Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

30 Junho 2023 - 8:42AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or 15d-16 of

the Securities Exchange Act of 1934

For the month of June, 2023

PRUDENTIAL PUBLIC LIMITED COMPANY

(Translation

of registrant's name into English)

13/F, One International Finance Centre,

1 Harbour View Street, Central,

Hong Kong, China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual

reports

under

cover Form 20-F or Form 40-F.

Form

20-F X

Form 40-F

Indicate

by check mark whether the registrant by furnishing the

information

contained

in this Form is also thereby furnishing the information to

the

Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of

1934.

Yes

No X

If

"Yes" is marked, indicate below the file number assigned to the

registrant

in

connection with Rule 12g3-2(b): 82-

The following text is the text of an announcement released to the

Stock Exchange of Hong Kong Limited on 30 June 2023 pursuant to

rule 17.06A of the Rules Governing the Listing of Securities (the

"Listing Rules") on the Stock Exchange of Hong Kong.

Hong

Kong Exchanges and Clearing Limited, The Stock Exchange of Hong

Kong Limited and the Singapore Exchange Securities Trading Limited

take no responsibility for the contents of this announcement, make

no representation as to its accuracy or completeness and expressly

disclaim any liability whatsoever for any loss howsoever arising

from or in reliance upon the whole or any part of the contents of

this announcement.

30 June

2023

(Hong Kong Stock

Code 2378)

GRANT OF SHARE AWARDS

SUPPLEMENTAL ANNOUNCEMENT

Reference

is made to the announcement of Prudential plc ("Prudential") issued

on 22 May 2023 regarding grant of share awards (the "May

Announcement"). As the May Announcement contained a few inadvertent

errors, the Board wishes to clarify by way of a supplemental

announcement as set out below.

This announcement is made pursuant to Rule 17.06A of the Rules

Governing the Listing of Securities (the "Listing Rules") on The

Stock Exchange of Hong Kong Limited.

Prudential announces that on 22 May 2023, an award (the "Award")

was granted over a total of 199,991 new ordinary shares of Prudential

to an employee participant under the Prudential Long Term Incentive

Plan (the "PLTIP"), who is not a director of

Prudential.

A summary is set out below:

|

Date of grant

|

:

|

22 May 2023

|

|

Number of shares under Award granted

|

:

|

199,991

|

|

Purchase price of the Award granted

|

:

|

Nil

|

|

Closing price of the shares on the date of grant

|

:

|

HK$ 114.3 per share

|

|

Vesting period of the Award granted

|

:

|

The vesting period is three years from the date of

grant.

|

|

Performance targets and clawback mechanism

|

:

|

Performance Targets: The PLTIP has stretching performance

conditions aligned to the strategic priorities of the Prudential

Group. The performance period is 1 January 2023 - 31 December

2025. The conditions are summarised below, with confirmation

of the threshold requirements, which result in 20% of the award

element vesting:

|

|

Performance Target

|

Weighting

|

Summary Description

|

|

Total Shareholder Return (TSR)

|

35%

|

Measured on a ranked basis over three years relative to a peer

group of 12 other insurance companies. Threshold is a median

ranking

|

|

Return on Embedded Value (RoEV)

|

40%

|

RoEV will be calculated as the total EEV operating profit as a

percentage of the average EEV basis shareholders' equity, with a

threshold return of 9.2%

|

|

Group GWS Operating Capital Generation

|

5%

|

Cumulative GWS operating capital generation. The threshold figure

for this metric will be published in the Annual Report for the

final year of the performance period

|

|

Group GIECA Surplus Generation

|

5%

|

Cumulative GIECA measure. The threshold figure for this metric will

be published in the Annual Report for the final year of the

performance period

|

|

Carbon Reduction Measure

|

5%

|

Reduction of weighted average carbon intensity, with a threshold of

a 25% reduction

|

|

Diversity Measure

|

5%

|

Measured as a % of the Core Group of leaders that is female at the

end of 2025, with a threshold 35% representation

|

|

Conduct Measure

|

5%

|

Through appropriate management action, ensure there are no

significant conduct/ culture / governance issues that could result

in significant capital add-ons or material fines, with a threshold

of partial achievement

|

|

Total

|

100%

|

|

|

Clawback mechanism: Clawback may be applied where there are the

following exceptional circumstances at any time before the fifth

anniversary of the award date:

● there

is a materially adverse restatement of Prudential's published

accounts in respect of any financial year which (in whole or part)

comprised part of that five year period;

● it

becomes apparent that a material breach of a law or regulation took

place during that five year period which resulted in significant

harm to Prudential or its reputation;

● the

calculation of the number of shares subject to an award or of the

extent to which any performance conditions have been satisfied or

the Remuneration Committee's determination of the extent to which

an award vests was based on erroneous or misleading data or was

otherwise incorrect; or

● the

participant's personal conduct during the relevant performance

period in respect of that award has:

o resulted

in Prudential, or any member of its group, suffering significant

reputational or financial damage;

o the

potential to cause significant reputational or financial damage to

Prudential or any member of its group; and/or

resulted in the material breach of the Prudential group's business

code of conduct or law.

|

|

|

|

|

As at the date of this announcement, the maximum number of shares

available for future grant under the scheme mandate of the plan and

any other plans is 201,882,802.

Reference is also made to the two announcements of Prudential

issued on 2 June 2023 regarding certain grants of share awards (the

"June Announcements"). Due to inadvertent oversight, the June

Announcements misstated the maximum number of shares available for

future grant. The Board wishes to clarify that, as at 2 June

2023, the maximum number of shares available for future grant was

201,378,255 under the scheme mandate of the plan and any other

plans and 39,478,587 under the service provider sublimit of the

plan and any other plans.

About Prudential plc

Prudential plc provides life and health insurance and asset

management in 24 markets across Asia and Africa. The

business helps people get the most out of life, by making

healthcare affordable and accessible and by promoting financial

inclusion. Prudential protects people's wealth, helps them grow

their assets, and empowers them to save for their goals. The

business has dual primary listings on the Stock Exchange

of Hong Kong (2378) and the London Stock Exchange (PRU).

It also has a secondary listing on the Singapore Stock Exchange

(K6S) and a listing on the New York Stock Exchange (PUK) in the

form of American Depositary Receipts. It is a constituent of the

Hang Seng Composite Index and is also included for trading in the

Shenzhen-Hong Kong Stock Connect programme and Shanghai-Hong

Kong Stock Connect programme.

Prudential is not affiliated in any manner with Prudential

Financial, Inc. a company whose principal place of business is

in the United States of America, nor with The Prudential

Assurance Company Limited, a subsidiary of M&G plc, a company

incorporated in the United Kingdom. https://www.prudentialplc.com/

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

Date: 30 June

2023

|

|

PRUDENTIAL

PUBLIC LIMITED COMPANY

|

|

|

|

|

|

By:

/s/ Sylvia Edwards

|

|

|

|

|

|

Sylvia

Edwards

|

|

|

Group

Deputy Secretary

|

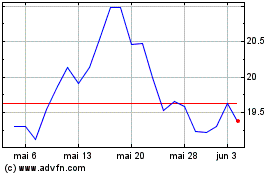

Prudential (NYSE:PUK)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Prudential (NYSE:PUK)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025