Studio City International Holdings Limited (NYSE: MSC) (“Studio

City” or the “Company”), a world-class integrated resort located in

Cotai, Macau, today reported its unaudited financial results for

the fourth quarter and full year ended December 31, 2022.

Total operating revenues for the fourth quarter

of 2022 were US$4.2 million, compared with total operating revenues

of US$28.4 million in the fourth quarter of 2021. The change was

primarily attributable to the heightened travel restrictions in

Macau and mainland China related to COVID-19 during the quarter

which led to a decrease in revenue from casino contract and lower

non-gaming revenues.

Studio City Casino generated gross gaming

revenues of US$40.9 million and US$91.1 million for the fourth

quarters of 2022 and 2021, respectively.

Studio City Casino’s rolling chip volume was

US$251.4 million in the fourth quarter of 2022 versus US$474.4

million in the fourth quarter of 2021. The rolling chip win rate

was 2.70% in the fourth quarter of 2022 versus 1.84% in the fourth

quarter of 2021. The expected rolling chip win rate range is 2.85%-

3.15%.

Mass market table games drop decreased to

US$113.5 million in the fourth quarter of 2022, compared with

US$253.5 million in the fourth quarter of 2021. The mass market

table games hold percentage was 27.1% in the fourth quarter of

2022, compared with 29.6% in the fourth quarter of 2021.

Gaming machine handle for the fourth quarter of

2022 was US$124.5 million, compared with US$262.4 million in the

fourth quarter of 2021. The gaming machine win rate was 2.7% in the

fourth quarter of 2022, compared with 2.8% in the fourth quarter of

2021.

Revenue from casino contract was negative

US$12.5 million for the fourth quarter of 2022, compared with

revenue from casino contract of US$4.1 million for the fourth

quarter of 2021. Revenue from casino contract is net of gaming

taxes and the costs incurred in connection with the on-going

operation of the Studio City Casino which are deducted by Melco

Resorts (Macau) Limited, the gaming operator of the Studio City

Casino (the "Gaming Operator").

Total gaming taxes and the costs incurred in

connection with the on-going operation of the Studio City Casino

deducted from gross gaming revenues were US$53.4 million and

US$87.0 million in the fourth quarters of 2022 and 2021,

respectively.

Total non-gaming revenues at Studio City for the

fourth quarter of 2022 were US$16.7 million, compared with US$24.3

million for the fourth quarter of 2021.

Operating loss for the fourth quarter of 2022

was US$70.0 million, compared with operating loss of US$45.0

million in the fourth quarter of 2021.

Studio City generated negative Adjusted

EBITDA(1) of US$34.5 million in the fourth quarter of 2022,

compared with negative Adjusted EBITDA of US$10.5 million in the

fourth quarter of 2021. The change was mainly attributable to the

decrease in revenue from casino contract and lower non-gaming

revenues.

Net loss attributable to Studio City

International Holdings Limited for the fourth quarter of 2022 was

US$85.4 million, compared with net loss attributable to Studio City

International Holdings Limited of US$53.9 million in the fourth

quarter of 2021. The net loss attributable to participation

interest was US$8.0 million and US$10.6 million in the fourth

quarters of 2022 and 2021, respectively.

Other Factors Affecting

Earnings

Total net non-operating expenses for the fourth

quarter of 2022 were US$23.6 million, which mainly included

interest expenses of US$21.9 million, net of amounts

capitalized.

Depreciation and amortization costs of US$31.6

million were recorded in the fourth quarter of 2022, of which

US$0.8 million was related to the amortization expense for the land

use right.

The negative Adjusted EBITDA for Studio City for

the three months ended December 31, 2022 referred to in Melco’s

earnings release dated March 1, 2023 (“Melco’s earnings release”)

is US$9.1 million less than the negative Adjusted EBITDA of Studio

City contained in this press release. The Adjusted EBITDA of Studio

City contained in this press release includes certain intercompany

charges that are not included in the Adjusted EBITDA for Studio

City contained in Melco’s earnings release. Such intercompany

charges include, among other items, fees and shared service charges

billed between the Company and its subsidiaries and certain

subsidiaries of Melco. Additionally, Adjusted EBITDA of Studio City

included in Melco’s earnings release does not reflect certain

intercompany costs related to the table games operations at Studio

City Casino.

