MISTRAS Group, Inc. (MG: NYSE), a leading "one source"

multinational provider of integrated technology-enabled asset

protection solutions, reported financial results for its first

quarter ended March 31, 2024.

Highlights for the First Quarter 2024*

- Revenue of $184.4 million,

an increase of 9.8%

- Gross profit of $51.1

million, an increase of 10.9%, with gross profit margin of 27.7%,

an increase of 30 basis points due to improved operating leverage

and strong Aerospace growth, partially offset by higher healthcare

claims expense in the current year period

- Selling, general and

administrative expenses of $41.2 million, down $1.6 million or

3.8%, due to savings associated with Project Phoenix

actions

- Net income of $1.0 million,

or $0.03 per share, reflecting an improvement from a net loss of

$5.0 million, or a loss of $0.17 per share in the prior year

period

- Adjusted EBITDA of $16.2

million, an increase of 55.1%, as a result of revenue growth and

the operating leverage generated from a reduction in overhead

costs

* All comparisons are consolidated and

versus the equivalent prior year period, unless otherwise

noted.

Manny Stamatakis, Interim President and Chief Executive Officer

commented, “The first quarter was a strong start to the year for

Mistras Group as we continue to execute on our key financial,

operational and strategic initiatives. In particular, we achieved

outstanding success with our initiatives implemented in connection

with Project Phoenix, with Adjusted EBITDA up over 55% compared to

the prior year period. Revenue was up almost 10%, which reflects

strong spring turnaround activity and continued expansion in our

Aerospace and Defense industry. Additionally, we benefited from the

successful implementation of strategic price increases with our

improved commercial focus, which consequentially contributed to

improvement in our gross margin. Selling, general and

administrative expenses (“SG&A”) were also reduced on both a

sequential and year-over-year basis. Furthermore, we recently

announced the hiring of a Chief Transformation Officer, whose

primary focus will be to sustain the momentum generated by Project

Phoenix and to further improve operating leverage. Consequently, I

am once again reiterating our expectation that fiscal 2024 Adjusted

EBITDA will be one of our all-time high-performance years.”

Edward Prajzner, Senior Executive Vice President and Chief

Financial Officer, commented, “First quarter results demonstrate

our continued commitment to unlocking significant value through the

ongoing implementation of Project Phoenix. While we have already

made significant progress, there is more work to be done, as we

plan to achieve our target of an incremental overhead reduction of

$12 million in 2024 versus the prior year. This will not only

generate an attractive bottom-line return but will also provide

funds to reinvest in our high margin growth initiatives, such as

Data Analytical Solutions and the Aerospace & Defense industry.

This is an exciting time for Mistras, and the entire organization

is focused on capitalizing on the unique growth opportunities in

our markets.”

For the first quarter of 2024, consolidated revenue was $184.4

million, an increase of 9.8% from the first quarter of 2023.

Revenue growth in the first quarter of 2024 was led by strong

growth in our two largest end markets, a 14.7% increase in Oil

& Gas as a result of the anticipated robust Spring turnaround

season and a 18.9% increase in Aerospace and Defense revenue.

Growth in the Oil & Gas industry was led by strong turnaround

activity, which is expected to continue into the second quarter of

fiscal 2024 before leveling out in the second half of the year.

First quarter 2024 gross profit increased 10.9%, with gross

profit margin increasing 30 basis points. Gross profit improved

from the increase in revenues and gross profit margin increased due

to the significant increase in the higher margin Aerospace and

Defense revenue, which was partially offset by higher healthcare

claims expense in the current year period.

SG&A in the first quarter of 2024 was $41.2 million, down

$1.6 million or 3.8%, from the year ago period and down $1.7

million, or 4.0%, sequentially, due to savings associated with

Project Phoenix initiatives which were taken in 2023. The Company

anticipates that, on a relative basis, SG&A will continue to

decrease throughout the year and reduce to approximately 21% of

full year 2024 revenue, from 23.6% in full year 2023. Income from

operations was $5.6 million for the first quarter of 2024, compared

to a loss from operations of $1.8 million in the prior year

period.

The Company reported quarterly net income of $1.0 million, or

$0.03 per share, compared to a loss of $5.0 million or $0.17 per

share in the prior year period. Net income excluding special items

(non-GAAP), primarily reorganization and related costs, was $2.2

million, or $0.07 per share for the first quarter of 2024, compared

to a net loss of $3.4 million, or $0.12 per share in the prior year

period.

