Studio City Company Announces Pricing of Senior Secured Notes Offering

09 Fevereiro 2022 - 4:20PM

Studio City Company Limited (“

Studio City

Company”) today announces that it priced its international

offering of senior secured notes due 2027. Studio City Company is a

wholly-owned subsidiary of Studio City International Holdings

Limited (“

SCIHL”).

The offering consists of US$350 million

aggregate principal amount of 7.00% senior secured notes due 2027

(the “Notes”) and the Notes were priced at 100%.

Studio City Company intends to use the net proceeds from the

offering to partially fund the capital expenditures of the

remaining project for Studio City and for general corporate

purposes.

The Notes are proposed to be senior obligations

of Studio City Company, ranking equally in right of payment with

all existing and future senior indebtedness of Studio City Company

(although any liabilities in respect of obligations under the

senior secured credit facilities with Studio City Company as

borrower that are secured by common collateral securing the Notes

will have priority over the Notes with respect to any proceeds

received upon any enforcement action of such common collateral),

and ranking senior in right of payment to all existing and future

subordinated indebtedness of Studio City Company. The Notes are

proposed to be guaranteed by Studio City Investments Limited and

all of its existing subsidiaries (other than Studio City Company)

on a senior basis (the “Note Guarantees”). Neither

Melco Resorts & Entertainment nor SCIHL will be a guarantor for

the Notes.

Completion of the offering is subject to

customary closing conditions. Approval-in-principle has been

received for the listing of the Notes on the Singapore Exchange

Securities Trading Limited (the “SGX-ST”).

Admission of the Notes to the SGX-ST is not to be taken as an

indication of the merits of Studio City Company or the Notes.

The Notes and the Note Guarantees are being

offered and sold in the United States to qualified institutional

buyers pursuant to Rule 144A under the U.S. Securities Act of 1933,

as amended (the “Securities Act”), and outside of

the United States in reliance on Regulation S under the Securities

Act. The Notes and the Note Guarantees will not be registered

under the Securities Act or under the securities laws of any state

or other jurisdiction and may not be offered or sold in the United

States absent registration or an applicable exemption from the

registration requirements of the Securities Act and any applicable

state laws. Studio City Company does not intend to register

any portion of the offering of the Notes and the Note Guarantees in

the United States.

This press release is for information purposes

only. Nothing in this press release constitutes an offer to buy, or

a solicitation of an offer to sell, securities in the United States

or any other jurisdiction in which such offer or solicitation would

be unlawful. This press release is being issued pursuant to and in

accordance with Rule 135c under the Securities Act.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Statements that are not historical facts, including

statements about the Studio City Company’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties, and a number

of factors could cause actual results to differ materially from

those contained in any forward-looking statement. These factors

include, but are not limited to, (i) the global

pandemic of COVID-19, caused by a novel strain

of the coronavirus, and the continued impact of its consequences on

our business, our industry and the global economy, (ii) growth

of the gaming market and visitations in Macau, (iii) capital

and credit market volatility, (iv) local and global economic

conditions, (v) our anticipated growth strategies,

(vi) gaming authority and other governmental approvals and

regulations, (vii) proposed amendments to the gaming law in Macau,

the extension of current concessions and subconcessions and tender

for new gaming concessions, and (viii) our future business

development, results of operations and financial condition. In some

cases, forward-looking statements can be identified by words or

phrases such as “may”, “will”, “expect”, “anticipate”, “target”,

“aim”, “estimate”, “intend”, “plan”, “believe”, “potential”,

“continue”, “is/are likely to” or other similar expressions. Any

forward-looking statements made in the Notes offering documents

speak only as of the date thereof and all information provided in

this press release is as of the date of this press release, and

Studio City Company does not undertake any duty to update such

information, except as required under applicable law.

For investment community, please contact:Robin

YuenDirector, Investor RelationsTel: +852 2598 3619Email:

robinyuen@melco-resorts.com

For media enquiries, please contact:Chimmy

LeungExecutive Director, Corporate CommunicationsTel: +852 3151

3765Email: chimmyleung@melco-resorts.com

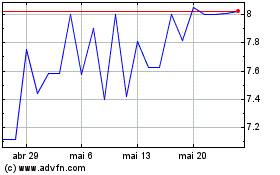

Studio City (NYSE:MSC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Studio City (NYSE:MSC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024