Financial Position and Capital

Expenditures

Total cash and bank balances as of December 31,

2022 aggregated to US$509.7 million (December 31, 2021: US$499.4

million), including US$0.1 million of restricted cash (December 31,

2021: US$0.1 million). Total debt, net of unamortized deferred

financing costs and original issue premiums, at the end of the

fourth quarter of 2022 was US$2.43 billion (December 31, 2021:

US$2.09 billion).

Capital expenditures for the fourth quarter of

2022 were US$64.6 million.

Full Year Results

For the year ended December 31, 2022, Studio

City International Holdings Limited reported total operating

revenues of US$11.5 million, compared with US$106.9 million in the

prior year. The decrease in total operating revenues was primarily

attributable to the government mandated temporary casino closures

in Macau in July and heightened travel restrictions in Macau and

mainland China related to COVID-19 in 2022 which led to a decrease

in revenue from casino contract and lower non-gaming revenues.

Operating loss for 2022 was US$277.2 million,

compared with operating loss of US$191.6 million for 2021.

Studio City generated negative Adjusted EBITDA

of US$140.8 million for the year ended December 31, 2022, compared

with negative Adjusted EBITDA of US$56.5 million in 2021. The

change in Adjusted EBITDA was mainly attributable to lower revenue

from casino contract and non-gaming revenues.

Net loss attributable to Studio City

International Holdings Limited for 2022 was US$326.5 million,

compared with net loss attributable to Studio City International

Holdings Limited of US$252.6 million for 2021. The net loss

attributable to participation interest for 2022 was US$34.9 million

and the net loss attributable to participation interest for 2021

was US$49.4 million.

Recent Developments

We expect Studio City Phase 2 to open in the

second quarter of 2023. The first stage of opening is expected to

include one of our hotel towers and the indoor water park, which is

expected to be the largest of its kind in Asia. The second phase of

opening is expected to be in the third quarter of 2023.

From January 8, 2023, travelers arriving in

Macau from Mainland China, Hong Kong and Taiwan were no longer

required to present negative nucleic acid tests, and thereby

contributed to a 233% increase in Macau’s gross gaming revenue from

MOP3.5 billion in December 2022 to MOP11.6 billion in January 2023

according to data reported by the Gaming Inspection and

Coordination Bureau of Macau. In addition, from February 27, 2023,

masks are not required in outdoor places. However, masks are still

required on public transportation (except taxis) and in certain

indoor areas, such as medical facilities and elderly homes.

Requirement to wear masks has been waived in most private indoor

areas by their operators or supervisory entities.

While quarantine-free travel within Greater

China has resumed, the pace of recovery remains highly uncertain,

and disruptions caused by the COVID-19 outbreak continue to have a

material adverse impact on our operations, financial position and

future prospects into the first quarter of 2023.

Safe Harbor Statement

This press release contains forward-looking

statements. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Studio City International Holdings Limited (the “Company”)

may also make forward-looking statements in its periodic reports to

the U.S. Securities and Exchange Commission (the “SEC”), in its

annual report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including statements about the Company’s beliefs and

expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties, and a number

of factors could cause actual results to differ materially from

those contained in any forward-looking statement. These factors

include, but are not limited to, (i) COVID-19 outbreaks, and the

continued impact of its consequences on our business, our industry

and the global economy, (ii) risks associated with the newly

adopted gaming law in Macau and its implementation by the Macau

government, (iii) changes in the gaming market and visitations in

Macau, (iv) capital and credit market volatility, (v) local and

global economic conditions, (vi) our anticipated growth strategies,

(vii) gaming authority and other governmental approvals and

regulations, and (viii) our future business development, results of

operations and financial condition. In some cases, forward-looking

statements can be identified by words or phrases such as “may”,

“will”, “expect”, “anticipate”, “target”, “aim”, “estimate”,

“intend”, “plan”, “believe”, “potential”, “continue”, “is/are

likely to” or other similar expressions. Further information

regarding these and other risks, uncertainties or factors is

included in the Company’s filings with the SEC. All information

provided in this press release is as of the date of this press

release, and the Company undertakes no duty to update such

information, except as required under applicable law.

