Kohl’s Corporation (NYSE:KSS) today reported results for the

third quarter ended November 2, 2024.

- Net sales decreased 8.8% and comparable sales decreased

9.3%

- Diluted earnings per share of $0.20

- Updates full year 2024 financial outlook

- Kohl’s Board announces CEO transition process

Tom Kingsbury, Kohl’s chief executive officer, said “Our third

quarter results did not meet our expectations as sales remained

soft in our apparel and footwear businesses. Although we had a

strong collective performance across our key growth areas,

including Sephora, home decor, gifting, and impulse, and also

benefited from the opening of Babies “R” Us shops in 200 of our

stores, these were unable to offset the declines in our core

business. Importantly, we delivered gross margin expansion and

managed expenses tightly in the quarter.”

“We are not satisfied with our performance in 2024 and are

taking aggressive action to reverse the sales declines. We must

execute at a higher level and ensure we are putting the customer

first in everything we do. We are approaching our financial outlook

for the year more conservatively given the third quarter

underperformance and our expectation for a highly competitive

holiday season,” Kingsbury continued.

CEO Transition Process

As announced on November 25, 2024, Chief Executive Officer Tom

Kingsbury plans to step down as CEO, effective January 15, 2025. He

will stay on in an advisory role to the new CEO and retain his

position on Kohl's Board of Directors (the "Board") through his

retirement in May 2025. The Board appointed retail veteran Ashley

Buchanan as CEO and Board member, effective January 15, 2025.

Third Quarter 2024

Results

Comparisons refer to the 13-week period ended November 2, 2024

versus the 13-week period ended October 28, 2023

- Net sales decreased 8.8% year-over-year, to $3.5

billion, with comparable sales down 9.3%.

- Gross margin as a percentage of net sales was 39.1%, an

increase of 20 basis points.

- Selling, general & administrative (SG&A)

expenses decreased 5.1% year-over-year, to $1.3 billion. As a

percentage of total revenue, SG&A expenses were 34.8%, an

increase of 125 basis points year-over-year.

- Operating income was $98 million compared to $157

million in the prior year. As a percentage of total revenue,

operating income was 2.7%, a decrease of 120 basis points

year-over-year.

- Net income was $22 million, or $0.20 per diluted share.

This compares to net income of $59 million, or $0.53 per diluted

share in the prior year.

- Inventory was $4.1 billion, a decrease of 3%

year-over-year.

- Operating cash flow was a use of $195 million.

Nine Months Fiscal Year 2024

Results

Comparisons refer to the 39-week period ended November 2, 2024

versus the 39-week period ended October 28, 2023

- Net sales decreased 6.1% year-over-year, to $10.2

billion, with comparable sales down 6.4%.

- Gross margin as a percentage of net sales was 39.4%, an

increase of 42 basis points.

- Selling, general & administrative (SG&A)

expenses decreased 3.4% year-over-year, to $3.8 billion. As a

percentage of total revenue, SG&A expenses were 34.8%, an

increase of 95 basis points year-over-year.

- Operating income was $307 million compared to $418

million in the prior year. As a percentage of total revenue,

operating income was 2.8%, a decrease of 79 basis points

year-over-year.

- Net income was $61 million, or $0.55 per diluted share.

This compares to net income of $131 million, or $1.18 per diluted

share in the prior year.

- Operating cash flow was $52 million.

- Long-term debt was reduced by $113 million through the

redemption of the remaining 9.50% notes due May 15, 2025.

Updated 2024 Financial and Capital

Allocation Outlook

For the full year 2024, which has 52 weeks compared to 53 weeks

in full year 2023, the Company currently expects the following:

- Net sales: A decrease of (7%) to a decrease of (8%)

- Comparable sales: A decrease of (6%) to a decrease of

(7%)

- Operating margin: In the range of 3.0% to 3.2%

- Diluted EPS: In the range of $1.20 to $1.50

- Capital Expenditures: Approximately $500 million,

including expansion of Sephora partnership and other store-related

investments

- Dividend: On November 13, 2024, Kohl’s Board of

Directors declared a quarterly cash dividend on the Company’s

common stock of $0.50 per share. The dividend is payable December

24, 2024 to shareholders of record at the close of business on

December 11, 2024.

Third Quarter 2024 Earnings Conference

Call

Kohl’s will host its quarterly earnings conference call at 9:00

am ET on November 26, 2024. A webcast of the conference call and

the related presentation materials will be available via the

Company's web site at investors.kohls.com, both live and after the

call.

Cautionary Statement Regarding

Forward-Looking Information

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. The Company intends forward-looking terminology such as

“believes,” “expects,” “may,” “will,” “should,” “anticipates,”

“plans,” or similar expressions to identify forward-looking

statements. Forward-looking statements include the information

under “Updated 2024 Financial and Capital Allocation Outlook.” Such

statements are subject to certain risks and uncertainties, which

could cause the Company's actual results to differ materially from

those anticipated by the forward-looking statements. These risks

and uncertainties include, but are not limited to, risks described

more fully in Item 1A in the Company’s Annual Report on Form 10-K,

which are expressly incorporated herein by reference, and other

factors as may periodically be described in the Company’s filings

with the SEC. Forward-looking statements relate to the date

initially made, and the Company undertakes no obligation to update

them.

