Pursuing Going-Concern Sale of Business

Secures Commitment for Debtor-in-Possession

Financing to Support Operations

Continues To Serve Customers and Provide a

Broad Range of Hard and Soft Surface Flooring Both Online and in

Stores

LL Flooring Holdings, Inc. (“LL Flooring” or the “Company”)

(NYSE: LL), today announced that the Company and certain of its

subsidiaries have commenced voluntary Chapter 11 reorganization

proceedings in the U.S. Bankruptcy Court for the District of

Delaware (the “Bankruptcy Court”). LL Flooring intends to use these

proceedings to pursue a going-concern sale of its business.

LL Flooring is generally operating in the normal course through

this process and remains focused on providing customers with a

broad range of hard and soft surface flooring and an exceptional

shopping experience. The Company has more than 300 continuing

stores across the U.S. that, along with its online platform, are

open and continuing to serve customers with few changes to store

operations and policies. In addition, LL Flooring entered into an

agreement with Hilco Merchant Resources, LLC, to assist the Company

in its recently initiated store closing sales at 94 of its

locations. Those 94 stores will remain open and serving customers

through this closing process.

Prior to filing for Chapter 11, the Company conducted extensive

marketing processes with respect to its business and certain of its

assets, including its distribution center in Sandston, Virginia.

The marketing process garnered significant interest, and the

Company intends to use these Chapter 11 proceedings to continue

pursuing a going-concern sale of its business under the Bankruptcy

Code. The Company remains in active negotiations with multiple

bidders and hopes to seek Bankruptcy Court approval of a sale of

its business in the first few weeks of the Chapter 11

proceedings.

LL Flooring has received a commitment for debtor-in-possession

(“DIP”) financing of up to $130 million from its existing bank

group led by Bank of America. Following Court approval, the

incremental liquidity provided by the DIP financing, combined with

cash generated from the Company’s ongoing operations is expected to

support the business during these proceedings.

Charles Tyson, President and Chief Executive Officer of LL

Flooring, said, “After comprehensive efforts to enhance our

liquidity position in a challenging macro environment, a

determination was made that initiating this Chapter 11 process is

the best path forward for the Company. Today’s step is intended to

provide LL Flooring with additional time and financial flexibility

as we reduce our physical footprint and close certain stores while

pursuing a going-concern sale of the rest of our business. As we

move through this process, we are committed to continuing to serve

our valued customers, and to working seamlessly with our vendors

and partners. I am appreciative of our associates for their ongoing

hard work in providing the best experience for our customers.”

LL Flooring has filed a number of customary motions in

connection with the Chapter 11 proceedings. Once approved by the

Court, those motions will allow the Company to smoothly transition

its business into Chapter 11, including by, among other things,

granting authority to continue payment of wages and maintain

healthcare and other benefits as well as certain other relief

customary in these circumstances. The Company has sought

authorization to continue honoring customer commitments subject to

certain modifications of store operations or policies relating to

its acceptance of customer deposits and gift cards. Any updates to

store operations or policies will be posted on the Company’s

website, where customers can also find a list of locations

conducting store closing sales. The Company intends to pay vendors

and suppliers in full under normal terms for goods and services

provided on or after the Chapter 11 filing date and has requested

Court approval to do so.

Additional information about the Company’s Chapter 11 process is

available at www.LLFlooringRestructuring.com.

Court filings and other information related to the proceedings

are available on a separate website administrated by the company's

claims agent, Stretto, at https://cases.stretto.com/LLFlooring; by

calling Stretto representatives toll-free at 855-314-5841, or

714-716-1925 for calls originating outside of the U.S. or Canada;

or by emailing Stretto at TeamLLFlooring@stretto.com.

Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal

counsel, Houlihan Lokey is serving as financial adviser, and

AlixPartners LLP is serving as restructuring advisor to the

Company.

About LL Flooring

LL Flooring is one of the country’s leading specialty retailers

of hard-surface flooring with more than 300 stores nationwide. The

Company seeks to offer the best customer experience online and in

stores, with more than 500 varieties of hard-surface floors

featuring a range of quality styles and on-trend designs. LL

Flooring's online tools also help empower customers to find the

right solution for the space they've envisioned. LL Flooring's

extensive selection includes waterproof hybrid resilient,

waterproof vinyl plank, solid and engineered hardwood, laminate,

bamboo, porcelain tile, and cork, with a wide range of flooring

enhancements and accessories to complement, as well as carpet in

select stores. LL Flooring stores are staffed with flooring experts

who provide advice, Pro partnership services and installation

options for all of LL Flooring's products, the majority of which is

in stock and ready for delivery.

