Tredegar Corporation (NYSE:TG, also the "Company" or "Tredegar")

today reported first quarter financial results for the period ended

March 31, 2024.

First quarter 2024 net income (loss) was $3.3 million ($0.10 per

diluted share) compared to net income (loss) of $(1.0) million

($(0.03) per diluted share) in the first quarter of 2023. Net

income (loss) from ongoing operations, which excludes special

items, was $5.6 million ($0.16 per diluted share) in the first

quarter of 2024 compared with $2.5 million ($0.07 per diluted

share) in the first quarter of 2023. A reconciliation of net income

(loss), a financial measure calculated in accordance with U.S.

generally accepted accounting principles (“GAAP”), to net income

(loss) from ongoing operations, a non-GAAP financial measure, for

the three months ended March 31, 2024 and 2023, is provided in Note

(a) to the Financial Tables in this press release.

First Quarter Financial Results Highlights

- Earnings before interest, taxes, depreciation and amortization

("EBITDA") from ongoing operations for Aluminum Extrusions was

$12.5 million in the first quarter of 2024 versus $14.6 million in

the first quarter of last year and $8.0 million in the fourth

quarter of 2023.

- Sales volume was 33.8 million pounds in the first quarter of

2024 versus 37.6 million pounds in the first quarter of last year

and 32.9 million pounds in the fourth quarter of 2023.

- Open orders at the end of the first quarter of 2024 were

approximately 15 million pounds (versus 27 million pounds in the

first quarter of 2023 and 14 million pounds at the end of the

fourth quarter of 2023). Net new orders increased 61% and 12% in

the first quarter of 2024 versus the first quarter of 2023 and

fourth quarter of 2023, respectively.

- EBITDA from ongoing operations for PE Films was $6.9 million in

the first quarter of 2024 versus $1.8 million in the first quarter

of 2023 and $4.5 million in the fourth quarter of 2023. Sales

volume was 10.0 million pounds in the first quarter of 2024 versus

7.4 million pounds in the first quarter of 2023 and 8.5 million

pounds in the fourth quarter of 2023.

- EBITDA from ongoing operations for Flexible Packaging Films

(also referred to as "Terphane") was $2.0 million during the first

quarter of 2024 versus $1.4 million in the first quarter of 2023

and $2.3 million during the fourth quarter of 2023. Sales volume

was 22.0 million pounds in the first quarter of 2024 versus 19.8

million pounds in the first quarter 2023 and 22.8 million pounds in

the fourth quarter of 2023. See the Status of Agreement to Sell

Terphane section of this report for information on the sale of

Terphane.

John Steitz, Tredegar’s president and chief executive officer,

said, “During the first quarter of 2024, we recognized a meaningful

profit from ongoing operations for the first time since the first

quarter of last year. The bottom of the recent severe down cycle

for Bonnell, which we believe was a residual impact of the pandemic

and started in the second half of 2022, appears to have occurred in

the third quarter of 2023. Net new orders and sales volume have

increased sequentially in each quarter since that time. In

addition, favorable preliminary determinations have been made by

U.S. authorities regarding a trade case backed by a coalition of

members of the Aluminum Extruders Council. PE Films EBITDA during

the first quarter of 2024 was exceptional at $6.9 million compared

with $8.6 million during the last six months of 2023.”

Mr. Steitz further stated, “The process to complete the closing

of our agreement to sell Terphane continues to advance as planned,

including the review required by competition authorities in Brazil.

Meanwhile, the recovery that we believe is underway in our business

units is having a favorable impact on overall operating results and

improving our outlook of net financial leverage, which we believe

peaked at 3.9x Credit EBITDA at the end of the fourth quarter of

2023 and was 3.8x at the end of the first quarter of this year. The

liquidity available under our new asset-based lending facility has

met our expectations in supporting us through the downturn. We

continue to focus on prudently managing costs, working capital and

capital spending.”

OPERATIONS REVIEW

Aluminum Extrusions

Aluminum Extrusions (or Bonnell Aluminum) produces high-quality,

soft-alloy and medium-strength custom fabricated and finished

aluminum extrusions primarily for the following markets: building

and construction (B&C), automotive and specialty (which

consists of consumer durables, machinery and equipment, electrical

and renewable energy, and distribution end-use products). A summary

of results for Aluminum Extrusions is provided below:

Three Months Ended

Favorable/

(Unfavorable)

% Change

(In thousands, except percentages)

March 31,

2024

2023

Sales volume (lbs)

33,841

37,562

(9.9)%

Net sales

$

114,222

$

133,370

(14.4)%

Ongoing operations:

EBITDA

$

12,540

$

14,638

(14.3)%

Depreciation & amortization

(4,542

)

(4,411

)

(3.0)%

EBIT*

$

7,998

$

10,227

(21.8)%

Capital expenditures

$

1,550

$

7,742

* For a reconciliation of this non-GAAP

measure to the most directly comparable measure calculated in

accordance with GAAP, see the EBITDA from ongoing operations by

segment statements in the Financial Tables in this press

release.

The following table presents the sales volume by end use market

for the three months ended March 31, 2024 and 2023, and the three

months ended December 31, 2023.

