Studio City Finance Limited Announces Results of Early Tender and Upsizing of its Tender Offer for Its 6.000% Senior Notes due 2025

24 Novembro 2023 - 7:14PM

Studio City Finance Limited (“Studio City Finance”) today announces

the expiration of the early tender period and results of early

tender of its previously announced cash tender offer for up to an

aggregate principal amount of US$75 million of its outstanding

6.000% senior notes due 2025 (ISIN: US86389QAE26 and USG85381AE48)

(the “Notes” and such tender offer, the “Tender Offer”).

Studio City Finance has elected to amend the Tender Offer to

increase the aggregate principal amount of Notes subject to the

Tender Offer from US$75.0 million to US$100.0 million (as amended,

the “Maximum Tender Amount”), with all other terms and conditions

of the Tender Offer remaining unchanged and described in the Offer

to Purchase dated November 9, 2023 (the “Offer to Purchase”).

Capitalized terms used in this announcement but not defined herein

have the meanings given to them in the Offer to Purchase.

The early tender period expired at 5:00 p.m.,

New York City time, on November 22, 2023 (the “Early Tender Date”).

At the Early Tender Date, valid tenders had been received (and not

validly withdrawn) with respect to US$317,461,000 aggregate

principal amount of the Notes.

Subject to the General Conditions set out in

“The Offer—Conditions to the Offer” in the Offer to Purchase having

been satisfied or otherwise waived by Studio City Finance, as the

case may be, Studio City Finance expects to accept for purchase the

Notes that were validly tendered (and not validly withdrawn)

pursuant to the Tender Offer by the Early Tender Date for a

combined aggregate principal amount equal to the Maximum Tender

Amount. The settlement for the Notes accepted by Studio City

Finance in connection with the Early Tender Date is expected to

take place on November 28, 2023 (the “Early Payment Date”). The

amount of Notes that is to be purchased on the Early Payment Date

will be determined in accordance with the proration procedures

described in the Offer to Purchase, subject to the Maximum Tender

Amount. It is expected that the Notes shall be accepted subject to

a proration factor of approximately 30.3%.

The Withdrawal Deadline has passed and has not

been extended. Notes tendered pursuant to the Tender Offer can no

longer be withdrawn, unless the Company is required to extend

withdrawal rights under applicable law.

The Tender Offer will expire at 5:00 p.m., New

York City Time, on December 8, 2023, unless extended or earlier

terminated (such time and date, as the same may be extended, the

“Expiration Time”). However, as Studio City Finance intends,

subject to the terms and conditions of the Tender Offer, to accept

for purchase the Maximum Tender Amount on the Early Payment Date,

further tenders of Notes prior to the Expiration Time will not be

accepted for purchase.

Studio City Finance has engaged Deutsche Bank

AG, Singapore Branch to act as the sole dealer manager for the

Tender Offer. For additional information regarding the terms of the

Tender Offer, please contact Deutsche Bank AG, Singapore Branch at

One Raffles Quay, #17-00 South Tower, Singapore 048583, Attention:

Global Risk Syndicate (Tel: +65 6423-4229), with a copy to Deutsche

Bank AG, London Branch at Winchester House, 1 Great Winchester

Street, London EC2N 2DB, United Kingdom, Attention: Liability

Management Group (Tel: +44 207-545-8011) and Deutsche Bank

Securities Inc. at 1 Columbus Circle, New York, New York 10019,

United States of America, Attention: Liability Management Group

(Tel: +1 855-287-1922 / +1 212-250-7527).

Studio City Finance has engaged Kroll Issuer

Services Limited to serve as the Tender and Information Agent for

the Tender Offer. Questions regarding the procedures for

participating in the Tender Offer or requests for additional copies

of the Offer to Purchase should be directed to Kroll Issuer

Services Limited, Attention: Mu-yen Lo and Kevin Wong (Tel: +852

2281-0114, Email: studiocity@is.kroll.com).

This press release is for information purposes

only and does not constitute an invitation or offer to acquire,

purchase or subscribe for the securities referred to herein.

Nothing in this press release constitutes an offer to buy, or a

solicitation of an offer to sell, securities in the United States

or any other jurisdiction in which such offer or solicitation would

be unlawful prior to registration or qualification under the

securities laws of any such jurisdiction.

Safe Harbor Statement

This press release contains forward-looking

statements. Without limiting the generality of the foregoing,

forward-looking statements contained in this press release

specifically include statements regarding Studio City Finance’s

plans and expected timing with respect to the Tender

Offer. These statements are made under the “safe harbor”

provisions of the U.S. Private Securities Litigation Reform Act of

1995. Statements that are not historical facts, including

statements about Studio City Finance’s beliefs and expectations,

are forward-looking statements. Forward-looking statements involve

inherent risks and uncertainties, and a number of factors could

cause actual results to differ materially from those contained in

any forward-looking statement. These factors include, but are not

limited to, (i) COVID-19 outbreaks, and the impact

of its consequences on our business, our industry and the global

economy, (ii) risks associated with the newly adopted gaming

law in Macau and its implementation by the Macau government,

(iii) changes in the gaming market and visitations in Macau,

(iv) capital and credit market volatility, (v) local and

global economic conditions, (vi) our anticipated growth

strategies, (vii) gaming authority and other governmental

approvals and regulations, and (viii) our future business

development, results of operations and financial condition. In some

cases, forward-looking statements can be identified by words or

phrases such as “may”, “will”, “expect”, “anticipate”, “target”,

“aim”, “estimate”, “intend”, “plan”, “believe”, “potential”,

“continue”, “is/are likely to” or other similar expressions.

Further information regarding these and other risks, uncertainties

or factors is included in the Studio City International Holdings

Limited’s filings with the United States Securities and Exchange

Commission. All information provided in this press release is as of

the date of this press release, and Studio City Finance undertakes

no duty to update such information, except as required under

applicable law.

For the investment community, please

contact: Jeanny Kim Senior Vice President, Group

TreasurerTel: +852 2598 3698Email: jeannykim@melco-resorts.com

For media enquiries, please contact: Chimmy

Leung Executive Director, Corporate Communications Tel: +852 3151

3765 Email: chimmyleung@melco-resorts.com

Studio City (NYSE:MSC)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

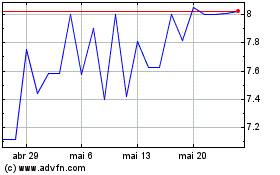

Studio City (NYSE:MSC)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024