Forward Looking Statements

Certain information in this press release may constitute

"forward-looking statements" within the meanings of the Private

Securities Litigation Reform Act of 1995, including but not limited

to, the asset purchase agreement and the Chapter 11 proceedings and

any other statements that refer to our expected, estimated or

anticipated future results or that do not relate solely to

historical facts. These statements, which may be identified by

words such as "may," "will," "should," "expects," "intends,"

"plans," "anticipates," "assumes," "believes," "thinks,"

"estimates," "seeks," "predicts," "could," "projects," "targets,"

"potential," "will likely result," and other similar terms and

phrases, are based on the beliefs of the Company’s management, as

well as assumptions made by, and information currently available

to, the Company’s management as of the date of such statements.

These statements are subject to risks and uncertainties, all of

which are difficult to predict and many of which are beyond the

Company’s control, including, among other things, the following:

the outcome of our contingency planning and restructuring

activities; settlement discussions or negotiations; the Company’s

liquidity, financial performance, cash position and operations; the

Company’s strategy; risks and uncertainties associated with Chapter

11 proceedings; the negative impacts on the Company’s businesses as

a result of filing for and operating under Chapter 11 protection;

the time, terms and ability to confirm a sale of the Company’s

businesses under Section 363 of the U.S. Bankruptcy Code; the

adequacy of the capital resources of the Company’s businesses and

the difficulty in forecasting the liquidity requirements of the

operations of the Company’s businesses; the unpredictability of the

Company’s financial results while in Chapter 11 proceedings; the

Company’s ability to discharge claims in Chapter 11 proceedings;

negotiations with the holders of the Company’s indebtedness and its

trade creditors and other significant creditors; risks and

uncertainties with performing under the terms of any arrangement

with lenders or creditors while in Chapter 11 proceedings; the

Company’s ability to conduct business as usual; the Company’s

ability to continue to serve customers, suppliers and other

business partners at the high level of service and performance they

have come to expect from the Company; the Company’s ability to

continue to pay employees, suppliers and vendors; the ability to

control costs during Chapter 11 proceedings; adverse litigation;

the risk that the Company’s Chapter 11 cases may be converted to

cases under Chapter 7 of the Bankruptcy Code; the Company’s ability

to secure operating capital; the Company’s ability to take

advantage of opportunities to acquire assets with upside potential;

the Company’s ability to execute on its strategic plan to pursue,

evaluate and close an asset sale of the Company’s businesses

pursuant to Section 363 of the U.S. Bankruptcy Code; our inability

to maintain compliance with financial covenants and operating

obligations which would expose us to potential events of default

under our outstanding indebtedness; our ability to incur additional

debt or equity financing for working capital, capital expenditures,

business development, debt service requirements, acquisitions or

general corporate or other purposes; a significant reduction in our

short-term or long-term revenues which could cause us to be unable

to fund our operations and liquidity needs or repay indebtedness;

and supply chain interruptions or difficulties. Therefore, the

reader is cautioned not to rely on these forward-looking

statements.

The Company specifically disclaims any obligation to update

these statements, which speak only as of the dates on which such

statements are made, except as may be required under the federal

securities laws. For a discussion of other risks and uncertainties

that could cause actual results to differ from those contained in

the forward-looking statements, see the "Risk Factors" section of

the Company’s annual report on Form 10-K for the year ended

December 31, 2023, and the Company’s other filings with the

Securities and Exchange Commission. Such filings are available on

the SEC’s website at www.sec.gov and the Company’s Investor

Relations website at https://investors.llflooring.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240811854150/en/

For media inquiries: Leigh Parrish / Ed Trissel / Spencer

Hoffman Joele Frank, Wilkinson Brimmer Katcher 212-355-4449

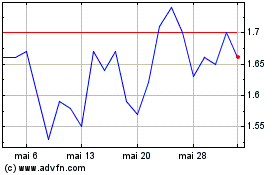

LL Flooring (NYSE:LL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

LL Flooring (NYSE:LL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024