Three Months Ended

Favorable/

Three Months Ended

Favorable/

(In millions of lbs)

March 31,

(Unfavorable)

December 31,

(Unfavorable)

2024

2023

% Change

2023

% Change

Sales volume by end-use market:

Non-residential B&C

20.1

22.3

(9.9

)%

18.4

9.2

%

Residential B&C

1.6

2.5

(36.0

)%

2.0

(20.0

)%

Automotive

3.2

3.4

(5.9

)%

3.3

(3.0

)%

Specialty products

8.9

9.4

(5.3

)%

9.2

(3.3

)%

Total

33.8

37.6

(9.9

)%

32.9

2.7

%

First Quarter 2024 Results vs. First

Quarter 2023 Results

Net sales (sales less freight) in the first quarter of 2024

decreased 14.4% versus the first quarter of 2023 primarily due to

lower sales volume and the pass-through of lower metal costs. Sales

volume in the first quarter of 2024 decreased 9.9% versus the first

quarter of 2023 but increased 2.7% versus the fourth quarter

2023.

Net new orders, which remain low compared to pre-pandemic levels

but are growing, increased 61% in the first quarter of 2024 versus

the first quarter of 2023, marking the sixth consecutive quarterly

increase in incoming orders. Since January 2021, net new orders for

the Company's aluminum extruded products have generally tracked the

ISM® Manufacturing PMI®. The Company believes that net new orders

continue to be below pre-pandemic levels due to higher interest

rates, tighter lender requirements and the increase in remote

working, which particularly impacts the non-residential B&C

end-use market. In addition, data indicates that aluminum extrusion

imports increased significantly in recent years, especially during

the pandemic, and some of Bonnell Aluminum’s customers may have

sourced, and continue to source, aluminum extrusions from producers

outside the United States.

Open orders at the end of the first quarter of 2024 were 15

million pounds (versus 14 million pounds at the end of the fourth

quarter of 2023 and 27 million pounds at the end of the first

quarter of 2023). This level is below the quarterly range of 21 to

27 million pounds in 2019 before pandemic-related disruptions

(particularly starting in early 2021 with the re-opening of markets

following the rollout of vaccines) that resulted in long lead

times, driving a peak in open orders of approximately 100 million

pounds during the first quarter of 2022.

The Company is participating as part of a coalition of members

of the Aluminum Extruders Council who have filed a trade case with

the Department of Commerce (“DOC”) and the U.S. International Trade

Commission (“ITC”) against 15 countries in response to alleged

large and increasing volumes of unfairly priced imports of aluminum

extrusions since 2019. In November 2023, the ITC found that there

is a reasonable indication that the American aluminum extrusions

industry is materially injured or threatened with injury due to

imports from 14 countries, including China. The ITC’s preliminary

determination found that subject import volumes were significant

and increasing, and that with regard to pricing, subject imports

predominantly undersold the domestic product by volume in each year

of the period of investigation. On May 2, 2024, the DOC announced

its preliminarily determination that aluminum extrusion producers

and exporters in 14 countries, including China, sold aluminum

extrusions at less-than-fair value in the United States. Final

determinations, which are expected by the end of the third quarter

of 2024, should provide an additional opportunity for Bonnell to

regain market share.

EBITDA from ongoing operations in the first quarter of 2024

decreased $2.1 million versus the first quarter of 2023 primarily

due to:

- Lower volume ($3.3 million) offset by higher net pricing after

the pass-through of metal cost changes ($2.0 million), lower labor

and employee-related costs ($0.6 million), lower supply expense

($0.6 million), lower utility expense ($0.4 million), lower

selling, general and administrative ("SG&A") expenses ($0.3

million) and lower freight rates ($0.2 million); and

- The timing of the flow-through under the first-in first-out

method of aluminum raw material costs passed through to customers,

previously acquired at higher prices in a quickly changing

commodity pricing environment, resulted in a charge of $1.2 million

in the first quarter of 2024 versus a benefit of $1.7 million in

the first quarter of 2023.

Refer to Item 3. Quantitative and Qualitative Disclosures About

Market Risk in the Company's Quarterly Report on Form 10-Q for the

period ended March 31, 2024 ("First Quarter Form 10-Q") for

additional information on aluminum price trends.

Projected Capital Expenditures and

Depreciation & Amortization

Capital expenditures for Bonnell Aluminum are projected to be $9

million in 2024, including $4 million for productivity projects and

$5 million for capital expenditures required to support continuity

of operations. The projected spending reflects stringent spending

measures that the Company has implemented to control its financial

leverage (See "Total Debt, Financial Leverage and Debt Covenants"

section for more information). The multi-year implementation of new

enterprise resource planning and manufacturing execution systems

("ERP/MES") has been reorganized with an extended implementation

period. As a result, the earliest "go-live" date for the net

ERP/MES is 2025. The ERP/MES project commenced in 2022, with

spending to-date of approximately $21 million. Depreciation expense

is projected to be $16 million in 2024. Amortization expense is

projected to be $2 million in 2024.

PE Films

PE Films produces surface protection films, polyethylene

overwrap and polypropylene films for other markets. A summary of

results for PE Films is provided below:

Three Months Ended

Favorable/

(Unfavorable)

% Change

(In thousands, except percentages)

March 31,

2024

2023

Sales volume (lbs)

10,036

7,368

36.2%

Net sales

$

24,735

$

20,182

22.6%

Ongoing operations:

EBITDA

$

6,904

$

1,849

273.4%

Depreciation & amortization

(1,329

)

(1,643

)

19.1%

EBIT*

$

5,575

$

206

NM**

Capital expenditures

$

394

$

716

* For a reconciliation of this non-GAAP

measure to the most directly comparable measure calculated in

accordance with GAAP, see the EBITDA from ongoing operations by

segment statements in the Financial Tables in this press

release.

