Natural Gas Services Group, Inc. (“NGS” or the

“Company”) (NYSE:NGS), a leading provider of natural gas

compression equipment, technology and services to the energy

industry, today announced financial results for the three months

ended March 31, 2024.

First Quarter

2024 Highlights

- Rental revenue

of $33.7 million, an increase of 48% when compared to the first

quarter of 2023 and 7% when compared to the fourth quarter of

2023.

- Net income of

$5.1 million, or $0.41 per basic share, as compared to a net income

of $0.4 million, or $0.03 per basic share in the first quarter of

2023 and net income of $1.7 million, or $0.14 per basic share in

the fourth quarter of 2023.

- Adjusted EBITDA

of $16.9 million, compared to $7.8 million in the first quarter of

2023 and $16.3 million in the fourth quarter of 2023. Please see

Non-GAAP Financial Measures - Adjusted EBITDA, below.

“The first quarter of 2024 continued our string

of strong results,” said Justin Jacobs, Chief Executive Officer.

“Our first quarter rental revenue of $33.7 million, rental adjusted

margin of $20.6 million, and rental adjusted gross margin

percentage of 61.1% are sequential increases over the historic

performance of the fourth quarter of 2023. We believe this

continued strong performance offers further validation of our high

horsepower strategy for new units, while also driving the increase

in our outlook for 2024 adjusted EBITDA. Our overall industry

outlook, particularly for compression related to crude oil

production, remains positive, and we believe we can capitalize on

additional growth opportunities while maintaining a prudent level

of leverage. I want to thank the entire NGS team for another great

quarter of results."

Revenue: Total revenue for the

three months ended March 31, 2024 increased 38.6% to $36.9

million from $26.6 million for the three months ended March 31,

2023. This increase was due primarily to an increase in rental

revenues. Rental revenue increased 48.5% to $33.7 million in the

first quarter of 2024 from $22.7 million in the first quarter of

2023 due to the addition of higher horsepower packages and pricing

improvements. As of March 31, 2024, we had 1,245 rented units

(444,220 horsepower) compared to 1,245 rented units (335,314

horsepower) as of March 31, 2023, reflecting a 32.5% increase in

total utilized horsepower. Sequentially, total revenue increased to

$36.9 million in the first quarter of 2024 compared to $36.2

million in the fourth quarter of 2023 due to a 7% increase in

rental revenues.

Gross Margins: Total gross

margins, including depreciation increased to $14.2 million for the

three months ended March 31, 2024, compared to $5.1 million

for the same period in 2023 and $13.3 million for the three months

ended December 31, 2023. Total adjusted gross margin,

exclusive of depreciation, for the three months ended

March 31, 2024, increased to $21.1 million compared to $11.1

million for the three months ended March 31, 2023 and $20.3 million

for the fourth quarter of 2023. These increases are primarily

attributable to increased rental revenues and a continuation of our

relatively high rental adjusted gross margin.

Operating Income: Operating

income for the three months ended March 31, 2024 was $9.3

million compared to operating income of $0.4 million for the three

months ended March 31, 2023 and operating income of $4.4 million

during the fourth quarter of 2023.

Net Income: Net income for the

three months ended March 31, 2024, was $5.1 million, or $0.41

per basic share compared to a net income of $0.4 million or $0.03

per basic share for the three months ended March 31, 2023. The

increase in net income during the first quarter of 2024 was mainly

due to increased rental revenue and rental gross margin.

Sequentially, net income was $1.7 million or $0.14 per basic share

during the fourth quarter of 2023. This sequential improvement of

$3.4 million was primarily due to higher rental revenue and

impairment costs related to inventory that were recorded in the

fourth quarter of 2023.

Adjusted EBITDA: Adjusted

EBITDA increased 116.8% to $16.9 million for the three months ended

March 31, 2024, from $7.8 million for the same period in 2023.

This increase was primarily attributable to higher rental revenue

and rental adjusted gross margin. Sequentially, adjusted EBITDA

increased 3.6% to $16.9 million for the three months ended

March 31, 2024, compared to adjusted EBITDA of $16.3 million

for the three months ended December 31, 2023.

