Updated Research Report on Deutsche Bank - Analyst Blog

19 Fevereiro 2014 - 6:55PM

Zacks

On Feb 14, 2014, we issued an updated research report on

Deutsche Bank AG (DB). The company recently

reported dismal fourth-quarter 2013 results. With elevated

litigation related expenses, the company recorded higher provision

for loan losses along with the deteriorating top line. Yet prudent

expense management led to a fall in expenses.

Deutsche Bank posted net loss of €965 million ($1.3 billion) in the

fourth quarter of 2013 as compared with a loss of €2.5 billion

($3.4 million) in the prior-year quarter. Furthermore, the bank

reported net revenue of €6.6 billion ($9.0 billion) in the reported

quarter, down 16% year over year.

Though organic growth remained a key strength at Deutsche Bank as

reflected by its revenue growth story in the past with a CAGR of

19.9% over the five years (2008–2012), revenues dropped 5% in 2013,

primarily due to a downturn in corporate banking and securities

business. Continuation of such a trend will become a hindrance for

bottom-line growth.

However, despite recording a CAGR of 11.3% over the 5 years

(2008–2012), non-interest expenses declined 11% in 2013, reflecting

the company’s successful expense reduction initiatives. Deutsche

Bank contemplates making investments of approximately €4 billion

and undertaking other measures to help achieve full run-rate annual

cost savings of €4.5 billion by 2015.

Amid the worldwide economic volatility, the company is focused on

building its capital level. Strategy 2015+ efforts are encouraging

and we expect such efforts to help improve its operating

efficiency.

Following fourth-quarter 2013 results, the Zacks Consensus Estimate

remained stable at $5.08 for 2013, over the last 30 days, while the

Zacks Consensus Estimate declined about 1% to $6.14 for 2014.

Hence, Deutsche Bank currently carries a Zacks Rank #3 (Hold).

Key Picks from the Sector

Some better ranked foreign stocks worth considering include

Shinhan Financial Group Company Ltd (SHG) with a

Zacks Rank #1 (Strong Buy), while The Royal Bank of

Scotland Group plc (RBS) and Lloyds Banking Group

plc (LYG) carry a Zacks Rank #2 (Buy).

DEUTSCHE BK AG (DB): Free Stock Analysis Report

LLOYDS BANK GRP (LYG): Free Stock Analysis Report

ROYAL BK SC-ADR (RBS): Free Stock Analysis Report

SHINHAN FIN-ADR (SHG): Get Free Report

To read this article on Zacks.com click here.

Zacks Investment Research

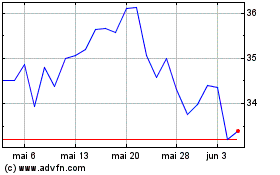

Shinhan Financial (NYSE:SHG)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Shinhan Financial (NYSE:SHG)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024