**Not meaningful ("NM")

First Quarter 2024 Results vs. First

Quarter 2023 Results

Net sales in the first quarter of 2024 were 22.6% higher

compared to the first quarter of 2023, with volume increases in

both Surface Protection and overwrap films. Surface Protection

sales volume in the first quarter of 2024 increased 43% versus the

first quarter of 2023 and 30% versus the fourth quarter of 2023.

Given recent volume improvements for Surface Protection and other

market indicators, the Company believes that the consumer

electronics market is now in recovery mode.

EBITDA from ongoing operations during the first quarter of 2024

was $6.9 million, which was exceptional and well above comparable

amounts realized during the second and first halves of 2023 of $8.6

million and $2.7 million, respectively.

EBITDA from ongoing operations in the first quarter of 2024

increased $5.1 million versus the first quarter of 2023, primarily

due to:

- A $4.4 million increase from Surface Protection primarily due

to higher contribution margin associated with higher volume ($1.0

million), favorable pricing ($0.3 million), operating efficiencies

and manufacturing costs savings ($1.9 million), lower fixed costs

($0.4 million), and lower SG&A ($0.7 million, including $0.6

million associated with the closure of the Richmond Technical

Center in 2023).

- A $0.7 million increase from overwrap films primarily due to

cost improvements.

Refer to Item 3. Quantitative and Qualitative Disclosures About

Market Risk in the First Quarter Form 10-Q for additional

information on resin price trends.

Projected Capital Expenditures and

Depreciation & Amortization

Capital expenditures for PE Films are projected to be $2 million

in 2024, including $1 million for productivity projects and $1

million for capital expenditures required to support continuity of

current operations. Depreciation expense is projected to be $5

million in 2024. There is no amortization expense for PE Films.

Flexible Packaging Films

Flexible Packaging Films produces polyester-based films for use

in packaging applications that have specialized properties, such as

heat resistance, strength, barrier protection and the ability to

accept high-quality print graphics. A summary of results for

Flexible Packaging Films is provided below:

Three Months Ended

Favorable/

(Unfavorable)

% Change

(In thousands, except percentages)

March 31,

2024

2023

Sales volume (lbs)

21,973

19,845

10.7%

Net sales

$

30,113

$

31,527

(4.5)%

Ongoing operations:

EBITDA

$

1,963

$

1,350

45.4%

Depreciation & amortization

(751

)

(700

)

(7.3)%

EBIT*

$

1,212

$

650

86.5%

Capital expenditures

$

518

$

605

* For a reconciliation of this non-GAAP

measure to the most directly comparable measure calculated in

accordance with GAAP, see the EBITDA from ongoing operations by

segment statements in the Financial Tables in this press

release.

First Quarter 2024 Results vs. First

Quarter 2023 Results

Net sales in the first quarter of 2024 decreased 4.5% compared

to the first quarter of 2023 primarily due to lower selling prices

that the Company believes are driven by excess global capacity and

strong competition in Brazil, Latin America and the U.S., and

unfavorable product mix, partially offset by higher sales

volume.

EBITDA from ongoing operations in the first quarter of 2024

increased $0.6 million versus the first quarter of 2023, primarily

due to:

- Lower raw material costs ($1.9 million), lower fixed costs

($1.7 million), higher sales volume ($ 1.0 million) and lower

SG&A ($0.2 million), partially offset by lower selling prices

from global excess capacity and margin pressures ($2.1 million) and

higher variable costs ($1.3 million);

- Foreign currency transaction gains ($0.1 million) in the first

quarter of 2024 compared to foreign currency transaction losses

($0.1 million) in the first quarter of 2023; and

- Net unfavorable foreign currency translation of

Real-denominated operating costs ($0.9 million).

Refer to Item 3. Quantitative and Qualitative Disclosures About

Market Risk in the First Quarter Form 10-Q for additional

information on polyester fiber and component price trends.

Projected Capital Expenditures and

Depreciation & Amortization

Capital expenditures for Flexible Packaging Films are projected

to be $4 million in 2024 for capital expenditures required to

support continuity of current operations. Depreciation expense is

projected to be $3 million in 2024. Amortization expense is

projected to be $0.1 million in 2024.

Corporate Expenses, Interest & Taxes

Corporate expenses, net in the first three months of 2024

decreased $3.2 million compared to the first three months of 2023

primarily due to lower pension expense as a result of the pension

plan termination completed in 2023 ($3.4 million) and lower

internal audit fees ($0.3 million), partially offset by higher

stock-based compensation ($0.6 million). Further information on

gains and losses associated with special items impacting corporate

expenses, net is provided in the accompanying tables.

Interest expense of $3.5 million in the first three months of

2024 increased $1.1 million compared to the first three months of

2023 due to higher average debt levels and interest rates.

The effective tax rate was 16.7% in the first three months of

2024 compared to (48.8)% in the first three months of 2023. The

change in effective tax rate was primarily due to pre-tax income in

the first quarter of 2024 versus a pre-tax loss in the first three

months of 2023. The effective tax rate for the first three months

of 2024 varies from the 21% statutory rate primarily due to foreign

rate differences and non-deductible expenses offset by Brazilian

tax incentives and federal tax credits. The effective tax rate from

ongoing operations comparable to the earnings reconciliation table

provided in Note (a) to the Financial Tables in this press release

was 19.0% for the first three months of 2024 versus 34.2% for the

first three months of 2023 (see also Note (e) to the Financial

Tables). Refer to Note 8 to the Company's Condensed Consolidated

Financial Statements in the First Quarter Form 10-Q for an

explanation of differences between the effective tax rate for

income (loss) and the U.S. federal statutory rate for 2024 and

2023.