Cash flows: At March 31,

2024, cash and cash equivalents were approximately $5.2 million,

while working capital was $54.4 million. For the three months of

2024, cash flows from operating activities were $5.6 million, while

cash flows used in investing activities was $10.9 million. Cash

flow used in investing activities included $10.9 million in capital

expenditures.

Debt: Outstanding debt on our

revolving credit facility as of March 31, 2024 was $172

million. Our leverage ratio at March 31, 2024 was 2.57 and our

fixed charge coverage ratio was 3.41. The company is in compliance

with all terms, conditions and covenants of the credit

agreement.

2024 Updated Outlook

NGS’s full year 2024 Outlook is as follows:

| |

FY 2024 Outlook |

| Adjusted

EBITDA |

$61 million - $67 million |

| New Unit Capital

Expenditures |

$40 million - $50 million |

| Maintenance Capital

Expenditures |

$8 million - $11 million |

| Target Return on Invested

Capital |

At least 20% |

Our current outlook for 2024 Fiscal Year

adjusted EBITDA is a range of $61 million to $67 million, an

increase from our previously announced outlook of $58 million to

$65 million. We have maintained our outlook range for 2024 new unit

capital expenditures of $40 million to $50 million for now, as we

continue to review our capital plan. Consistent with the previous

outlook, approximately $15 million of the new unit capital

expenditures relates to holdover from the 2023 new unit plan. We

have also added outlook related to maintenance capital expenditures

to aid investors in their understanding of our cash flows. Our

target return on invested capital remains unchanged.

Selected data:

The tables below show, the three months ended March 31, 2024

and 2023, revenues and percentage of total revenues, along with our

gross margin and adjusted gross margin (exclusive of depreciation

and amortization), as well as, related percentages of revenue for

each of our product lines. Adjusted gross margin is the difference

between revenue and cost of sales, exclusive of depreciation.