Adjusted EBITDA was $16.2 million in the first quarter of 2024,

compared to $10.4 million in the prior year period, an increase of

55.1%.

Cash Flow and Balance SheetThe Company’s net

cash provided by operating activities was $0.6 million for the

first quarter of 2024, compared to $4.4 million in the prior year

period. Free cash flow was negative $5.3 million for the first

quarter of 2024, compared to negative $0.3 million in the prior

year. The Company’s decreased free cash flow was primarily

attributable to an increase in working capital related to timing of

customer invoicing and an increase in capital expenditures compared

to the prior year. The Company is intently focused on improving

working capital and maintaining organic growth investments via

strategic capital expenditures and an improved commercial function,

in order to foster revenue growth in expanding areas such as

Aerospace shop laboratories and Data Analytical Solutions.

The Company’s gross debt was $198.4 million as of March 31,

2024, compared to $190.4 million as of December 31, 2023. While the

Company is typically a net borrower in the first quarter of each

year, the Company remains committed to using free cash flow to

reduce debt throughout the remainder of 2024.

Reorganization and OtherFor the first quarter

of 2024, the Company recorded $1.6 million of reorganization costs

related to on-going Project Phoenix efficiency and productivity

initiatives, including the final portion of professional fees

associated with changes made in the Company’s organizational

structure.

2024 Outlook The Company reaffirms the 2024

full year guidance previously provided, that being:

- Full year Revenue between $725 and $750 million

- Adjusted EBITDA between $84 and $89 million

- Free cash flow between $34 and $38 million

Mr. Stamatakis concluded, “I am encouraged by the results of the

first quarter and the momentum which the Company has developed for

the remainder of the year. There is always room for improvement,

particularly in increasing our free cash flow generation, and we

are focused on achieving our outlook over the remainder of 2024. We

remain committed to strategic investments in our business to expand

our proprietary technologies and extensive knowledge to solve

problems for our customers and create long-term value for our

shareholders. I am energized by the commitment and focus of our

employees who continually demonstrate their dedication to

delivering high quality results and best in class customer service

to meet and exceed our customer needs.”

Conference Call In connection with this

release, MISTRAS will hold a conference call on May 2, 2024, at

9:00 a.m. (Eastern).To listen to the live webcast of the conference

call, visit the Investor Relations section of MISTRAS Group’s

website at www.mistrasgroup.com

Note there is a new process to participate in the live question

and answer session. Individuals wishing to participate may

preregister at:

https://register.vevent.com/register/BIebdf48d69cb04674a4848bcd372409be.

Upon registering, a dial-in number and unique PIN will be

provided to join the conference call. Following the conference

call, an archived webcast of the event will be available for one

year by visiting the Investor Relations section of MISTRAS Group’s

website.

About MISTRAS Group, Inc. - One Source for Asset

Protection Solutions®MISTRAS Group, Inc. (NYSE: MG) is a

leading "one source" multinational provider of integrated

technology-enabled asset protection solutions, helping to maximize

the safety and operational uptime for civilization’s most critical

industrial and civil assets.

Backed by an innovative, data-driven asset protection portfolio,

proprietary technologies, strong commitment to Environmental,

Social, and Governance (ESG) initiatives, and a decades-long legacy

of industry leadership, MISTRAS leads clients in the oil and gas,

aerospace and defense, renewable and nonrenewable power, civil

infrastructure, and manufacturing industries towards achieving

operational and environmental excellence. By supporting these

organizations that help fuel our vehicles and power our society;

inspecting components that are trusted for commercial, defense, and

space craft; building real-time monitoring equipment to enable safe

travel across bridges; and helping to propel sustainability,

MISTRAS helps the world at large.

MISTRAS enhances value for its clients by integrating asset

protection throughout supply chains and centralizing integrity data

through a suite of Industrial IoT-connected digital software and

monitoring solutions. The company’s core capabilities also include

non-destructive testing field and in-line inspections enhanced by

advanced robotics, laboratory quality control and assurance

testing, sensing technologies and NDT equipment, asset and

mechanical integrity engineering services, and light mechanical

maintenance and access services.

