LL Flooring’s Projected Liquidity Will Not Be

Sufficient to Maintain Compliance with its Credit Agreement as Soon

as September, Months Earlier than Previously Revealed

LL Flooring is at Immediate Risk of Running out

of Cash and Going Out of Business, Further Reinforcing the Urgent

Need for Change at the Board Level

F9’s Three Highly Qualified Nominees – Tom D.

Sullivan, Jason Delves, and Jill Witter – Are the Right Individuals

to Restore Long-Term Value to LL Flooring

F9 Urges Shareholders to Vote the

GOLD Proxy Card

“FOR” its Three Highly

Qualified Director Nominees and “WITHHOLD” on All LL Flooring Nominees to

Protect the Value of Their Investment

F9 Investments, LLC (“F9”), which together with its affiliates

collectively owns approximately 8.85% of LL Flooring Holdings, Inc.

(“LL Flooring” or the “Company”) (NYSE: LL) common stock and is the

Company’s largest shareholder, today commented on the Company’s

shocking June 28, 2024 filing which revealed that, under the terms

of the Company’s asset-backed revolving facility credit agreement

(the “Credit Agreement”), the Company now believes that its

projected levels of liquidity may not be sufficient to meet the

minimum excess availability threshold in the third quarter of

2024.1

In a previous filing on May 8, 2024, the Company had announced

its belief that its projected levels of liquidity would be

insufficient to maintain compliance with the Credit Agreement in

the fourth quarter of 2024.2

Tom Sullivan, Chairman of F9, commented, “LL Flooring’s shocking

disclosure that its projected liquidity will not be sufficient to

maintain compliance with its credit agreement months earlier than

previously revealed only further hammers home that urgent change is

needed in LL Flooring’s boardroom. It is preposterous for the Board

to announce this dire development mere days after communicating to

shareholders its strategic plan is working and positions the

Company for long-term growth. This Board is burning through cash at

a rate that could bankrupt the Company in the third quarter, yet it

continues to waste valuable shareholder resources paying

high-priced advisors to wage a proxy contest.”

“It should be clear that this Board cannot be left at the helm

of LL Flooring if shareholders wish to protect the remaining value

of their investments in the Company. F9’s three highly qualified

director nominees bring the relevant flooring industry expertise,

track records of value creation, shareholder alignment, and

actionable plan necessary to stabilize LL Flooring’s business and

put it on a path to long-term value creation for the benefit of all

shareholders.”

VOTE ON THE GOLD PROXY CARD TODAY “FOR” F9’S

NOMINEES TOM SULLIVAN, JASON DELVES, AND JILL WITTER AND “WITHHOLD”

ON ALL LL FLOORING NOMINEES AND JERALD HAMMANN

Shareholders must act decisively to safeguard their

investment. YOUR VOTE MATTERS, NO MATTER HOW MANY SHARES YOU OWN.

We urge all shareholders to protect the value of their investment

by voting for F9’s nominees today using the GOLD proxy

card.

You can cast your vote online at www.ProxyVote.com or by

completing, signing and dating the GOLD proxy card or GOLD voting

instruction form and mailing it in the postage paid envelope

provided.

If you have not received the GOLD proxy card from F9 and have

only received a WHITE proxy card sent to you by the Company, you

can still support F9’s nominees using the WHITE proxy card. You can

do so by checking the “WITHHOLD” boxes on all of the Company

nominees and Jerald Hammann and checking the “FOR” boxes for all F9

nominees – Tom Sullivan, Jason Delves, and Jill Witter.

If you have any questions about how to vote your shares, please

contact our proxy solicitor, Campaign Management, by telephone

1-(855) 264-1527 (shareholders) or (212) 632-8422 (banks &

brokerages) or by email at info@campaign-mgmt.com.

For more information about F9 and detailed voting instructions,

visit our website at www.LLGroove.com.

Solomon Partners Securities, LLC is serving as F9’s financial

advisor and Dentons US LLP is serving as its legal advisor.

DISCLAIMER

Except as otherwise set forth in this press release, the views

expressed in this press release reflect the opinions of F9

Investments, LLC and its affiliates (“F9”) and are based on

publicly available information with respect to LL Flooring

Holdings, Inc. (“LL” or the “Company”). F9 recognizes that there

may be confidential information in the possession of the Company

that could lead it or others to disagree with F9’s conclusions. F9

reserves the right to change any of its opinions expressed herein

at any time as it deems appropriate and disclaims any obligation to

notify the market or any other party of any such change, except as

required by law. F9 disclaims any obligation to update the

information or opinions contained in this press release, except as

required by law. For the avoidance of doubt, this press release is

not affiliated with or endorsed by LL.

