Completed State-of-the-Art Fulfillment Center

Transition

Announces Minority Investment in OOG, Inc., A

New Online Platform for Healthcare Professionals

Updates Full Year 2024 Outlook

FIGS, Inc. (NYSE: FIGS) (the “Company”), the global leading

healthcare apparel brand dedicated to improving the lives of

healthcare professionals, today released its third quarter 2024

financial results and published a financial highlights presentation

on its investor relations website at

ir.wearfigs.com/financials/quarterly-results.

Third Quarter 2024 Financial Highlights

- Net revenues(1) were $140.2 million, a decrease of 1.5%

year over year, due to a decrease in average order value

(“AOV”),(2) partially offset by an increase in orders from existing

customers.

- Gross margin was 67.1%, a decrease of 1.3% year over

year, primarily from higher discounted sales and, to a lesser

extent, product mix shift related to limited edition

scrubwear.

- Operating expenses were $102.7 million, an increase of

17.4% year over year. As a percentage of net revenues, operating

expenses increased to 73.2% from 61.5% primarily due to higher

marketing and selling expenses, including higher digital and brand

marketing expenses related to our 2024 Olympics campaign and higher

transitory expenses associated with the transition to our new

fulfillment center.

- Net income (loss) and Net income (loss), as

adjusted(3) were $(1.7) million (or $(0.01) in diluted

earnings per share), a decrease of $7.8 million as compared to

net income in the same period last year and a decrease of $8.0

million as compared to net income, as adjusted(3) in the same

period last year.

- Net income (loss) margin(4) was (1.2)%, as compared to

4.2% in the same period last year.

- Adjusted EBITDA(3) was $4.8 million, a decrease of $19.6

million year over year.

- Adjusted EBITDA margin(3)(4) was 3.4%, as compared to

17.2% in the same period last year.

Key Operating Metrics

- Active customers(2) as of September 30, 2024 increased

3.8% year over year to 2.7 million.

- Net revenues per active customer(2)(5) were $205, a

decrease of 3.3% year over year.

- AOV(2)(5) was $108, a decrease of 5.3% year over year,

primarily driven by a combination of factors including lower units

per transaction, higher discounts and returns, and the accounting

reclassification between net revenues and selling expense related

to duty subsidies for international customers.

“The third quarter included several key investments to support

and scale FIGS, highlighted by our incredible Olympics campaign

with the Team USA Medical Team and the completed transition of our

fulfillment center to a state-of-the-art, highly-automated

facility,” said Trina Spear, Chief Executive Officer and

Co-Founder. “Our financial performance during the period continued

to show positive signs with brand interest and engagement remaining

high, newness and innovation resonating, and frequency improving.

We also experienced several challenges in the quarter, including

the impacts of our footwear inventory and pricing, our promotional

timing, and the costs to ramp up our fulfillment center, which we

are addressing to further strengthen our performance. Additionally,

our focus on a strong balance sheet and cash flow provide ongoing

flexibility to invest in our core business, return value to

shareholders and find unique ways to disrupt the industry.”

Minority Investment in OOG, Inc.

The Company also announced that it signed and closed a $25.0

million minority investment in OOG, Inc. (“OOG”).

Expected to launch within the next six months, OOG offers an

AI-powered, multi-disciplinary education platform for healthcare

professionals. While more details will be announced about OOG when

its platform launches, FIGS also expects to work with OOG in ways

that will enable FIGS to receive a range of benefits across

marketing, community engagement, data and AI. OOG was founded, and

is led, by FIGS Co-Founder and Executive Chair Heather Hasson.

A special committee of the Company’s board of directors (the

“Board”) comprised solely of independent and disinterested

directors, evaluated, negotiated and recommended approval of this

transaction, which was subsequently approved by the Board. LionTree

Advisors LLC acted as financial advisor and Freshfields LLP acted

as legal advisor to the special committee. Latham & Watkins LLP

acted as legal advisor to the Company.

“We are thrilled to be investing in and collaborating with OOG,”

said Ms. Spear. “Much like the original inspiration for FIGS, OOG

looks to transform a large, fragmented and outdated industry

through AI, technology and a revolutionary platform. We believe

that the OOG platform will significantly expand the ways that we

can serve our Awesome Humans and, most importantly, improve their

experience of being a healthcare professional.”