For more information about how MISTRAS helps protect

civilization’s critical infrastructure and the environment, visit

https://www.mistrasgroup.com/.

MEDIA CONTACT:Nestor S. MakarigakisGroup

Vice-President of Marketing and Communications+1 (609) 716-4000

| marcom@mistrasgroup.com

Forward-Looking and Cautionary

StatementsCertain statements contained in this press

release are "forward-looking statements" within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended. Such

forward-looking statements include, but are not limited to, our

2024 outlook, guidance, costs savings and other benefits we expect

to realize from Project Phoenix and actions that we expect or seek

to take in furtherance of our strategies and activities to enhance

our financial results and future growth. Such forward-looking

statements relate to MISTRAS' financial results and estimates,

products and services, business model, Project Phoenix, strategy,

growth opportunities, profitability and competitive position, and

other matters. These forward-looking statements generally use words

such as "future," "possible," "potential," "targeted,"

"anticipate," "believe," "estimate," "expect," "intend," "plan,"

"predict," "project," "will," "may," "should," "could," "would" and

other similar words and phrases. Such statements are not guarantees

of future performance or results, and will not necessarily be

accurate indications of the times at, or by which, such performance

or results will be achieved, if at all. These statements are

subject to risks and uncertainties that could cause actual

performance or results to differ materially from those expressed in

these statements. A list, description and discussion of these and

other risks and uncertainties can be found in the "Risk Factors"

section of the Company's 2023 Annual Report on Form 10-K filed on

March 11, 2024, as updated by our reports on Form 10-Q and Form

8-K. The forward-looking statements are made as of the date hereof,

and MISTRAS undertakes no obligation to update such statements as a

result of new information, future events or otherwise.

Use of Non-GAAP Financial MeasuresIn addition

to financial information prepared in accordance with generally

accepted accounting principles in the U.S. (GAAP), this press

release also contains adjusted financial measures that are not

prepared in accordance with GAAP and that we believe provide

investors and management with supplemental information relating to

the Company’s operating performance and trends that facilitate

comparisons between periods and with respect to trends and

projected information. The term "Adjusted EBITDA" used in this

release is a financial measurement not calculated in accordance

with GAAP and is defined by the Company as net income attributable

to MISTRAS Group, Inc. plus: interest expense, provision for income

taxes, depreciation and amortization, share-based compensation

expense, certain acquisition related costs (including transaction

due diligence costs and adjustments to the fair value of contingent

consideration), foreign exchange (gain) loss, non-cash impairment

charges, reorganization and related charges and, if applicable,

certain additional special items which are noted. A reconciliation

of Adjusted EBITDA to Net Income (Loss) as computed under GAAP is

set forth in a table attached to this press release. The Company

also uses the term “free cash flow”, a non-GAAP financial

measurement the Company defines as cash provided by operating

activities less capital expenditures (which is classified as an

investing activity). A reconciliation of these non-GAAP financial

measurements to GAAP are also set forth in tables attached to this

press release. In the tables attached is also a table reconciling

“Segment and Total Company Income (Loss) from Operations (GAAP) to

Income (Loss) from Operations before Special Items (non-GAAP)”,

“Net Loss (GAAP) and Diluted EPS (GAAP) to Net Loss Excluding

Special Items (non-GAAP) and Diluted EPS Excluding Special Items

(non-GAAP)” which reconciles the non-GAAP amounts to the GAAP

financial measurement. The tables also include the term “net debt”,

a non-GAAP financial measurement the Company defines as the sum of

the current and long-term portions of long term debt, less cash and

cash equivalents. Each of these non-GAAP financial measurements has

material limitations as a performance or liquidity measure and

should not be considered alternatives to Net Income (Loss) or any

other measurements derived in accordance with GAAP. Because Income

(loss) from operations before special items and other non-GAAP

financial measurements used in this press release may not be

calculated in the same manner by all companies, these measurements

may not be comparable to other similarly-titled measurements used

by other companies.

