MeridianLink Introduces Digital Progression Model to Help Financial Institutions of All Sizes Realize the Benefits of Digitalization

25 Julho 2024 - 12:00PM

Business Wire

Innovative Framework Backed by 25 Years of Data

and Expertise to Drive Sustainable Digital Growth

MeridianLink, Inc. (NYSE: MLNK), a leading provider of modern

software platforms for financial institutions and consumer

reporting agencies, is proud to announce the launch of its Digital

Progression Model. This innovative framework is designed to guide

financial institutions of all sizes and at different levels of

digital maturity, helping them realize the full potential of

adopting a digital ecosystem.

Built on 25 years of experience, data, marketplace partnerships,

in-depth expertise from completed engagements, and customer

feedback, MeridianLink's Digital Progression Model enables

financial institutions to determine their current digital state,

identify their best opportunities to grow, and chart a path to

achieve that growth — all while effectively meeting the

expectations of modern consumers.

The Digital Progression Model is distinguished by its blueprint

customized to each organization, which addresses the five key areas

instrumental for enabling continued digital growth:

- Consumer Experience: Enhancing the overall consumer journey and

satisfaction through digital tools.

- Data-Centricity: Collecting, analyzing, and using data to help

drive informed business decisions, optimize workflows, enhance

experiences, and support compliance in a data-first culture.

- Share-of-Wallet Growth: Adopting technology that increases the

share of financial products held by existing customers.

- Instant Decisioning: Improving the speed and accuracy of

decision-making processes.

- Process Automation: Streamlining operations through advanced

automation techniques.

“By offering the Digital Progression Model, MeridianLink® is

providing clarity on how to operationalize digital transformation

in the financial sector,” said Wes Zauner, VP of product management

at MeridianLink. “Our blueprint provides a clear, actionable

roadmap for financial institutions to achieve their digital growth

goals. This approach not only enhances operational efficiency but

also helps drive significant improvements in customer satisfaction

and business growth.”

The blueprint provides a tailored plan that aligns with each

institution’s unique business objectives and market conditions. The

model's multi-phased approach is designed to help the financial

institution assess its current state, establish a clear roadmap for

future progress, and outline the steps required to achieve its

goals.

MeridianLink's process offers banks and credit unions a

disciplined approach to measuring progress with metrics such as

processing times, origination ratios, loan officer efficiency,

instant decisioning rates, and consumer experience times.

MeridianLink provides tools and benchmarks, gathered from analyzing

millions of transactions and completing thousands of

implementations, to enable data-driven decision-making and

strategic adjustments that boost growth and improve consumer

satisfaction.

Many financial institutions have already adopted the Digital

Progression Model, attaining results such as higher application

completion and conversion rates, quicker loan application

processing times, a rise in instant approvals, and more time for

their teams to support consumers — all contributing to accelerated

growth and improved consumer experiences. Broadway Bank, a

MeridianLink customer and winner of the Company’s second annual Arc

Award, leverages the multi-product MeridianLink® One platform as a

catalyst for its digital progress, enhancing experiences for both

customers and staff.

“MeridianLink has been instrumental in putting us on the path of

digital progression,” said Lynn Yznaga, SVP at Broadway Bank.

“Without the MeridianLink One platform, we would have clunky

systems and inefficient processes. Now, we offer truly

digital-first experiences, leading to improved customer service and

satisfaction. Having our blueprint for digital progress is

invaluable as we continue on our path to digital maturity.”

“With our Digital Progression Model, we are empowering financial

institutions to navigate the complexities of digital transformation

with confidence,” added Zauner. “Our goal is to recognize the

unique circumstances of each customer and support them in achieving

their digital ambitions while enabling long-term, sustainable

growth.”

A comprehensive self-assessment will be launched shortly that

will allow financial institutions to get a head start on their

digital progression journey. For more information about

MeridianLink’s Digital Progression Model, please visit

https://www.meridianlink.com/digital-progression-model/

An infographic about the Digital Progression Model is available

at https://meridianlink.me/4eBk6ek

About MeridianLink

MeridianLink® (NYSE: MLNK) empowers financial institutions and

consumer reporting agencies to drive efficient growth.

MeridianLink’s cloud-based digital lending, account opening,

background screening, and data verification solutions leverage

shared intelligence from a unified data platform, MeridianLink®

One, to enable customers of all sizes to identify growth

opportunities, effectively scale up, and support compliance

efforts, all while powering an enhanced experience for staff and

consumers alike.

For more than 25 years, MeridianLink has prioritized the

democratization of lending for consumers, businesses, and

communities. Learn more at www.meridianlink.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725357027/en/

Sydney Wishnow Email: meridianlinkPR@clyde.us Phone: (508)

808-9060

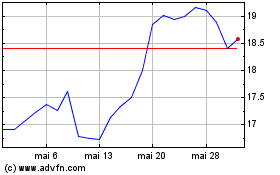

MeridianLink (NYSE:MLNK)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

MeridianLink (NYSE:MLNK)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024