Financial Outlook

For Full-Year 2024, the Company now expects:

Net Revenues growth versus 2023

Down 1% to flat

Adjusted EBITDA Margin(3)(6)

~ 8%

(1) Third quarter 2024 net revenues results reflect $2.0 million

in international duty subsidies recorded as contra revenue, whereas

international duty subsidies were recorded in selling expense in

third quarter 2023. As a result, year over year net revenues growth

was negatively impacted by 1.4 percentage points.

(2) “Active customers,” “net revenues per active customer” and

“average order value” are key operational and business metrics that

are important to understanding the Company’s performance. Please

see the sections titled “Non-GAAP Financial Measures and Key

Operating Metrics” and “Key Operating Metrics” below for

information regarding how the Company calculates its key

operational and business metrics and for comparisons of active

customers, net revenues per active customer and average order value

to the prior year period.

(3) “Net income (loss), as adjusted,” “adjusted EBITDA” and

“adjusted EBITDA margin” are non-GAAP financial measures. Please

see the sections titled “Non-GAAP Financial Measures and Key

Operating Metrics” and “Reconciliations of GAAP to Non-GAAP

Measures” below for more information regarding the Company’s use of

non-GAAP financial measures and reconciliations to the most

directly comparable GAAP measures.

(4) “Net income (loss) margin” and “adjusted EBITDA margin” are

calculated by dividing net income (loss) and adjusted EBITDA by net

revenues, respectively.

(5) Net revenues per active customer and AOV results for the

third quarter 2024 each reflect international duty subsidies

recorded as contra revenue, which were not reflected in the results

for these metrics for third quarter 2023. As a result, year over

year growth in net revenues per active customer and AOV were

negatively impacted by approximately 2 and 1 percentage points,

respectively.

(6) The Company has not provided a quantitative reconciliation

of its adjusted EBITDA margin outlook to a GAAP net income margin

outlook because it is unable, without making unreasonable efforts,

to project certain reconciling items. These items include, but are

not limited to, future stock-based compensation expense, income

taxes, expenses related to non-ordinary course disputes, and

transaction costs. These items are inherently variable and

uncertain and depend on various factors, some of which are outside

of the Company’s control or ability to predict. For more

information regarding the Company’s use of non-GAAP financial

measures, please see the section titled “Non-GAAP Financial

Measures and Key Operating Metrics.”

Conference Call Details

FIGS management will host a conference call and webcast today at

2:00 p.m. PT / 5:00 p.m. ET to discuss the Company’s financial and

business results and outlook. To participate, please dial

1-833-470-1428 (US) or +1-404-975-4839 (International) and the

conference ID 452177. The call is also accessible via webcast at

ir.wearfigs.com. A recording will be available shortly after the

conclusion of the call through November 14, 2024. To access the

replay, please dial 1-866-813-9403 (US) or +1-929-458-6194

(International) and the conference ID 984524. An archive of the

webcast will be available on FIGS’ investor relations website at

ir.wearfigs.com.

Non-GAAP Financial Measures and Key Operating Metrics

In addition to the GAAP financial measures set forth in this

press release, the Company has included non-GAAP financial measures

within the meaning of Regulation G and Item 10(e) of Regulation

S-K. The Company uses “net income (loss), as adjusted,” “diluted

earnings per share, as adjusted,” “adjusted EBITDA” and “adjusted

EBITDA margin” to provide useful supplemental measures that assist

in evaluating its ability to generate earnings, provide consistency

and comparability with its past financial performance and

facilitate period-to-period comparisons of its core operating

results as well as the results of its peer companies. The Company

uses “free cash flow” as a useful supplemental measure of liquidity

and as an additional basis for assessing its ability to generate

cash. The Company calculates “net income (loss), as adjusted,” as

net income (loss) adjusted to exclude transaction costs, expenses

related to non-ordinary course disputes, other than temporary

impairment of held-to-maturity investments, stock-based

compensation, including expense related to award modifications,

accelerated performance awards and associated payroll taxes and

costs, ambassador grants in connection with its initial public

offering, and expense resulting from the retirement of a former CFO

of the Company, and the income tax impact of these adjustments. The

Company calculates “diluted earnings per share, as adjusted” as net

income (loss), as adjusted divided by diluted shares outstanding.