Status of Agreement to Sell Terphane

On September 1, 2023, the Company announced that it had entered

into a definitive agreement to sell Terphane to Oben Group (the

“Contingent Terphane Sale”). Completion of the sale is contingent

upon the satisfaction of customary closing conditions, including

the receipt of certain competition filing approvals by authorities

in Brazil and Colombia. On October 27, 2023, the Company filed the

requisite competition forms with the Administrative Council for

Economic Defense (“CADE”) in Brazil. The regulatory review process

is ongoing and in line with the Company’s expectations. CADE’s

maximum deadline for completing its review is no later than

November 18, 2024. The merger review regarding the transaction was

cleared by the Colombian authority in early February 2024.

As of March 31, 2024, the Company has reported results for

Terphane as a continuing operation, given the status of the

approval process by authorities. If the sale transaction is

completed, the Company expects to realize after-tax net debt-free

cash proceeds of $85 million after deducting projected Brazil

withholding taxes, escrow funds, U.S. capital gains taxes and

transaction costs. Actual after-tax proceeds may differ from

estimates due to possible changes in deductions and the Company's

tax situation during the potentially lengthy interim period to the

closing date.

Total Debt, Financial Leverage and Debt Covenants

Total debt was $148.3 million at March 31, 2024 and $146.3

million at December 31, 2023. Cash, cash equivalents and restricted

cash was $4.8 million at March 31, 2024 and $13.5 million at

December 31, 2023. Net debt (total debt in excess of cash, cash

equivalents and restricted cash), a non-GAAP financial measure, was

$143.5 million at March 31, 2024 and $132.8 million at December 31,

2023. See Note (f) to the Financial Tables in this press release

for a reconciliation of net debt to the most directly comparable

GAAP financial measure.

The Company has been focused on stringent management of net

working capital, capital expenditures and costs during the current

slowdown in business. Total debt increased $2.0 million and net

debt increased $10.7 million in the first quarter of 2024 versus

the end of 2023 due primarily to higher net working capital to

support the recovery the Company believes is underway in its

businesses.

As of March 31, 2024, the Company was in compliance with all

covenants under its $180 million asset-based credit agreement

maturing June 30, 2026 (the "ABL Facility"). Availability for

borrowings under the ABL Facility is governed by a borrowing base,

determined by the application of specified advance rates against

eligible assets, including trade accounts receivable, inventory,

owned real properties and owned machinery and equipment. As of

March 31, 2024, excess available borrowings under the ABL Facility

were approximately $22.2 million, based upon the outstanding

borrowing base availability net of the financial covenant for

Minimum Liquidity (as defined in the ABL Facility). Daily liquidity

under the ABL Facility from January 1, 2024 to March 31, 2024, was

$10 million to $27 million with an average of $16 million and

median of $16 million, which was consistent with the Company's

expectations. Refer to Note 10 Company's Condensed Consolidated

Financial Statements in the First Quarter Form 10-Q for an

explanation of the financial highlights and primary debt

covenants.

FORWARD-LOOKING AND CAUTIONARY

STATEMENTS

Some of the information contained in this press release may

constitute “forward-looking statements” within the meaning of the

“safe harbor” provisions of the Private Securities Litigation

Reform Act of 1995. When the Company uses the words “believe,”

“estimate,” “anticipate,” “appear to,” “expect,” “project,” “plan,”

“likely,” “may” and similar expressions, it does so to identify

forward-looking statements. Such statements are based on the

Company's then current expectations and are subject to a number of

risks and uncertainties that could cause actual results to differ

materially from those addressed in the forward-looking statements.

It is possible that the Company's actual results and financial

condition may differ, possibly materially, from the anticipated

results and financial condition indicated in or implied by these

forward-looking statements. Accordingly, you should not place undue

reliance on these forward-looking statements. Factors that could

cause actual results to differ materially from expectations

include, without limitation, the following:

- inability to successfully complete strategic dispositions,

including the Contingent Terphane Sale, failure to realize the

expected benefits of such dispositions and assumption of

unanticipated risks in such dispositions;

- inability to successfully transition into an asset-based

revolving lending facility;

- noncompliance with any of the financial and other restrictive

covenants in the Company's asset-based credit facility;

- the impact of macroeconomic factors, such as inflation,

interest rates, recession risks and other lagging effects of the

COVID-19 pandemic

- an increase in the operating costs incurred by the Company’s

business units, including, for example, the cost of raw materials

and energy;

- failure to continue to attract, develop and retain certain key

officers or employees;

- disruptions to the Company’s manufacturing facilities,

including those resulting from labor shortages;

- inability to develop, efficiently manufacture and deliver new

products at competitive prices;

- the impact of the imposition of tariffs and sanctions on

imported aluminum ingot used by Bonnell Aluminum;

- failure to prevent foreign companies from evading anti-dumping

and countervailing duties;

- unanticipated problems or delays with the implementation of the

enterprise resource planning and manufacturing executions systems,

or security breaches and other disruptions to the Company's

information technology infrastructure;

- loss or gain of sales to significant customers on which the

Company’s business is highly dependent;

- inability to achieve sales to new customers to replace lost

business;