About Kohl's

Kohl’s (NYSE: KSS) is a leading omnichannel retailer built on a

foundation that combines great brands, incredible value and

convenience for our customers. Kohl’s is uniquely positioned to

deliver against its long-term strategy and its purpose to take care

of families’ realest moments. Kohl's serves millions of families in

its more than 1,100 stores in 49 states, online at Kohls.com, and

through the Kohl's App. With a large national footprint, Kohl’s is

committed to making a positive impact in the communities it serves.

For a list of store locations or to shop online, visit Kohls.com.

For more information about Kohl’s impact in the community or how to

join our winning team, visit Corporate.Kohls.com.

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF

OPERATIONS

(Unaudited)

Three Months Ended

Nine Months Ended

(Dollars in Millions, Except per Share

Data)

November 2, 2024

October 28, 2023

November 2, 2024

October 28, 2023

Net sales

$ 3,507

$ 3,843

$ 10,210

$ 10,876

Other revenue

203

211

614

644

Total revenue

3,710

4,054

10,824

11,520

Cost of merchandise sold

2,137

2,349

6,188

6,638

Gross margin rate

39.1%

38.9%

39.4%

39.0%

Operating expenses:

Selling, general, and administrative

1,291

1,360

3,769

3,902

As a percent of total revenue

34.8%

33.5%

34.8%

33.9%

Depreciation and amortization

184

188

560

562

Operating income

98

157

307

418

Interest expense, net

76

89

245

262

Income before income taxes

22

68

62

156

(Benefit) Provision for income taxes

—

9

1

25

Net income

$ 22

$ 59

$ 61

$ 131

Average number of shares:

Basic

111

110

111

110

Diluted

112

111

112

111

Earnings per share:

Basic

$ 0.20

$ 0.54

$ 0.55

$ 1.19

Diluted

$ 0.20

$ 0.53

$ 0.55

$ 1.18

KOHL’S CORPORATION

CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(Dollars in Millions)

November 2, 2024

October 28, 2023

Assets

Current assets:

Cash and cash equivalents

$ 174

$ 190

Merchandise inventories

4,099

4,239

Other

344

291

Total current assets

4,617

4,720

Property and equipment, net

7,472

7,861

Operating leases

2,500

2,492

Other assets

465

394

Total assets

$ 15,054

$ 15,467

Liabilities and Shareholders’

Equity

Current liabilities:

Accounts payable

$ 1,873

$ 1,918

Accrued liabilities

1,245

1,324

Borrowings under revolving credit

facility

749

625

Current portion of:

Long-term debt

353

111

Finance leases and financing

obligations

80

84

Operating leases

93

94

Total current liabilities

4,393

4,156

Long-term debt

1,174

1,638

Finance leases and financing

obligations

2,533

2,714

Operating leases

2,799

2,780

Deferred income taxes

78

107

Other long-term liabilities

273

321

Shareholders’ equity:

3,804

3,751

Total liabilities and shareholders’

equity

$ 15,054

$ 15,467

KOHL’S CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

Nine Months Ended

(Dollars in Millions)

November 2, 2024

October 28, 2023

Operating activities

Net income

$ 61

$ 131

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

560

562

Share-based compensation

25

31

Deferred income taxes

(33)

(25)

Non-cash lease expense

67

70

Other non-cash items

2

13

Changes in operating assets and

liabilities:

Merchandise inventories

(1,216)

(1,046)

Other current and long-term assets

(75)

66

Accounts payable

739

588

Accrued and other long-term

liabilities

(2)

58

Operating lease liabilities

(76)

(69)

Net cash provided by operating

activities

52

379

Investing activities

Acquisition of property and equipment

(367)

(495)

Proceeds from sale of real estate

2

15

Other

2

(11)

Net cash used in investing activities

(363)

(491)

Financing activities

Net borrowings under revolving credit

facility

657

540

Shares withheld for taxes on vested

restricted shares

(10)

(13)

Dividends paid

(166)

(165)

Repayment of long-term borrowings

(113)

(164)

Premium paid on redemption of debt

(5)

—

Finance lease and financing obligation

payments

(62)

(68)

Proceeds from financing obligations

1

19

Net cash provided by financing

activities

302

149

Net (decrease) increase in cash and cash

equivalents

(9)

37

Cash and cash equivalents at beginning of

period

183

153

Cash and cash equivalents at end of

period

$ 174

$ 190

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241126418006/en/

Investor Relations: Jill Timm, (262) 703-2203,

jill.timm@kohls.com

Media: Jen Johnson, (262) 703-5241,

jen.johnson@kohls.com

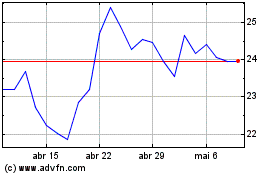

Kohls (NYSE:KSS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

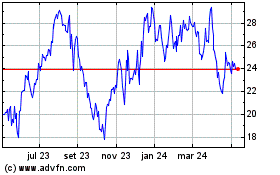

Kohls (NYSE:KSS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024