Parker Agrees to Sell North America Composites & Fuel Containment Division

29 Julho 2024 - 5:45PM

Parker Hannifin Corporation (NYSE: PH), the global leader in motion

and control technologies, today announced it has signed an

agreement to divest its North America Composites and Fuel

Containment (CFC) Division to private investment firm SK Capital

Partners. With the completion of this transaction the company will

have successfully divested businesses and product lines over the

past three years that total nearly $450 million in annual sales.

The transaction is subject to customary closing conditions.

“One element of our strategy is assessing whether

we are the best owner for certain businesses or whether they could

be more successful as part of another organization,” said Chairman

and Chief Executive Officer, Jenny Parmentier. “The CFC Division is

a solid business with strong performance and growth potential

backed by a great team, whom we wish continued success under the

ownership of SK Capital Partners.”

Parker’s CFC Division is headquartered in

Erlanger, Kentucky and has five additional locations in the U.S.

and Mexico,with annual sales of approximately $350 million. It

became part of Parker’s Diversified Industrial Segment, North

America businesses following the acquisition of Meggitt plc in

2022. CFC is a leading manufacturer of composites, fuel tanks and

bladders.

Parker has also completed the divestiture of

several other businesses or product lines over the past 36 months,

including: France Electromechanical Solutions Division;

MicroStrain® Division; Filter Resources Division; the Calzoni

product line; the Industrial Profile Systems product line; and the

Indego® exoskeleton product line.

About Parker HannifinParker Hannifin is a

Fortune 250 global leader in motion and control technologies. For

more than a century the company has been enabling engineering

breakthroughs that lead to a better tomorrow. Learn more

at www.parker.com or @parkerhannifin.

AdvisorsLazard acted as exclusive financial

advisor for Parker. Jones Day acted as legal advisor in this

transaction.

Forward-Looking StatementsForward-looking

statements contained in this and other written and oral reports are

made based on known events and circumstances at the time of

release, and as such, are subject in the future to unforeseen

uncertainties and risks. Often but not always, these statements may

be identified from the use of forward-looking terminology such as

“anticipates,” “believes,” “may,” “should,” “could,” “expects,”

“targets,” “is likely,” “will,” or the negative of these terms and

similar expressions, and include all statements regarding future

performance, earnings projections, events or developments. Neither

Parker nor any of its respective associates or directors, officers

or advisers, provides any representation, assurance or guarantee

that the occurrence of the events expressed or implied in any

forward-looking statements will actually occur. Parker cautions

readers not to place undue reliance on these statements. It is

possible that the future performance and earnings projections of

the company, including its individual segments, may differ

materially from past performance or current expectations. A change

in the economic conditions in individual markets may have a

particularly volatile effect on segment performance.

Among other factors which may affect future

performance are: changes in business relationships with and

purchases by or from major customers, suppliers or distributors,

including delays or cancellations in shipments; disputes regarding

contract terms or significant changes in financial condition,

changes in contract cost and revenue estimates for new development

programs and changes in product mix; the impact of political,

social and economic instability and disruptions; ability to

identify acceptable strategic acquisition targets; uncertainties

surrounding timing, successful completion or integration of

acquisitions and similar transactions, including the integration of

Meggitt PLC; our ability to effectively manage expanded operations

from acquisitions; the ability to successfully divest businesses

planned for divestiture and realize the anticipated benefits of

such divestitures; the determination to undertake business

realignment activities and the expected costs thereof and, if

undertaken, the ability to complete such activities and realize the

anticipated cost savings from such activities; ability to implement

successfully capital allocation initiatives, including timing,

pricing and execution of share repurchases; availability,

limitations or cost increases of raw materials, component products

and/or commodities that cannot be recovered in product pricing;

global economic factors, including manufacturing activity, air

travel trends, currency exchange rates, difficulties entering new

markets and general economic conditions such as inflation,

deflation, interest rates, credit availability and changes in

consumer habits and preferences; ability to manage costs related to

insurance and employee retirement and health care benefits; legal

and regulatory developments and changes; additional liabilities

relating to changes in tax rates or exposure to additional income

tax liabilities; ability to enter into, own, renew, protect and

maintain intellectual property and know-how; leverage and future

debt service obligations; potential impairment of goodwill;

compliance costs associated with environmental laws and

regulations; potential labor disruptions or shortages and the

ability to attract and retain key personnel; uncertainties

surrounding the ultimate resolution of outstanding legal

proceedings, including the outcome of any appeals; global

competitive market conditions, including U.S. trade policies and

resulting effects on sales and pricing; local and global political

and economic conditions, including the Russia-Ukraine war and other

armed conflicts and their residual effects; inability to obtain, or

meet conditions imposed for, required governmental and regulatory

approvals; government actions and natural phenomena such as

pandemics, floods, earthquakes, hurricanes or other natural

phenomena that may be related to climate change; increased cyber

security threats and sophisticated computer crime; and success of

business and operating initiatives. Readers should consider these

forward-looking statements in light of risk factors discussed in

Parker’s Annual Report on Form 10-K for the fiscal year ended June

30, 2023 and other periodic filings made with the SEC.

###

Contact:

Media -

Aidan Gormley - Director, Global Communications and Branding

216-896-3258

aidan.gormley@parker.com

Financial Analysts -

Jeff Miller - Vice President, Investor Relations

216-896-2708

jeffrey.miller@parker.com

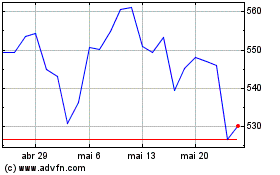

Parker Hannifin (NYSE:PH)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Parker Hannifin (NYSE:PH)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025