- ServiceNow exceeds guidance across all Q3 2024 topline growth

and profitability metrics; raises 2024 subscription revenues

guidance

- Subscription revenues of $2,715 million in Q3 2024,

representing 23% year-over-year growth, 22.5% in constant

currency

- Total revenues of $2,797 million in Q3 2024, representing 22%

year-over-year growth, 22% in constant currency

- Current remaining performance obligations of $9.36 billion as

of Q3 2024, representing 26% year-over-year growth, 23.5% in

constant currency

- Remaining performance obligations of $19.5 billion as of Q3

2024, representing 36% year-over-year growth, 33% in constant

currency

- 15 transactions over $5 million in net new ACV in Q3 2024, up

50% year-over-year

ServiceNow (NYSE: NOW), the AI platform for business

transformation, today announced financial results for its third

quarter ended September 30, 2024, with subscription revenues of

$2,715 million in Q3 2024, representing 23% year-over-year growth

and 22.5% in constant currency.

“ServiceNow raised our full year topline guidance on the

strength of our Q3 results, once again going beyond expectations,”

said ServiceNow Chairman and CEO Bill McDermott. “This remarkable

momentum stems from both existing and new customers doubling down

on their investments in ServiceNow as the AI platform for business

transformation. The mandate to put AI to work for people represents

a generational technology shift. We have never been more confident

in ServiceNow’s team, our platform, and our position as the

ultimate growth company in enterprise software.”

As of September 30, 2024, current remaining performance

obligations (“cRPO”), contract revenue that will be recognized as

revenue in the next 12 months, was $9.36 billion, representing 26%

year-over-year growth and 23.5% in constant currency. The company

now has 2,020 total customers with more than $1 million in annual

contract value (“ACV”), representing 14% year-over-year growth in

customers.

“Q3 was another spectacular quarter driven by robust demand for

the Now Platform and exceptional team execution,” said ServiceNow

CFO Gina Mastantuono. “With Now Assist already delivering fantastic

results, our latest Xanadu release marks our most comprehensive set

of new AI innovations yet, further fueling our durable topline

growth and margin expansion.”

ServiceNow also named enterprise software industry veteran Amit

Zavery as president, chief product officer (CPO), and chief

operating officer (COO) to lead product and engineering, effective

October 28, 2024. With more than three decades in enterprise

technology and previous leadership roles at Google Cloud and

Oracle, Zavery is a visionary leader who brings extensive

experience in enterprise innovation, transformation, and scale.

Zavery’s responsibilities will include ServiceNow’s platform,

products, engineering, cloud infrastructure, user experience, and

enterprise-wide operations, ensuring all solutions meet the

real-world business needs of ServiceNow customers.

Recent Business Highlights

Innovation

- ServiceNow is putting AI to work for customers. In Q3, the Now

Platform Xanadu release, ServiceNow’s largest AI release to date,

introduced hundreds of additional, new AI capabilities including

Now Assist Skill Kit and purpose-built GenAI industry solutions for

telecom, media, and technology; financial services; the public

sector; and more.

- Alongside Xanadu, the company announced its plans to integrate

Agentic AI into the ServiceNow platform and unlock 24/7

productivity at massive scale. With advanced reasoning and grounded

in cross‑enterprise data through the Now Platform, ServiceNow AI

Agents evolve from the more familiar prompt‑based activity to deep

contextual comprehension, keeping people in the loop for robust

oversight and governance. First use cases will be available in

November for Customer Service Management (CSM) and IT Service

Management (ITSM).

- Today, the company announced ServiceNow Workflow Data Fabric,

an integrated data layer that unifies business and technology data

across the enterprise, powering all workflows and AI agents with

real-time, secure access to data from any source. Powered by

Automation Engine and RaptorDB Pro high-performance database,

Workflow Data Fabric unlocks value with orchestration and

automation at ultra-speed and scale.

- At the United Nations General Assembly last month, ServiceNow

demonstrated its commitment to building a better world through

greater access to technology, knowledge, and opportunity. Through

efforts such as ServiceNow.org and others, ServiceNow has set a

bold ambition to partner with nonprofits and customers to

accelerate impact and reach 1 billion people. This includes the

company’s ambition to positively reach 20 million people through

its philanthropy efforts.

