Additional Proxy Soliciting Materials (definitive) (defa14a)

09 Junho 2023 - 7:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☒ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

NATURAL GAS SERVICES GROUP, INC.

________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule

0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

June 8, 2023

Charles Adrian Carlos

Associate Vice President – Governance Research

Rachel Hedrick

Associate Director – Executive Compensation

Institutional Shareholder Services

702 King Farm Boulevard Suite 400

Rockville, MD 20850

Ref: Natural Gas Services Group, Inc.

ISS Proxy Advisory Services (“ISS”) Report – June 2, 2023

Natural Gas Services Group Proxy Analysis

Dear Mr. Carlos and Ms. Hedrick:

I serve as the Lead Independent Director on the Natural Gas Services Group, Inc. (“NGS” or the “Company”) Board of Directors. Thank you for your analysis regarding the Company’s executive compensation program. Over the past several years, the Company’s Board of Directors and Compensation Committee have worked with our shareholders, compensation consultants and management to respond to your critiques of the Company’s executive compensation plan as well as recommendations regarding the program from our shareholders and compensation experts.

As a result of the Company’s responsiveness to shareholder concerns, the Compensation Committee and the Board of Directors have made adjustments to the compensation program for the Company’s executives. In fact, changes in the executive compensation program have caused ISS to reduce both the “Qualitative Concern” and “Quantitative Concern” over executive compensation to “low”, an indication of the level of responsiveness of the Company to shareholder (and ISS) concerns. Moreover, the executive compensation data cited in the most recent ISS report, when compared to previous reports, shows the Company’s compensation plan to be more consistent with peer group compensation.

Your current report is critical of the Company’s responsiveness to last year’s failed say-on-pay vote, specifically indicating that the Compensation Committee did not provide adequate disclosure regarding shareholder outreach.

We understand and appreciate the criticism regarding disclosure of the Company’s shareholder outreach activities. However, that is exclusively the result of incomplete disclosure and not due to a lack of outreach and interaction with our shareholders. The lack of detail and background

can also be attributed to unique events that occurred in 2022, including entering into a retirement agreement with our long-time Chief Executive Officer, other turnover in our executive ranks and the addition of two new members to our Board of Directors which, as noted below, occurred just a few days before the required filing date of the 2023 proxy statement. As the recent management changes take hold, shareholder outreach will be addressed with updated and improved disclosure in our annual proxy in 2024.

That said, we intend to file this correspondence as Additional Definitive Material on Form 14A to supplement our original proxy filing to clarify and expand on our recent outreach efforts.

Specifically, members of the Compensation Committee, the Board of Directors and Company leadership were engaged in the following shareholder engagement initiatives following the 2022 annual meeting:

a.Members of the Board of Directors, Compensation Committee and company leadership sought meetings with shareholders representing over 50% of the Company’s outstanding common shares. Members of the Board and Compensation Committee engaged in dialogue with investors representing over 20% of shares outstanding.

a.Members of the Board of Directors and company leadership were involved in multiple meetings and ongoing dialogue with shareholders representing over 16% of the outstanding common shares regarding issues of compensation, governance and other strategic matters during the period from the 2022 annual meeting to the filing of the current proxy statement on May 1, 2023.

a.On a regular basis, members of Company leadership and, from time-to-time, directors engage with shareholders on numerous issues including compensation, financial performance, strategy and other issues related to the operations of the Company. Given the recent turnover in company leadership, past and present members of the Board of Directors have been involved in such interactions.

a.As a result of shareholder interaction, critique and feedback, the Board of Directors agreed to add two new directors on April 28, 2023. The two new directors were recommended or endorsed by two ‘top five’ shareholders of the Company, a direct indication of the level of outreach and responsiveness of the Company to shareholder concerns.

As the above data indicate, the lack of complete disclosure in the Company’s original proxy filing should in no way suggest the Company was not actively engaged in shareholder outreach. In fact, the April, 2023 additions to the Board of Directors were in direct response to shareholder outreach and recommendations, suggesting the Company’s shareholder engagement program resulted in significant enhancements to Company governance.

We appreciate the opportunity to address this issue with you. In addition to clarifying our shareholder engagement activities over the past year, I pledge to our shareholders that the Company and the Board of Directors will continue to engage with shareholders on issues critical to good governance and compensation practices and will enhance our disclosures in future proxies.

Thank you for your consideration.

Sincerely,

NATURAL GAS SERVICES GROUP, INC.

/s/ David L. Bradshaw

David L. Bradshaw

Lead Independent Director

cc: Members – Natural Gas Services Group, Inc Board of Directors

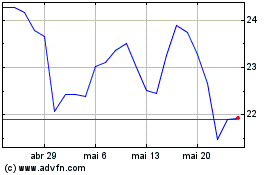

Natural Gas Services (NYSE:NGS)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Natural Gas Services (NYSE:NGS)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024