UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

______________

FORM 11-K

________________________

| | | | | |

(Mark One): |

| |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the fiscal year ended December 31, 2023 |

| |

| OR |

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| For the transition period from __________ to __________ |

| |

| Commission file number 1-04851 |

| |

| |

| |

| A. | Full title of the plan and the address of the plan, if different from that of the issuer named below: |

| THE SHERWIN-WILLIAMS COMPANY 401(K) PLAN |

| |

| |

| B. | Name of issuer of the securities held pursuant to the plan and the address of its principal executive office: |

| | THE SHERWIN-WILLIAMS COMPANY, 101 W. PROSPECT AVENUE, CLEVELAND, OHIO 44115 |

THE SHERWIN-WILLIAMS COMPANY 401(K) PLAN

Table of Contents

| | | | | |

| Page |

| |

| Report of Independent Registered Public Accounting Firm | |

| |

| Financial Statements | |

| Statements of Net Assets Available for Benefits | |

| Statement of Changes in Net Assets Available for Benefits | |

| Notes to Financial Statements | |

| Supplemental Schedule - Schedule H, Line 4(i)-Schedule of Assets (Held at End of Year) | |

| |

| Signature | |

| |

| Exhibit Index | |

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Plan Participants and Administrative Committee of

The Sherwin-Williams Company 401(k) Plan

Cleveland, Ohio

Opinion on the Financial Statements

We have audited the accompanying statements of net assets available for benefits of The Sherwin-Williams Company 401(k) Plan (the "Plan") as of December 31, 2023 and 2022, the related statement of changes in net assets available for benefits for the year ended December 31, 2023, and the related notes (collectively referred to as the "financial statements"). In our opinion, the financial statements present fairly, in all material respects, the net assets available for benefits of the Plan as of December 31, 2023 and 2022, and the changes in net assets available for benefits for the year ended December 31, 2023, in conformity with accounting principles generally accepted in the United States of America

Basis for Opinion

These financial statements are the responsibility of the Plan's management. Our responsibility is to express an opinion on the Plan's financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) ("PCAOB") and are required to be independent with respect to the Plan in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether due to error or fraud. The Plan is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. As part of our audits we are required to obtain an understanding of internal control over financial reporting but not for the purpose of expressing an opinion on the effectiveness of the Plan’s internal control over financial reporting. Accordingly, we express no such opinion.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Supplemental Information

The supplemental Schedule H, Line 4(i) – Schedule of Assets (Held at End of Year) as of December 31, 2023 has been subjected to audit procedures performed in conjunction with the audit of The Sherwin-Williams Company 401(k) Plan’s financial statements. The supplemental schedule is the responsibility of the Plan’s management. Our audit procedures included determining whether the information presented in the supplemental schedule reconciles to the financial statements or the underlying accounting and other records, as applicable, and performing procedures to test the completeness and accuracy of the information presented in the supplemental schedule. In forming our opinion on the supplemental schedule, we evaluated whether the supplemental schedule, including its form and content, is presented in conformity with the Department of Labor’s Rules and Regulations for Reporting and Disclosure under the Employee Retirement Income Security Act of 1974. In our opinion, the supplemental schedule is fairly stated in all material respects in relation to the financial statements as a whole.

/s/ Crowe LLP

We have served as the Plan's auditor since 2015.

New York, New York

June 13, 2024

THE SHERWIN-WILLIAMS COMPANY 401(K) PLAN

STATEMENTS OF NET ASSETS AVAILABLE FOR BENEFITS

| | | | | | | | | | | | | | |

| | December 31, |

| | 2023 | | 2022 |

| Investments, at fair value: | | | | |

| The Sherwin-Williams Company common stock | | $ | 5,826,369,430 | | | $ | 4,672,911,588 | |