Non-GAAP Financial Measures

(1) "Adjusted EBITDA" is defined as net

income/loss before interest, taxes, depreciation, amortization,

pre-opening costs, property charges and other, share-based

compensation and other non-operating income and expenses. We

believe that Adjusted EBITDA provides useful information to

investors and others in understanding and evaluating our operating

results. This non-GAAP financial measure eliminates the impact of

items that we do not consider indicative of the performance of our

business. While we believe that this non-GAAP financial measure is

useful in evaluating our business, this information should be

considered as supplemental in nature and is not meant as a

substitute for the related financial information prepared in

accordance with U.S. GAAP. It should not be considered in isolation

or construed as an alternative to net income/loss, cash flow or any

other measure of financial performance or as an indicator of our

operating performance, liquidity, profitability or cash flows

generated by operating, investing or financing activities. The use

of Adjusted EBITDA has material limitations as an analytical tool,

as Adjusted EBITDA does not include all items that impact our net

income/loss. In addition, the Company’s calculation of Adjusted

EBITDA may be different from the calculation methods used by other

companies and, therefore, comparability may be limited. Investors

are encouraged to review the reconciliation of the historical

non-GAAP financial measure to its most directly comparable GAAP

financial measure. Reconciliations of Adjusted EBITDA with the most

comparable financial measures calculated and presented in

accordance with U.S. GAAP are provided herein immediately following

the financial statements included in this press release.(2)

“Adjusted net income/loss” is net income/loss before pre-opening

costs, property charges and other and loss on extinguishment of

debt, net of participation interest. Adjusted net income/loss is

presented as supplemental disclosure because management believes it

provides useful information to investors and others in

understanding and evaluating our performance, in addition to

income/loss computed in accordance with U.S. GAAP. Adjusted net

income/loss may be different from the calculation methods used by

other companies and, therefore, comparability may be limited.

Reconciliations of adjusted net income/loss attributable to Studio

City International Holdings Limited with the most comparable

financial measures calculated and presented in accordance with U.S.

GAAP are provided herein immediately following the financial

statements included in this press release.About Studio City

International Holdings Limited

The Company, with its American depositary shares

listed on the New York Stock Exchange (NYSE: MSC), is a world-class

integrated resort located in Cotai, Macau. For more information

about the Company, please visit www.studiocity-macau.com.

The Company is majority owned by Melco Resorts

& Entertainment Limited, a company with its American depositary

shares listed on the Nasdaq Global Select Market (Nasdaq:

MLCO).

For the investment community, please

contact:Jeanny KimSenior Vice President, Group

TreasurerTel: +852 2598 3698Email: jeannykim@melco-resorts.com

For media enquiries, please

contact: Chimmy LeungExecutive Director, Corporate

CommunicationsTel: +852 31513765Email:

chimmyleung@melco-resorts.com

| Studio City

International Holdings Limited and Subsidiaries |

| Condensed

Consolidated Statements of Operations (Unaudited) |

| (In

thousands of U.S. dollars, except share and per share

data) |

| |

| |

Three Months Ended |

|

Year Ended |

| |

December 31, |

|

December 31, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue from casino contract(3) |