Mistras Group, Inc. and

SubsidiariesUnaudited Condensed Consolidated

Balance Sheets(in thousands, except share and per share

data)

| |

|

March 31, 2024 |

|

December 31, 2023 |

| ASSETS |

|

(unaudited) |

|

|

| Current Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

16,855 |

|

|

$ |

17,646 |

|

|

Accounts receivable, net |

|

|

140,404 |

|

|

|

132,847 |

|

|

Inventories |

|

|

15,079 |

|

|

|

15,283 |

|

|

Prepaid expenses and other current assets |

|

|

14,632 |

|

|

|

14,580 |

|

|

Total current assets |

|

|

186,970 |

|

|

|

180,356 |

|

| Property, plant and equipment,

net |

|

|

79,702 |

|

|

|

80,972 |

|

| Intangible assets, net |

|

|

42,660 |

|

|

|

43,994 |

|

| Goodwill |

|

|

185,726 |

|

|

|

187,354 |

|

| Deferred income taxes |

|

|

2,647 |

|

|

|

2,316 |

|

| Other assets |

|

|

44,422 |

|

|

|

39,784 |

|

|

Total assets |

|

$ |

542,127 |

|

|

$ |

534,776 |

|

| LIABILITIES AND

EQUITY |

|

|

|

|

| Current Liabilities |

|

|

|

|

|

Accounts payable |

|

$ |

15,629 |

|

|

$ |

17,032 |

|

|

Accrued expenses and other current liabilities |

|

|

84,475 |

|

|

|

84,331 |

|

|

Current portion of long-term debt |

|

|

9,464 |

|

|

|

8,900 |

|

|

Current portion of finance lease obligations |

|

|

4,907 |

|

|

|

5,159 |

|

|

Income taxes payable |

|

|

406 |

|

|

|

1,101 |

|

|

Total current liabilities |

|

|

114,881 |

|

|

|

116,523 |

|

| Long-term debt, net of current

portion |

|

|

188,962 |

|

|

|

181,499 |

|

| Obligations under finance

leases, net of current portion |

|

|

11,151 |

|

|

|

11,261 |

|

| Deferred income taxes |

|

|

2,685 |

|

|

|

2,552 |

|

| Other long-term

liabilities |

|

|

36,983 |

|

|

|

32,438 |

|

|

Total liabilities |

|

|

354,662 |

|

|

|

344,273 |

|

| Commitments and

contingencies |

|

|

|

|

| Equity |

|

|

|

|

|

Preferred stock, 10,000,000 shares authorized |

|

|

— |

|

|

|

— |

|

|

Common stock, $0.01 par value, 200,000,000 shares authorized,

30,910,552 and 29,895,487 shares issued and outstanding |

|

|

328 |

|

|

|

305 |

|

|

Additional paid-in capital |

|

|

247,329 |

|

|

|

247,165 |

|

|

Accumulated deficit |

|

|

(27,947 |

) |

|

|

(28,942 |

) |

|

Accumulated other comprehensive loss |

|

|

(32,565 |

) |

|

|

(28,336 |

) |

|

Total Mistras Group, Inc. stockholders’ equity |

|

|

187,145 |

|

|

|

190,192 |

|

|

Noncontrolling interests |

|

|

320 |

|

|

|

311 |

|

|

Total equity |

|

|

187,465 |

|

|

|

190,503 |

|

|

Total liabilities and equity |

|

$ |

542,127 |

|

|

$ |

534,776 |

|

|

|

|

|

|

|

|

|

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Condensed Consolidated

Statements of Income (Loss)(in thousands, except per share

data)

| |

Three months ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

| |

|

|

|

| Revenue |

$ |

184,442 |

|

$ |

168,016 |

|

|

Cost of revenue |

|

127,418 |

|

|

116,051 |

|

|

Depreciation |

|

5,934 |

|

|

5,888 |

|

| Gross

profit |

|

51,090 |

|

|

46,077 |

|

|

Selling, general and administrative expenses |

|

41,189 |

|

|

42,823 |

|

|

Reorganization and other costs |

|

1,557 |

|

|

2,076 |

|

|

Research and engineering |

|

343 |

|

|

480 |

|

|

Depreciation and amortization |

|

2,447 |

|

|

2,525 |

|

|

Acquisition-related expense, net |

|

1 |

|

|

3 |

|

| Income (loss) from

operations |

|

5,553 |

|

|

(1,830 |

) |

|

Interest expense |

|

4,430 |

|

|

4,068 |

|

| Income (loss) before

provision (benefit) for income taxes |

|

1,123 |

|

|

(5,898 |

) |

|

Provision (benefit) for income taxes |

|

119 |

|

|

(920 |

) |

| Net income

(loss) |

|

1,004 |

|

|

(4,978 |

) |

|

Less: net income attributable to noncontrolling interests, net of

taxes |

|

9 |

|

|

8 |

|

| Net income (loss)

