Enhanced Security Tops Singapore Banking Customers’ Wishlist Amid Rising Fraud Fears: FIS Survey

19 Setembro 2024 - 2:00AM

Business Wire

Key facts and findings

- A new FIS consumer survey finds security is the number one

online banking priority for surveyed Singaporeans.

- 56% of respondents believe online banking fraud attempts to be

rising, with Millennials experiencing the most incidences of fraud

and Boomers the least.

- Most surveyed consumers are seeking a balance of convenience

and security in their online banking interactions.

Strengthening online security tops the innovation wishlist of

Singapore banking customers surveyed, with “money lock” to prevent

withdrawals emerging as the most sought-after innovation, ranking

above features like cardless withdrawals and voice-activated

virtual assistants.

Overall, when it comes to customer experience, the top priority

for surveyed consumers is feeling confident that their personal

information and assets are secure. While 86% consider this

extremely or very important, 68% are satisfied with their bank’s

performance in this area.

These findings are part of a major new survey of more than 1,000

retail banking customers in Singapore, conducted by global

financial technology leader FIS® (NYSE: FIS). The research

explores those consumers’ attitudes towards the online banking

customer experience, perceptions and experiences regarding online

banking fraud, and approach to investing.

Banking fraud remains a concern

The survey revealed that 92% of surveyed consumers expressed

concern over online banking fraud. The majority of surveyed

consumers (56%) also believe online banking fraud attempts have

been ‘on the rise’ in the past 12 months, versus 27% that see it as

unchanged.

Additionally, almost a quarter of Singaporeans surveyed have

been a victim of online banking fraud, underscoring the scale of

the problem. These problems have prompted coordinated efforts by

the Government, law enforcement, banks and fintech players.* Fraud

incidents were most widespread amongst surveyed Millennials

(28-42-year-olds) (34%), and least prevalent amongst surveyed

Boomers (59+-year-olds) (12%).

Commenting on security concerns by banking customers, Kanv

Pandit, Head of Corporates and International Banking, FIS, said:

“As online banking fraud becomes increasingly sophisticated, FIS is

strategically investing in the implementation of new technologies

to aid banks in their fight against scams. This includes embedding

AI and machine learning in our products to mitigate fraud in

billions of transactions. By leveraging advanced technologies,

banks can anticipate new threats, understand fraud patterns with

greater precision, and respond swiftly to emerging risks – ensuring

that their customers’ trust and safety is protected.”

Balancing convenience with security

Of those surveyed who have experienced fraud, 51% saw their bank

assume total responsibility and provide a full refund, versus 32%

who received a partial refund. Along those lines, 53% of

respondents expected banks to assume full responsibility regardless

of the reason for the fraud. Where the responsibility for fraud

lies may be addressed in the Singapore Government’s new Shared

Responsibility Framework that is expected to be rolled out later in

2024.**

Banks that double down on security measures for fraud prevention

may impose additional steps and inconvenience for customers when

carrying out various banking interactions. FIS’ research found that

most respondents are seeking a balance of convenience and security

across the full spectrum of online banking interactions. In each

category, only a minority of respondents sought convenience over

security. Gen Zs (18-27-year-olds) were more focused on convenience

in areas such as checking balances and statements, whereas the

Boomers were much more conservative across the board.

Kanv Pandit continues: “Examining attitudes towards balancing

security and convenience, it is clear that consumers want fast and

seamless experiences in today’s digital age, however not at the

expense of security. FIS is committed to helping banks unlock

financial technology to combat scams and close the satisfaction

gap. Banks must act swiftly or risk customers switching banks if

security is perceived as not strong enough, particularly around

investing and moving money.”

About the Research

FIS’ survey was conducted by Savanta in July-August 2024. The

research explores consumers’ attitudes towards the online banking

customer experience, perceptions and experiences regarding online

banking fraud, and approach to investing.

The Singapore data is based on a representative sample of 1,001

adult consumers across Singapore, spanning Generation Z (18-27),

Millennials (28-42), Generation X (43-58) and Baby Boomers

(59+).

Notes

*These efforts include GovTech’s development of the ScamShield

mobile app that protects users from scam calls by by

cross-referencing unknown numbers with a database maintained by the

SPF, and the joint effort by the Monetary Authority of Singapore

(MAS) and The Association of Banks in Singapore (ABS) to

progressively phase out the use of One-Time Passwords (OTPs) for

bank account login to better protect users against phishing. **MAS:

Consultation Paper on Proposed Shared Responsibility Framework

About FIS

FIS is a leading provider of technology solutions for financial

institutions and businesses of all sizes and across any industry

globally. We enable the movement of commerce by unlocking the

financial technology that powers the world’s economy. Our employees

are dedicated to advancing the way the world pays, banks and

invests through our trusted innovation, system performance and

flexible architecture. We help our clients use technology in

innovative ways to solve business-critical challenges and deliver

superior experiences for their customers. Headquartered in

Jacksonville, Florida, FIS is a member of the Fortune 500® and the

Standard & Poor’s 500® Index. To learn more, visit

www.FISglobal.com. Follow FIS on Facebook, LinkedIn and Twitter

(@FISglobal).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240918327153/en/

Kim Snider, 904.438.6278 Senior Vice President FIS Global

Marketing and Communications kim.snider@fisglobal.com

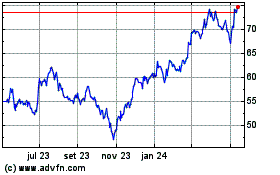

Fidelity National Inform... (NYSE:FIS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

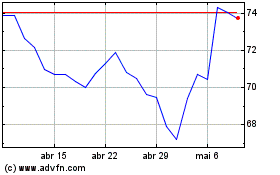

Fidelity National Inform... (NYSE:FIS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024