The Company calculates “adjusted EBITDA” as net income (loss)

adjusted to exclude: other income (loss), net; gain/loss on

disposal of assets; provision for income taxes; depreciation and

amortization expense; stock-based compensation and related expense;

transaction costs; and expenses related to non-ordinary course

disputes. The Company calculates “adjusted EBITDA margin” by

dividing adjusted EBITDA by net revenues. The Company calculates

“free cash flow” as net cash (used in) provided by operating

activities reduced by capital expenditures, including purchases of

property and equipment and capitalized software development

costs.

Reconciliations of non-GAAP financial measures to the most

directly comparable GAAP measures are included below under the

heading “Reconciliations of GAAP to Non-GAAP Measures.”

The Company has also included herein “active customers,” “net

revenues per active customer” and “average order value,” which are

key operational and business metrics that are important to

understanding Company performance. The Company believes the number

of active customers is an important indicator of growth as it

reflects the reach of the Company’s digital platform, brand

awareness and overall value proposition. The Company defines an

active customer as a unique customer account that has made at least

one purchase in the preceding 12-month period. In any particular

period, the Company determines the number of active customers by

counting the total number of customers who have made at least one

purchase in the preceding 12-month period, measured from the last

date of such period. The Company believes measuring net revenues

per active customer is important to understanding engagement and

retention of customers, and as such, the value proposition for its

customer base. The Company defines net revenues per active customer

as the sum of total net revenues in the preceding 12-month period

divided by the current period active customers. The Company defines

average order value as the sum of the total net revenues in a given

period divided by the total orders placed in that period. Total

orders are the summation of all completed individual purchase

transactions in a given period. The Company believes its relatively

high average order value demonstrates the premium nature of its

products. As the Company expands into and increases its presence in

additional product categories, price points and international

markets, average order value may fluctuate.

Active customers as of September 30, 2024 and 2023,

respectively, net revenues per active customer as of September 30,

2024 and 2023, respectively, and average order value for the three

and nine months ended September 30, 2024 and 2023, respectively,

are presented below under the heading “Key Operating Metrics.”

About FIGS

FIGS is a founder-led, direct-to-consumer healthcare apparel and

lifestyle brand that seeks to celebrate, empower, and serve current

and future generations of healthcare professionals. We create

technically advanced apparel and products that feature an unmatched

combination of comfort, durability, function, and style. We share

stories about healthcare professionals’ experiences in ways that

inspire them. We build meaningful connections within the healthcare

community that we created. Above all, we seek to make an impact for

our community, including by advocating for them and always having

their backs.

We serve healthcare professionals in numerous countries in North

America, Europe, the Asia Pacific region and the Middle East. We

also serve healthcare institutions through our TEAMS platform.

Forward Looking Statements

This press release contains various forward-looking statements

about the Company within the meaning of the Private Securities

Litigation Reform Act of 1995, as amended, that are based on

current management expectations, and which involve substantial

risks and uncertainties that could cause actual results to differ

materially from the results expressed in, or implied by, such

forward-looking statements. All statements contained in this press

release that do not relate to matters of historical fact should be

considered forward-looking. These forward-looking statements

generally are identified by the words “anticipate”, “believe”,

“contemplate”, “continue”, “could”, “estimate”, “expect”,

“forecast”, “future”, “intend”, “may”, “might”, “opportunity”,

“outlook”, “plan”, “possible”, “potential”, “predict”, “project,”

“should”, “strategy”, “strive”, “target”, “will” or “would”, the

negative of these words or other similar terms or expressions. The

absence of these words does not mean that a statement is not

forward-looking. These forward-looking statements address various

matters, including the Company’s plans to address challenges

experienced in the quarter ended September 30, 2024; the Company’s

ongoing flexibility to invest in its core business, return value to

shareholders and find unique ways to disrupt the industry; the

expected timing of OOG’s launch and for additional details about

the platform to be announced; the Company’s expectation of working

with OOG and the benefits it expects to receive, including as to

marketing, community engagement and AI; OOG’s plan to transform an

outdated industry; the Company’s belief that the OOG platform will

significantly expand the ways that it can serve its community; and

the Company’s outlook as to net revenues growth and adjusted EBITDA

margin for the full year ending December 31, 2024; all of which

reflect the Company’s expectations based upon currently available

information and data. Because such statements are based on

expectations as to future financial and operating results and are

not statements of fact, the Company’s actual results, performance

or achievements may differ materially from those expressed or

implied by the forward-looking statements, and you are cautioned

not to place undue reliance on these forward-looking statements.

