Parker’s Promising Future Highlighted at Investor Day, Win Strategy™ Enables Sustainable Growth, New 5-Year Targets Announced

16 Maio 2024 - 6:00PM

Parker Hannifin Corporation (NYSE: PH), the global leader in motion

and control technologies, today hosted its 2024 investor meeting

where members of the Office of the Chief Executive presented an

update on the company’s ongoing transformation, detailed how Parker

is positioned for continued growth from secular trends, reinforced

the importance of The Win StrategyTM in driving growth and margin

expansion, and announced new five-year financial performance

targets for fiscal year 2029. The Win StrategyTM is the Parker

business system and establishes goals and strategies for engaged

people, premier customer experience, profitable growth and

financial performance.

“Parker is a very different company today,” said Jenny

Parmentier, Chairman and CEO. “Our portfolio of interconnected

technologies strengthens our competitive position, increases

resiliency, and aligns us with secular trends that are expected to

sustain organic sales growth. In addition, the Win Strategy

provides the necessary tools to drive continuous improvement and

operational excellence which compounds performance. Given our

performance and our promising future, we have announced new

five-year targets that would keep us among the top quartile of our

peer companies.”

Parmentier began the meeting with a strategic overview of

Parker’s ongoing transformation and a review of how Parker is

positioned for growth. Andy Ross, President and Chief

Operating Officer provided an overview of how Parker’s highly

engaged global team deploys The Win StrategyTM 3.0 to drive

operational excellence and deliver exceptional results with further

opportunities for growth and margin expansion. A financial review

by Todd Leombruno, Executive Vice President and Chief Financial

Officer, highlighted Parker’s ongoing ability to generate strong

cash flow leaving substantial capital deployment optionality to

drive shareholder returns. A replay of the presentations is

available at investors.parker.com.

The company noted the following significant highlights from the

presentations:

- Parker has built a high-performance culture where team members

can directly contribute to improved results using high performance

teams to drive improvements in areas such as safety, quality, lean

and kaizen.

- The company is positioned to benefit from secular growth trends

such as aerospace, digitalization, electrification, clean

technologies, and the mega capex growth cycle related to

infrastructure spending and global supply chain near-shoring.

- Parker has greatly increased its exposure to longer cycle

markets that allows for more resilient financial performance.

- The company announced five-year targets through fiscal year

2029 that include:

- 4-6% organic sales growth CAGR

- 27% adjusted segment operating margin, an increase of 200 basis

points from the previous target

- 28% adjusted EBITDA margin, an increase of 300 basis points

from the previous target

- 17% free cash flow margin, an increase of 100 basis points from

the previous target

- 10%+ adjusted earnings per share CAGR

Parmentier added, “Our targets indicate that we can continue

transforming Parker into a faster growing, more resilient, higher

margin company. With our strong culture and highly engaged team

members we can continue to take Parker’s performance to the next

level and create significant shareholder value.”

About Parker HannifinParker Hannifin is a

Fortune 250 global leader in motion and control technologies.

For more than a century the company has been enabling engineering

breakthroughs that lead to a better tomorrow. Parker has

increased its annual dividend per share paid to shareholders for 68

consecutive fiscal years, among the top five longest-running,

dividend-increase records in the S&P 500 index. Learn

more at www.parker.com or @parkerhannifin.

Note on Non-GAAP Financial Measures

This press release contains references to non-GAAP financial

information including (a) adjusted earnings per share; (b) adjusted

segment operating margin; (c) adjusted EBITDA margin; (d) free cash

flow margin; and (e) organic sales growth. Although adjusted

earnings per share, segment operating margin, adjusted EBITDA

margin, free cash flow margin and organic sales growth are not

measures of performance calculated in accordance with GAAP, we

believe that they are useful to an investor in evaluating the

company performance for the periods presented. The non-GAAP metrics

included in our new 5-year targets for fiscal year 2029 could not

be reconciled without unreasonable effort.