| Mutual funds | | 487,393,015 | | | 870,956,718 | |

| Collective trust funds | | 3,589,860,480 | | | 2,599,459,158 | |

| Money market fund | | 111,088,845 | | | 101,146,207 | |

| Total | | 10,014,711,770 | | | 8,244,473,671 | |

| | | | |

| Receivables: | | | | |

| Notes receivable from participants | | 93,618,110 | | | 85,371,358 | |

| Contributions receivable from participants | | 9,874,668 | | | 8,745,505 | |

| Contributions receivable from The Sherwin-Williams Company | | 5,642,622 | | | 4,949,497 | |

| Other | | 5,479,840 | | | 294,177 | |

| Total | | 114,615,240 | | | 99,360,537 | |

| | | | |

| Net assets available for benefits | | $ | 10,129,327,010 | | | $ | 8,343,834,208 | |

See notes to financial statements.

THE SHERWIN-WILLIAMS COMPANY 401(K) PLAN

STATEMENT OF CHANGES IN NET ASSETS AVAILABLE FOR BENEFITS

| | | | | | | | |

| | Year Ended |

| | December 31, 2023 |

| Increases in net assets available for benefits: | | |

| Interest and dividend income on diversified investments | | $ | 33,209,750 | |

| Interest on Notes receivable from participants | | 5,263,320 | |

| Dividends on The Sherwin-Williams Company common stock | | 46,540,064 | |

| Contributions from participants | | 272,335,228 | |

| Contributions from The Sherwin-Williams Company | | 149,906,331 | |

| Other income | | 630,317 | |

| | 507,885,010 | |

| | |

| Decreases in net assets available for benefits: | | |

| Benefits paid directly to participants | | (777,622,021) | |

| Fees | | (2,939,373) | |

| | (780,561,394) | |

| | |

Net realized and unrealized appreciation in fair value of: | | |

| The Sherwin-Williams Company common stock | | 1,412,791,477 | |

| Diversified investments | | 609,949,904 | |

| | 2,022,741,381 | |

| | |

Net increase in net assets available for benefits before transfer related to plan merger | | 1,750,064,997 | |

| | |

| Transfer related to plan merger | | 35,427,805 | |

| | |

Net increase | | 1,785,492,802 | |

| | |

| Net assets available for benefits: | | |

| Beginning of year | | 8,343,834,208 | |

| End of year | | $ | 10,129,327,010 | |

See notes to financial statements.

THE SHERWIN-WILLIAMS COMPANY 401(K) PLAN

NOTES TO THE FINANCIAL STATEMENTS

December 31, 2023 and 2022

NOTE 1 - DESCRIPTION OF THE PLAN

General

The Sherwin-Williams Company 401(k) Plan (the Plan) is a defined contribution plan subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (ERISA). Any salaried employee of The Sherwin-Williams Company (the Company) or participating subsidiary and any employee in a group of employees to which coverage has been extended on a non-discriminatory basis by the Administration Committee is eligible for membership in the Plan provided the employee: (a) is a full-time or part-time employee of the Company or a subsidiary of the Company which has adopted the Plan; (b) is not a member of a collective bargaining unit which was recognized by the Company on the date coverage under the Plan is extended to the work group, division or subsidiary of the employee, unless and until such eligibility shall be extended to members of such collective bargaining unit by negotiations between an employer and the bargaining agent, and is not a member of a collective bargaining unit which is first recognized by an employer after the date coverage under the Plan is extended to the work group, division or subsidiary of the employee where such collective bargaining unit through its representative has agreed with an employer that the members of such collective bargaining unit shall no longer be eligible for membership in the Plan; and (c) is employed in the United States or is a United States citizen if not employed therein.

Effective January 1, 2024, the Plan was restated to incorporate prior amendments.

Enrollment

Eligible employees hired or rehired by the Company are automatically enrolled in the Plan. Employee contributions are established at 3% of pre-tax earnings. Eligible new hires may change the pre-selected enrollment option, including all or a portion of the contribution source to post-tax earnings or choose not to participate in the Plan prior to being automatically enrolled. If new hires choose not to change the automatic enrollment employee contribution level of 3%, the employee contribution level will increase at the beginning of each subsequent plan year by 1%, until either the employee individually changes the employee contribution level or the employee contribution level reaches the maximum automatic employee contribution level. The maximum automatic employee contribution level is 10%.

