Emphasizes the Company’s Director Nominees are

Highly Qualified and Engaged, and their Election is in the Best

Interest of All Shareholders

Urges Shareholders to Vote the Universal

WHITE Proxy Card Today “FOR” ONLY LL

Flooring’s Three Highly Qualified Director Nominees

Visit www.VoteLLFlooring.com for More

Information

LL Flooring Holdings, Inc. (“LL Flooring” or “Company”) (NYSE:

LL) today mailed a letter to shareholders in connection with the

Company’s upcoming 2024 Annual Meeting of Stockholders.

The letter contains critical information for shareholders’

decision making, including highlighting the Board’s view that

Thomas Sullivan is pushing a personal agenda, that Mr. Sullivan and

his nominees are conflicted and would not be truly independent

given Mr. Sullivan’s ongoing interest in buying the Company and

that Mr. Sullivan has a track record that shareholders are urged to

question. The letter also emphasizes LL Flooring’s director

nominees are highly qualified and engaged and how they are the

right directors to oversee the Company’s path forward.

The LL Flooring Board of Directors unanimously urges

shareholders to vote using the universal white proxy card today

“FOR” only LL Flooring’s three highly qualified director

nominees.

Visit www.VoteLLFlooring.com, to find additional information and

resources to help shareholders vote at the 2024 Annual Meeting of

Stockholders.

The full text of the letter follows:

Dear Fellow Shareholders,

We are seeking your support at LL Flooring’s

upcoming 2024 Annual Meeting of Stockholders for our three highly

qualified nominees – Douglas T. Moore, Ashish Parmar and Nancy M.

Taylor – who are standing for re-election to your Board of

Directors.

The costly and distracting proxy contest that

has been launched by Thomas Sullivan is self-serving and not in the

best interests of all shareholders. We believe that he may be

attempting to force a sale of LL Flooring to himself at a price

that may undervalue the Company by installing himself and two of

his hand-picked employees on your Board. Mr. Sullivan has long

wanted to acquire the Company and we believe he and his other

nominees would not be truly independent, rather they would push Mr.

Sullivan’s personal agenda.

Mr. Sullivan and his other two nominees or

Jerald Hammann, another individual shareholder of LL Flooring who

has nominated himself to the Board of Directors, offer no

incremental value to your Board. In fact, if these nominees were

elected, they would remove superior talent, critical skills and

three independent directors from your Board and risk derailing the

progress being made in executing on the Company’s set of five

strategic priorities and completing the evaluation of strategic

alternatives that is underway.

We urge you to support your Board by

voting the universal WHITE proxy card

today “FOR” ONLY LL Flooring’s three highly qualified director

nominees – Douglas T. Moore, Ashish Parmar and Nancy M.

Taylor.

Mr.

Sullivan is Pushing a Personal Agenda, is Conflicted Given His

Ongoing Interest in Buying the

Company and Has a Questionable Track Record

Based on Mr. Sullivan’s actions during the

Company’s strategic review process and even more recently, we

believe that his focus would be to push a personal agenda to

acquire LL Flooring at a price that may undervalue the Company if

he were appointed to your Board. The two additional candidates

being put forth by Mr. Sullivan have longstanding relationships

with him, and currently work for F9 Investments or Cabinets To Go,

both owned and controlled by Mr. Sullivan and the latter of which

competes with LL Flooring.

While Mr. Sullivan misleadingly claims he is

not trying to take control of LL Flooring, his actions demonstrate

the opposite. Your Board initiated good faith discussions with Mr.

Sullivan to reach a proposed compromise in this proxy contest by

appointing one of his nominees. However, in those discussions, Mr.

Sullivan’s representatives requested as part of such compromise

that he receive diligence access to the Company under a

confidentiality agreement. Mr. Sullivan is seemingly more focused

on advancing his self-serving objectives than the best interests of

all shareholders.

In addition to questioning Mr. Sullivan’s

true motives, we encourage shareholders to ask themselves if an

individual with Mr. Sullivan’s track record should be overseeing LL

Flooring’s path forward. Some of the “highlights” in Mr. Sullivan’s

history include:

- In 2013, Mr. Sullivan was the subject of a civil racketeering

derivative complaint filed by condominium and hotel associations in

Miami bankruptcy court on behalf of all debtors of Elcom Hotel

& Spa LLC, which Mr. Sullivan co-founded. The bankruptcy

clawback lawsuit sought more than $20 million for Mr. Sullivan’s

actions involving his ownership of 51 units and the common areas of

Bal Harbour Hotel & Spa. The lawsuit accused Mr. Sullivan of

fraud, racketeering, gross negligence and breach of fiduciary duty,

among other counts, for his personal use of funds that were

intended to be allocated for building operations.