Partnerships

- Today, the company made several partnership announcements

designed to expand the ServiceNow ecosystem and accelerate business

transformation. ServiceNow and NVIDIA will co-develop native AI

Agents using NVIDIA NIM Agent Blueprints within the ServiceNow

platform, creating use cases fueled by business knowledge that

customers can simply choose to turn on; ServiceNow and Siemens

announced a collaboration designed to bolster industrial

cybersecurity and integrate GenAI into shop floor operations;

ServiceNow and Rimini Street announced a partnership to help enable

organizations to unlock value in legacy ERP systems; and ServiceNow

and Pearson announced plans to supercharge workforce development

and employee experiences in the age of AI.

- Earlier in October, ServiceNow and Zoom announced an expanded

strategic alliance to integrate the companies’ GenAI technologies –

ServiceNow Now Assist and Zoom AI Companion – to offer

organizations advanced workflow automation for tasks and

activities.

Global Expansion

- Continuing efforts to expand AI and technology skills, during

the quarter, ServiceNow announced a new National Academic

Partnership with Singapore’s Republic Polytechnic to provide

hundreds of early-in-career and lifelong learners access to

emerging AI and cloud computing roles in support of the

government's Smart Nation agenda.

- Later this month, the company plans to launch a new data center

pair located in Milan and Rome in response to growing demand for

data center infrastructure in the region. The data center pair will

help enhance customer agility, boost productivity, and promote

innovation.

- In October, ServiceNow announced plans to invest $1.5 billion

cumulatively in its UK business over the next five years. This

includes plans to increase headcount, office space, and AI skills

programs.

Investment

- ServiceNow repurchased approximately 272,000 shares of its

common stock for $225 million as part of its share repurchase

program, with the primary objective of managing the impact of

dilution. Of the original authorized amount, approximately $562

million remains available for future share repurchases under the

existing program.

Recognition

- As a testament to ServiceNow’s workplace culture, ServiceNow

was awarded 10th place on the Fortune Best Workplaces in Technology

list1, in addition to placing on the TIME World's Best Companies,

PEOPLE Companies that Care, Fast Company 100 Best Workplaces for

Innovators, and more.

(1)

©2024 Fortune Media IP Limited All rights

reserved. Used under license. Fortune and Fortune Media IP Limited

are not affiliated with, and do not endorse products or services

of, ServiceNow.

Third Quarter 2024 GAAP and Non-GAAP Results:

The following table summarizes our financial results for the

third quarter 2024:

Third Quarter 2024 GAAP

Results

Third Quarter 2024 Non-GAAP

Results(1)

Amount ($

millions)

Year/Year Growth

(%)

Amount ($

millions)(3)

Year/Year Growth

(%)

Subscription revenues

$2,715

23%

$2,711

22.5%

Professional services and other

revenues

$82

14%

$81

13.5%

Total revenues

$2,797

22%

$2,792

22%

Amount ($

billions)

Year/Year Growth

(%)

Amount ($ billions)(3)

Year/Year Growth

(%)

cRPO

$9.36

26%

$9.18

23.5%

RPO

$19.5

36%

$19.1

33%

Amount ($

millions)

Margin (%)

Amount ($

millions)(2)

Margin (%)(2)

Subscription gross profit

$2,219

82%

$2,305

85%

Professional services and other

gross (loss) profit

($6)

(7%)

$5

7%

Total gross profit

$2,213

79%

$2,310

83%

Income from operations

$418

15%

$872

31%

Net cash provided by operating

activities

$671

24%

Free cash flow

$471

17%

Amount ($

millions)

Earnings per Basic/Diluted

Share ($)

Amount ($

millions)(2)

Earnings per

Basic/Diluted Share ($)(2)

Net income

$432

$2.09 / $2.07

$775

$3.76 / $3.72

(1)

We report non-GAAP financial measures in

addition to, and not as a substitute for, or superior to, financial

measures calculated in accordance with GAAP. See the section

entitled “Statement Regarding Use of Non-GAAP Financial Measures”

for an explanation of non-GAAP measures.