$ |

(12,494 |

) |

|

$ |

4,067 |

|

|

$ |

(56,665 |

) |

|

$ |

(1,455 |

) |

|

Rooms |

|

4,349 |

|

|

|

7,975 |

|

|

|

17,915 |

|

|

|

38,749 |

|

|

Food and beverage |

|

4,634 |

|

|

|

6,317 |

|

|

|

17,489 |

|

|

|

26,734 |

|

|

Entertainment |

|

474 |

|

|

|

221 |

|

|

|

1,649 |

|

|

|

2,649 |

|

|

Services fee |

|

5,674 |

|

|

|

5,413 |

|

|

|

21,889 |

|

|

|

24,906 |

|

|

Mall |

|

1,389 |

|

|

|

3,999 |

|

|

|

7,189 |

|

|

|

13,683 |

|

|

Retail and other |

|

211 |

|

|

|

389 |

|

|

|

2,082 |

|

|

|

1,602 |

|

| Total

operating revenues |

|

4,237 |

|

|

|

28,381 |

|

|

|

11,548 |

|

|

|

106,868 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating

costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

| Costs

related to casino contract(3) |

|

(8,007 |

) |

|

|

(9,151 |

) |

|

|

(29,871 |

) |

|

|

(28,085 |

) |

|

Rooms |

|

(2,643 |

) |

|

|

(2,848 |

) |

|

|

(11,119 |

) |

|

|

(12,176 |

) |

|

Food and beverage |

|

(6,162 |

) |

|

|

(6,914 |

) |

|

|

(24,403 |

) |

|

|

(27,853 |

) |

|

Entertainment |

|

(549 |

) |

|

|

(590 |

) |

|

|

(2,253 |

) |

|

|

(2,842 |

) |

|

Mall |

|

(1,074 |

) |

|

|

(878 |

) |

|

|

(4,115 |

) |

|

|

(3,785 |

) |

|

Retail and other |

|

(296 |

) |

|

|

(359 |

) |

|

|

(1,200 |

) |

|

|

(1,474 |

) |

|

General and administrative |

|

(20,328 |

) |

|

|

(18,628 |

) |

|

|

(79,785 |

) |

|

|

(87,577 |

) |

|

Pre-opening costs |

|

(1,532 |

) |

|

|

(245 |

) |

|

|

(3,263 |

) |

|

|

(984 |

) |

|

Amortization of land use right |

|

(826 |

) |

|

|

(829 |

) |

|

|

(3,300 |

) |

|

|

(3,325 |

) |

|

Depreciation and amortization |

|

(30,802 |

) |

|

|

(31,010 |

) |

|

|

(123,656 |

) |

|

|

(124,309 |

) |

|

Property charges and other |

|

(2,009 |

) |

|

|

(1,902 |

) |

|

|

(5,799 |

) |

|

|

(6,031 |

) |

| Total

operating costs and expenses |

|

(74,228 |

) |

|

|

(73,354 |

) |

|

|

(288,764 |

) |

|

|

(298,441 |

) |

| Operating

loss |

|

(69,991 |

) |

|

|

(44,973 |

) |

|

|

(277,216 |

) |

|

|

(191,573 |

) |

|

Non-operating income (expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

2,240 |

|

|

|

710 |

|

|

|

6,427 |

|

|

|

3,060 |

|

|

Interest expenses, net of amounts capitalized |

|

(21,928 |

) |

|

|

(21,894 |

) |

|

|

(92,358 |

) |

|

|

(90,967 |

) |

|

Other financing costs |

|

(106 |

) |

|

|

(105 |

) |

|

|

(417 |

) |

|

|

(419 |

) |

|

Foreign exchange (losses) gains, net |

|

(4,012 |

) |

|

|

1,268 |

|

|

|

2,390 |

|

|

|

6,257 |

|

|

Other income |

|

249 |

|

|

|

- |

|

|

|

249 |

|

|

|

- |

|

|

Loss on extinguishment of debt |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(28,817 |

) |

| Total

non-operating expenses, net |

|

(23,557 |

) |

|

|

(20,021 |

) |

|

|

(83,709 |

) |

|

|

(110,886 |

) |

| Loss before

income tax |

|

(93,548 |

) |

|

|

(64,994 |

) |

|

|

(360,925 |

) |

|

|

(302,459 |

) |

| Income tax

credit (expense) |

|

103 |

|

|

|

486 |

|

|

|

(382 |

) |

|

|

457 |

|

| Net

loss |

|

(93,445 |

) |

|

|

(64,508 |

) |

|

|

(361,307 |

) |

|

|

(302,002 |

) |

| Net loss

attributable to participation interest |

|

8,039 |

|

|

|

10,562 |

|

|

|

34,856 |

|

|

|

49,447 |

|

| Net loss

attributable to Studio City International Holdings Limited |

$ |

(85,406 |

) |

|

$ |

(53,946 |

) |

|

$ |

(326,451 |

) |

|

$ |

(252,555 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss

attributable to Studio City International Holdings Limited per

Class A ordinary share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.111 |

) |

|

$ |

(0.146 |

) |

|

$ |

(0.459 |

) |

|

$ |

(0.682 |

) |

|

Diluted |

$ |

(0.111 |

) |

|

$ |

(0.146 |

) |

|

$ |

(0.461 |

) |

|

$ |

(0.682 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Net loss

attributable to Studio City International Holdings Limited per

ADS: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.443 |

) |

|

$ |

(0.583 |

) |

|

$ |

(1.838 |

) |

|

$ |

(2.728 |

) |

|

Diluted |

$ |

(0.443 |

) |

|

$ |

(0.583 |

) |

|

$ |

(1.846 |

) |

|

$ |

(2.728 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average Class A ordinary shares outstanding used in net loss