|

|

Revenue |

| |

Three months ended |

| |

March 31, 2024 |

|

March 31, 2023 |

|

|

($ in 000) |

|

% of rev |

|

($ in 000) |

|

% of rev |

| Rental |

$ |

33,734 |

|

91 |

% |

|

$ |

22,723 |

|

86 |

% |

| Sales |

|

2,503 |

|

7 |

% |

|

|

2,992 |

|

11 |

% |

| Aftermarket services |

|

670 |

|

2 |

% |

|

|

905 |

|

3 |

% |

| Total |

$ |

36,907 |

|

|

|

$ |

26,620 |

|

|

|

|

Revenue |

| |

Three months ended |

| |

March 31, 2024 |

|

December 31, 2023 |

|

|

($ in 000) |

|

% of rev |

|

($ in 000) |

|

% of rev |

| Rental |

$ |

33,734 |

|

91 |

% |

|

$ |

31,626 |

|

87 |

% |

| Sales |

|

2,503 |

|

7 |

% |

|

|

2,921 |

|

8 |

% |

| Aftermarket services |

|

670 |

|

2 |

% |

|

|

1,674 |

|

5 |

% |

| Total |

$ |

36,907 |

|

|

|

$ |

36,221 |

|

|

| |

Gross Margin |

| |

Three months ended March 31, |

| |

|

2024 |

|

|

|

2023 |

|

| |

($ in 000) |

|

% margin |

|

($ in 000) |

|

% margin |

| Rental |

$ |

13,761 |

|

41 |

% |

|

$ |

5,137 |

|

|

23 |

% |

| Sales |

|

253 |

|

10 |

% |

|

|

(312 |

) |

|

(10) % |

| Aftermarket services |

|

163 |

|

24 |

% |

|

|

289 |

|

|

32 |

% |

| Total |

$ |

14,177 |

|

38 |

% |

|

$ |

5,114 |

|

|

19 |

% |

| |

|

|

|

|

|

|

|

| |

Gross Margin |

| |

Three months ended |

| |

March 31, 2024 |

|

December 31, 2023 |

| |

($ in 000) |

|

% margin |

|

($ in 000) |

|

% margin |

| Rental |

$ |

13,761 |

|

41 |

% |

|

$ |

12,368 |

|

39 |

% |

| Sales |

|

253 |

|

10 |

% |

|

|

553 |

|

19 |

% |

| Aftermarket services |

|

163 |

|

24 |

% |

|

|

419 |

|

25 |

% |

| Total |

$ |

14,177 |

|

38 |

% |

|

$ |

13,340 |

|

37 |

% |

| |

|

|

|

|

|

|

|

| |

Adjusted Gross Margin (1) |

| |

Three months ended March 31, |

| |

|

2024 |

|

|

|

2023 |

|

| |

( $ in 000) |

|

% margin |

|

( $ in 000) |

|

% margin |

| Rental |

$ |

20,620 |

|

61 |

% |

|

$ |

11,078 |

|

|

49 |

% |

| Sales |

|

323 |

|

13 |

% |

|

|

(245 |

) |

|

(8) % |

| Aftermarket services |

|

170 |

|

25 |

% |

|

|

296 |

|

|

33 |

% |

| Total |

$ |

21,113 |

|

57 |

% |

|

$ |

11,129 |

|

|

42 |

% |

| |

Adjusted Gross Margin (1) |

| |

Three months ended |

| |

March 31, 2024 |

|

December 31, 2023 |

| |

( $ in 000) |

|

% margin |

|

( $ in 000) |

|

% margin |

| Rental |

$ |

20,620 |

|

61 |

% |

|

$ |

19,199 |

|

61 |

% |

| Sales |

|

323 |

|

13 |

% |

|

|

620 |

|

21 |

% |

| Aftermarket services |

|

170 |

|

25 |

% |

|

|

440 |

|

26 |

% |

| Total |

$ |

21,113 |

|

57 |

% |

|

$ |

20,259 |

|

56 |

% |

(1) For a reconciliation of adjusted gross

margin to its most directly comparable financial measure calculated

and presented in accordance with GAAP, please read “Non-GAAP

Financial Measures - Adjusted Gross Margin” below.

Non-GAAP Financial Measure - Adjusted

Gross Margin: “Adjusted Gross Margin” is defined as total

revenue less cost of sales (excluding depreciation expense).

Adjusted gross margin is included as a supplemental disclosure

because it is a primary measure used by management as it represents

the results of revenue and cost of sales (excluding depreciation

expense), which are key operating components. Adjusted gross margin

differs from gross margin in that gross margin includes

depreciation expense. We believe adjusted gross margin is important

because it focuses on the current operating performance of our

operations and excludes the impact of the prior historical costs of

the assets acquired or constructed that are utilized in those

operations. Depreciation expense reflects the systematic allocation

of historical property and equipment values over the estimated

useful lives.

Adjusted gross margin has certain material

limitations associated with its use as compared to gross margin.

Depreciation expense is a necessary element of our costs and our

ability to generate revenue. Management uses this non-GAAP measure

as a supplemental measure to other GAAP results to provide a more

complete understanding of the Company's performance. As an

indicator of operating performance, adjusted gross margin should

not be considered an alternative to, or more meaningful than, gross

margin as determined in accordance with GAAP. Adjusted Gross margin

may not be comparable to a similarly titled measure of another

Company because other entities may not calculate adjusted gross

margin in the same manner.

The following table calculates gross margin, the

most directly comparable GAAP financial measure, and reconciles it

to adjusted gross margin:

| |

Three months ended March 31, |

| |

|

2024 |

|

|

|

2023 |

|

| |

(in thousands) |

| Total revenue |

$ |

36,907 |

|

|

$ |

26,620 |

|

| Costs of revenue, exclusive of

depreciation |

|

(15,794 |

) |

|

|

(15,491 |

) |

| Depreciation allocable to

costs of revenue |

|

(6,936 |

) |

|

|

(6,014 |

) |

| Gross margin |

|

14,177 |

|

|

|

5,115 |

|

| Depreciation allocable to

costs of revenue |

|

6,936 |

|

|

|

6,014 |

|

| Adjusted Gross Margin |

$ |

21,113 |

|

|

$ |

11,129 |

|

| |

Three months ended |

| |

March 31, 2024 |

|

December 31, 2023 |

| |

(in thousands) |

| Total revenue |

$ |

36,907 |

|

|

$ |

36,221 |

|

| Costs of revenue, exclusive of

depreciation |

|

(15,794 |

) |

|

|

(15,962 |

) |

| Depreciation allocable to

costs of revenue |

|

(6,936 |

) |

|

|

(6,919 |

) |

| Gross margin |

|

14,177 |

|

|

|

13,340 |

|

| Depreciation allocable to

costs of revenue |

|

6,936 |

|

|

|

6,919 |

|

| Adjusted Gross Margin |

$ |

21,113 |

|

|

$ |

20,259 |

|

Non-GAAP Financial Measures - Adjusted

EBITDA: “Adjusted EBITDA” reflects net income or loss

before interest, taxes, depreciation and amortization, non-cash

stock compensation expense, severance expenses, impairment

expenses, increases in inventory allowance and retirement of rental

equipment. Adjusted EBITDA is a measure used by management,

analysts and investors as an indicator of operating cash flow since

it excludes the impact of movements in working capital items,

non-cash charges and financing costs. Therefore, Adjusted EBITDA

gives the investor information as to the cash generated from the

operations of a business. However, Adjusted EBITDA is not a measure

of financial performance under accounting principles GAAP, and

should not be considered a substitute for other financial measures

of performance. Adjusted EBITDA as calculated by NGS may not be

comparable to Adjusted EBITDA as calculated and reported by other

companies. The most comparable GAAP measure to Adjusted EBITDA is

net income (loss).

The following table reconciles our net income,

the most directly comparable GAAP financial measure, to Adjusted

EBITDA:

| |

Three months ended March 31, |

| |

|

2024 |

|

|

2023 |

| |

(in thousands) |

| Net income |

$ |

5,098 |

|

$ |

370 |

|

Interest expense |

|

2,935 |

|

|

— |

|

Income tax expense (benefit) |

|

1,479 |

|

|

150 |

|

Depreciation and amortization |

|

7,087 |

|

|

6,165 |

|

Non-cash stock compensation expense |

|

274 |

|

|

487 |

|

Severance expenses |

|

— |

|

|

612 |

|

Retirement of rental equipment |

|

5 |

|

|

— |

| Adjusted EBITDA |

$ |

16,878 |

|

$ |

7,784 |

| |

Three months ended |

| |

March 31, 2024 |

|

December 31, 2023 |

| |

(in thousands) |

| Net income |

$ |

5,098 |

|

$ |

1,702 |

|

Interest expense |

|

2,935 |

|

|

2,297 |

|

Income tax expense (benefit) |

|

1,479 |

|

|

431 |

|

Depreciation and amortization |

|

7,087 |

|

|

7,160 |

|

Non-cash stock compensation expense |

|

274 |

|

|

228 |

|

Inventory allowance |

|

— |

|

|

3,965 |

|

Retirement of rental equipment |

|

5 |

|

|

505 |

| Adjusted EBITDA |

$ |

16,878 |

|

$ |

16,288 |

Conference Call Details: The

Company will host a conference call to review first-quarter

financial results on Thursday, May 16, 2024 at 8:30 a.m. (EST),

7:30 a.m. (CST). To join the conference call, kindly access the

Investor Relations section of our website at www.ngsgi.com or dial

in at (800) 550-9745 and enter conference ID 167298 at least five

minutes prior to the scheduled start time. Please note that using

the provided dial-in number is necessary for participation in the

Q&A section of the call. A recording of the conference will be

made available on our Company's website following its conclusion.

Thank you for your interest in our Company's updates.

About Natural Gas Services Group, Inc.

