Court-Appointed Mediator Proposes CCAA Plan to Resolve Tobacco Product-Related Claims and Litigation in Canada

18 Outubro 2024 - 5:04AM

Business Wire

CCAA Plan Includes PMI’s Canadian

Affiliate RBH, Deconsolidated Since 2019; If RBH Reconsolidated,

Expected to be Incremental to Key PMI Financial Metrics

Regulatory News:

Philip Morris International Inc. (PMI) has been informed by its

deconsolidated Canadian affiliate, Rothmans, Benson & Hedges

Inc. (RBH), that the court-appointed mediator and monitor in RBH’s

Companies’ Creditors Arrangement Act (CCAA) proceeding filed a

proposed plan of compromise and arrangement (Proposed Plan)

outlining certain terms of a comprehensive resolution of tobacco

product-related claims and litigation in Canada against RBH and its

affiliates. The court-appointed mediator and monitors also filed

substantially similar proposed plans for Imperial Tobacco Canada

Limited and Imperial Tobacco Company Limited (together, ITL) and

JTI-Macdonald Corp. (JTIM).

Under the Proposed Plan, if ultimately approved and implemented,

RBH, ITL and JTIM (the Companies) would pay an aggregate settlement

amount of CAD 32.5 billion (approximately USD 23.5 billion). This

amount would be funded by an upfront payment equal to the

Companies’ cash and cash equivalents on hand in Canada plus certain

court deposits (subject to an aggregate withholding of CAD 750

million (approximately USD 540 million) for working capital

inclusive of cash pledged as collateral) and annual payments based

on a percentage of the Companies’ net income after taxes (excluding

that generated by certain non-combustible products including

heat-not-burn, e-vapor and nicotine pouch products) until the

aggregate settlement amount is paid. As stated in the Proposed

Plan, the issue of allocation of the CAD 32.5 billion aggregate

settlement as between the Companies in the CCAA proceedings remains

unresolved.

“After years of mediation, we welcome this important step

towards the resolution of long-pending tobacco product-related

litigation in Canada,” said Jacek Olczak, Chief Executive Officer

of PMI. “Although important issues with the plan remain to be

resolved, we are hopeful that this legal process will soon

conclude, allowing RBH and its stakeholders to focus on the

future.”

Potential Impact on PMI Financials if RBH

Reconsolidated

- Beginning with the first quarter of 2019, and to date, PMI’s

reported and adjusted EPS, net debt and other financial results

exclude RBH.

- The reconsolidation of RBH’s financial results after the plan

is implemented would be subject to the final terms of the Proposed

Plan and U.S. GAAP. We estimate reconsolidation would be

incremental to PMI’s cash and equivalents, cash flow, adjusted

EBITDA, adjusted operating income, and adjusted EPS numbers.

- RBH has not paid dividends to PMI or otherwise since May 2015.

As of June 30, 2024, RBH held approximately CAD 5.5 billion

(approximately USD 4 billion) in cash and cash equivalents.

- For the full year 2023, RBH reported 5.1 billion domestic

cigarette shipment volumes, CAD 1.2 billion (approximately USD 900

million) in net revenues, and held approximately 36% volume share

of the cigarette category in Canada. Smoke-free products IQOS and

VEEV are also commercialized by RBH in Canada.

Select Terms of Proposed Plan, Which Remain Subject to

Approvals

- The Proposed Plan, broadly speaking, would release claims

against RBH and its affiliates, including PMI and its indemnitees,

relating to the manufacture, marketing, sale, or use of or exposure

to, RBH’s combustible and traditional smokeless tobacco products

based on conduct prior to the effective date of the Proposed Plan;

related litigation would also be dismissed - bringing an end to all

pending tobacco product litigation in Canada, including class

actions brought in different provinces and, beginning in 2001,

health care cost recovery actions brought by each of the

Provinces.