attributable to Studio City International Holdings Limited per

Class A ordinary share calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

770,352,700 |

|

|

|

370,352,700 |

|

|

|

710,582,947 |

|

|

|

370,352,700 |

|

|

Diluted |

|

770,352,700 |

|

|

|

370,352,700 |

|

|

|

783,094,707 |

|

|

|

370,352,700 |

|

|

(3) |

As a result of the amendments made to the agreement for the

operation of the Studio City Casino announced on June 23, 2022,

certain revenues and operating costs of the Company were previously

captioned as i) revenue from provision of gaming related services

and are now captioned as revenue from casino contract; and ii)

costs for provision of gaming related services and are now

captioned as costs related to casino contract. |

| Studio City

International Holdings Limited and Subsidiaries |

| Condensed

Consolidated Balance Sheets |

| (In

thousands of U.S. dollars, except share and per share

data) |

| |

| |

December

31, |

|

December

31, |

| |

2022 |

|

2021 |

| |

|

(Unaudited) |

|

|

|

|

ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

| Current

assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

509,523 |

|

|

$ |

499,289 |

|

|

Accounts receivable, net |

|

263 |

|

|

|

247 |

|

|

Receivables from affiliated companies |

|

221 |

|

|

|

15,697 |

|

|

Inventories |

|

5,121 |

|

|

|

5,828 |

|

|

Prepaid expenses and other current assets |

|

38,721 |

|

|

|

42,633 |

|

| Total

current assets |

|

553,849 |

|

|

|

563,694 |

|

| |

|

|

|

|

|

| Property and

equipment, net |

|

2,868,064 |

|

|

|

2,556,040 |

|

| Intangible

assets, net |

|

1,373 |

|

|

|

2,777 |

|

| Long-term

prepayments, deposits and other assets |

|

48,325 |

|

|

|

69,624 |

|

| Restricted

cash |

|

130 |

|

|

|

130 |

|

| Operating

lease right-of-use assets |

|

13,136 |

|

|

|

14,588 |

|

| Land use

right, net |

|

108,645 |

|

|

|

112,114 |

|

| Total

assets |

$ |

3,593,522 |

|

|

$ |

3,318,967 |

|

| |

|

|

|

|

|

|

LIABILITIES, SHAREHOLDERS’ EQUITY AND PARTICIPATION

INTEREST |

|

|

|

|

|

| |

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

501 |

|

|

$ |

211 |

|

|

Accrued expenses and other current liabilities |

|

165,688 |

|

|

|

201,405 |

|

|

Income tax payable |

|

22 |

|

|

|

21 |

|

|

Payables to affiliated companies |

|

81,178 |

|

|

|

53,093 |

|

| Total

current liabilities |

|

247,389 |

|

|

|

254,730 |

|

| |

|

|

|

|

|

| Long-term

debt, net |

|

2,434,476 |

|

|

|

2,087,486 |

|

| Other

long-term liabilities |

|

21,631 |

|

|

|

17,771 |

|

| Deferred tax

liabilities, net |

|

382 |

|

|

|

- |

|

| Operating

lease liabilities, non-current |

|

13,499 |

|

|

|

14,797 |

|

| Total

liabilities |

|

2,717,377 |

|

|

|

2,374,784 |

|

| |

|

|

|

|

|

|

Shareholders’ equity and participation interest: |

|

|

|

|

|

|

Class A ordinary shares, par value $0.0001; 1,927,488,240 shares

authorized; 770,352,700 and 370,352,700 shares issued and

outstanding, respectively |

|

77 |

|

|

|

37 |

|

|

Class B ordinary shares, par value $0.0001; 72,511,760 shares

authorized; 72,511,760 shares issued and outstanding |

|

7 |

|

|

|

7 |

|

|

Additional paid-in capital |

|

2,477,359 |

|

|

|

2,134,227 |

|

|

Accumulated other comprehensive losses |

|

(11,671 |

) |

|

|

(6,136 |

) |

|

Accumulated losses |

|

(1,665,166 |

) |

|

|

(1,338,715 |

) |

| Total

shareholders’ equity |

|

800,606 |

|

|

|

789,420 |

|

|

Participation interest |

|

75,539 |

|

|

|

154,763 |

|

| Total

shareholders’ equity and participation interest |

|

876,145 |

|

|

|

944,183 |

|

| Total

liabilities, shareholders’ equity and participation interest |

$ |

3,593,522 |

|

|

$ |

3,318,967 |

|

| Studio City

International Holdings Limited and Subsidiaries |

|

Reconciliation of Net Loss Attributable to Studio City

International Holdings Limited to |

| Adjusted Net

Loss Attributable to Studio City International Holdings Limited

(Unaudited) |

| (In

thousands of U.S. dollars, except share and per share

data) |

| |

| |

Three Months Ended |

|

Year Ended |

| |

December 31, |

|

December 31, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss attributable to Studio City International Holdings

