Form 8-K - Current report

17 Junho 2024 - 6:16PM

Edgar (US Regulatory)

0001413329false00014133292024-06-172024-06-170001413329us-gaap:CommonStockMember2024-06-172024-06-170001413329pm:A0.625Notesdue2024Member2024-06-172024-06-170001413329pm:A3.250Notesdue2024Member2024-06-172024-06-170001413329pm:A2.750Notesdue2025Member2024-06-172024-06-170001413329pm:A3.375Notesdue2025Member2024-06-172024-06-170001413329pm:A2.750Notesdue2026Member2024-06-172024-06-170001413329pm:A2.875Notesdue2026Member2024-06-172024-06-170001413329pm:A0.125Notesdue2026Member2024-06-172024-06-170001413329pm:A3.125Notesdue2027Member2024-06-172024-06-170001413329pm:A3.125Notesdue2028Member2024-06-172024-06-170001413329pm:A2.875Notesdue2029Member2024-06-172024-06-170001413329pm:A3.375Notesdue2029Member2024-06-172024-06-170001413329pm:A3.750NotesDue2031Member2024-06-172024-06-170001413329pm:A0.800Notesdue2031Member2024-06-172024-06-170001413329pm:A3.125Notesdue2033Member2024-06-172024-06-170001413329pm:A2.000Notesdue2036Member2024-06-172024-06-170001413329pm:A1.875Notesdue2037Member2024-06-172024-06-170001413329pm:A6.375Notesdue2038Member2024-06-172024-06-170001413329pm:A1.450Notesdue2039Member2024-06-172024-06-170001413329pm:A4.375Notesdue2041Member2024-06-172024-06-170001413329pm:A4.500Notesdue2042Member2024-06-172024-06-170001413329pm:A3.875Notesdue2042Member2024-06-172024-06-170001413329pm:A4.125Notesdue2043Member2024-06-172024-06-170001413329pm:A4.875Notesdue2043Member2024-06-172024-06-170001413329pm:A4.250Notesdue2044Member2024-06-172024-06-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 17, 2024

Philip Morris International Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

Virginia | | 1-33708 | | 13-3435103 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 677 Washington Blvd, Ste. 1100 | Stamford | Connecticut | | | 06901 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant's telephone number, including area code: (203) 905-2410

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, no par value | | PM | | New York Stock Exchange |