attributable to Mistras Group, Inc. |

$ |

995 |

|

$ |

(4,986 |

) |

| |

|

|

|

| Earnings (loss) per common

share |

|

|

|

|

Basic |

$ |

0.03 |

|

$ |

(0.17 |

) |

|

Diluted |

$ |

0.03 |

|

$ |

(0.17 |

) |

| Weighted-average common shares

outstanding: |

|

|

|

|

Basic |

|

30,680 |

|

|

30,021 |

|

|

Diluted |

|

31,356 |

|

|

30,021 |

|

|

|

|

|

|

|

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Operating Data by

Segment(in thousands)

| |

Three months ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Revenues |

|

|

|

|

North America |

$ |

150,349 |

|

|

$ |

136,932 |

|

|

International |

|

33,047 |

|

|

|

29,407 |

|

|

Products and Systems |

|

3,210 |

|

|

|

3,739 |

|

|

Corporate and eliminations |

|

(2,164 |

) |

|

|

(2,062 |

) |

| |

$ |

184,442 |

|

|

$ |

168,016 |

|

| |

|

|

|

| |

|

|

|

| |

Three months ended March 31, |

| |

|

2024 |

|

|

|

2023 |

|

| Gross

profit |

|

|

|

|

North America |

$ |

39,991 |

|

|

$ |

36,637 |

|

|

International |

|

9,459 |

|

|

|

7,367 |

|

|

Products and Systems |

|

1,613 |

|

|

|

2,063 |

|

|

Corporate and eliminations |

|

27 |

|

|

|

10 |

|

| |

$ |

51,090 |

|

|

$ |

46,077 |

|

| |

|

|

|

|

|

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Revenues by

Category(in thousands)

Revenue by industry was as follows:

| Three Months Ended

March 31, 2024 |

North America |

|

International |

|

Products & Systems |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

103,027 |

|

$ |

10,066 |

|

$ |

72 |

|

|

— |

|

|

$ |

113,165 |

| Aerospace & Defense |

|

15,375 |

|

|

6,732 |

|

|

11 |

|

|

— |

|

|

|

22,118 |

| Industrials |

|

8,909 |

|

|

5,853 |

|

|

437 |

|

|

— |

|

|

|

15,199 |

| Power Generation &

Transmission |

|

3,592 |

|

|

1,682 |

|

|

578 |

|

|

— |

|

|

|

5,852 |

| Other Process Industries |

|

7,928 |

|

|

3,933 |

|

|

39 |

|

|

— |

|

|

|

11,900 |

| Infrastructure, Research &

Engineering |

|

3,972 |

|

|

2,205 |

|

|

409 |

|

|

— |

|

|

|

6,586 |

| Petrochemical |

|

3,813 |

|

|

531 |

|

|

— |

|

|

— |

|

|

|

4,344 |

| Other |

|

3,733 |

|

|

2,045 |

|

|

1,664 |

|

|

(2,164 |

) |

|

|

5,278 |

|

Total |

$ |

150,349 |

|

$ |

33,047 |

|

$ |

3,210 |

|

$ |

(2,164 |

) |

|

$ |

184,442 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Three Months Ended

March 31, 2023 |

North America |

|

International |

|

Products & Systems |

|

Corp/Elim |

|

Total |

|

Oil & Gas |

$ |

89,773 |

|

$ |

8,855 |

|

$ |

37 |

|

|

— |

|

|

$ |

98,665 |

| Aerospace & Defense |

|

13,611 |

|

|

4,980 |

|

|

11 |

|

|

— |

|

|

|

18,602 |

| Industrials |

|

9,302 |

|

|

6,053 |

|

|

558 |

|

|

— |

|

|

|

15,913 |

| Power Generation &

Transmission |

|

4,987 |

|

|

1,657 |

|

|

1,326 |

|

|

— |

|

|

|

7,970 |

| Other Process Industries |

|

9,109 |

|

|

3,237 |

|

|

27 |

|

|

— |

|

|

|

12,373 |

| Infrastructure, Research &

Engineering |

|

2,483 |

|

|

2,136 |

|

|

1,142 |

|

|

— |

|

|

|

5,761 |

| Petrochemical |

|

5,137 |

|

|

145 |

|

|

— |

|

|

— |

|

|

|

5,282 |

| Other |

|

2,530 |

|

|

2,344 |

|

|

638 |

|

|

(2,062 |

) |

|

|

3,450 |

|

Total |

$ |

136,932 |

|

$ |

29,407 |

|

$ |

3,739 |

|

$ |

(2,062 |

) |

|

$ |

168,016 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil & Gas Revenue by sub-industry was as follows:

| |

Three months ended March 31, |

|

|

|

2024 |

|

|

2023 |

| |

($ in thousands) |

| Oil and Gas

Revenue |

|

|

|

| Upstream |

$ |

41,767 |

|

$ |

36,939 |

| Midstream |

|

21,392 |

|

|

21,231 |

| Downstream |

|

50,006 |

|

|

40,495 |

| Total |

$ |

113,165 |

|

$ |

98,665 |

| |

|

|

|

|

|

Consolidated Revenue by type was as follows:

| |

Three months ended March 31, |

|

|

|

2024 |

|

|

2023 |

| |

($ in thousands) |

| Field Services |

$ |

126,355 |

|

$ |

109,680 |

| Shop Laboratories |

|

17,195 |

|

|

13,132 |

| Data Analytical Solutions |

|

15,539 |

|

|

16,812 |

| Other |

|

25,353 |

|

|

28,392 |

|

Total |

$ |

184,442 |

|

$ |

168,016 |

|

|

|

|

|

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation of Segment

and Total Company Income (Loss) from Operations (GAAP) to

Income (Loss) from Operations before Special Items

(non-GAAP)(in thousands)

| |

Three months ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

| North

America: |

|

|

|

|

Income from operations (GAAP) |

$ |

13,561 |

|

|

$ |

9,378 |

|

|

Reorganization and other costs |

|

— |

|

|

|

61 |

|

|

Income from operations before special items (non-GAAP) |

$ |

13,561 |

|

|

$ |

9,439 |

|

|

International: |

|

|

|

|

Income (loss) from operations (GAAP) |

$ |

1,124 |

|

|

$ |

(568 |

) |

|

Reorganization and other costs |

|

102 |

|

|

|

107 |

|

|

Income (loss) from operations before special items (non-GAAP) |

$ |

1,226 |

|

|

$ |

(461 |

) |

| Products and

Systems: |

|

|

|

|

Income from operations (GAAP) |

$ |

314 |

|

|

$ |

384 |

|

|

Reorganization and other costs |

|

2 |

|

|

|

— |

|

|

Income from operations before special items (non-GAAP) |

$ |

316 |

|

|

$ |

384 |

|

| Corporate and

Eliminations: |

|

|

|

|

Loss from operations (GAAP) |

$ |

(9,446 |

) |

|

$ |

(11,024 |

) |

|

Reorganization and other costs |

|

1,453 |

|

|

|

1,908 |

|

|

Acquisition-related expense, net |

|

1 |

|

|

|

3 |

|

|

Loss from operations before special items (non-GAAP) |

$ |

(7,992 |

) |

|

$ |

(9,113 |

) |

| Total

Company: |

|

|

|

|

Income (loss) from operations (GAAP) |

$ |

5,553 |

|

|

$ |

(1,830 |

) |

|

Reorganization and other costs |

|

1,557 |

|

|

|

2,076 |

|

|

Acquisition-related expense, net |

|

1 |

|

|

|

3 |

|

|

Income from operations before special items (non-GAAP) |

$ |

7,111 |

|

|

$ |

249 |

|

|

|

|

|

|

|

|

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Summary Cash Flow

Information(in thousands)

| |

Three months ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Net cash provided by (used

in): |

|

|

|

|

Operating activities |

$ |

604 |

|

|

$ |

4,433 |

|

|

Investing activities |

|

(5,648 |

) |

|

|

(4,460 |

) |

|

Financing activities |

|

5,127 |

|

|

|

(3,951 |

) |

|

Effect of exchange rate changes on cash |

|

(874 |

) |

|

|

207 |

|

| Net change in cash and cash

equivalents |

$ |

(791 |

) |

|

$ |

(3,771 |

) |

| |

|

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation of Net Cash

Provided by Operating Activities (GAAP) to Free Cash Flow

(non-GAAP)(in thousands)

