

Franklin BSP Realty Trust, Inc. (NYSE: FBRT) is a real estate

investment trust that originates, acquires and manages a

diversified portfolio of commercial real estate debt secured by

properties located in the United States. As of March 31, 2024, FBRT

had approximately $6.0 billion of assets. FBRT is externally

managed by Benefit Street Partners L.L.C., a wholly owned

subsidiary of Franklin Resources, Inc. For further information,

please visit www.fbrtreit.com.

Forward-Looking Statements

Certain statements included in this press release are

forward-looking statements. Those statements include statements

regarding the intent, belief or current expectations of the Company

and members of our management team, as well as the assumptions on

which such statements are based, and generally are identified by

the use of words such as "may," "will," "seeks," "anticipates,"

"believes," "estimates," "expects," "plans," "intends," "should" or

similar expressions. Actual results may differ materially from

those contemplated by such forward-looking statements. Further,

forward-looking statements speak only as of the date they are made,

and we undertake no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results over

time, unless required by law.

The Company's forward-looking statements are subject to various

risks and uncertainties. Factors that could cause actual outcomes

to differ materially from our forward-looking statements include

macroeconomic factors in the United States including inflation,

changing interest rates and economic contraction, the extent of any

recoveries on delinquent loans, the financial stability of our

borrowers and the other risks and important factors contained and

identified in the Company’s filings with the Securities and

Exchange Commission (“SEC”), including its Annual Report on Form

10-K for the fiscal year ended December 31, 2023 and its subsequent

filings with the SEC, any of which could cause actual results to

differ materially from the forward-looking statements. The

forward-looking statements included in this communication are made

only as of the date hereof.

FRANKLIN BSP REALTY TRUST,

INC.

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share data)

(Unaudited)

March 31, 2024

December 31, 2023

ASSETS

Cash and cash equivalents

$

240,030

$

337,595

Restricted cash

8,092

6,092

Commercial mortgage loans, held for

investment, net of allowance for credit losses of $49,215 and

$47,175 as of March 31, 2024 and December 31, 2023,

respectively

5,184,205

4,989,767

Commercial mortgage loans, held for sale,

measured at fair value

30,457

—

Real estate securities, available for

sale, measured at fair value, amortized cost of $217,324 and

$243,272 as of March 31, 2024 and December 31, 2023, respectively

(includes pledged assets of $217,855 and $167,948 as of March 31,

2024 and December 31, 2023, respectively)

217,855

242,569

Receivable for loan repayment(1)

26,683

55,174

Accrued interest receivable

39,628

42,490

Prepaid expenses and other assets

19,911

19,213

Intangible lease asset, net of

amortization

42,037

42,793

Real estate owned, net of depreciation

115,169

115,830

Real estate owned, held for sale

103,657

103,657

Total assets

$

6,027,724

$

5,955,180

LIABILITIES AND STOCKHOLDERS'

EQUITY

Collateralized loan obligations

$

3,530,740

$

3,567,166

Repurchase agreements and revolving credit

facilities - commercial mortgage loans

412,556

299,707

Repurchase agreements - real estate

securities

194,769

174,055

Mortgage note payable

23,998

23,998

Other financings

12,865

36,534

Unsecured debt

81,320

81,295

Derivative instruments, measured at fair

value

524

—

Interest payable

15,052

15,383

Distributions payable

36,308

36,133

Accounts payable and accrued expenses

11,195

13,339

Due to affiliates

20,969

19,316

Intangible lease liability, held for

sale

12,297

12,297

Total liabilities

$

4,352,593

$

4,279,223

Commitments and Contingencies

Redeemable convertible preferred

stock:

Redeemable convertible preferred stock

Series H, $0.01 par value, 20,000 authorized and 17,950 issued and

outstanding as of March 31, 2024 and December 31, 2023

$

89,748

$

89,748

Total redeemable convertible preferred

stock

$

89,748

$

89,748

Equity:

Preferred stock, $0.01 par value;

100,000,000 shares authorized, 7.5% Cumulative Redeemable Preferred

Stock, Series E, 10,329,039 shares issued and outstanding as of

March 31, 2024 and December 31, 2023

$

258,742

$

258,742

Common stock, $0.01 par value, 900,000,000

shares authorized, 83,254,483 and 82,751,913 shares issued and

outstanding as of March 31, 2024 and December 31, 2023,

respectively

820

820

Additional paid-in capital

1,597,611

1,599,197

Accumulated other comprehensive income

(loss)

530

(703

)

Accumulated deficit

(299,326

)

(298,942

)

Total stockholders' equity

$

1,558,377

$

1,559,114

Non-controlling interest

27,006

27,095

Total equity

$

1,585,383

$

1,586,209

Total liabilities, redeemable

convertible preferred stock and equity

$

6,027,724

$

5,955,180

_______________________

(1)

Includes $26.6 million and $55.1 million of cash held by servicer

related to the CLOs as of March 31, 2024 and December 31, 2023,

respectively.

FRANKLIN BSP REALTY TRUST,

INC.