Limited |

$ |

(85,406 |

) |

|

$ |

(53,946 |

) |

|

$ |

(326,451 |

) |

|

$ |

(252,555 |

) |

|

Pre-opening costs |

|

1,532 |

|

|

|

245 |

|

|

|

3,263 |

|

|

|

984 |

|

|

Property charges and other |

|

2,009 |

|

|

|

1,902 |

|

|

|

5,799 |

|

|

|

6,031 |

|

|

Loss on extinguishment of debt |

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

28,817 |

|

|

Participation interest impact on adjustments |

|

(305 |

) |

|

|

(352 |

) |

|

|

(1,017 |

) |

|

|

(5,867 |

) |

| Adjusted net

loss attributable to Studio City International Holdings

Limited |

$ |

(82,170 |

) |

|

$ |

(52,151 |

) |

|

$ |

(318,406 |

) |

|

$ |

(222,590 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net

loss attributable to Studio City International Holdings Limited per

Class A ordinary share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.107 |

) |

|

$ |

(0.141 |

) |

|

$ |

(0.448 |

) |

|

$ |

(0.601 |

) |

|

Diluted |

$ |

(0.107 |

) |

|

$ |

(0.141 |

) |

|

$ |

(0.450 |

) |

|

$ |

(0.601 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted net

loss attributable to Studio City International Holdings

Limited per ADS: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(0.427 |

) |

|

$ |

(0.563 |

) |

|

$ |

(1.792 |

) |

|

$ |

(2.404 |

) |

|

Diluted |

$ |

(0.427 |

) |

|

$ |

(0.563 |

) |

|

$ |

(1.799 |

) |

|

$ |

(2.404 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

| Weighted

average Class A ordinary shares outstanding used in adjusted net

loss attributable to Studio City International Holdings Limited per

Class A ordinary share calculation: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