The following important factors and uncertainties, among others,

could cause actual results, performance or achievements to differ

materially from those described in these forward-looking

statements: the Company’s ability to maintain its historical

growth; the Company’s ability to maintain profitability; the

Company’s ability to maintain the value and reputation of its

brand; the Company’s ability to attract new customers, retain

existing customers, and to maintain or increase sales to those

customers; the success of the Company’s marketing efforts; the

Company’s ability to maintain a strong community of engaged

customers and Ambassadors; negative publicity related to the

Company’s marketing efforts or use of social media; the Company’s

ability to successfully develop and introduce new, innovative and

updated products; the competitiveness of the market for healthcare

apparel; the Company’s ability to maintain its key employees; the

Company’s ability to attract and retain highly skilled team

members; risks associated with expansion into, and conducting

business in, international markets; changes in, or disruptions to,

the Company’s shipping arrangements; the successful operation of

the Company’s distribution and warehouse management systems; the

Company’s ability to accurately forecast customer demand, manage

its inventory, and plan for future expenses; the impact of changes

in consumer confidence, shopping behavior and consumer spending on

demand for the Company’s products; the impact of macroeconomic

trends on the Company’s operations; the Company’s reliance on a

limited number of third-party suppliers; the fluctuating costs of

raw materials; the Company’s failure to protect proprietary,

confidential or sensitive information or personal customer data, or

risks of cyberattacks; the Company’s failure to protect its

intellectual property rights; the fact that the operations of many

of the Company’s suppliers and vendors are subject to additional

risks that are beyond its control; and other risks, uncertainties,

and factors discussed in the “Risk Factors” section of the

Company’s Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024 to be filed with the Securities and Exchange

Commission (“SEC”), the Company’s Annual Report on Form 10-K for

the year ended December 31, 2023 filed with the SEC on February 28,

2024, and the Company’s other periodic filings with the SEC. The

forward-looking statements in this press release speak only as of

the time made and the Company does not undertake to update or

revise them to reflect future events or circumstances.

FIGS, INC.

BALANCE SHEETS

(In thousands, except share

and per share data)

As of

September 30,

2024

December 31,

2023

Assets

(Unaudited)

Current assets

Cash and cash equivalents

$

124,103

$

144,173

Short-term investments

157,607

102,522

Accounts receivable

10,499

7,469

Inventory, net

123,396

119,040

Prepaid expenses and other current

assets

18,689

12,455

Total current assets

434,294

385,659

Non-current assets

Property and equipment, net

35,395

24,864

Operating lease right-of-use assets

52,769

43,059

Deferred tax assets

17,870

18,291

Other assets

2,160

1,336

Total non-current assets

108,194

87,550

Total assets

$

542,488

$

473,209

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

$

27,399

$

14,749

Operating lease liabilities

11,849

8,230

Accrued expenses

29,036

7,906

Accrued compensation and benefits

5,407

7,312

Sales tax payable

4,250

3,149

Gift card liability

7,944

8,240

Deferred revenue

3,883

2,160

Returns reserve

4,632

2,989

Income tax payable

345

2,557

Total current liabilities

94,745

57,292

Non-current liabilities

Operating lease liabilities,

non-current

44,050

38,884

Other non-current liabilities

183

183

Total liabilities

$

138,978

$

96,359

Commitments and contingencies

Stockholders’ equity

Class A Common stock — par value $0.0001

per share, 1,000,000,000 shares authorized as of September 30, 2024

and December 31, 2023; 161,292,723 and 161,457,403 shares issued

and outstanding as of September 30, 2024 and December 31, 2023,

respectively

16

16

Class B Common stock — par value $0.0001

per share, 150,000,000 shares authorized as of September 30, 2024

and December 31, 2023; 8,283,641 shares issued and outstanding as

of September 30, 2024 and December 31, 2023

—

—

Preferred stock — par value $0.0001 per

share, 100,000,000 shares authorized as of September 30, 2024 and

December 31, 2023; zero shares issued and outstanding as of

September 30, 2024 and December 31, 2023

—

—

Additional paid-in capital

340,684

315,075

Accumulated other comprehensive income

221

5

Retained earnings

62,589

61,754

Total stockholders’ equity

403,510

376,850

Total liabilities and stockholders’

equity

$

542,488

$

473,209

FIGS, INC.

