Lithium Americas Corp. (“

Lithium Americas” or the

“

Company”), now

Lithium Americas

(Argentina) Corp. (“

Lithium Argentina”)

(TSX: LAAC) (NYSE: LAAC) and a new

Lithium

Americas Corp. (“

Lithium Americas

(NewCo)”)

(TSX: LAC) (NYSE: LAC) today

jointly announced the completion of the reorganization of Lithium

Americas into two independent publicly traded companies,

implemented by way of statutory plan of arrangement (the

“

Separation”).

“We look forward to seeing these two

market-leading companies thrive independently,” said Jonathan

Evans, President and CEO of Lithium Americas (NewCo) and former

President and CEO of Lithium Americas. “The Separation offers

investors two unique and highly focused pure-play lithium companies

with world-class assets in our respective regions of

operation.”

“I am extremely proud of the Lithium Argentina

and Lithium Americas (NewCo) teams for their hard work and

dedication in redesigning these companies with the right management

teams and resources to flourish independently,” said John

Kanellitsas, Executive Chairman, President and Interim CEO of

Lithium Argentina and former Executive Vice Chair of Lithium

Americas. “The closing of this Separation is a pivotal moment in

allowing each company to sharpen its focus and pursue independent

and unique growth opportunities within the lithium industry.”

As of close of trading on Tuesday, October 3,

2023 (the “Effective Date”), common shares of

Lithium Americas (“Lithium Americas Shares”) have

concluded regular-way trading on the Toronto Stock Exchange

(“TSX”) and New York Stock Exchange

(“NYSE”) under the symbol “LAC,” and Lithium

Argentina common shares (“Lithium Argentina

Shares”) and Lithium Americas (NewCo) common shares

(“Lithium Americas (NewCo) Shares”) have concluded

trading on a “when-issued” basis on the NYSE.

At the start of trading on Wednesday, October 4,

2023, Lithium Argentina Shares and Lithium Americas (NewCo) Shares

will commence trading on the TSX and NYSE on a regular-way basis

under the ticker symbols “LAAC” and “LAC,” respectively.

REGISTERED SHAREHOLDERS

Registered shareholders of Lithium Americas

(“LAC Registered Shareholders”) are reminded to

submit their certificates or direct registration statements

(“DR Statements”) representing their Lithium

Americas Shares with a duly completed letter of transmittal

(“Letter of Transmittal”) to Computershare

Investor Services Inc., as depositary, in order to receive DR

Statements representing their Lithium Argentina Shares and Lithium

Americas (NewCo) Shares. The Letter of Transmittal is filed on

Lithium Argentina’s SEDAR profile (www.sedarplus.ca).

LAC Registered

Shareholders who fail to submit their certificates or DR Statements

and their Letter of Transmittals on or before October 3, 2026, the

third anniversary of the Effective Date of the Separation, will

cease to have any right or claim against or interest of any kind or

nature in Lithium Argentina or Lithium Americas (NewCo).

Accordingly, persons who tender certificates or DR Statements for

Lithium Americas Shares after October 3, 2026 will not receive any

Lithium Argentina Shares or Lithium Americas (NewCo) Shares, will

not own any interest in Lithium Argentina or Lithium Americas

(NewCo) and will not be paid any cash or other compensation in lieu

thereof.

GM TRANSACTION – LITHIUM AMERICAS

(NEWCO)

Upon completion of the Separation, General

Motors Holdings LLC (“GM”) executed a second

tranche subscription agreement (pursuant to which GM will, subject

to the fulfillment of certain conditions precedent, purchase

US$329,852,134.38 in Lithium Americas (NewCo) Shares). GM also

executed an investor rights agreement with Lithium Americas (NewCo)

and GM’s offtake agreement with the Company was assigned to Lithium

Americas (NewCo). The second tranche alternative exercise warrants

previously issued to GM by the Company and the second tranche

subscription agreement between GM and the Company are no longer

effective in accordance with the terms of those agreements. GM is

the largest shareholder of both Lithium Americas (NewCo) and

Lithium Argentina with approximately 9.4% of the shares of each

company.

CONVERTIBLE NOTES – LITHIUM

ARGENTINA

The Separation constitutes a Make-Whole

Fundamental Change as defined in the indenture, dated December 6,

2021 (the “Indenture”), between the Company (now

Lithium Argentina) and Computershare Trust Company N.A., governing

the Company’s 1.75% Convertible Senior Notes due 2027 (the

“Notes”). The effective date (as defined in the

Indenture) of such Make-Whole Fundamental Change is October 3,

2023. In addition, the Separation will result in an adjustment to

the conversion rate of the Notes. Notices will be sent to the

Depository Trust Company (“DTC”) as the holder of

the Notes and filed on SEDAR and EDGAR regarding (i) the number of

additional Lithium Argentina Shares by which the conversion rate of

the Notes may be increased per US$1,000 principal amount of Notes

with respect to conversions occurring in connection with such

Make-Whole Fundamental Change being nil, as the last reported sale

prices of the Company’s common shares over the five trading day

period ending on, and including, the trading day immediately

preceding the applicable effective date Make-Whole Fundamental

Change, was less than US$34.89, and (ii) the adjustment to the

conversion rate for the Notes as a result of the Separation.

ABOUT LITHIUM

ARGENTINA

Lithium Argentina owns a 44.8% interest in the

Caucharí-Olaroz project located in Jujuy, Argentina. The company is

focused on advancing its Caucharí-Olaroz project toward full

production capacity and exploring regional growth opportunities in

the Pastos Grandes basin with its Pastos Grandes and Sal de la Puna

projects (100% and 65% owned, respectively).