(2)

Refer to the table entitled “GAAP to

Non-GAAP Reconciliation” for a reconciliation of GAAP to non-GAAP

measures.

(3)

Non-GAAP subscription revenues and total

revenues are adjusted for constant currency by excluding effects of

foreign currency rate fluctuations and any gains or losses from

foreign currency hedge contracts. Professional services and other

revenues, cRPO, and RPO are adjusted only for constant currency.

See the section entitled “Statement Regarding Use of Non-GAAP

Financial Measures” for an explanation of non-GAAP measures.

Note: Numbers rounded for presentation

purposes and may not foot.

Financial Outlook

Our guidance includes GAAP and non-GAAP financial measures. The

non-GAAP growth rates for subscription revenues are adjusted for

constant currency by excluding effects of foreign currency rate

fluctuations and any gains or losses from foreign currency hedge

contracts, and cRPO are adjusted only for constant currency to

provide better visibility into the underlying business trends.

The following table summarizes our guidance for the fourth

quarter 2024:

Fourth Quarter 2024

GAAP Guidance

Fourth Quarter 2024

Non-GAAP Guidance(1)

Amount ($ millions)(3)

Year/Year Growth

(%)(3)

Constant Currency Year/Year

Growth (%)

Subscription revenues

$2,875 - $2,880

21.5% - 22%

20.5%

cRPO

21.5%

21.5%

Margin (%)(2)

Income from operations

29%

Amount

(millions)

Weighted-average shares used to compute

diluted net income per share

209

(1)

We report non-GAAP financial measures in

addition to, and not as a substitute for, or superior to, financial

measures calculated in accordance with GAAP. See the section

entitled “Statement Regarding Use of Non-GAAP Financial Measures”

for an explanation of non-GAAP measures.

(2)

Refer to the table entitled

“Reconciliation of Non-GAAP Financial Guidance” for a

reconciliation of GAAP to non-GAAP measures.

(3)

Guidance for GAAP subscription revenues

and GAAP subscription revenues and cRPO growth rates are based on

the 30-day average of foreign exchange rates for September 2024 for

entities reporting in currencies other than U.S. Dollars.

The following table summarizes our guidance for the full-year

2024:

Full-Year 2024 GAAP

Guidance

Full-Year 2024 Non-GAAP

Guidance(1)

Amount ($ millions)(3)

Year/Year Growth

(%)(3)

Constant Currency

Year/Year Growth (%)

Subscription revenues

$10,655 - $10,660

23%

22.5%

Margin (%)(2)

Subscription gross profit

84.5%

Income from operations

29.5%

Free cash flow

31%

Amount

(millions)

Weighted-average shares used to compute

diluted net income per share

208

(1)

We report non-GAAP financial measures in

addition to, and not as a substitute for, or superior to, financial

measures calculated in accordance with GAAP. See the section

entitled “Statement Regarding Use of Non-GAAP Financial Measures”

for an explanation of non-GAAP measures.

(2)

Refer to the table entitled

“Reconciliation of Non-GAAP Financial Guidance” for a

reconciliation of GAAP to non-GAAP measures.

(3)

GAAP subscription revenues and related

growth rate for the future quarter included in our full-year 2024

guidance are based on the 30-day average of foreign exchange rates

for September 2024 for entities reporting in currencies other than

U.S. Dollars.

Note: Numbers are rounded for presentation

purposes and may not foot.

Conference Call Details

The conference call will begin at 2 p.m. Pacific Time (“PT”)

(21:00 GMT) on October 23, 2024. Interested parties may listen to

the call by dialing (888) 330‑2455 (Passcode: 8135305), or if

outside North America, by dialing (240) 789‑2717 (Passcode:

8135305). Individuals may access the live teleconference from this

webcast.

https://events.q4inc.com/attendee/941960692

An audio replay of the conference call and webcast will be

available two hours after its completion and will be accessible for

30 days. To hear the replay, interested parties may go to the

investor relations section of the ServiceNow website or dial (800)

770‑2030 (Passcode: 8135305), or if outside North America, by

dialing (609) 800‑9909 (Passcode: 8135305).