- failure of the Company’s customers to achieve success or

maintain market share;

- failure to protect our intellectual property rights;

- risks of doing business in countries outside the U.S. that

affect our international operations;

- political, economic and regulatory factors concerning the

Company’s products;

- competition from other manufacturers, including manufacturers

in lower-cost countries and manufacturers benefiting from

government subsidies;

- impact of fluctuations in foreign exchange rates;

- the termination of anti-dumping duties on products imported to

Brazil that compete with products produced by Flexible

Packaging;

- an information technology system failure or breach;

- the impact of public health epidemics on employees, production

and the global economy, such as the COVID-19 pandemic;

- inability to successfully identify, complete or integrate

strategic acquisitions; failure to realize the expected benefits of

such acquisitions and assumption of unanticipated risks in such

acquisitions;

- impairment of the Surface Protection reporting unit's

goodwill;

and the other factors discussed in the reports Tredegar files

with or furnishes to the Securities and Exchange Commission (the

“SEC”) from time to time, including the risks and important factors

set forth in additional detail in “Risk Factors” Part I, Item 1A of

the Company's Form 10-K for the year ended December 31, 2023.

Readers are urged to review and consider carefully the disclosures

Tredegar makes in its filings with the SEC.

Tredegar does not undertake, and expressly disclaims any duty,

to update any forward-looking statement made in this press release

to reflect any change in management’s expectations or any change in

conditions, assumptions or circumstances on which such statements

are based, except as required by applicable law.

To the extent that the financial information portion of this

press release contains non-GAAP financial measures, it also

presents both the most directly comparable financial measures

calculated and presented in accordance with GAAP and a quantitative

reconciliation of the difference between any such non-GAAP measures

and such comparable GAAP financial measures. Reconciliations of

non-GAAP financial measures are provided in the Notes to the

Financial Tables included with this press release and can also be

found within “Presentations” in the “Investors” section of our

website, www.tredegar.com.

Tredegar uses its website as a channel of distribution of

material Company information. Financial information and other

material information regarding Tredegar is posted on and assembled

in the “Investors” section of its website.

Tredegar Corporation is an industrial manufacturer with three

primary businesses: custom aluminum extrusions for the North

American building & construction, automotive and specialty

end-use markets; surface protection films for high-technology

applications in the global electronics industry; and specialized

polyester films primarily for the Latin American flexible packaging

market. Tredegar had 2023 sales of $705 million. With approximately

1,900 employees, the Company operates manufacturing facilities in

North America, South America, and Asia.

Tredegar Corporation

Condensed Consolidated

Statements of Income (Loss)

(In Thousands, Except

Per-Share Data)

(Unaudited)

Three Months Ended

March 31,

2024

2023

Sales

$

175,736

$

191,122

Other income (expense), net (c)(d)

8

280

175,744

191,402

Cost of goods sold (c)

142,043

159,525

Freight

6,666

6,043

Selling, R&D and general expenses

(c)

18,610

20,211

Amortization of intangibles

464

503

Pension and postretirement benefits

54

3,418

Interest expense

3,455

2,311

Asset impairments and costs associated

with exit and disposal activities, net of adjustments (c)

507

69

Total

171,799

192,080

Income (loss) before income taxes

3,945

(678

)

Income tax expense (benefit) (c)

657

331

Net income (loss)

$

3,288

$

(1,009

)

Earnings (loss) per share:

Basic

$

0.10

$

(0.03

)

Diluted

$

0.10

$

(0.03

)

Shares used to compute earnings (loss) per

share:

Basic

34,323

33,895

Diluted

34,323

33,895

Tredegar Corporation

Net Sales and EBITDA from

Ongoing Operations by Segment

(In Thousands)

(Unaudited)

Three Months Ended

March 31,

2024

2023

Net Sales

Aluminum Extrusions

$

114,222

$

133,370

PE Films

24,735

20,182

Flexible Packaging Films

30,113

31,527

Total net sales

169,070

185,079

Add back freight

6,666

6,043

Sales as shown in the condensed

consolidated statements of income

$

175,736

$

191,122

EBITDA from Ongoing Operations

(i)

Aluminum Extrusions:

Ongoing operations:

EBITDA (b)

$

12,540

$

14,638

Depreciation & amortization

(4,542

)

(4,411

)

EBIT (b)

7,998

10,227

Plant shutdowns, asset impairments,

restructurings and other (c)

(1,167

)

(493

)

PE Films:

Ongoing operations:

EBITDA (b)

6,904

1,849

Depreciation & amortization

(1,329

)

(1,643

)

EBIT (b)

5,575

206

Plant shutdowns, asset impairments,

restructurings and other (c)

(504

)

2

Flexible Packaging Films:

Ongoing operations:

EBITDA (b)

1,963

1,350

Depreciation & amortization

(751

)

(700

)

EBIT (b)

1,212

650

Plant shutdowns, asset impairments,

restructurings and other (c)

—

(78

)

Total

13,114

10,514

Interest income

22

44

Interest expense

3,455

2,311

Gain on investment in kaleo, Inc.