This press release is provided merely as information and is not

intended to be, nor should it be construed as, an offer to sell or

a solicitation of an offer to buy any security nor as a

recommendation to purchase or sell any security. Certain of the

Participants (as defined below) currently beneficially own shares

of the Company. The Participants and their affiliates may from time

to time sell all or a portion of their holdings of the Company in

open market transactions or otherwise, buy additional shares (in

open market or privately negotiated transactions or otherwise), or

trade in options, puts, calls, swaps or other derivative

instruments relating to such shares.

Some of the materials in this press release contain

forward-looking statements. All statements contained herein that

are not clearly historical in nature or that necessarily depend on

future events are forward-looking, and the words “anticipate,”

“believe,” “expect,” “potential,” “could,” “opportunity,”

“estimate,” “plan,” “once again,” “achieve,” and similar

expressions are generally intended to identify forward-looking

statements. The projected results and statements contained herein

that are not historical facts are based on current expectations,

speak only as of the date of these materials and involve risks,

uncertainties and other factors that may cause actual results,

performances or achievements to be materially different from any

future results, performances or achievements expressed or implied

by such projected results and statements. Assumptions relating to

the foregoing involve judgments with respect to, among other

things, future economic competitive and market conditions and

future business decisions, all of which are difficult or impossible

to predict accurately and many of which are beyond the control of

F9.

The estimates, projections and potential impact of the

opportunities identified by F9 herein are based on assumptions that

F9 believes to be reasonable as of the date of this press release,

but there can be no assurance or guarantee (i) that any of the

proposed actions set forth in this press release will be completed,

(ii) that the actual results or performance of the Company will not

differ, and such differences may be material, or (iii) that any of

the assumptions provided in this press release are accurate.

F9 has neither sought nor obtained the consent from any third

party to use any statements or information contained herein that

have been obtained or derived from statements made or published by

such third parties, nor has it paid for any such statements. Any

such statements or information should not be viewed as indicating

the support of such third parties for the views expressed herein.

F9 does not endorse third-party estimates or research which are

used herein solely for illustrative purposes.

Important Information

F9 Investments, LLC, Thomas D. Sullivan, John Jason Delves and

Jill Witter (collectively, the “Participants”) filed a definitive

proxy statement and accompanying form of gold proxy card (as

supplemented and amended, the “Definitive Proxy Statement”) with

the Securities and Exchange Commission (the "SEC”) on May 31, 2024

to be used in connection with the 2024 annual meeting of

stockholders of the Company.

THE PARTICIPANTS STRONGLY ADVISE ALL STOCKHOLDERS OF THE COMPANY

TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER PROXY MATERIALS

BECAUSE THEY CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

ARE AVAILABLE AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV AND

F9’S WEBSITE AT WWW.LLGROOVE.COM. THE DEFINITIVE PROXY STATEMENT

AND ACCOMPANYING PROXY CARD WILL BE FURNISHED TO SOME OR ALL OF THE

COMPANY’S STOCKHOLDERS. STOCKHOLDERS MAY ALSO DIRECT A REQUEST TO

F9’S PROXY SOLICITOR, CAMPAIGN MANAGEMENT, 15 WEST 38TH STREET,

SUITE #747, NEW YORK, NY 10018 (STOCKHOLDERS CAN E-MAIL

INFO@CAMPAIGNMANAGEMENT.COM OR CALL TOLL-FREE: (855) 264-1527.

Information about the Participants and a description of their

direct or indirect interests by security holdings or otherwise can

be found in the Definitive Proxy Statement.

1 LL Flooring Holdings, Inc. – Form 8-K, 28 June, 2024,

accessible at:

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001396033/000119312524171336/d860512d8k.htm

2 LL Flooring Holdings, Inc. – Form 10-Q, 8 May 2024, accessible

at:

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001396033/000095017024055042/ll-20240331.htm

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240628794742/en/

INVESTOR AND MEDIA CONTACTS Investors: Michael Fein

Campaign Management (212) 632-8422 michael.fein@campaign-mgmt.com

Media: Jonathan Gasthalter/Nathaniel Garnick Gasthalter & Co.

(212) 257-4170 F9Investments@gasthalter.com

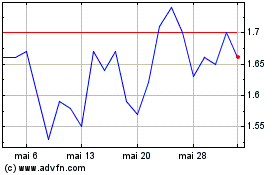

LL Flooring (NYSE:LL)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

LL Flooring (NYSE:LL)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024