Investor Presentation Details

An investor presentation providing additional information,

including forward-looking guidance, and analysis can be found at

https://investors.servicenow.com.

Upcoming Investor Conferences

ServiceNow today announced that it will attend and have

executives present at four upcoming investor conferences.

These include:

- ServiceNow Global Executive Committee Member Nick Tzitzon will

participate in a fireside chat at the RBC Capital Markets 2024

Global TIMT Conference on Wednesday, November 20, 2024 at 10:20am

PT.

- ServiceNow Chief Financial Officer Gina Mastantuono will

participate in a keynote presentation at the UBS Global Technology

Conference on Tuesday, December 3, 2024 at 9:15am PT.

- ServiceNow Chief Financial Officer Gina Mastantuono will

participate in a keynote presentation at the Wells Fargo TMT Summit

on Wednesday, December 4, 2024 at 12:00pm PT.

- ServiceNow Chief Financial Officer Gina Mastantuono will

participate in a keynote presentation at the Barclays Global

Technology Conference on Wednesday, December 11, 2024 at 12:10pm

PT.

The live webcast will be accessible on the investor relations

section of the ServiceNow website at

https://investors.servicenow.com and archived on the ServiceNow

site for a period of 30 days.

Statement Regarding Use of Non-GAAP Financial

Measures

We use the following non-GAAP financial measures in addition to,

and not as a substitute for, or superior to, financial measures

calculated in accordance with GAAP.

- Revenues. We adjust revenues and related growth rates for

constant currency to provide a framework for assessing how our

business performed excluding the effect of foreign currency rate

fluctuations and any gains or losses from foreign currency hedge

contracts that are reported in the current and comparative period.

To exclude the effect of foreign currency rate fluctuations,

current period results for entities reporting in currencies other

than U.S. Dollars (“USD”) are converted into USD at the average

exchange rates in effect during the comparison period (for Q3 2023,

the average exchange rates in effect for our major currencies were

1 USD to 0.92 Euros and 1 USD to 0.79 British Pound Sterling

(“GBP”)), rather than the actual average exchange rates in effect

during the current period (for Q3 2024, the average exchange rates

in effect for our major currencies were 1 USD to 0.91 Euros and 1

USD to 0.77 GBP). Guidance for related growth rates is derived by

applying the average exchange rates in effect during the comparison

period, rather than the exchange rates for the guidance period,

adjusted for any foreign currency hedging effects. We believe the

presentation of revenues and related growth rates adjusted for

constant currency facilitates the comparison of revenues

year-over-year.

- Remaining performance obligations and current remaining

performance obligations. We adjust cRPO and remaining performance

obligations (“RPO”) and related growth rates for constant currency

to provide a framework for assessing how our business performed. To

present this information, current period results for entities

reporting in currencies other than USD are converted into USD at

the exchange rates in effect at the end of the comparison period

(for Q3 2023, the end of the period exchange rates in effect for

our major currencies were 1 USD to 0.95 Euros and 1 USD to 0.82

GBP), rather than the actual end of the period exchange rates in

effect during the current period (for Q3 2024, the end of the

period exchange rates in effect for our major currencies were 1 USD

to 0.90 Euros and 1 USD to 0.75 GBP). Guidance for the related

growth rate is derived by applying the end of period exchange rates

in effect during the comparison period rather than the exchange

rates in effect during the guidance period. We believe the

presentation of cRPO and RPO and related growth rates adjusted for

constant currency facilitates the comparison of cRPO and RPO

year-over-year, respectively.

- Gross profit, Income from operations, Net income and Net income

per share - diluted. Our non-GAAP presentation of gross profit,

income from operations, and net income measures exclude certain

non-cash or non-recurring items, including stock-based compensation

expense, amortization of debt discount and issuance costs related

to our convertible senior notes, loss on early note conversions,

amortization of purchased intangibles, legal settlements, business

combination and other related costs, income tax effects and

adjustments, and the income tax benefit from the release of a

valuation allowance on deferred tax assets. The non-GAAP

weighted-average shares used to compute our non-GAAP net income per

share - diluted excludes the dilutive effect of the in-the-money

portion of convertible senior notes as they are covered by our note

hedges, and includes the dilutive effect of time-based stock

awards, the dilutive effect of warrants and the potentially

dilutive effect of our stock awards with performance conditions not

yet satisfied at forecasted attainment levels to the extent we

believe it is probable that the performance condition will be met.