("kaléo") (d)

—

262

Stock option-based compensation costs

—

231

Corporate expenses, net (c)

5,736

8,956

Income (loss) before income taxes

3,945

(678

)

Income tax expense (benefit)

657

331

Net income (loss)

$

3,288

$

(1,009

)

Tredegar Corporation

Condensed Consolidated Balance

Sheets

(In Thousands)

(Unaudited)

March 31, 2024

December 31, 2023

Assets

Cash & cash equivalents

$

3,493

$

9,660

Restricted cash

1,299

3,795

Accounts & other receivables, net

73,032

67,938

Income taxes recoverable

793

1,182

Inventories

86,822

82,037

Prepaid expenses & other

9,438

12,065

Total current assets

174,877

176,677

Net property, plant and equipment

177,972

183,455

Right-of-use leased assets

16,761

11,848

Identifiable intangible assets, net

9,364

9,851

Goodwill

35,717

35,717

Deferred income taxes

24,320

25,034

Other assets

3,520

3,879

Total assets

$

442,531

$

446,461

Liabilities and Shareholders’

Equity

Accounts payable

$

84,925

$

95,023

Accrued expenses

23,083

24,442

Lease liability, short-term

2,871

2,107

ABL revolving facility (matures on June

30, 2026) (h)

128,330

126,322

Income taxes payable

225

1,210

Total current liabilities

239,434

249,104

Lease liability, long-term

15,318

10,942

Long-term debt

20,000

20,000

Pension and other postretirement benefit

obligations, net

6,582

6,643

Other non-current liabilities

4,382

4,119

Shareholders’ equity

156,815

155,653

Total liabilities and shareholders’

equity

$

442,531

$

446,461

Tredegar Corporation

Condensed Consolidated

Statements of Cash Flows

(In Thousands)

(Unaudited)

Three Months Ended March 31,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

3,288

$

(1,009

)

Adjustments for noncash items:

Depreciation

6,252

6,340

Amortization of intangibles

464

503

Reduction of right-of-use lease asset

610

551

Deferred income taxes

623

411

Accrued pension income and post-retirement

benefits

54

3,418

Stock-based compensation expense

686

186

Gain on investment in kaléo

—

(262

)

Changes in assets and liabilities:

Accounts and other receivables

(5,337

)

(4,320

)

Inventories

(5,481

)

14,840

Income taxes recoverable/payable

(580

)

(1,156

)

Prepaid expenses and other

1,890

1,816

Accounts payable and accrued expenses

(10,306

)

(28,977

)

Lease liability

(689

)

(558

)

Pension and postretirement benefit plan

contributions

(158

)

(154

)

Other, net

965

(737

)

Net cash provided by (used in) operating

activities

(7,719

)

(9,108

)

Cash flows from investing activities:

Capital expenditures

(2,461

)

(9,025

)

Proceeds on sale of investment in

kaléo

—

262

Proceeds from the sale of assets

83

—

Net cash provided by (used in) investing

activities

(2,378

)

(8,763

)

Cash flows from financing activities:

Borrowings

179,248

37,250

Debt principal payments

(177,240

)

(19,250

)

Dividends paid

—

(4,419

)

Net cash provided by (used in) financing

activities

2,008

13,581

Effect of exchange rate changes on

cash

(574

)

83

Increase (decrease) in cash, cash

equivalents and restricted cash

(8,663

)

(4,207

)

Cash, cash equivalents and restricted cash

at beginning of period

13,455

19,232

Cash, cash equivalents and restricted cash

at end of period

$

4,792

$

15,025

Notes to the Financial

Tables

(Unaudited)

(a)

Tredegar’s presentation of net income

(loss) and diluted earnings (loss) per share from ongoing

operations are non-GAAP financial measures that exclude the effects

of gains or losses associated with plant shutdowns, asset

impairments and restructurings, gains or losses from the sale of

assets, goodwill impairment charges, net periodic benefit cost for

the frozen defined benefit pension plan and other items (which

includes gains and losses for an investment accounted for under the

fair value method), which have been presented separately and

removed from net income (loss) and diluted earnings (loss) per

share as reported under GAAP. Net income (loss) and diluted

earnings (loss) per share from ongoing operations are key financial

and analytical measures used by management to gauge the operating

performance of Tredegar’s ongoing operations. They are not intended

to represent the stand-alone results for Tredegar’s ongoing

operations under GAAP and should not be considered as an

alternative to net income (loss) or earnings (loss) per share as

defined by GAAP. They exclude items that management believes do not

relate to Tredegar’s ongoing operations. A reconciliation to net

income (loss) and diluted earnings (loss) per share from ongoing

operations for the three months ended March 31, 2024 and 2023 is

shown below:

Three Months Ended March 31,

($ in millions, except per share data)

2024

2023

Net income (loss) as reported under

GAAP1

$

3.3

$

(1.0

)

After-tax effects of:

(Gains) losses associated with plant

shutdowns, asset impairments and restructurings

0.4

0.1

(Gains) losses from sale of assets and

other:

Gain associated with the investment in

kaléo

—

(0.2

)

Other

1.9

1.0

Net periodic benefit cost for the frozen

defined benefit pension plan in process of termination2

—

2.6

Net income (loss) from ongoing

operations1

$

5.6

$

2.5

Earnings (loss) per share as reported

under GAAP (diluted)

$

0.10

$

(0.03

)

After-tax effects per diluted share

of:

(Gains) losses associated with plant

shutdowns, asset impairments and restructurings

0.01

—

(Gains) losses from sale of assets and

other:

Gain associated with the investment in

kaléo

—

(0.01

)

Other

0.05

0.03

Net periodic benefit cost for the frozen

defined benefit pension plan in process of termination2

—

0.08

Earnings (loss) per share from ongoing

operations (diluted)

$

0.16

$

0.07

1. Reconciliations of the pre-tax and

post-tax balances attributed to net income (loss) are shown in Note

(e).