| | | | | | | | | | | | | | |

| 0.625% Notes due 2024 | | PM24B | | New York Stock Exchange |

| 3.250% Notes due 2024 | | PM24A | | New York Stock Exchange |

| 2.750% Notes due 2025 | | PM25 | | New York Stock Exchange |

| 3.375% Notes due 2025 | | PM25A | | New York Stock Exchange |

| 2.750% Notes due 2026 | | PM26A | | New York Stock Exchange |

| 2.875% Notes due 2026 | | PM26 | | New York Stock Exchange |

| 0.125% Notes due 2026 | | PM26B | | New York Stock Exchange |

| 3.125% Notes due 2027 | | PM27 | | New York Stock Exchange |

| 3.125% Notes due 2028 | | PM28 | | New York Stock Exchange |

| 2.875% Notes due 2029 | | PM29 | | New York Stock Exchange |

| 3.375% Notes due 2029 | | PM29A | | New York Stock Exchange |

| 3.750% Notes due 2031 | | PM31B | | New York Stock Exchange |

| 0.800% Notes due 2031 | | PM31 | | New York Stock Exchange |

| 3.125% Notes due 2033 | | PM33 | | New York Stock Exchange |

| 2.000% Notes due 2036 | | PM36 | | New York Stock Exchange |

| 1.875% Notes due 2037 | | PM37A | | New York Stock Exchange |

| 6.375% Notes due 2038 | | PM38 | | New York Stock Exchange |

| 1.450% Notes due 2039 | | PM39 | | New York Stock Exchange |

| 4.375% Notes due 2041 | | PM41 | | New York Stock Exchange |

| 4.500% Notes due 2042 | | PM42 | | New York Stock Exchange |

| 3.875% Notes due 2042 | | PM42A | | New York Stock Exchange |

| 4.125% Notes due 2043 | | PM43 | | New York Stock Exchange |

| 4.875% Notes due 2043 | | PM43A | | New York Stock Exchange |

| 4.250% Notes due 2044 | | PM44 | | New York Stock Exchange |

| | | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

On June 17, 2024, Philip Morris International Inc. issued a press release in connection with the receipt of a subpoena from the Attorney General of the District of Columbia. A copy of the press release is attached as Exhibit 99.1 to this report and is incorporated herein by reference.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

| | | | | |

| 104 | Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document and contained in Exhibit 101) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| PHILIP MORRIS INTERNATIONAL INC. |

| |

| By: | | /s/ DARLENE QUASHIE HENRY |

| Name: | | Darlene Quashie Henry |

| Title: | | Vice President, Associate General Counsel & Corporate Secretary |

Date: June 17, 2024

| | | | | | | | | | | | | | |

| PRESS RELEASE | | |

| | | | |

| Investor Relations: | | Media: Corey Henry | | |

| Stamford, CT: +1 (203) 904 2410 | | Stamford, CT: +1 (202) 679 7296 | | |

| Lausanne: +41 582 424 666 | | Email: Corey.Henry@pmi.com | | |

| Email: InvestorRelations@pmi.com | | | | |

DISTRICT OF COLUMBIA SUBPOENA

STAMFORD, CT, June 17, 2024 – Swedish Match North America LLC (“SMNA”), a Philip Morris International Inc. (“PMI” or “Company”) affiliate acquired in November 2022, has received a subpoena from the Attorney General of the District of Columbia (also referred to in this press release as, “D.C.”) requesting, among other things, information about SMNA’s compliance with D.C.’s ban on the sale of flavored products as it relates to ZYN nicotine pouches.

The Company’s affiliate, SMNA, intends to comply with the Attorney General’s request for information concerning sales of its nicotine pouch products in D.C. Our preliminary investigation indicates that there have been sales of flavored nicotine pouch products in D.C., predominantly related to certain online sales platforms and some independent retailers. In the event of an unfavorable outcome related to this matter, a material liability is reasonably possible though not estimable at this time. At the request of PMI, SMNA is conducting a full review of its sales and supply chain arrangements in D.C. and other U.S. localities where flavor bans may apply.

As an initial remedial measure, while our investigation continues, SMNA is taking steps to immediately suspend online sales on ZYN.com. We reaffirm our commitment to 21+ only access and confirm that ZYN.com sales have been fully age-gated. ZYN.com sales have represented a very small percentage of nationwide ZYN volumes since PMI’s acquisition of SMNA.

We remain committed to ensuring compliance with all laws and regulations concerning the sale of our affiliates’ products in the U.S. and worldwide.

Philip Morris International: Delivering a Smoke-Free Future

Philip Morris International (PMI) is a leading international tobacco company, actively delivering a smoke-free future and evolving its portfolio for the long term to include products outside of the tobacco and nicotine sector. The company’s current product portfolio primarily consists of cigarettes and smoke-free products. Since 2008, PMI has invested over $12.5 billion to develop, scientifically substantiate and commercialize innovative smoke-free products for adults who would otherwise continue to smoke, with the goal of completely ending the sale of cigarettes. This includes the building of world-class scientific assessment capabilities, notably in the areas of pre-clinical systems toxicology, clinical and behavioral research, as well as post-market studies. In 2022, PMI acquired Swedish Match – a leader in oral nicotine delivery – creating a global smoke-free champion led by the companies’ IQOS and ZYN brands. The U.S. Food and Drug Administration has authorized versions of PMI’s IQOS devices and consumables and Swedish Match’s General snus as Modified Risk Tobacco Products. As of December 31, 2023, PMI's smoke-free products were available for sale in 84 markets, and PMI estimates that approximately 33 million adults around the world use PMI's smoke-free products. Smoke-free business accounted for approximately 37% of PMI’s total full-year 2023 net revenues. With a strong foundation and significant expertise in life sciences, PMI announced in February 2021 its ambition to expand into wellness and healthcare areas and, through its Vectura Fertin Pharma business, aims to enhance life through the delivery of seamless health experiences. For more information, please visit www.pmi.com and www.pmiscience.com.