Employee Contributions

Participant contributions to the Plan are made through payroll deductions and credited to individual participant accounts. The maximum participant contribution is 50% of eligible earnings, subject to limitations imposed by law. Participants direct the investment of their contributions into various investment options offered by the Plan. In the absence of participant direction, contributions are directed to an age-appropriate T. Rowe Price target date retirement fund.

Employer Contributions

The Company makes matching contributions of 100% on the first 6% of eligible employee contributions beginning the quarter following the employees' one-year anniversary with the Company. Participants direct the investment of Company matching contributions into various investment options offered by the Plan. In the absence of participant direction, Company matching contributions are directed to Company common stock.

Investments

Investments in Company common stock and the diversified investments are participant directed. In the absence of participant direction, employee and Company contributions are directed as described above. Costs incidental to the purchase and sale of securities, such as brokerage fees, commissions, and stock transfer taxes, are borne by the respective funds.

Investment securities, including Company common stock, are exposed to various risks such as interest rate, market and credit risks. Due to the level of risk associated with certain investment securities, it is at least reasonably possible that changes in the values of investment securities will occur in the near term and that such changes could materially affect participants' account balances and the amounts reported in the Statements of Net Assets Available for Benefits.

Vesting

Participant contributions to the Plan are 100% vested.

Participants hired or rehired prior to January 1, 2017 are 100% vested in Company matching contributions. Participants hired or rehired on or after January 1, 2017 are 100% vested in Company matching contributions after completing three years of vesting

service. The vesting service period begins at a participant's hire or adjusted service date. There is no partial vesting. Participants that leave the Company before completing three years of vesting service forfeit all Company contributions made on their behalf.

Forfeitures

Forfeited balances of terminated participants’ unvested accounts are used to reduce future Company contributions. Forfeitures used to reduce Company contributions for the year ended December 31, 2023 were $3,393,541. Forfeited accounts were $438,630 and $822,901 at December 31, 2023 and 2022, respectively.

Notes Receivable from Participants

The Plan permits eligible employees to borrow from the vested benefit portion of their accounts up to the lesser of: (a) $50,000, reduced by certain outstanding loans to the eligible employee under the Plan, or (b) one half of the vested benefit portion of the eligible employee's account under the Plan. Notes receivable from participants are treated as a transfer between the other investment funds and the notes receivable from participants activity fund. Terms range from one to five years or up to ten years for the purchase of a primary residence. Notes receivable from participants are secured by the vested balance in the eligible employee's account and bear interest at the prime interest rate plus one percent. Principal and interest are paid ratably through payroll deductions and credited to the eligible employee's account.

Payment of Benefits and Withdrawals

Subject to Plan provisions, vested participant account balances are eligible to be paid upon retirement, death, or termination of employment. At such time, a participant is eligible to receive a lump-sum amount equal to the value of their vested interest or may choose from various other withdrawal options permitted by the Plan. Withdrawals are paid in cash, or at the option of the participant, shares of Company stock to the extent the participant's account balance is held in the Company Stock Fund. Participants also have the option to leave their vested account balance in the Plan, subject to certain limitations and required minimum distribution rules.

In-service withdrawals are available in certain limited circumstances, as defined by the Plan. Hardship withdrawals, which are regulated by the Internal Revenue Service, are permitted for participants incurring an immediate and heavy financial need, as defined by the Plan.

Administrative Fees

Costs and expenses of administering the Plan are primarily borne by the Company, with the exception of fees relating to participant loan activity and qualified domestic relations orders, which are borne by the eligible employees. At times, the Plan receives revenue credits from Fidelity Management Trust Company (the Trustee), which are recorded as Other income on the Statement of Changes in Net Assets Available for Benefits. The Plan uses revenue credits to pay for future administrative expenses.