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except share

and per share data)

(Unaudited)

Three Months Ended

March 31,

2024

2023

Income

Interest income

$

130,558

$

130,536

Less: Interest expense

81,318

71,075

Net interest income

49,240

59,461

Revenue from real estate owned

4,712

3,312

Total income

$

53,952

$

62,773

Expenses

Asset management and subordinated

performance fee

$

7,865

$

8,085

Acquisition expenses

238

378

Administrative services expenses

2,860

4,029

Professional fees

4,084

4,814

Share-based compensation

1,799

1,022

Depreciation and amortization

1,417

1,805

Other expenses

2,363

2,166

Total expenses

$

20,626

$

22,299

Other income/(loss)

(Provision)/benefit for credit losses

$

(2,880

)

$

(4,360

)

Realized gain/(loss) on extinguishment of

debt

—

4,767

Realized gain/(loss) on real estate

securities, available for sale

88

596

Realized gain/(loss) on sale of commercial

mortgage loans, held for sale, measured at fair value

5,513

—

Unrealized gain/(loss) on commercial

mortgage loans, held for sale, measured at fair value

457

347

Gain/(loss) on other real estate

investments

6

(1,339

)

Trading gain/(loss)

—

2,968

Unrealized gain/(loss) on derivatives

(138

)

(320

)

Realized gain/(loss) on derivatives

290

44

Total other income/(loss)

$

3,336

$

2,703

Income/(loss) before taxes

36,662

43,177

(Provision)/benefit for income tax

(835

)

662

Net income/(loss)

$

35,827

$

43,839

Net (income)/loss attributable to

non-controlling interest

93

(9

)

Net income/(loss) attributable to

Franklin BSP Realty Trust, Inc.

$

35,920

$

43,830

Less: Preferred stock dividends

6,748

6,748

Net income/(loss) applicable to common

stock

$

29,172

$

37,082

Basic earnings per share

$

0.35

$

0.44

Diluted earnings per share

$

0.35

$

0.44

Basic weighted average shares

outstanding

81,994,096

82,774,771

Diluted weighted average shares

outstanding

81,994,096

82,774,771

FRANKLIN BSP REALTY TRUST,

INC.

RECONCILIATION OF GAAP NET

INCOME TO DISTRIBUTABLE EARNINGS

(In thousands, except share

and per share data)

(Unaudited)

The following table provides a

reconciliation of GAAP net income to Distributable Earnings and

Distributable Earnings to Common as of the three months ended March

31, 2024 and 2023 (amounts in thousands, except share and per share

data):

Three months ended March

31,

2024

2023

GAAP Net Income (Loss)

$

35,827

$

43,839

Adjustments:

CLO amortization acceleration(1)

—

(1,468

)

Unrealized (gain)/loss on financial

instruments(2)

(325

)

1,312

Unrealized (gain)/loss - ARMs

—

(734

)

(Reversal of)/Provision for credit

losses

2,880

4,360

Non-Cash Compensation Expense

1,799

1,022

Depreciation and amortization

1,417

1,805

Subordinated performance fee(3)

(554

)

(594

)

Realized (gain)/loss on debt

extinguishment / CLO call

—

(4,767

)

Distributable Earnings

$

41,044

$

44,775

7.5% Series E Cumulative Redeemable

Preferred Stock Dividend

(4,842

)

(4,842

)

Non-controlling interests in joint

ventures net income/(loss)

93

(9

)

Noncontrolling Interests in Joint Ventures

Depreciation and Amortization

(276

)

(360

)

Distributable Earnings to

Common

$

36,019

$

39,564

Average Common Stock & Common Stock

Equivalents(4)

1,389,912

1,422,565

GAAP Net Income/(Loss) ROE

8.9

%

11.0

%

Distributable Earnings ROE

10.4

%

11.1

%

GAAP Net Income/(Loss) Per Share,

Diluted

$

0.35

$

0.44

GAAP Net Income/(Loss) Per Share, Fully

Converted(5)

$

0.35

$

0.44

Distributable Earnings Per Share, Fully

Converted(5)

$

0.41

$

0.44

_______________________

(1)

Before Q1 2024, we adjusted GAAP income for non-cash CLO

amortization acceleration to effectively amortize the issuance

costs of our CLOs over the expected lifetime of the CLOs. We assume

our CLOs will be outstanding for approximately four years and

amortized the financing costs over approximately four years in our

distributable earnings as compared to effective yield methodology

in our GAAP earnings. Starting in Q1 2024, we amortized the

issuance costs incurred on our CLOs over the expected lifetime of

the CLOs in our GAAP presentation, making our previous adjustment

no longer necessary.

(2)

Represents unrealized gains and losses on (i) commercial mortgage

loans, held for sale, measured at fair value, (ii) other real

estate investments, measured at fair value and (iii) derivatives.

(3)

Represents accrued and unpaid subordinated performance fee. In

addition, reversal of subordinated performance fee represents cash

payment obligations in the quarter.

(4)

Represents the average of all classes of equity except the Series E

Preferred Stock.

(5)

Fully Converted assumes conversion of our series of convertible

preferred stock and full vesting of our outstanding equity

compensation awards.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240429528454/en/

Investor Relations Contact: Lindsey Crabbe

l.crabbe@benefitstreetpartners.com (214) 874-2339

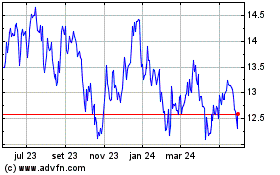

Franklin BSP Realty (NYSE:FBRT)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

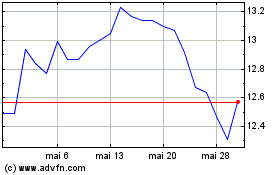

Franklin BSP Realty (NYSE:FBRT)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024