Forward-Looking Statements Forward-looking

statements contained in this, and other written and oral reports

are made based on known events and circumstances at the time of

release, and as such, are subject in the future to unforeseen

uncertainties and risks. Often but not always, these statements may

be identified from the use of forward-looking terminology such as

“anticipates,” “believes,” “may,” “should,” “could,” “expects,”

“targets,” “is likely,” “will,” or the negative of these terms and

similar expressions, and include all statements regarding future

performance, earnings projections, events or developments. Neither

Parker nor any of its respective associates or directors, officers

or advisers, provides any representation, assurance or guarantee

that the occurrence of the events expressed or implied in any

forward-looking statements will actually occur. Parker cautions

readers not to place undue reliance on these statements. It is

possible that the future performance and earnings projections of

the company, including its individual segments, may differ

materially from past performance or current expectations. A change

in the economic conditions in individual markets may have a

particularly volatile effect on segment performance.

Among other factors which may affect future performance are:

changes in business relationships with and purchases by or from

major customers, suppliers or distributors, including delays or

cancellations in shipments; disputes regarding contract terms or

significant changes in financial condition, changes in contract

cost and revenue estimates for new development programs and changes

in product mix; the impact of political, social and economic

instability and disruptions; ability to identify acceptable

strategic acquisition targets; uncertainties surrounding timing,

successful completion or integration of acquisitions and similar

transactions, including the integration of Meggitt PLC; our ability

to effectively manage expanded operations from acquisitions; the

ability to successfully divest businesses planned for divestiture

and realize the anticipated benefits of such divestitures; the

determination to undertake business realignment activities and the

expected costs thereof and, if undertaken, the ability to complete

such activities and realize the anticipated cost savings from such

activities; ability to implement successfully capital allocation

initiatives, including timing, pricing and execution of share

repurchases; availability, limitations or cost increases of raw

materials, component products and/or commodities that cannot be

recovered in product pricing; global economic factors, including

manufacturing activity, air travel trends, currency exchange rates,

difficulties entering new markets and general economic conditions

such as inflation, deflation, interest rates, credit availability

and changes in consumer habits and preferences; ability to manage

costs related to insurance and employee retirement and health care

benefits; legal and regulatory developments and changes; additional

liabilities relating to changes in tax rates or exposure to

additional income tax liabilities; ability to enter into, own,

renew, protect and maintain intellectual property and know-how;

leverage and future debt service obligations; potential impairment

of goodwill; compliance costs associated with environmental laws

and regulations; potential labor disruptions or shortages and the

ability to attract and retain key personnel; uncertainties

surrounding the ultimate resolution of outstanding legal

proceedings, including the outcome of any appeals; global

competitive market conditions, including U.S. trade policies and

resulting effects on sales and pricing; local and global political

and economic conditions, including the Russia-Ukraine war and other

armed conflicts and their residual effects; inability to obtain, or

meet conditions imposed for, required governmental and regulatory

approvals; government actions and natural phenomena such as

pandemics, floods, earthquakes, hurricanes or other natural

phenomena that may be related to climate change; increased cyber

security threats and sophisticated computer crime; and success of

business and operating initiatives. Readers should consider these

forward-looking statements in light of risk factors discussed in

Parker’s Annual Report on Form 10-K for the fiscal year ended June

30, 2023 and other periodic filings made with the SEC.

###

Media –

Aidan Gormley, Director, Global Communications and Branding

216/896-3258

aidan.gormley@parker.com

Financial Analysts –

Jeff Miller, Vice President, Investor Relations

216/896-2708

jeffrey.miller@parker.com

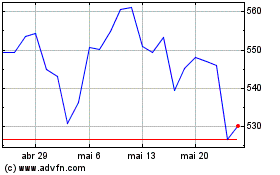

Parker Hannifin (NYSE:PH)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Parker Hannifin (NYSE:PH)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025