STATEMENTS OF

OPERATIONS

(In thousands, except share

and per share data)

(Unaudited)

Three months ended September

30,

Nine months ended September

30,

2024

2023

2024

2023

Net revenues

$

140,209

$

142,364

$

403,726

$

400,728

Cost of goods sold

46,181

44,971

130,299

121,625

Gross profit

94,028

97,393

273,427

279,103

Operating expenses

Selling

38,599

32,195

103,992

97,092

Marketing

28,529

19,012

68,778

56,965

General and administrative

35,529

36,232

107,292

105,229

Total operating expenses

102,657

87,439

280,062

259,286

Net income (loss) from operations

(8,629

)

9,954

(6,635

)

19,817

Other income, net

Interest income

2,926

1,901

8,603

4,494

Other income (expense)

2

(6

)

(8

)

(11

)

Total other income, net

2,928

1,895

8,595

4,483

Net income (loss) before provision for

income taxes

(5,701

)

11,849

1,960

24,300

Provision for income taxes

(4,001

)

5,703

1,125

11,663

Net income (loss)

$

(1,700

)

$

6,146

$

835

$

12,637

Earnings (loss) attributable to Class A

and Class B common stockholders

Basic earnings (loss) per share

$

(0.01

)

$

0.04

$

—

$

0.08

Diluted earnings (loss) per

share

$

(0.01

)

$

0.03

$

—

$

0.07

Weighted-average shares

outstanding—basic

170,168,732

168,668,844

170,161,922

167,628,888

Weighted-average shares

outstanding—diluted

170,168,732

181,429,745

180,614,560

182,545,627

FIGS, INC.

STATEMENTS OF CASH

FLOWS

(In thousands)

(Unaudited)

Nine months ended

September 30,

2024

2023

Cash flows from operating

activities:

Net income

$

835

$

12,637

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization expense

4,848

2,128

Deferred income taxes

421

(1,841

)

Non-cash operating lease cost

6,211

2,138

Stock-based compensation

32,618

34,305

Accretion of discount on

available-for-sale securities

(4,335

)

(897

)

Changes in operating assets and

liabilities:

Accrued interest

(385

)

—

Accounts receivable

(3,030

)

550

Inventory

(4,356

)

34,793

Prepaid expenses and other current

assets

(7,965

)

(1,563

)

Other assets

(824

)

18

Accounts payable

10,828

(4,092

)

Accrued expenses

21,231

(9,496

)

Accrued compensation and benefits

(1,905

)

3,266

Sales tax payable

1,101

674

Gift card liability

(296

)

807

Deferred revenue

1,723

551

Returns reserve

1,643

(818

)

Income tax payable

(2,212

)

9,670

Operating lease liabilities

(5,405

)

(2,183

)

Net cash provided by operating

activities

50,746

80,647

Cash flows from investing

activities:

Purchases of property and equipment

(13,658

)

(9,733

)

Purchases of available-for-sale

securities

(191,379

)

(65,805

)

Maturities of available-for-sale

securities

141,230

17,550

Net cash used in investing activities

(63,807

)

(57,988

)

Cash flows from financing

activities:

Repurchases of Class A common stock

(7,277

)

—

Proceeds from stock option exercises and

employee stock purchases

268

763

Tax payments related to net share

settlements on restricted stock units

—

(246

)

Net cash (used in) provided by financing

activities

(7,009

)

517

Net change in cash and cash

equivalents

(20,070

)

23,176

Cash and cash equivalents, beginning of

period

144,173

159,775

Cash and cash equivalents, end of

period

$

124,103

$

182,951

FIGS, INC.