| |

Three months ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

| Net cash provided by

operating activities (GAAP) |

$ |

604 |

|

|

$ |

4,433 |

|

| Less: |

|

|

|

| Purchases of property, plant

and equipment |

|

(4,804 |

) |

|

|

(4,332 |

) |

| Purchases of intangible

assets |

|

(1,117 |

) |

|

|

(361 |

) |

| Free cash flow

(non-GAAP) |

$ |

(5,317 |

) |

|

$ |

(260 |

) |

| |

|

|

|

|

|

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation of Gross Debt

(GAAP) to Net Debt (non-GAAP)(in thousands)

| |

|

March 31, 2024 |

|

December 31, 2023 |

| |

|

|

|

|

|

Current portion of long-term debt |

|

$ |

9,464 |

|

|

$ |

8,900 |

|

| Long-term debt, net of current

portion |

|

|

188,962 |

|

|

|

181,499 |

|

| Total Debt (Gross) |

|

|

198,426 |

|

|

|

190,399 |

|

| Less: Cash and cash

equivalents |

|

|

(16,855 |

) |

|

|

(17,646 |

) |

| Total Debt (Net) |

|

$ |

181,571 |

|

|

$ |

172,753 |

|

| |

|

|

|

|

|

|

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation of Net Income

(Loss) (GAAP) to Adjusted EBITDA (non-GAAP)(in

thousands)

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

| Net Income (loss)

(GAAP) |

$ |

1,004 |

|

|

$ |

(4,978 |

) |

|

Less: Net income attributable to non-controlling interests, net of

taxes |

|

9 |

|

|

|

8 |

|

| Net Income (loss)

attributable to Mistras Group, Inc. |

$ |

995 |

|

|

$ |

(4,986 |

) |

|

Interest expense |

|

4,430 |

|

|

|

4,068 |

|

|

Provision (benefit) for income taxes |

|

119 |

|

|

|

(920 |

) |

|

Depreciation and amortization |

|

8,381 |

|

|

|

8,413 |

|

|

Share-based compensation expense |

|

1,228 |

|

|

|

1,542 |

|

|

Acquisition-related expense |

|

1 |

|

|

|

3 |

|

|

Reorganization and other related costs |

|

1,557 |

|

|

|

2,076 |

|

|

Foreign exchange (gain) loss |

|

(561 |

) |

|

|

219 |

|

| Adjusted EBITDA

(non-GAAP) |

$ |

16,150 |

|

|

$ |

10,415 |

|

| |

|

|

|

|

|

|

|

Mistras Group, Inc. and

SubsidiariesUnaudited Reconciliation of Net Income

(Loss) (GAAP) and Diluted EPS (GAAP) to Net Income

(Loss) Excluding Special Items (non-GAAP) and Diluted EPS Excluding

Special Items (non-GAAP)(tabular dollars in thousands,

except per share data)

| |

Three Months Ended March 31, |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income (loss)

attributable to Mistras Group, Inc. (GAAP) |

$ |

995 |

|

|

$ |

(4,986 |

) |

|

Special items |

|

1,558 |

|

|

|

2,079 |

|

|

Tax impact on special items |

|

(381 |

) |

|

|

(504 |

) |

|

Special items, net of tax |

$ |

1,177 |

|

|

$ |

1,575 |

|

| Net income (loss)

attributable to Mistras Group, Inc. Excluding Special Items

(non-GAAP) |

$ |

2,172 |

|

|

$ |

(3,411 |

) |

| |

|

|

|

| Diluted EPS

(GAAP)(1) |

$ |

0.03 |

|

|

$ |

(0.17 |

) |

|

Special items, net of tax |

|

0.04 |

|

|

|

0.05 |

|

| Diluted EPS Excluding

Special Items (non-GAAP) |

$ |

0.07 |

|

|

$ |

(0.12 |

) |

_______________(1) For the three months ended March 31, 2023,

1,513,000 shares, related to restricted stock were excluded from

the calculation of diluted EPS due to the net loss for the

period.

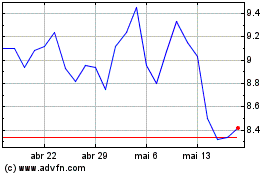

Mistras (NYSE:MG)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Mistras (NYSE:MG)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024