- In 2013, while Mr. Sullivan served as Executive Chairman of LL

Flooring (then Lumber Liquidators) the government served search

warrants on the Company related to an investigation into

environmental crimes. In October 2015, after Mr. Sullivan had

stepped into the role of Interim CEO following the departure of the

previous CEO, the Company pleaded guilty in federal court to

charges related to its sourcing of illegally logged timber from Far

East Russia, as well as false statements on Lacey Act declarations

which concealed the true species and source of the timber. This was

the largest criminal fine ever under the Lacey Act at the

time.

- In March 2015, when Mr. Sullivan was serving as Executive

Chairman, LL Flooring (then Lumber Liquidators) was also the

subject of a 60 Minutes exposé regarding claims that the laminate

flooring imported by the Company from China had unsafe levels of

formaldehyde. Mr. Sullivan chose to appear on the program as a

spokesman for the Company, and following the airing of the program,

the Company experienced significant negative impact to its stock

price and reputation. In this same timeframe, the Company was also

the target of a class action lawsuit, and the California Air

Regulation Board started an investigation into the Company’s

products.

- In 2019, three years after his departure from the Company as a

director and executive, Mr. Sullivan made public statements about

his interest in acquiring LL Flooring. He then reversed those

statements while timing his trades of LL Flooring stock in a manner

that benefitted his own personal portfolio and whipsawed other

investors. Mr. Sullivan disclosed he had increased his stock

ownership in LL Flooring (then Lumber Liquidators). Shortly

thereafter, he publicly expressed interest in taking the Company

private through a transaction with Cabinets To Go, which led to a

significant increase in the stock price. Shortly after, Mr.

Sullivan sold down his stock ownership after which he made a

subsequent public statement noting he was no longer interested in

acquiring the Company, which sent the stock price down after he had

already profited from his stock sales.

- In 2019, Mr. Sullivan’s company, Cabinets To Go, was involved

in litigation with LL Flooring related to Cabinets To Go violating

the terms of a Memorandum of Understanding signed between the

companies under which Cabinets To Go would not sell flooring in

competition with LL Flooring. Cabinets To Go later settled with LL

Flooring regarding the violation of terms.

As a result of actions taken by prior

management while serving under the oversight of Mr. Sullivan as

Executive Chairman and during the time Mr. Sullivan served as

Interim CEO, the Company paid a total of $112.2 million to settle

litigation and pay fines related to product quality, sourcing

issues and securities fraud1. Mr. Sullivan does not bring the

skills and expertise appropriate for your Board, is conflicted

given his interest in acquiring the Company and has a history of

questionable actions.

LL

Flooring’s Highly Qualified and Engaged Nominees Are the Right

Directors to Oversee the

Company’s Path Forward and Maximize Value

We firmly believe that LL Flooring’s current

directors are the right directors with the right experience and

skillsets to oversee the Company’s strategic direction and to

maximize value.

Consistent with your Board’s commitment to

independence, eight of LL Flooring’s nine directors – all but the

Company’s CEO – are independent, including all three nominees who

are up for re-election at this year’s Annual Meeting. In addition

to ensuring true independence, your Board is committed to ongoing

refreshment, as evidenced by the voluntary replacement of nearly

one-third of your Board over the last five years.

Most recently, this deliberate and thoughtful

group has supported management’s definition and initial execution

of the Company’s five clear strategic priorities along with the

ongoing thorough consideration of strategic alternatives.

We strongly encourage shareholders to vote

for LL Flooring’s three directors who are up for re-election:

Douglas T. Moore Former Chairman and

CEO of CleanCore Solutions, Inc.; Former CEO of 1847 Goedeker, Inc.

and Goedeker’s Through his more than 25 years of merchandising and

retail experience, Mr. Moore has developed an understanding of

strategic and tactical business issues that include store

operations, supply chain, sourcing, and human resource planning. He

also possesses marketing, risk assessment and retail knowledge. He

recently stepped down from his role as Chairman and CEO of

CleanCore Solutions, Inc., and previously served in other chief

executive officer and senior executive roles at companies in the

home goods, home improvement and broader retail industry. He has

been a member of our Nominating and Corporate Governance Committee

since our initial public offering and a member of our Compliance

and Regulatory Affairs Committee since May 2016. Mr. Moore also

served as a member of our Audit Committee from our initial public

offering until May 2016 and as Chairperson of our Nominating and

Corporate Governance Committee from our initial public offering

until May 2019.