We believe these adjustments provide useful supplemental

information to investors and facilitates the analysis of our

operating results and comparison of operating results across

reporting periods.

- Free cash flow. Free cash flow is defined as net cash provided

by operating activities plus cash outflows for legal settlements,

repayments of convertible senior notes attributable to debt

discount and business combination and other related costs including

compensation expense, reduced by purchases of property and

equipment. Free cash flow margin is calculated as free cash flow as

a percentage of total revenues. We believe information regarding

free cash flow and free cash flow margin provides useful

information to investors because it is an indicator of the strength

and performance of our business operations.

Our presentation of non-GAAP financial measures may not be

comparable to similar measures used by other companies. We

encourage investors to carefully consider our results under GAAP,

as well as our supplemental non-GAAP information and the

reconciliation between these presentations, to more fully

understand our business. Please see the tables included at the end

of this release for the reconciliation of GAAP and non-GAAP results

for gross profit, income from operations, net income, net income

per share, and free cash flow.

Use of Forward-Looking Statements

This release contains “forward-looking statements” regarding our

performance, including but not limited to statements in the section

entitled “Financial Outlook” and statements regarding the expected

benefits of our announced partnerships. Forward-looking statements

are subject to known and unknown risks and uncertainties and are

based on potentially inaccurate assumptions that could cause actual

results to differ materially from those expected or implied by the

forward-looking statements. If any such risks or uncertainties

materialize or if any of the assumptions prove incorrect, our

results could differ materially from the results expressed or

implied by the forward-looking statements we make.

Factors that may cause actual results to differ materially from

those in any forward-looking statements include, among others,

experiencing an actual or perceived cyber-security event or

weakness; our ability to comply with evolving privacy laws, data

transfer restrictions, and other foreign and domestic standards

related to data and the Internet; errors, interruptions, delays or

security breaches in or of our service or data centers; our ability

to maintain and attract key employees and manage workplace culture;

alleged violations of laws and regulations, including those

relating to anti-bribery and anti-corruption and those relating to

public sector contracting requirements; our ability to compete

successfully against existing and new competitors; our ability to

predict, prepare for and respond promptly to rapidly evolving

technological, market and customer developments; our ability to

grow our business, including converting remaining performance

obligations into revenue, adding and retaining customers, selling

additional subscriptions to existing customers, selling to larger

enterprises, government and regulated organizations with complex

sales cycles and certification processes, and entering new

geographies and markets; our ability to develop and gain customer

demand for and acceptance of existing, new and improved products

and services; our ability to expand and maintain our partnerships

and partner programs, including expected market opportunity from

such relationships, and realize the anticipated benefits thereof;

global economic conditions; fluctuations in the value of foreign

currencies relative to the U.S. Dollar; fluctuations in interest

rates; our ability to consummate and realize the benefits of any

strategic transactions or acquisitions; the impact of armed

conflicts and bank failures on macroeconomic conditions; inflation;

and fluctuations and volatility in our stock price.

Further information on these and other factors that could affect

our financial results are included in our Form 10-K for the year

ended December 31, 2023, and in other filings we make with the

Securities and Exchange Commission from time to time.

We undertake no obligation, and do not intend, to update these

forward-looking statements, to review or confirm analysts’

expectations, or to provide interim reports or updates on the

progress of the current financial quarter.

About ServiceNow

ServiceNow (NYSE: NOW) is putting AI to work for people. We move

with the pace of innovation to help customers transform

organizations across every industry while upholding a trustworthy,

human centered approach to deploying our products and services at

scale. Our AI platform for business transformation connects people,

processes, data, and devices to increase productivity and maximize

business outcomes. For more information, visit:

www.servicenow.com.

© 2024 ServiceNow, Inc. All rights reserved. ServiceNow, the

ServiceNow logo, Now, and other ServiceNow marks are trademarks

and/or registered trademarks of ServiceNow, Inc. in the United

States and/or other countries. Other company names, product names,

and logos may be trademarks of the respective companies with which

they are associated.