2. For more information, see Note (g).

(b)

EBITDA (earnings before interest, taxes,

depreciation and amortization) from ongoing operations is the key

segment profitability metric used by the Company’s chief operating

decision maker to assess segment financial performance. The Company

uses sales less freight ("net sales") as its measure of revenues

from external customers. For more business segment information, see

Note 9 to the Company's Condensed Consolidated Financial Statements

in the First Quarter Form 10-Q.

EBIT (earnings before interest and taxes) from ongoing

operations is a non-GAAP financial measure included in the

accompanying tables and the reconciliation of segment financial

information to consolidated results for the Company in the net

sales and EBITDA from ongoing operations by segment statements. It

is not intended to represent the stand-alone results for Tredegar’s

ongoing operations under GAAP and should not be considered as an

alternative to net income (loss) as defined by GAAP. The Company

believes that EBIT is a widely understood and utilized metric that

is meaningful to certain investors and that including this

financial metric in the reconciliation of management’s performance

metric, EBITDA from ongoing operations, provides useful information

to those investors that primarily utilize EBIT to analyze the

Company’s core operations.

(c) Gains and losses associated with plant shutdowns, asset

impairments, restructurings and other items for the three months

ended March 31, 2024 and 2023 detailed below are shown in the

statements of net sales and EBITDA from ongoing operations by

segment and are included in “Asset impairments and costs associated

with exit and disposal activities, net of adjustments” in the

condensed consolidated statements of income, unless otherwise

noted.

Three Months Ended March 31,

2024

($ in millions)

Pre-Tax

Net of Tax

Aluminum Extrusions:

(Gains) losses from sale of assets,

investment writedowns and other items:

Consulting expenses for ERP/MES

project1

$

0.6

$

0.4

Storm damage to the Newnan, Georgia

plant1

0.1

0.1

Legal fees associated with the Aluminum

Extruders Trade Case1

0.2

0.2

Total for Aluminum Extrusions

$

0.9

$

0.7

PE Films:

(Gains) losses from sale of assets,

investment writedowns and other items:

Richmond, Virginia Technical Center

closure expenses, including severance2

$

0.2

$

0.1

Richmond, Virginia Technical Center lease

abandonment2

0.3

0.3

Total for PE Films

$

0.5

$

0.4

Corporate:

(Gain) losses from sale of assets,

investment writedowns and other items:

Professional fees associated with business

development activities1

$

0.5

$

0.4

Professional fees associated with

remediation activities related to internal control over financial

reporting1

0.9

0.7

Professional fees associated with the

transition to the ABL Facility1

0.2

0.1

Total for Corporate

$

1.6

$

1.2

1. Included in “Selling, R&D and

general expenses” in the condensed consolidated statements of

income.

2. For more information, refer to Note 1

to the Company's Condensed Consolidated Financial Statements in the

First Quarter Form 10-Q.

Three Months Ended March 31,

2023

($ in millions)

Pre-Tax

Net of Tax

Aluminum Extrusions:

(Gains) losses from sale of assets,

investment writedowns and other items:

Storm damage to the Newnan, Georgia

plant1

$

0.6

$

0.4

Total for Aluminum Extrusions

$

0.6

$

0.4

Flexible Packaging Films:

(Gains) losses associated with plant

shutdowns, asset impairments and restructurings:

Other restructuring costs - severance

$

0.1

$

0.1

Total for Flexible Packaging Films

$

0.1

$

0.1

Corporate:

(Gain) losses from sale of assets,

investment writedowns and other items:

Professional fees associated with business

development activities1

$

0.3

$

0.3

Professional fees associated with

remediation activities related to internal control over financial

reporting1

0.5

0.4

Stock-based compensation expense

associated with the fair value remeasurement of awards granted at

the time of the 2020 Special Dividend1

(0.1

)

(0.1

)

Net periodic benefit cost for the frozen

defined benefit pension plan in process of termination2

3.4

2.6

Total for Corporate

$

4.1

$

3.2

- Included in "Selling, R&D and general expenses" in the

condensed consolidated statements of income.

- For more information, see Note (g).

(d)

On December 27, 2021, the Company

completed the sale of its investment interests in kaléo and

received closing cash proceeds of $47.1 million. In January 2023,

additional cash consideration of $0.3 million was received related

to customary post-closing adjustments, which is reported in “Other

income (expense), net” in the condensed consolidated statements of

income.

(e) Tredegar’s presentation of net income (loss) from

ongoing operations is a non-GAAP financial measure that excludes

the effects of gains or losses associated with plant shutdowns,

asset impairments and restructurings, gains or losses from the sale

of assets, goodwill impairment charges, net periodic benefit cost

for the frozen defined benefit pension plan and other items (which

includes unrealized gains and losses for an investment accounted

for under the fair value method), which has been presented

separately and removed from net income (loss) as reported under

GAAP. Net income (loss) from ongoing operations is a key financial

and analytical measure used by management to gauge the operating

performance of Tredegar’s ongoing operations. It is not intended to

represent the stand-alone results for Tredegar’s ongoing operations

under GAAP and should not be considered as an alternative to net

income (loss) as defined by GAAP. It excludes items that we believe

do not relate to Tredegar’s ongoing operations.