- If the Proposed Plan is approved and implemented, RBH, ITL, and

JTIM would pay an aggregate amount of CAD 32.5 billion

(approximately USD 23.5 billion) into trusts for the benefit of

claimants, comprising two primary components:

- upfront contribution equal to the Companies’ cash and cash

equivalents on hand plus certain court deposits, with a withholding

of CAD 750 million (approximately 540 million USD) for working

capital inclusive of cash pledged as collateral (to be allocated

among the Companies); the Proposed Plan projects that the total

industry upfront contribution would be CAD 12.5 billion as at 31

December 2024, after the CAD 750 million withheld working capital

amount is deducted.

- annual contributions determined by reference to a percentage of

the Companies’ (Canadian affiliates’ only) “net after-tax income”

(NATI, as defined in the Proposed Plan and excluding that generated

by alternative products, including heat-not-burn, e-vapor and

nicotine pouch products) until the aggregate amount is paid in

full. Annual contributions start at 85% of NATI, with a

five-percentage point reduction in NATI every five years until

reaching 70%. Annual contributions are contingent on positive NATI

of the Companies. Such payments and obligations concern only the

Canadian affiliates and not the ultimate parent company PMI.

- As stated in the Proposed Plan, the issue of allocation of the

CAD 32.5 billion aggregate settlement as between the Companies in

the CCAA proceedings remains unresolved.

- Alternative product businesses would be transferred to an RBH

affiliate and not factored into the calculation of the annual

contribution payments described above.

- The Proposed Plan, including the terms described above, remains

subject to any further negotiation by the parties and CCAA court

orders, voting by claimants, and approval by the CCAA court.

According to a schedule proposed by the court-appointed mediator

and monitors, voting on the Proposed Plan would occur in December

2024. If accepted by claimants, a hearing to consider approval of

the Proposed Plan would then be expected in the first half of

2025.

Matters Relating to Potential Asset Impairment

- The carrying value of PMI’s equity interest in RBH is in line

with the fair value determined at the date of deconsolidation,

$3.28 billion, subject only to ongoing adjustments for the effect

of foreign currency exchange rates.

- If the Proposed Plan is approved and implemented, the fair

value of PMI’s continuing investment in RBH will be dependent on

its final terms, and any allocation of responsibility for funding

the aggregate settlement amount among the Companies.

These or similar or related developments may have a material

adverse impact on the fair value of PMI’s continuing investment in

RBH and may result in non-cash impairment charges, which could be

material to PMI.

CCAA Process and Deconsolidation of RBH by PMI in

2019

- In March 2019, RBH obtained an initial order from the Ontario

Superior Court of Justice granting, among other things, protection

under the CCAA. The CCAA process allows RBH to conduct its business

in the ordinary course while restructuring its affairs, subject to

the terms of the initial order of the CCAA court, as amended.

- As RBH previously announced, obtaining creditor protection

became necessary following the Court of Appeal of Quebec’s 2019

issuance of its judgments in two class actions against RBH, ITL,

and JTIM. PMI is not a party to these cases.

- As part of the CCAA process, the CCAA court imposed a

comprehensive stay of all tobacco product-related litigation

pending in Canada against RBH and PMI, thereby enabling RBH to seek

resolution of all such litigation in the CCAA proceeding. That stay

remains in place until October 31, 2024, and is expected to be

extended.

- As a result of RBH’s March 2019 CCAA filing, and under U.S.

GAAP, PMI deconsolidated RBH from its financial statements and

recorded its continuing investment in RBH as an equity security on

its balance sheet at the fair value of $3.28 billion.

Information regarding RBH’s CCAA proceedings, including copies

of all court orders made and the Proposed Plan, will be available

on the Monitor’s website here. The information on this website is

not, and shall not be deemed to be, part of this press release or

incorporated into any filings we make with the SEC.

Philip Morris International: Delivering a Smoke-Free

Future

Philip Morris International (PMI) is a leading international

tobacco company, actively delivering a smoke-free future and

evolving its portfolio for the long term to include products

outside of the tobacco and nicotine sector. The company’s current

product portfolio primarily consists of cigarettes and smoke-free

products. Since 2008, PMI has invested over $12.5 billion to

develop, scientifically substantiate and commercialize innovative

smoke-free products for adults who would otherwise continue to

smoke, with the goal of completely ending the sale of cigarettes.