Acquisitions

On July 1, 2022, the Company acquired Dur-A-Flex, Inc. The acquired employees became eligible to participate in the Plan on January 1, 2023. Effective May 1, 2023, the Dur-A-Flex, Inc. 401(k) Savings Plan was merged into the Plan resulting in a transfer of net assets in the amount of $35.4 million.

Additional Information

Further information about the Plan is contained in the Plan's Summary Plan Description (SPD). Copies of the SPD are available from the Administration Committee of the Company.

NOTE 2 - SIGNIFICANT ACCOUNTING POLICIES

Basis of Accounting

The accompanying financial statements of the Plan are prepared under the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (U.S. GAAP).

Use of Estimates

The preparation of financial statements in accordance with U.S. GAAP requires management to make estimates and assumptions that affect the amounts reported in the financial statements and accompanying notes and supplemental schedule. Actual results could differ from these estimates.

Investment Valuation

The Plan's investments are stated at fair value. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. See Note 3 for further details.

Income Recognition

Net realized and unrealized appreciation in the fair value of investments represents the change in the difference between the aggregate fair value and the cost of the Plan's investments, including investments bought, sold and held during the year.

Dividends are recorded on the ex-dividend date.

Payment of Benefits

Benefits are recorded when paid.

Notes Receivable from Participants

Notes receivable from participants are valued at their unpaid principal balance plus accrued interest.

NOTE 3 - FAIR VALUE

The Fair Value Measurements and Disclosures Topic of the Accounting Standards Codification (ASC) applies to the Plan's financial assets. The levels of the fair value hierarchy are as follows:

Level 1: Quoted prices in active markets for identical assets

Level 2: Significant other observable inputs

Level 3: Significant unobservable inputs

The following tables present the Plan's financial assets that are measured at fair value on a recurring basis, categorized using the fair value hierarchy as of December 31, 2023 and 2022: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair Value at December 31, 2023 | | Level 1 | | Level 2 | | Level 3 |

The Sherwin-Williams Company common stock | | $ | 5,826,369,430 | | | $ | 5,826,369,430 | | | | | |

Mutual funds | | 487,393,015 | | | 487,393,015 | | | | | |

Money market fund | | 111,088,845 | | | 111,088,845 | | | | | |

| Total assets in the fair value hierarchy | | 6,424,851,290 | | | $ | 6,424,851,290 | | | — | | | — | |

| Collective trust funds | | 3,589,860,480 | | | | | | | |

| Investments at fair value | | $ | 10,014,711,770 | | | | | | | |

| | | | | | | | |

| | Fair Value at December 31, 2022 | | Level 1 | | Level 2 | | Level 3 |

| The Sherwin-Williams Company common stock | | $ | 4,672,911,588 | | | $ | 4,672,911,588 | | | | | |

| Mutual funds | | 870,956,718 | | | 870,956,718 | | | | | |

| Money market fund | | 101,146,207 | | | 101,146,207 | | | | | |

| Total assets in the fair value hierarchy | | 5,645,014,513 | | | $ | 5,645,014,513 | | | — | | | — | |

| Collective trust funds | | 2,599,459,158 | | | | | | | |

| Investments at fair value | | $ | 8,244,473,671 | | | | | | | |

The fair value of The Sherwin-Williams Company common stock and Money market fund is based on quoted prices in active markets for identical securities.

The fair value of Mutual funds is based on quoted redemption values on national security exchanges on the last business day of the Plan year.

The Collective trust funds are measured at net asset value (NAV) using the practical expedient. In accordance with the Fair Value Measurement Topic of the ASC, investments that are measured at NAV using the practical expedient are not classified in the fair value hierarchy. The fair value amounts presented in this table are intended to permit reconciliation of the fair value hierarchy to the Statements of Net Assets Available for Benefits. There are no unfunded commitments, significant redemption limitations or restrictions on the ability to sell these funds.