(NGS): NGS is a leading provider of natural gas

compression equipment, technology and services to the energy

industry. The Company manufactures, fabricates, rents, sells and

maintains natural gas compressors for oil and natural gas

production and plant facilities. NGS is headquartered in Midland,

Texas, with a fabrication facility located in Tulsa, Oklahoma, a

rebuild shop located in Midland, Texas, and service facilities

located in major oil and natural gas producing basins in the U.S.

Additional information can be found at www.ngsgi.com.

Forward-Looking Statements

Certain statements herein (and oral statements

made regarding the subjects of this release) constitute

“forward-looking statements” within the meaning of the federal

securities laws. Words such as “may,” “might,” “should,” “believe,”

“expect,” “anticipate,” “estimate,” “continue,” “predict,”

“forecast,” “project,” “plan,” “intend” or similar expressions, or

statements regarding intent, belief, or current expectations, are

forward-looking statements. These forward-looking statements are

based upon current estimates and assumptions.

These forward–looking statements rely on a

number of assumptions concerning future events and are subject to a

number of uncertainties and factors that could cause actual results

to differ materially from such statements, many of which are

outside the control of the Company. Forward–looking information

includes, but is not limited to statements regarding: guidance or

estimates related to EBITDA growth, projected capital expenditures;

returns on invested capital, fundamentals of the compression

industry and related oil and gas industry, valuations, compressor

demand assumptions and overall industry outlook, and the ability of

the Company to capitalize on any potential opportunities.

While the Company believes that the assumptions

concerning future events are reasonable, investors are cautioned

that there are inherent difficulties in predicting certain

important factors that could impact the future performance or

results of its business. Some of these factors that could cause

results to differ materially from those indicated by such

forward-looking statements include, but are not limited to: (i)

achieving increased utilization of assets, including rental fleet

utilization and unlocking other non-cash balance sheet assets; (ii)

failure of projected organic growth due to adverse changes in the

oil and gas industry, including depressed oil and gas prices,

oppressive environmental regulations and competition; (iii)

inability to finance capital expenditures; (iv) adverse changes in

customer, employee or supplier relationships; (v) adverse regional

and national economic and financial market conditions, including in

our key operating areas; (vi) impacts of world events, including

pandemics; the financial condition of the Company’s customers and

failure of significant customers to perform their contractual

obligations; (vii) the Company’s ability to economically develop

and deploy new technologies and services, including technology to

comply with health and environmental laws and regulations; and

(viii) failure to achieve accretive financial results in connection

with any acquisitions the Company may make.

In addition, these forward-looking statements

are subject to other various risks and uncertainties, including

without limitation those set forth in the Company’s filings with

the Securities and Exchange Commission, including the Company's

Annual Report on Form 10-K for the year ended December 31, 2023.

Thus, actual results could be materially different. The Company

expressly disclaims any obligation to update or alter statements

whether as a result of new information, future events or otherwise,

except as required by law.