Forward-Looking and Cautionary Statements

This press release contains projections of future results and goals and other forward-looking statements, including statements regarding expected operational performance; regulatory outcomes; and business plans and strategies. Achievement of future results is subject to risks, uncertainties and inaccurate assumptions. In the event that risks or uncertainties materialize, or underlying assumptions prove inaccurate, actual results could vary materially from those contained in such forward-looking statements. Pursuant to the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, PMI is identifying important factors that, individually or in the aggregate, could cause actual results and outcomes to differ materially from those contained in any forward-looking statements made by PMI.

PMI's business risks include: excise tax increases and discriminatory tax structures; increasing marketing and regulatory restrictions that could reduce our competitiveness, eliminate our ability to communicate with adult consumers, or ban certain of our products in certain markets or countries; health concerns relating to the use of tobacco and other nicotine-containing products and exposure to environmental tobacco smoke; litigation related to tobacco and/or nicotine use and intellectual property; intense competition; the effects of global and individual country economic, regulatory and political developments, natural disasters and conflicts; the impact and consequences of Russia's invasion of Ukraine; changes in adult smoker behavior; the impact of natural disasters and pandemics on PMI's business; lost revenues as a result of counterfeiting, contraband and cross-border purchases; governmental investigations; unfavorable currency exchange rates and currency devaluations, and limitations on the ability to repatriate funds; adverse changes in applicable corporate tax laws; adverse changes in the cost, availability, and quality of tobacco and other agricultural products and raw materials, as well as components and materials for our electronic devices; and the integrity of its information systems and effectiveness of its data privacy policies. PMI's future profitability may also be adversely affected should it be unsuccessful in its attempts to introduce, commercialize, and grow smoke-free products or if regulation or taxation do not differentiate between such products and cigarettes; if it is unable to successfully introduce new products, promote brand equity, enter new markets or improve its margins through increased prices and productivity gains; if it is unable to expand its brand portfolio internally or through acquisitions and the development of strategic business relationships; if it is unable to attract and retain the best global talent, including women or diverse candidates; or if it is unable to successfully integrate and realize the expected benefits from recent transactions and acquisitions. Future results are also subject to the lower predictability of our smoke-free products performance.

PMI is further subject to other risks detailed from time to time in its publicly filed documents, including PMI's Annual Report on Form 10-K for the fourth quarter and year ended December 31, 2023, and the Quarterly Report on Form 10-Q for the first quarter ended March 31, 2024. PMI cautions that the foregoing list of important factors is not a complete discussion of all potential risks and uncertainties. PMI does not undertake to update any forward-looking statement that it may make from time to time, except in the normal course of its public disclosure obligations.

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A0.625Notesdue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.250Notesdue2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.750Notesdue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.375Notesdue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.750Notesdue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.875Notesdue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A0.125Notesdue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.125Notesdue2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.125Notesdue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.875Notesdue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.375Notesdue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A0.800Notesdue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.125Notesdue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A2.000Notesdue2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A1.875Notesdue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A6.375Notesdue2038Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A1.450Notesdue2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.375Notesdue2041Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.500Notesdue2042Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.875Notesdue2042Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.125Notesdue2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.875Notesdue2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A4.250Notesdue2044Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=pm_A3.750NotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

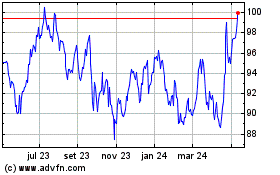

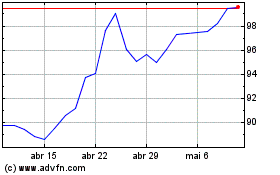

Philip Morris (NYSE:PM)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Philip Morris (NYSE:PM)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024