This includes the building of world-class scientific assessment

capabilities, notably in the areas of pre-clinical systems

toxicology, clinical and behavioral research, as well as

post-market studies. In 2022, PMI acquired Swedish Match – a leader

in oral nicotine delivery – creating a global smoke-free champion

led by the companies’ IQOS and ZYN brands. The U.S. Food and Drug

Administration has authorized versions of PMI’s IQOS devices and

consumables and Swedish Match’s General snus as Modified Risk

Tobacco Products and renewal applications for these products are

presently pending before the FDA. As of June 30, 2024, PMI's

smoke-free products were available for sale in 90 markets, and PMI

estimates that 36.5 million adults around the world use PMI's

smoke-free products. Smoke-free business accounted for

approximately 38% of PMI’s total first-half 2024 net revenues. With

a strong foundation and significant expertise in life sciences, PMI

announced in February 2021 its ambition to expand into the wellness

and healthcare area and aims to enhance life through the delivery

of seamless health experiences. "PMI" refers to Philip Morris

International Inc. and its subsidiaries. For more information,

please visit www.pmi.com and www.pmiscience.com.

Forward-Looking and Cautionary Statements

This press release contains projections of future results and

goals and other forward-looking statements, including statements

regarding the timing, likelihood, and impact to PMI from the

Proposed Plan and related allocation arrangements, including the

possibility of a material asset impairment; expected costs and

benefits of a resolution of the proceedings in Canada including the

CCAA proceedings; the likelihood and impact of reconsolidating RBH;

the extension of stays for pending litigation; and related plans

and strategies. Achievement of future results is subject to risks,

uncertainties and inaccurate assumptions. In the event that risks

or uncertainties materialize, or underlying assumptions prove

inaccurate, actual results could vary materially from those

contained in such forward-looking statements. Pursuant to the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995, PMI is identifying important factors that, individually or

in the aggregate, could cause actual results and outcomes to differ

materially from those contained in any forward-looking statements

made by PMI. The factors that may adversely impact the anticipated

outcomes include, among others: the occurrence of any event, change

or other circumstances that could give rise to the modification or

termination of the Proposed Plan; the outcome of any legal

proceedings that may be instituted against the parties or others

related to the addressed proceedings; conditions to the resolution

of the proceedings that may not be satisfied, or the required

approvals may not be obtained on the terms expected or on the

anticipated schedule; the parties' ability to meet expectations

regarding the timing, completion and other elements of the

proceedings may be different than currently planned; and the

possibility that the expected benefits of the resolution of the

proceedings may not materialize in the expected manner or

timeframe, if at all. PMI is further subject to other risks

detailed from time to time in its publicly filed documents,

including PMI's Annual Report on Form 10-K for the fourth quarter

and year ended December 31, 2023, and the Quarterly Report on Form

10-Q for the second quarter ended June 30, 2024. PMI cautions that

the foregoing list of important factors is not a complete

discussion of all potential risks and uncertainties. PMI does not

undertake to update any forward-looking statement that it may make

from time to time, except in the normal course of its public

disclosure obligations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241018288717/en/

Philip Morris International

Investor Relations: Stamford, CT: +1 (203) 905 2413 Lausanne:

+41 582 424 666 Email: InvestorRelations@pmi.com

Media: David Fraser Lausanne: +41 582 424 500 Email:

David.Fraser@pmi.com

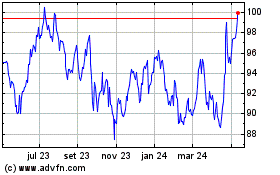

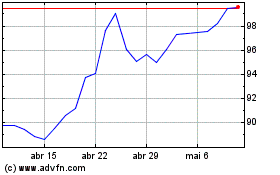

Philip Morris (NYSE:PM)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Philip Morris (NYSE:PM)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024