|

For More Information, Contact: |

Anna Delgado, Investor Relations |

| |

(432) 262-2700ir@ngsgi.com |

| |

www.ngsgi.com |

|

NATURAL GAS SERVICES GROUP,

INC.CONDENSED CONSOLIDATED BALANCE

SHEETS(in thousands, except par value)(unaudited) |

| |

|

|

|

| |

March 31, 2024 |

|

December 31, 2023 |

|

ASSETS |

|

|

|

| Current

Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

5,239 |

|

|

$ |

2,746 |

|

|

Trade accounts receivable, net of allowance for doubtful accounts

of $933 and $823, respectively |

|

42,341 |

|

|

|

39,186 |

|

|

Inventory, net of allowance for obsolescence of $2,836 |

|

18,811 |

|

|

|

21,639 |

|

|

Federal income tax receivable |

|

11,512 |

|

|

|

11,538 |

|

|

Prepaid expenses and other |

|

938 |

|

|

|

1,162 |

|

|

Total current assets |

|

78,841 |

|

|

|

76,271 |

|

| Long-term inventory, net of

allowance for obsolescence of $1,168 |

|

879 |

|

|

|

701 |

|

| Rental equipment, net of

accumulated depreciation of $197,780 and $191,745,

respectively |

|

377,999 |

|

|

|

373,649 |

|

| Property and equipment, net of

accumulated depreciation of $18,061 and $17,649, respectively |

|

20,071 |

|

|

|

20,550 |

|

| Intangibles, net of

accumulated amortization of $2,415 and $2,384, respectively |

|

744 |

|

|

|

775 |

|

| Other assets |

|

7,642 |

|

|

|

6,783 |

|

|

Total assets |

$ |

486,176 |

|

|

$ |

478,729 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

| Current

Liabilities: |

|

|

|

|

Accounts payable |

$ |

12,431 |

|

|

$ |

17,628 |

|

|

Accrued liabilities |

|

11,995 |

|

|

|

15,085 |

|

|

Total current liabilities |

|

24,426 |

|

|

|

32,713 |

|

| Long-term debt |

|

172,000 |

|

|

|

164,000 |

|

| Deferred income tax

liability |

|

43,092 |

|

|

|

41,636 |

|

| Other long-term liabilities |

|

5,392 |

|

|

|

4,486 |

|

|

Total liabilities |

|

244,910 |

|

|

|

242,835 |

|

| Commitments and

contingencies |

|

|

|

| Stockholders’

Equity: |

|

|

|

| Preferred stock, 5,000 shares

authorized, no shares issued or outstanding |

|

— |

|

|

|

— |

|

| Common stock, 30,000 shares

authorized, par value $0.01; 13,694 and 13,688 shares issued,

respectively |

|

137 |

|

|

|

137 |

|

|

Additional paid-in capital |

|

116,754 |

|

|

|

116,480 |

|

| Retained earnings |

|

139,379 |

|

|

|

134,281 |

|

| Treasury shares, at cost,

1,310 shares |

|

(15,004 |

) |

|

|

(15,004 |

) |

|

Total stockholders' equity |

|

241,266 |

|

|

|

235,894 |

|

|

Total liabilities and stockholders' equity |

$ |

486,176 |

|

|

$ |

478,729 |

|

|

NATURAL GAS SERVICES GROUP, INC.CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS(in thousands, except

earnings per share)(unaudited) |

|

| |

|

|

| |

Three months ended |

|

| |

March 31, |

|

| |

|

2024 |

|

|

|

2023 |

|

|

| Revenue: |

|

|

|

|

| Rental income |

$ |

33,734 |

|

|

$ |

22,723 |

|

|

| Sales |

|

2,503 |

|

|

|

2,992 |

|

|

| Aftermarket services |

|

670 |

|

|

|

905 |

|

|

|

Total revenue |

|

36,907 |

|

|

|

26,620 |

|

|

| Operating costs and

expenses: |

|

|

|

|

| Cost of rentals, exclusive of

depreciation stated separately below |

|

13,114 |

|

|

|

11,645 |

|

|

| Cost of sales, exclusive of

depreciation stated separately below |

|

2,180 |

|

|

|

3,237 |

|

|

| Cost of aftermarket services,

exclusive of depreciation stated separately below |

|

500 |

|

|

|

609 |

|

|

| Selling, general and

administrative expenses |

|

4,702 |

|

|

|

4,562 |

|

|

| Depreciation and

amortization |

|

7,087 |

|

|

|

6,165 |

|

|

| Retirement of rental

equipment |

|

5 |

|

|

|

— |

|

|

|

Total operating costs and expenses |

|

27,588 |

|

|

|

26,218 |

|

|

| Operating

income |

|

9,319 |

|

|

|

402 |

|

|

| Other income

(expense): |

|

|

|

|

| Interest expense |

|

(2,935 |

) |

|

|

— |

|

|

| Other income, net |

|

193 |

|

|

|

118 |

|

|

|

Total other income (expense), net |

|

(2,742 |

) |

|

|

118 |

|

|

| Income before

provision for income taxes |

|

6,577 |

|

|

|

520 |

|

|

| Income tax benefit

(expense) |

|

(1,479 |

) |

|

|

(150 |

) |

|

| Net income

(loss) |

$ |

5,098 |

|

|

$ |

370 |

|

|

| Earnings (loss) per

share: |

|

|

|

|

|

Basic |

$ |

0.41 |

|

|

$ |

0.03 |

|

|

|

Diluted |

$ |

0.41 |

|

|

$ |

0.03 |

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

Basic |

|

12,380 |

|

|

|

12,213 |

|

|

|

Diluted |

|

12,465 |

|

|

|

12,354 |

|

|

|

NATURAL GAS SERVICES GROUP, INC.CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS(in