Ashish Parmar Current Chief

Information Officer of Standard Industries, Inc. Mr. Parmar brings

more than 20 years of leadership experience in leading digital

transformations and delivering a seamless omnichannel experience.

He is a key leader in strategic change initiatives to drive growth,

develop corporate strategy, and drive new business opportunities.

Mr. Parmar also has a breadth of international experience in both

technology and supply chain and his experience as a Chief

Information Officer is helpful to our oversight of cybersecurity.

Mr. Parmar has attained the designation of NACD Directorship

Certified and the CERT Certificate in Cybersecurity Oversight.

Nancy M. Taylor Current LL Flooring

Independent Board Chair; Former CEO of Tredegar Corporation Public

company director at TopBuild Corp. and Malibu Boats, Inc. Ms.

Taylor brings significant experience as a chief executive officer

of a publicly-traded international manufacturer. Through her

decades of experience, she has gained and developed extensive

business, finance, and leadership skills. Further, she possesses an

understanding of strategic planning, risk assessment and

international operations. Ms. Taylor has been a member of our

Nominating and Corporate Governance Committee since January 2015

and a member of our Compliance and Regulatory Affairs Committee

since May 2019. Ms. Taylor also served as a member of our

Compensation Committee from May 2014 until May 2019. Additionally,

Ms. Taylor was appointed Chairperson of your Board in November

2015. Ms. Taylor has attained the designations of Board Leadership

Fellow and NACD Directorship Certified.

Over the course of their respective tenures as members of your

Board, Messrs. Moore and Parmar and Ms. Taylor have been active and

engaged, leveraging their deep collective experiences and expertise

to provide critical, independent oversight and decision making to

drive value.

Vote today “FOR” ONLY LL Flooring’s three

highly qualified and engaged director nominees on the universal

WHITE proxy card

Your Board unanimously recommends that you vote “FOR” the

election of each of the three nominees proposed by your Board,

Messrs. Moore and Parmar and Ms. Taylor, on your universal

WHITE proxy card.

Your Board does not endorse Mr. Sullivan and his other two

nominees, who are conflicted due to their roles at F9 Investments

and Cabinets To Go, the latter of which competes with LL Flooring,

or Mr. Hammann. Your Board strongly urges you to DISCARD and NOT

vote using any gold proxy card that may be sent to you by Mr.

Sullivan or any proxy card that may be sent to you by Mr. Hammann.

If you have already voted using a gold proxy card or other proxy

card sent to you by either Mr. Sullivan or Mr. Hammann,

respectively, you have every right to change your vote and we

strongly encourage you to revoke that proxy by using the

WHITE proxy card to vote in

favor of ONLY the three nominees recommended by your Board ‐ by

Internet or by signing, dating and returning the enclosed

WHITE proxy card in the

postage‐paid envelope provided. Only the latest validly executed

proxy that you submit will be counted ‐ any proxy may be revoked at

any time prior to its exercise at the Annual Meeting.

Your vote is very important. Even if you plan to attend the

Annual Meeting, we request that you read the proxy statement and

vote your shares by signing and dating the enclosed universal

WHITE proxy card and returning it in

the postage‐paid envelope provided or by voting via the Internet by

following the instructions provided on the enclosed universal

WHITE proxy card.

If you have any questions or

require

any assistance with voting

your

shares, please contact our

proxy

solicitor, Saratoga, at (888)

368‐0379

or (212) 257‐1311 or by email

at

info@saratogaproxy.com.

Additional Information

On June 7, 2024, Mr. Moore resigned from his positions as

Chairman, Chief Executive Officer and President of CleanCore

Solutions, Inc. Mr. Moore is expected to continue to serve as a

senior advisor for a transition period.

About LL Flooring

LL Flooring is one of the country’s leading specialty retailers

of hard-surface flooring with more than 435 stores nationwide. The

Company seeks to offer the best customer experience online and in

stores, with more than 500 varieties of hard-surface floors

featuring a range of quality styles and on-trend designs. LL

Flooring's online tools also help empower customers to find the

right solution for the space they've envisioned. LL Flooring's

extensive selection includes waterproof hybrid resilient,

waterproof vinyl plank, solid and engineered hardwood, laminate,

bamboo, porcelain tile, and cork, with a wide range of flooring

enhancements and accessories to complement. LL Flooring stores are

staffed with flooring experts who provide advice, Pro partnership

services and installation options for all of LL Flooring's

products, the majority of which is in stock and ready for

delivery.

Learn More about LL Flooring

- Our commitment to quality, compliance, the communities we serve

and corporate giving: https://llflooring.com/corp/quality.html

- Follow us on social media: Facebook, Instagram and

Twitter.