ServiceNow, Inc.

Condensed Consolidated

Statements of Operations

(in millions, except per share

data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Revenues:

Subscription

$

2,715

$

2,216

$

7,780

$

6,315

Professional services and other

82

72

247

219

Total revenues

2,797

2,288

8,027

6,534

Cost of revenues (1):

Subscription

496

420

1,406

1,163

Professional services and other

88

76

250

242

Total cost of revenues

584

496

1,656

1,405

Gross profit

2,213

1,792

6,371

5,129

Operating expenses (1):

Sales and marketing

944

799

2,827

2,454

Research and development

626

549

1,875

1,562

General and administrative

225

213

679

621

Total operating expenses

1,795

1,561

5,381

4,637

Income from operations

418

231

990

492

Interest income

108

82

313

216

Other expense, net

(10

)

(14

)

(28

)

(47

)

Income before income taxes

516

299

1,275

661

Provision for (benefit from) income

taxes

84

57

234

(775

)

Net income

$

432

$

242

$

1,041

$

1,436

Net income per share - basic

$

2.09

$

1.18

$

5.06

$

7.04

Net income per share - diluted

$

2.07

$

1.17

$

5.00

$

7.00

Weighted-average shares used to compute

net income per share - basic

206

204

206

204

Weighted-average shares used to compute

net income per share - diluted

209

206

208

205

(1)

Includes stock-based compensation as

follows:

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Cost of revenues:

Subscription

$

64

$

52

$

184

$

148

Professional services and other

11

11

35

40

Operating expenses:

Sales and marketing

144

132

419

378

Research and development

150

150

479

430

General and administrative

57

68

175

195

ServiceNow, Inc.

Condensed Consolidated Balance

Sheets

(in millions)

September 30, 2024

December 31, 2023

(unaudited)

Assets

Current assets:

Cash and cash equivalents

$

1,885

$

1,897

Short-term investments

3,410

2,980

Accounts receivable, net

1,308

2,036

Current portion of deferred

commissions

502

461

Prepaid expenses and other current

assets

591

403

Total current assets

7,696

7,777

Deferred commissions, less current

portion

946

919

Long-term investments

3,829

3,203

Property and equipment, net

1,718

1,358

Operating lease right-of-use assets

661

715

Intangible assets, net

214

224

Goodwill

1,291

1,231

Deferred tax assets

1,444

1,508

Other assets

635

452

Total assets

$

18,434

$

17,387

Liabilities and Stockholders’

Equity

Current liabilities:

Accounts payable

$

165

$

126

Accrued expenses and other current

liabilities

1,058

1,365

Current portion of deferred revenue

5,457

5,785

Current portion of operating lease

liabilities

106

89

Total current liabilities

6,786

7,365

Deferred revenue, less current portion

77

81

Operating lease liabilities, less current

portion

650

707

Long-term debt, net

1,489

1,488

Other long-term liabilities

142

118

Stockholders’ equity

9,290

7,628

Total liabilities and stockholders’

equity

$

18,434

$

17,387

ServiceNow, Inc.

Condensed Consolidated

Statements of Cash Flows

(in millions)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Cash flows from operating

activities:

Net income

$

432

$

242

$

1,041

$

1,436

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

144

146

410

408

Amortization of deferred commissions

140

115

403

333

Stock-based compensation

426

413

1,292

1,191

Deferred income taxes

(5

)

30

47

(874

)

Other

(6

)

(11

)

(31

)

(13

)

Changes in operating assets and

liabilities, net of effect of business combinations:

Accounts receivable

228

(83

)

727

552

Deferred commissions

(155

)

(173

)

(461

)

(453

)

Prepaid expenses and other assets

(15

)

(47

)

(267

)

(183

)

Accounts payable

(130

)

(98

)

42

(188

)

Deferred revenue

(263

)

(128

)

(355

)

(217

)

Accrued expenses and other liabilities

(125

)

(95

)

(216

)

(199

)

Net cash provided by operating

activities

671

311

2,632

1,793

Cash flows from investing

activities:

Purchases of property and equipment

(202

)

(136

)

(599

)

(433

)

Business combinations, net of cash

acquired(1)

(41

)

(279

)

(82

)

(279

)

Purchases of other intangibles

—

(3

)

(30

)

(3

)

Purchases of investments

(1,292

)

(984

)

(3,952

)

(3,805

)

Purchases of non-marketable

investments

(61

)

(10

)

(149

)

(56

)

Sales and maturities of investments

911

915

3,024

2,868

Other

27

(28

)

25

(15

)

Net cash used in investing activities

(658

)

(525

)

(1,763

)

(1,723

)

Cash flows from financing

activities:

Proceeds from employee stock plans

106

76

237

193

Repurchases of common stock

(225

)

(282

)

(400

)

(282

)

Taxes paid related to net share settlement

of equity awards

(173

)

(127

)

(525

)

(333

)

Business combination (1)

—

—

(184

)

—

Net cash used in financing activities

(292

)

(333

)

(872

)

(422

)

Foreign currency effect on cash, cash

equivalents and restricted cash

5

(4

)

(8

)

(4

)

Net change in cash, cash equivalents and

restricted cash

(274

)

(551

)

(11

)

(356

)

Cash, cash equivalents and restricted cash

at beginning of period

2,167

1,670

1,904

1,475

Cash, cash equivalents and restricted cash

at end of period

$

1,893

$

1,119

$

1,893

$

1,119

(1)

The nine-months period ended September 30,

2024 reflects a reclassification of $184 million from investing

activities to financing activities related to the second

installment payment made in the acquisition of G2K Group GmbH

during the three months ended March 31, 2024.

ServiceNow, Inc.

GAAP to Non-GAAP

Reconciliation

(in millions, except per share

data)

(unaudited)

Three Months Ended

Nine Months Ended

September 30, 2024

September 30, 2023

September 30, 2024

September 30, 2023

Gross profit:

GAAP subscription gross profit

$

2,219

$

1,796

$

6,374

$

5,152

Stock-based compensation

64

52

184

148

Amortization of purchased intangibles

22

20

64

57

Non-GAAP subscription gross profit

$

2,305

$

1,868

$

6,622

$

5,357

GAAP professional services and other gross

loss

$

(6

)

$

(4

)

$

(3

)

$

(23

)

Stock-based compensation

11

11

35

40

Non-GAAP professional services and other

gross profit

$

5

$

7

$

32

$

17

GAAP gross profit

$

2,213

$

1,792

$

6,371

$

5,129

Stock-based compensation

75

63

219

188

Amortization of purchased intangibles

22

20

64

57

Non-GAAP gross profit

$

2,310

$

1,875

$

6,654

$

5,374

Gross margin:

GAAP subscription gross margin

82

%

81

%

82

%

82

%

Stock-based compensation as % of

subscription revenues

2

%

2

%

2

%

2

%

Amortization of purchased intangibles as %

of subscription revenues

1

%

1

%

1

%

1

%

Non-GAAP subscription gross margin

85

%

84

%

85

%

85

%

GAAP professional services and other gross

margin

(7

%)

(6

%)

(1

%)

(11

%)

Stock-based compensation as % of

professional services and other revenues

13

%

15

%

14

%

18

%

Non-GAAP professional services and other

gross margin

7

%

10

%

13

%

8

%

GAAP gross margin

79

%

78

%

79

%

79

%

Stock-based compensation as % of total

revenues

3

%

3

%

3

%

3

%

Amortization of purchased intangibles as %

of total revenues

1

%

1

%

1

%

1

%

Non-GAAP gross margin

83

%

82

%

83

%

82

%

Income from operations:

GAAP income from operations

$

418

$

231

$

990

$

492

Stock-based compensation

426

413

1,292

1,191

Amortization of purchased intangibles

23

21

71

63

Business combination and other related

costs

4

11

29

26

Non-GAAP income from operations

$

872

$

676

$

2,383

$

1,772

Operating margin:

