NOG Provides Update on First Quarter Hedging Results and Stock Repurchases

16 Abril 2024 - 5:10PM

Business Wire

Northern Oil and Gas, Inc. (NYSE: NOG) (“NOG” or the “Company”)

today provided an update regarding first quarter hedging results

and stock repurchases.

HEDGING UPDATE

The Company periodically enters into derivative agreements to

hedge a portion of its commodity pricing exposure. For the first

quarter of 2024, realized gains on derivatives are expected to be

$19.1 million. Unrealized mark-to-market losses on derivatives are

expected to be $146.2 million for the quarter.

STOCK REPURCHASE UPDATE

The Company allocated capital in the first quarter of 2024 to

common stock repurchases. NOG repurchased 549,356 shares of its

common stock at a weighted average price of $36.42 per share,

repurchased prior to the most recent dividend record date. For

comparative purposes, the average closing price of NOG’s common

stock during March 2024 was $37.71, and the final closing price at

quarter end was $39.68. As of the end of the first quarter, the

Company had $67.5 million of availability remaining on its existing

common stock repurchase authorization.

MANAGEMENT COMMENTS

“Repurchases of NOG’s common stock offered a compelling option

for our excess cash flow in the first quarter,” commented Nick

O’Grady, NOG’s Chief Executive Officer. “With a positive growth

outlook, and promising developments in our larger joint operated

ventures, NOG is poised for a productive 2024 with a sightline to

continued strength in 2025. Our dynamic approach to delivering a

compelling total return for our shareholders provides us the

flexibility to allocate capital where we see the most attractive

value.”

ABOUT NOG

NOG is a real asset company with a primary strategy of acquiring

and investing in non-operated minority working and mineral

interests in the premier hydrocarbon producing basins within the

contiguous United States. More information about NOG can be found

at www.noginc.com.

PRELIMINARY INFORMATION

The preliminary unaudited first quarter 2024 financial and

operating information included in this press release (including

with respect to hedging results and other matters) are based on

estimates and subject to completion of NOG’s financial closing

procedures. Such information has been prepared by management solely

based on currently available information. The preliminary

information does not represent and is not a substitute for a

comprehensive statement of financial and operating results, and

NOG’s actual results may differ materially from these estimates

because of final adjustments, the completion of NOG’s financial

closing procedures, and other developments after the date of this

release.

SAFE HARBOR

This release contains forward-looking statements regarding

future events and future results that are subject to the safe

harbors created under the Securities Act of 1933, as amended (the

“Securities Act”), and the Securities Exchange Act of 1934, as

amended (the “Exchange Act”). All statements other than statements

of historical facts included or referenced in this press release

regarding NOG’s dividend plans and practices (including timing,

amounts and relative performance), financial position, business

strategy, plans and objectives for future operations, industry

conditions, cash flow, and growth prospects are forward-looking

statements. When used in this release, forward-looking statements

are generally accompanied by terms or phrases such as “estimate,”

“project,” “predict,” “believe,” “expect,” “continue,”

“anticipate,” “target,” “could,” “plan,” “intend,” “seek,” “goal,”

“will,” “should,” “may” or other words and similar expressions that

convey the uncertainty of future events or outcomes. Items

contemplating or making assumptions about actual or potential

future sales, market size, collaborations, and trends or operating

results also constitute such forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties, and important factors (many of which are beyond

NOG’s control) that could cause actual results to differ materially

from those set forth in the forward-looking statements, including

the following: changes in NOG’s capitalization, changes in crude

oil and natural gas prices; the pace of drilling and completions

activity on NOG’s properties and properties pending acquisition;

NOG’s ability to acquire additional development opportunities;

integration and benefits of property acquisitions, or the effects

of such acquisitions on NOG’s cash position and levels of

indebtedness; changes in NOG’s reserves estimates or the value

thereof; general economic or industry conditions, nationally and/or

in the communities in which NOG conducts business; changes in the

interest rate environment or market dividend practices, legislation

or regulatory requirements; conditions of the securities markets;

NOG’s ability to raise or access capital; changes in accounting

principles, policies or guidelines; and financial or political

instability, acts of war or terrorism, and other economic,

competitive, governmental, regulatory and technical factors

affecting NOG’s operations, products, services and prices.

Additional information concerning potential factors that could

affect future plans and results is included in the section entitled

“Item 1A. Risk Factors” and other sections of NOG’s most recent

Annual Report on Form 10-K and subsequent Quarterly Reports on Form

10-Q, as updated from time to time in amendments and subsequent

reports filed with the SEC, which describe factors that could cause

NOG’s actual results to differ from those set forth in the

forward-looking statements.

NOG has based these forward-looking statements on its current

expectations and assumptions about future events. While management

considers these expectations and assumptions to be reasonable, they

are inherently subject to significant business, economic,

competitive, regulatory, and other risks, contingencies, and

uncertainties, most of which are difficult to predict and many of

which are beyond NOG’s control. You are urged not to place undue

reliance on these forward-looking statements, which speak only as

of the date they are made. Except as may be required by applicable

law or regulation, NOG does not undertake, and specifically

disclaims, any obligation to update any forward-looking statements

to reflect events or circumstances occurring after the date of such

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240416301471/en/

Evelyn Leon Infurna Vice President of Investor Relations (952)

476-9800 ir@northernoil.com

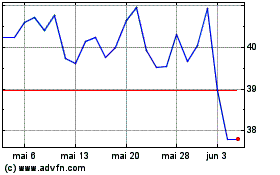

Northern Oil and Gas (NYSE:NOG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Northern Oil and Gas (NYSE:NOG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024