Lithium Argentina contact:Kelly O’Brien, VP

Investor Relations and ESGTelephone: +54-11-52630616 Email:

ir@lithium-argentina.comWebsite:

www.lithium-argentina.com

ABOUT LITHIUM

AMERICAS (NEWCO)

Lithium Americas (NewCo) owns the Thacker Pass

project located in Nevada, which hosts the largest known Measured

and Indicated lithium resource in the United States. The company is

focused on advancing construction at Thacker Pass; construction

commenced in early 2023. Thacker Pass is expected to employ over

1,000 workers during construction and create 500 permanent jobs

during operations over its 40-year mine life.

Lithium Americas (NewCo) contact:Virginia

Morgan, VP Investor Relations and ESGTelephone: 778-726-4070 Email:

ir@lithiumamericas.comWebsite:

www.lithiumamericas.com

FORWARD-LOOKING INFORMATION

Certain statements in this release constitute

“forward-looking statements” within the meaning of applicable

United States securities legislation and “forward-looking

information” under applicable Canadian securities legislation

(collectively, “forward-looking statements”). Such forward-looking

statements involve known and unknown risks, uncertainties and other

factors that may cause the actual results, events, performance or

achievements of the Separation and of Lithium Americas (NewCo) /

Lithium Argentina (collectively the “Entities” and individually, an

“Entity”), its projects, or industry results, to be materially

different from any future results, events, performance or

achievements expressed or implied by such forward-looking

statements. Such statements can be identified by the use of words

such as “may,” “would,” “could,” “will,” “intend,” “expect,”

“believe,” “plan,” “anticipate,” “estimate,” “schedule,”

“forecast,” “predict” and other similar terminology, or state that

certain actions, events or results “may,” “could,” “would,” “might”

or “will” be taken, occur or be achieved. These statements reflect

the Entity’s current expectations regarding future events,

financial or operating performance and results, and speak only as

of the date of this release. Such statements include without

limitation, statements with respect to the expected benefits of the

Separation for each business and the Entity’s shareholders and

other stakeholders, the strategic advantages, future opportunities

and focus of each business and expectations regarding the status of

development of the Entity’s projects, and expectation for the

completion of the second tranche investment by GM; statements with

respect to expectations around Thacker Pass supporting North

American supply chain, the number of workers it will employ and its

expected mine life.

Forward-looking statements involve significant

risks and uncertainties, should not be read as guarantees of future

performance, events or results and will not necessarily be accurate

indicators of whether or not such events or results will be

achieved. A number of factors could cause actual results to differ

materially from the results discussed in the forward-looking

statements or information, including, but not limited to, the

performance, the operations and financial condition of Lithium

Americas (NewCo) and Lithium Argentina as separately traded public

companies, including the reduced geographical and property

portfolio diversification resulting from the Separation; the impact

of the Separation on the trading prices for, and market for trading

in, the shares of the Entities; the potential for significant tax

liability for a violation of the tax-deferred spinoff rules

applicable in Canada and the United States; uncertainties with

realizing the potential benefits of the Separation; risks with

respect to Lithium Americas (NewCo) not meeting the conditions with

respect to GM’s second tranche investment and other risks with

respect to any delays in completing such transaction; risks

associated with mining project development, achieving anticipated

milestones and budgets as planned, and meeting expected timelines;

risks inherent in litigation or rulings that are adverse for an

Entity or its projects; maintaining local community support in the

regions where an Entity’s projects are located; changing social

perceptions and their impact on project development and litigation;

ongoing global supply chain disruptions and their impact on

developing an Entity’s projects; availability of personnel,

supplies and equipment; the impact of inflation or changing

economic conditions on an Entity, its projects and their

feasibility; any impacts of COVID-19 or an escalation thereof on

the business of an Entity; unanticipated changes in market price

for an Entity’s shares; changes to an Entity’s current and future

business plans and the strategic alternatives available to the

Entity; industry and stock market conditions generally; demand,

supply and pricing for lithium; and general economic and political

conditions in Canada, the United States, Argentina and other

jurisdictions where an Entity conducts business. Additional

information about certain of these assumptions and risks and

uncertainties is contained in the Entity’s filings with securities

regulators, including the Company’s management information circular

dated June 16, 2023 available on SEDAR+ at www.sedarplus.ca and

EDGAR at www.sec.gov.

Although the forward-looking statements

contained in this release are based upon what management of the

applicable Entity believes are reasonable assumptions as of the

date hereof, there can be no assurance that actual results will be

consistent with these forward-looking statements. These

forward-looking statements are made as of the date of this release

and are expressly qualified in their entirety by this cautionary

statement. Subject to applicable securities laws, none of the

Entities assume any obligation to update or revise the

forward-looking statements contained herein to reflect events or

circumstances occurring after the date of this release.

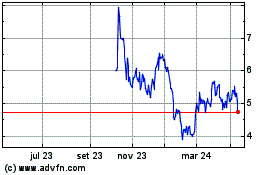

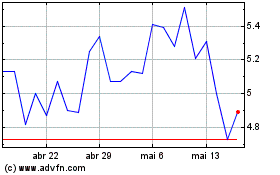

Lithium Americas Argentina (NYSE:LAAC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Lithium Americas Argentina (NYSE:LAAC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024