GAAP operating margin

15

%

10

%

12

%

8

%

Stock-based compensation as % of total

revenues

15

%

18

%

16

%

18

%

Amortization of purchased intangibles as %

of total revenues

1

%

1

%

1

%

1

%

Business combination and other related

costs as % of total revenues

—

%

—

%

—

%

—

%

Non-GAAP operating margin

31

%

30

%

30

%

27

%

Net income:

GAAP net income

$

432

$

242

$

1,041

$

1,436

Stock-based compensation

426

413

1,292

1,191

Amortization of purchased intangibles

23

21

71

63

Business combination and other related

costs

4

11

29

26

Income tax effects and adjustments(1)

(110

)

(64

)

(300

)

(159

)

Release of a valuation allowance on

deferred tax assets

—

(20

)

—

(985

)

Non-GAAP net income

$

775

$

603

$

2,133

$

1,572

Net income per share - basic and

diluted:

GAAP net income per share - basic

$

2.09

$

1.18

$

5.06

$

7.04

GAAP net income per share - diluted

$

2.07

$

1.17

$

5.00

$

7.00

Non-GAAP net income per share - basic

$

3.76

$

2.95

$

10.37

$

7.71

Non-GAAP net income per share -

diluted

$

3.72

$

2.92

$

10.26

$

7.66

Weighted-average shares used to compute

net income per share - basic

206

204

206

204

Weighted-average shares used to compute

net income per share - diluted

209

206

208

205

Free cash flow:

GAAP net cash provided by operating

activities

$

671

$

311

$

2,632

$

1,793

Purchases of property and equipment

(202

)

(136

)

(599

)

(433

)

Business combination and other related

costs

2

21

22

24

Non-GAAP free cash flow

$

471

$

196

$

2,055

$

1,384

Free cash flow margin:

GAAP net cash provided by operating

activities as % of total revenues

24

%

14

%

33

%

27

%

Purchases of property and equipment as %

of total revenues

(7

%)

(6

%)

(7

%)

(7

%)

Business combination and other related

costs as % of total revenues

—

%

1

%

—

%

—

%

Non-GAAP free cash flow margin

17

%

9

%

26

%

21

%

(1)

We use a non-GAAP effective tax rate for

evaluating our operating results to provide consistency across

reporting periods. Based on our long-term projections, we are using

a non-GAAP tax rate of 20% and 19% for the three and nine months

ended September 30, 2024 and 2023, respectively. This non-GAAP tax

rate could change for various reasons including significant changes

in our geographic earnings mix or fundamental tax law changes in

major jurisdictions in which we operate.

Note: Numbers are rounded for presentation

purposes and may not foot.

ServiceNow, Inc.

Reconciliation of Non-GAAP

Financial Guidance

Three Months Ending

December 31, 2024

GAAP operating margin

13%

Stock-based compensation expense as % of

total revenues

15%

Amortization of purchased intangibles as %

of total revenues

1%

Business combination and other related

costs as % of total revenues

—%

Non-GAAP operating margin

29%

Twelve Months Ending

December 31, 2024

GAAP subscription gross margin

81.5%

Stock-based compensation expense as % of

subscription revenues

2%

Amortization of purchased intangibles as %

of subscription revenues

1%

Non-GAAP subscription margin

84.5%

GAAP operating margin

12.5%

Stock-based compensation expense as % of

total revenues

16%

Amortization of purchased intangibles as %

of total revenues

1%

Business combination and other related

costs as % of total revenues

—%

Non-GAAP operating margin

29.5%

GAAP net cash provided by operating

activities as % of total revenues

38%

Purchases of property and equipment as %

of total revenues

(7%)

Business combination and other related

costs as % of total revenues

—%

Non-GAAP free cash flow margin

31%

Note: Numbers are rounded for presentation

purposes and may not foot.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023215869/en/

Media Contact: Johnna Hoff (408) 250-8644

press@servicenow.com

Investor Contact: Darren Yip (925) 388-7205

ir@servicenow.com

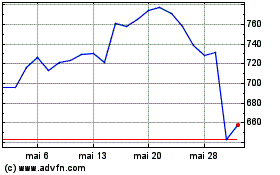

ServiceNow (NYSE:NOW)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

ServiceNow (NYSE:NOW)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024