NOTE 4 - INCOME TAX STATUS

The Plan has received a determination letter from the Internal Revenue Service (IRS) dated August 13, 2020, stating that the Plan is qualified under Section 401(a) of the Internal Revenue Code (the Code) and, therefore, the related trust is exempt from taxation. Once qualified, the Plan is required to operate in conformity with the Code to maintain its qualified status. Subsequent to this determination by the IRS, the Plan was amended. The Plan Administrator believes the Plan, as amended, is being operated in compliance with the applicable requirements of the Code and, therefore, believes the Plan is qualified and the related trust is tax-exempt.

U.S. GAAP requires Plan management to evaluate uncertain tax positions taken by the Plan. The financial statement effects of a tax position are recognized when the position is more likely than not, based on the technical merits, to be sustained upon examination by the IRS. The Plan Administrator has analyzed the tax positions taken by the Plan, and has concluded that as of December 31, 2023, there are no uncertain positions taken or expected to be taken. The Plan has recognized no interest or penalties related to uncertain tax positions. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress. The Plan Administrator believes it is no longer subject to income tax examinations for years prior to 2020.

NOTE 5 - PRIORITIES ON TERMINATION OF THE PLAN

Although it has not expressed any intent to do so, the Company reserves the right, by action of its Board of Directors, to amend, modify, suspend or terminate the Plan. No such action would allow funds held in trust by the Trustee or the income thereon to be used for purposes other than for the exclusive benefit of participants or their beneficiaries. In the event of Plan termination, participants would become 100% vested in their accounts.

NOTE 6 - TRANSACTIONS WITH PARTIES-IN-INTEREST

The Plan held 18,680,108 and 19,689,197 shares of the Company's common stock as of December 31, 2023 and 2022, respectively. During the year ended December 31, 2023, the Plan had dividend income on shares of the Company's common stock of $46.5 million, and purchases and sales of shares of the Company's common stock of approximately $260 million and $450 million, respectively.

Certain Plan investments are shares of mutual or collective trust funds managed by the Trustee or an affiliate of the Trustee, and therefore qualify as party-in-interest transactions. Fees paid during the year for services rendered by the Trustee or an affiliate of the Trustee constitute party-in-interest transactions. In addition, the Plan holds notes receivable representing participant loans, which qualify as party-in-interest transactions.

THE SHERWIN-WILLIAMS COMPANY 401(K) PLAN

SCHEDULE H, LINE 4(i)-SCHEDULE OF ASSETS (HELD AT END OF YEAR)

AS OF DECEMBER 31, 2023

EIN: 34-0526850

PLAN NUMBER: 001

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | (c) | | | | |

| | (b) | | Description of Investment Including | | | | |

| | Identity of Issue, Borrower, | | Maturity Date, Rate of Interest, Collateral, | | (d) | | (e) |

| (a) | | Lessor or Similar Party | | Par or Maturity Value | | Cost | | Current Value |

| Common Stock | | | | |

| * | | The Sherwin-Williams Company | | Company Stock Fund (18,680,108 shares) | | ** | | $ | 5,826,369,430 | |

| | | | | | | | |

| Mutual Funds | | | | |

| | Vanguard Group, Inc. | | Vanguard FTSE All-World ex-US Index Fund Institutional Plus Shares | | ** | | 112,985,225 | |

| | Virtus Investment Partners | | Virtus Ceredex Large-Cap Value Equity Fund | | ** | | 70,986,272 | |

| | Vanguard Group, Inc. | | Vanguard Wellington Fund Admiral Shares | | ** | | 69,203,255 | |

| * | | Fidelity Investments | | Fidelity® Puritan® Fund | | ** | | 59,759,960 | |

| * | | Fidelity Investments | | Fidelity® International Capital Appreciation Fund | | ** | | 59,601,687 | |

| | Vanguard Group, Inc. | | Vanguard Wellesley® Income Fund Admiral™ Shares | | ** | | 41,031,965 | |

| | Vanguard Group, Inc. | | Vanguard Inflation-Protected Securities Fund Institutional Shares | | ** | | 27,964,529 | |

| * | | Fidelity Investments | | Fidelity® Limited Term Government Fund | | ** | | 23,774,903 | |