RECONCILIATIONS OF GAAP TO NON-GAAP

MEASURES (Unaudited)

The following table presents a reconciliation of net income

(loss), as adjusted to net income (loss), which is the most

directly comparable financial measure calculated in accordance with

GAAP, and presents diluted earnings per share (“EPS”), as adjusted

with diluted EPS:

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

(in thousands, except share

and per share amounts)

Net income (loss)

$

(1,700

)

$

6,146

$

835

$

12,637

Add (deduct):

Expenses related to non-ordinary course

disputes(1)

—

—

—

1,256

Stock-based compensation expense in

connection with the IPO and other(2)

—

290

—

290

Income tax impacts of items above

—

(140

)

—

(847

)

Net income (loss), as adjusted

$

(1,700

)

$

6,296

$

835

$

13,336

Diluted EPS

$

(0.01

)

$

0.03

$

—

$

0.07

Diluted EPS, as adjusted

$

(0.01

)

$

0.03

$

—

$

0.07

Weighted-average shares used to compute

Diluted EPS and Diluted EPS, as adjusted

170,168,732

181,429,745

180,614,560

182,545,627

(1) Exclusively represents attorney’s fees, costs and expenses

incurred by the Company in connection with the Company’s

now-concluded litigation against Strategic Partners, Inc.

(2) Includes certain stock-based compensation expense in

connection with the IPO, including expense related to accelerated

performance awards and associated payroll taxes and costs.

The following table presents a reconciliation of adjusted EBITDA

to net income (loss), which is the most directly comparable

financial measure calculated in accordance with GAAP, and presents

adjusted EBITDA margin with net income (loss) margin, which is the

most directly comparable financial measure calculated in accordance

with GAAP:

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

(in thousands, except

margin)

Net income (loss)

$

(1,700

)

$

6,146

$

835

$

12,637

Add (deduct):

Other income, net

(2,928

)

(1,895

)

(8,595

)

(4,483

)

Provision for income taxes

(4,001

)

5,703

1,125

11,663

Depreciation and amortization

expense(1)

2,885

756

4,848

2,128

Stock-based compensation and related

expense(2)

10,544

13,713

32,506

36,195

Expenses related to non-ordinary course

disputes(3)

—

—

—

1,256

Adjusted EBITDA

$

4,800

$

24,423

$

30,719

$

59,396

Net revenues

$

140,209

$

142,364

$

403,726

$

400,728

Net income (loss) margin(4)

(1.2

)%

4.2

%

0.2

%

3.1

%

Adjusted EBITDA margin

3.4

%

17.2

%

7.6

%

14.8

%

(1) Excludes amortization of debt issuance costs included in

“Other income, net.”

(2) Includes stock-based compensation expense, payroll taxes,

and costs related to equity award activity.

(3) Exclusively represents attorney's fees, costs and expenses

incurred by the Company in connection with the Company’s

now-concluded litigation against Strategic Partners, Inc.

(4) Net income (loss) margin represents net income (loss) as a

percentage of net revenues.

The following table presents a reconciliation of free cash flow

to net cash provided by operating activities, which is the most

directly comparable financial measure calculated in accordance with

GAAP:

Nine months ended

September 30,

2024

2023

(in thousands)

Net cash provided by operating

activities

$

50,746

$

80,647

Less: capital expenditures

(13,658

)

(9,733

)

Free cash flow

$

37,088

$

70,914

FIGS, INC.

KEY OPERATING METRICS

(Unaudited)

Active customers as of September 30, 2024 and 2023,

respectively, net revenues per active customer as of September 30,

2024 and 2023, respectively, and average order value for the three

and nine months ended September 30, 2024 and 2023, respectively,

are presented in the following tables:

As of September 30,

2024

2023

(in thousands)

Active customers

2,673

2,576

As of September 30,

2024

2023

Net revenues per active customer

$

205

$

212

Three months ended

September 30,

Nine months ended

September 30,

2024

2023

2024

2023

Average order value

$

108

$

114

$

112

$

114

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107063692/en/

Investors: Tom Shaw IR@wearfigs.com

Media: Todd Maron press@wearfigs.com

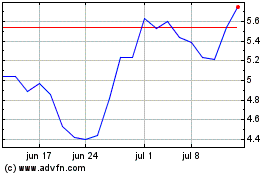

FIGS (NYSE:FIGS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

FIGS (NYSE:FIGS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024