770,352,700 |

|

|

|

370,352,700 |

|

|

|

710,582,947 |

|

|

|

370,352,700 |

|

|

Diluted |

|

770,352,700 |

|

|

|

370,352,700 |

|

|

|

783,094,707 |

|

|

|

370,352,700 |

|

| Studio City

International Holdings Limited and Subsidiaries |

|

Reconciliation of Operating Loss to Adjusted EBITDA

(Unaudited) |

| (In

thousands of U.S. dollars) |

| |

| |

Three Months Ended |

|

Year Ended |

| |

December 31, |

|

December 31, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

|

|

Operating loss |

$ |

(69,991 |

) |

|

$ |

(44,973 |

) |

|

$ |

(277,216 |

) |

|

$ |

(191,573 |

) |

|

Pre-opening costs |

|

1,532 |

|

|

|

245 |

|

|

|

3,263 |

|

|

|

984 |

|

|

Depreciation and amortization |

|

31,628 |

|

|

|

31,839 |

|

|

|

126,956 |

|

|

|

127,634 |

|

|

Share-based compensation |

|

361 |

|

|

|

438 |

|

|

|

361 |

|

|

|

438 |

|

|

Property charges and other |

|

2,009 |

|

|

|

1,902 |

|

|

|

5,799 |

|

|

|

6,031 |

|

| Adjusted

EBITDA |

$ |

(34,461 |

) |

|

$ |

(10,549 |

) |

|

$ |

(140,837 |

) |

|

$ |

(56,486 |

) |

| Studio City

International Holdings Limited and Subsidiaries |

|

Reconciliation of Net Loss Attributable to Studio City

International Holdings Limited |

| to

Adjusted EBITDA (Unaudited) |

| (In

thousands of U.S. dollars) |

| |

| |

Three Months Ended |

|

Year Ended |

| |

December 31, |

|

December 31, |

| |

2022 |

|

2021 |

|

2022 |

|

2021 |

| |

|

|

|

|

|

|

|

|

Net loss attributable to Studio City International Holdings

Limited |

$ |

(85,406 |

) |

|

$ |

(53,946 |

) |

|

$ |

(326,451 |

) |

|

$ |

(252,555 |

) |

| Net loss

attributable to participation interest |

|

(8,039 |

) |

|

|

(10,562 |

) |

|

|

(34,856 |

) |

|

|

(49,447 |

) |

| Net

loss |

|

(93,445 |

) |

|

|

(64,508 |

) |

|

|

(361,307 |

) |

|

|

(302,002 |

) |

|

Income tax (credit) expense |

|

(103 |

) |

|

|

(486 |

) |

|

|

382 |

|

|

|

(457 |

) |

|

Interest and other non-operating expenses, net |

|

23,557 |

|

|

|

20,021 |

|

|

|

83,709 |

|

|

|

110,886 |

|

|

Property charges and other |

|

2,009 |

|

|

|

1,902 |

|

|

|

5,799 |

|

|

|

6,031 |

|

|

Share-based compensation |

|

361 |

|

|

|

438 |

|

|

|

361 |

|

|

|

438 |

|

|

Depreciation and amortization |

|

31,628 |

|

|

|

31,839 |

|

|

|

126,956 |

|

|

|

127,634 |

|

|

Pre-opening costs |

|

1,532 |

|

|

|

245 |

|

|

|

3,263 |

|

|

|

984 |

|

| Adjusted

EBITDA |

$ |

(34,461 |

) |

|

$ |

(10,549 |

) |

|

$ |

(140,837 |

) |

|

$ |

(56,486 |

) |

| Studio City

International Holdings Limited and Subsidiaries |

| Supplemental

Data Schedule |

| |

|

|

Three Months Ended |

|

Year Ended |

|

|

December 31, |

|

December 31, |

|

|

2022 |

|

2021 |

|

2022 |

|

2021 |

| Room

Statistics(4): |

|

|

|

|

|

|

|

|

Average daily rate (5) |

$ |

100 |

|

|

$ |

131 |

|

|

$ |

111 |

|

|

$ |

123 |

|

|

Occupancy per available room |

|

32 |

% |

|

|

39 |

% |

|

|

28 |

% |

|

|

51 |

% |

|

Revenue per available room (6) |

$ |

32 |

|

|

$ |

52 |

|

|

$ |

31 |

|

|

$ |

62 |

|

| |

|

|

|

|

|

|

|

|

Other

Information(7): |

|

|

|

|

|

|

|

|

Average number of table games |

|

277 |

|

|

|

288 |

|

|

|

277 |

|

|

|

290 |

|

|

Average number of gaming machines |

|

671 |

|

|

|

710 |

|

|

|

700 |

|

|

|

645 |

|

|

Table games win per unit per day (8) |

$ |

1,477 |

|

|

$ |

3,162 |

|

|

$ |

1,562 |

|

|

$ |

3,306 |

|

|

Gaming machines win per unit per day (9) |

$ |

54 |

|

|

$ |

113 |

|

|

$ |

75 |

|

|

$ |

129 |

|

|

(4) |

Room statistics exclude rooms that were temporarily closed or

provided to staff members due to the COVID-19

outbreak |

|

(5) |

Average daily rate is calculated by dividing total room revenues

including complimentary rooms (less service charges, if any) by

total occupied rooms including complimentary rooms |

|

(6) |

Revenue per available room is calculated by dividing total room

revenues including complimentary rooms (less service charges, if

any) by total rooms available |

|

(7) |

Table games and gaming machines that were not in operation due to

government-mandated closures or social distancing measures in

relation to the COVID-19 outbreak have been

excluded |

|

(8) |

Table games win per unit per day is shown before discounts,

commissions, non-discretionary incentives (including the

point-loyalty programs) as administered by the Gaming Operator and

allocating casino revenues related to goods and services provided

to gaming patrons on a complimentary basis |

|

(9) |

Gaming machines win per unit per day is shown before

non-discretionary incentives (including the point-loyalty programs)

as administered by the Gaming Operator and allocating casino

revenues related to goods and services provided to gaming patrons

on a complimentary basis |

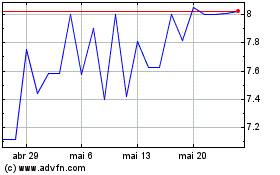

Studio City (NYSE:MSC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Studio City (NYSE:MSC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024