| | PIMCO Investments LLC | | PIMCO Low Duration Fund Institutional Class | | ** | | 17,388,947 | |

| | PIMCO Investments LLC | | PIMCO All Asset Fund Institutional Class | | ** | | 4,696,272 | |

| | | | | | | | |

| Collective Trust Funds | | | | |

| * | | Fidelity Management Trust Company | | Fidelity® Contrafund® Commingled Pool | | ** | | 429,096,406 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2030 Fund | | ** | | 334,650,247 | |

| | Vanguard Group, Inc. | | Vanguard Institutional 500 Index Trust | | ** | | 333,859,080 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2035 Fund | | ** | | 315,679,081 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2040 Fund | | ** | | 280,369,294 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2025 Fund | | ** | | 260,430,040 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2050 Fund | | ** | | 250,757,496 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2045 Fund | | ** | | 248,674,829 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2055 Fund | | ** | | 210,316,301 | |

| * | | Fidelity Management Trust Company | | Managed Income Portfolio II Class 3 | | ** | | 159,539,741 | |

| | Vanguard Group, Inc. | | Vanguard Institutional Total Bond Market Index Trust | | ** | | 154,877,782 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2060 Fund | | ** | | 126,319,241 | |

| | Wellington Trust Company | | WTC-CIF II Small Cap Opportunities Portfolio | | ** | | 116,924,533 | |

| * | | Fidelity Management Trust Company | | Fidelity® Mid-Cap Stock Commingled Pool | | ** | | 105,753,123 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2020 Fund | | ** | | 93,431,174 | |

| * | | Fidelity Management Trust Company | | Fidelity® Low-Priced Stock Commingled Pool | | ** | | 75,803,478 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2065 Fund | | ** | | 33,243,061 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2015 Fund | | ** | | 29,805,236 | |

| | Invesco Trust Company | | Invesco Core Plus Fixed Income Fund | | ** | | 12,901,418 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2010 Fund | | ** | | 9,559,165 | |

| | T. Rowe Price Trust Company | | T. Rowe Price Retirement 2005 Fund | | ** | | 7,869,754 | |

| | | | | | | | |

| Other | | | | |

| * | | Fidelity Investments | | Fidelity® Money Market Government Portfolio | | ** | | 111,088,845 | |

| * | | Participant Loans | | Notes Receivable from participants with maturity dates through 2033

and interest rates ranging from of 3.25% to 10.5%

| | ** | | 93,618,110 | |

| | | | | | | | |

| | | | | | | | $ | 10,108,329,880 | |

| | | | | | | | |

| * | | Represents a party-in-interest | | | | |

| ** | | Cost information is not required for participant-directed investments | | | | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Plan trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on their behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | THE SHERWIN-WILLIAMS COMPANY 401(K) PLAN |

| | |

| | |

| June 13, 2024 | By: | /s/ G.P. Sofish |

| | G.P. Sofish |

| | Senior Vice President - Human Resources |

| | |

| | |

EXHIBIT INDEX

| | | | | | | | | | | | | | |

Exhibit

Number | | Exhibit Description | | Sequential Page Number

Where Exhibit Can Be Found |

| | | | |

| 23 | | Consent of Independent Registered Public Accounting Firm | | 14 |

| | | | |

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the incorporation by reference in Registration Statement Nos. 2-80510, 033-62229, 333-105211 and 333-152443 on Forms S-8 of The Sherwin-Williams Company of our report dated June 13, 2024 appearing in this Annual Report on Form 11-K of The Sherwin-Williams Company 401(k) Plan for the year ended December 31, 2023.

/s/ Crowe LLP

New York, New York

June 13, 2024

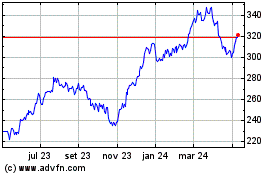

Sherwin Williams (NYSE:SHW)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

Sherwin Williams (NYSE:SHW)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024