Forward Looking Statements

Certain statements in this press release may include statements

of the Company’s expectations, intentions, plans and beliefs that

constitute “forward-looking statements” within the meanings of the

Private Securities Litigation Reform Act of 1995. These statements,

which may be identified by words such as “may,” “will,” “should,”

“expects,” “intends,” “plans,” “anticipates,” “assumes,”

“believes,” “thinks,” “estimates,” “seeks,” “predicts,” “could,”

“projects,” “targets,” “potential,” “will likely result,” and other

similar terms and phrases, are based on the beliefs of the

Company’s management, as well as assumptions made by, and

information currently available to, the Company’s management as of

the date of such statements.

These statements are subject to risks and uncertainties, all of

which are difficult to predict and many of which are beyond the

Company’s control. These risks include, without limitation, the

impact of any of the following: reduced consumer spending due to

slower growth, economic recession, inflation, higher interest

rates, and consumer sentiment; our advertising and overall

marketing strategy, including anticipating consumer trends and

increasing brand awareness; the results of our ongoing strategic

review; a sustained period of inflation impacting consumer

spending; our inability to execute on our key initiatives or if

such key initiatives do not yield desired results; stock price

volatility; competition, including alternative e-commerce

offerings; liquidity and/or capital resources changes and the

impact of any changes or limitations, including, without

limitation, ability to borrow funds and/or renew or roll over

existing indebtedness; transportation availability and costs,

including the impact of the war in Ukraine and the conflict in the

middle east on the Company’s European and Asian suppliers;

potential disruptions to supply chain and product availability

related to forced labor and other trade regulations; including with

respect to the Uyghur Forced Labor Prevention Act; inability to

hire and/or retain employees; inability to staff stores due to

overall pressures in the labor market; the outcomes of legal

proceedings, and the related impact on liquidity; reputational

harm; inability to open new stores with acceptable financial

returns, find suitable locations for our new stores, and fund other

capital expenditures; managing growth; disruption in our ability to

distribute our products, including due to severe weather; operating

an office in China; managing third-party installers and product

delivery companies; renewing store, warehouse, or other corporate

leases; maintaining optimal inventory for consumer demand; our and

our suppliers’ compliance with complex and evolving rules,

regulations, and laws at the federal, state, and local levels

having an overreliance on limited or sole-source suppliers; damage

to our assets; availability of suitable hardwood, carpet and other

products, including disruptions from the impacts of severe weather

and supply chain constraints; product liability claims, marketing

substantiation claims, wage and hour claims, and other labor and

employment claims; sufficient insurance coverage, including

cybersecurity insurance; disruptions due to cybersecurity threats,

including any impacts from a network security incident; the

handling of confidential customer information, including the

impacts from the California Consumer Privacy Act, California

Privacy Rights Act and other applicable data privacy laws and

regulations; management information systems and customer

relationship management system disruptions; obtaining products

domestically and from abroad, including tariffs, the effects of

antidumping and countervailing duties, and delays in shipping and

transportation whether due to international events, such as the Red

Sea shipping crisis, or scenarios outside of the Company’s control;

impact of changes in accounting guidance, including implementation

guidelines and interpretations related to Environmental, Social,

and Governance matters; deficiencies or weaknesses in internal

controls; and anti-takeover provisions.

The Company specifically disclaims any obligation to update

these statements, which speak only as of the dates on which such

statements are made, except as may be required under the federal

securities laws.

Additional factors are set forth in the Company’s Annual Report

on Form 10-K and Form 10-K/A for the year ended December 31, 2023,

under the captions “Risk Factors”, the Company’s quarterly report

on Form 10-Q for the quarter ended March 31, 2024, and subsequent

filings with the SEC.

_________________________

1 Based on Company SEC filings filed on

February 29, 2016, November 6, 2019, August 5, 2020 and February

25, 2020.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240610513011/en/

For further information: LL Flooring Investor Relations

ICR Bruce Williams ir@llflooring.com Tel: 804-420-9801

For media inquiries: Leigh Parrish / Ed Trissel Joele

Frank, Wilkinson Brimmer Katcher 212-355-4449

For Investors: Saratoga Proxy Consulting LLC: John

Ferguson / Joe Mills info@saratogaproxy.com Tel: 212-257-1311

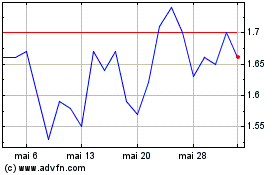

LL Flooring (NYSE:LL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

LL Flooring (NYSE:LL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024