thousands)(unaudited) |

| |

Three months ended |

| |

March 31, |

| |

|

2024 |

|

|

|

2023 |

|

| CASH FLOWS FROM OPERATING

ACTIVITIES: |

|

|

|

| Net income |

$ |

5,098 |

|

|

$ |

370 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

|

7,087 |

|

|

|

6,165 |

|

|

Amortization of debt issuance costs |

|

150 |

|

|

|

52 |

|

|

Deferred income tax expense |

|

1,456 |

|

|

|

148 |

|

|

Stock-based compensation |

|

274 |

|

|

|

487 |

|

|

Bad debt allowance |

|

110 |

|

|

|

48 |

|

|

Gain on sale of assets |

|

— |

|

|

|

(25 |

) |

|

Retirement of rental equipment |

|

5 |

|

|

|

— |

|

|

Loss (gain) on company owned life insurance |

|

(184 |

) |

|

|

(18 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

Trade accounts receivables |

|

(3,265 |

) |

|

|

(351 |

) |

|

Inventory |

|

2,650 |

|

|

|

(986 |

) |

|

Prepaid expenses and prepaid income taxes |

|

250 |

|

|

|

497 |

|

|

Accounts payable and accrued liabilities |

|

(7,962 |

) |

|

|

11,574 |

|

|

Deferred income |

|

(418 |

) |

|

|

77 |

|

|

Other |

|

358 |

|

|

|

184 |

|

| NET CASH PROVIDED BY

OPERATING ACTIVITIES |

|

5,609 |

|

|

|

18,222 |

|

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

Purchase of rental equipment, property and other equipment |

|

(10,932 |

) |

|

|

(47,792 |

) |

|

Purchase of company owned life insurance |

|

(9 |

) |

|

|

(50 |

) |

| NET CASH USED IN

INVESTING ACTIVITIES |

|

(10,941 |

) |

|

|

(47,842 |

) |

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

Proceeds from loan |

|

8,000 |

|

|

|

36,011 |

|

|

Payments of other long-term liabilities, net |

|

(175 |

) |

|

|

(36 |

) |

|

Payments of debt issuance cost |

|

— |

|

|

|

(2,131 |

) |

|

Taxes paid related to net share settlement of equity awards |

|

— |

|

|

|

(184 |

) |

| NET CASH PROVIDED BY

FINANCING ACTIVITIES |

|

7,825 |

|

|

|

33,660 |

|

| NET CHANGE IN CASH AND

CASH EQUIVALENTS |

|

2,493 |

|

|

|

4,040 |

|

| CASH AND CASH EQUIVALENTS

AT BEGINNING OF PERIOD |

|

2,746 |

|

|

|

3,372 |

|

| CASH AND CASH EQUIVALENTS

AT END OF PERIOD |

$ |

5,239 |

|

|

$ |

7,412 |

|

| SUPPLEMENTAL DISCLOSURE

OF CASH FLOW INFORMATION: |

|

|

|

|

Interest paid |

$ |

6,220 |

|

|

$ |

855 |

|

| NON-CASH

TRANSACTIONS |

|

|

|

|

Transfer of rental equipment components to inventory |

$ |

— |

|

|

$ |

708 |

|

|

Right of use asset acquired through a finance lease |

$ |

532 |

|

|

$ |

— |

|

Investor Relations

IR@ngsgi.com

432-262-2700

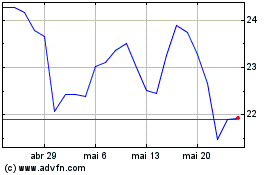

Natural Gas Services (NYSE:NGS)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Natural Gas Services (NYSE:NGS)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024