Q2's New Consumer Survey Reveals People of All Ages Want Personalized Banking

12 Agosto 2024 - 11:00AM

Business Wire

More than 65 percent of consumers say they are

comfortable with their financial institutions using their data to

personalize their banking experiences and AI technology for fraud

protection

Q2 Holdings Inc., a leading provider of digital transformation

solutions for financial services, today announced the release of a

new Harris Poll consumer report, The Personal Bank: Delivering

personalized experiences across generations, which reveals

consumers across generations have similar perspectives, behaviors

and preferences about banking.

The study, commissioned by Q2 and executed by The Harris Poll,

provides insights on the state of consumer banking preferences

among generations, including Gen Z (ages 18-26), Millennials (ages

27-42) and Gen X/Baby Boomers (ages 43 and up). The survey focused

on topics ranging from digital banking usage, preferences for AI,

and fraud and security.

According to the survey results, 74 percent of respondents

across generations asked for more personalized banking experiences,

and they are comfortable with their financial institution using

data to deliver what they need. The study also reveals that 70

percent of consumers said they don’t mind the use of artificial

intelligence (AI) technology for fraud protection.

Other key findings from the survey:

- 70% of consumers across all generations have expressed their

belief in the banking industry's trustworthiness based on personal

experiences.

- 41% of consumers affirmed their financial institutions provided

occasional support or choices that reflected their dreams and

priorities.

- 66% of consumers are comfortable with their financial

institution using their data to personalize their experiences.

- 48% demand higher levels of security for their financial data

in the future.

- 60% of Gen Zers said they noticed a positive impact on their

financial habits or goals due to personalized digital banking

features, compared to just 33% of Gen Xers and Baby Boomers.

“The digital landscape is continuing to shift and evolve for

banks and credit unions,” said VP, Product Management at Q2,

Anthony Ianniciello. “The goal of this survey is to help financial

institutions better understand the needs of their consumers and

that, while there is a large focus on generational differences,

consumers across all generations are asking for the same things:

personalized experiences, increased security, and an increased use

of AI.”

“Understanding these needs is the first step in building banking

products that meet consumers in every life stage, while helping

banks and credit unions better know, serve, and grow their account

holder relationships,” said Ianniciello.

To read the full report, please visit: The Personal Bank:

Delivering personalized experiences across generations

About Q2 Holdings, Inc.

Q2 is a leading provider of digital transformation solutions for

financial services, serving banks, credit unions, alternative

finance companies, and fintechs in the U.S. and internationally. Q2

enables its financial institution and fintech customers to provide

comprehensive, data-driven digital engagement solutions for

consumers, small businesses and corporate clients. Headquartered in

Austin, Texas, Q2 has offices worldwide and is publicly traded on

the NYSE under the stock symbol QTWO. To learn more, please visit

Q2.com. Follow us on LinkedIn and X to stay up to date.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240812078278/en/

Maria Gari Q2 Holdings, Inc. Maria.gari@q2.com 315-657-0041

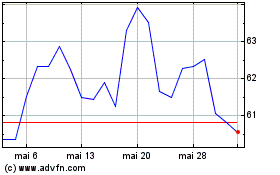

Q2 (NYSE:QTWO)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Q2 (NYSE:QTWO)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024