Reconciliations of the pre-tax and post-tax balances attributed to

net income (loss) from ongoing operations for the three months

ended March 31, 2024 and 2023 are presented below in order to show

the impact on the effective tax rate:

($ in millions)

Pre-tax

Tax Expense (Benefit)

After-Tax

Effective Tax Rate

Three Months Ended March 31,

2024

(a)

(b)

(b)/(a)

Net income (loss) reported under GAAP

$

3.9

$

0.6

$

3.3

16.7

%

(Gains) losses associated with plant

shutdowns, asset impairments and restructurings

0.5

0.1

0.4

(Gains) losses from sale of assets and

other

2.5

0.6

1.9

Net income (loss) from ongoing

operations

$

6.9

$

1.3

$

5.6

19.0

%

Three Months Ended March 31,

2023

Net income (loss) reported under GAAP

$

(0.7

)

$

0.3

$

(1.0

)

(48.8

)%

(Gains) losses associated with plant

shutdowns, asset impairments and restructurings

0.1

—

0.1

(Gains) losses from sale of assets and

other

1.0

0.2

0.8

Net periodic benefit cost for the frozen

defined benefit pension plan in process of termination

3.4

0.8

2.6

Net income (loss) from ongoing

operations

$

3.8

$

1.3

$

2.5

34.2

%

(f) Net debt is calculated as follows:

March 31,

December 31,

($ in millions)

2024

2023

ABL revolving facility (matures on June

30, 2026) (h)

$

128.3

$

126.3

Long-term debt

20.0

20.0

Total debt

148.3

146.3

Less: Cash and cash equivalents

3.5

9.7

Less: Restricted cash

1.3

3.8

Net debt

$

143.5

$

132.8

Net debt is not intended to represent

total debt as defined by GAAP. Net debt is utilized by management

in evaluating the Company’s financial leverage and equity

valuation, and management believes that investors also may find net

debt to be helpful for the same purposes.

(g) Beginning in 2022, and consistent with no expected

required minimum cash contributions, no pension expense has been

included in calculating earnings before interest, taxes,

depreciation and amortization as defined in the Second Amended and

Restated Credit Agreement, which is used to compute certain

borrowing ratios and to compute non-GAAP net income (loss) from

ongoing operations. (h) The ABL Facility has customary

representations and warranties including, as a condition to each

borrowing, that all such representations and warranties are true

and correct in all material respects (including a representation

that no Material Adverse Effect (as defined in the ABL Facility)

has occurred since December 31, 2022). In the event that the

Company cannot certify that all conditions to the borrowing have

been met, the lenders can restrict the Company’s future borrowings

under the ABL Facility. Because a Cash Dominion Period (as defined

in the ABL Facility) is currently in effect and the Company is

required to represent that no Material Adverse Effect has occurred

as a condition to borrowing, the outstanding debt under the ABL

Facility (all contractual payments due on June 30, 2026) is

classified as a current liability in the consolidated balance

sheets. In accordance with the ABL Facility, the lenders

have been provided with the Company’s financial statements,

covenant compliance certificates and projections to facilitate

their ongoing assessment of the Company. Accordingly, the Company

believes the likelihood that lenders would exercise the subjective

acceleration clause whereby prohibiting future borrowings is

remote. As of March 31, 2024, the Company was in compliance with

all debt covenants. (i) Tredegar’s presentation of

Consolidated EBITDA from ongoing operations is a non-GAAP financial

measure that excludes the effects of gains or losses associated

with plant shutdowns, asset impairments and restructurings, gains

or losses from the sale of assets, goodwill impairment charges, net

periodic benefit cost for the frozen defined benefit pension plan

and other items (which includes gains and losses for an investment

accounted for under the fair value method). Consolidated EBITDA

from ongoing operations also excludes depreciation &

amortization, stock option-based compensation costs, interest and

income taxes. Consolidated EBITDA is a key financial and analytical

measure used by management to gauge the operating performance of

Tredegar’s ongoing operations. It is not intended to represent the

stand-alone results for Tredegar’s ongoing operations under GAAP

and should not be considered as an alternative to net income (loss)

or earnings (loss) per share as defined by GAAP. It excludes items

that management believes do not relate to Tredegar’s ongoing

operations. A reconciliation of Consolidated EBITDA from ongoing

operations for the three months ended March 31, 2024 and 2023 is

shown below:

Three Months Ended March 31,

($ in millions)

2024

2023

Net income (loss) as reported under

GAAP1

$

3.3

$

(1.0

)

After-tax effects of:

(Gains) losses associated with plant

shutdowns, asset impairments and restructurings

0.4

0.1

Gain associated with the investment in

kaléo

—

(0.2

)

(Gains) losses from sale of assets and

other

1.9

1.0

Net periodic benefit cost for the frozen

defined benefit pension plan in process of termination2

—

2.6

Net income (loss) from ongoing

operations1

5.6

2.5

Depreciation and amortization

6.7

6.8

Stock option-based compensation costs

—

0.2

Interest expense

3.5

2.3

Income taxes from ongoing operations1

1.3

1.3

Consolidated EBITDA from ongoing

operations

$

17.1

$

13.1

1. Reconciliations of the pre-tax and

post-tax balances attributed to net income (loss) are shown in Note

(e).

2. For more information, see Note (g).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509797818/en/

Tredegar Corporation Neill Bellamy, 804-330-1211

neill.bellamy@tredegar.com

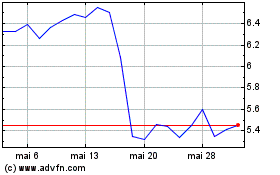

Tredegar (NYSE:TG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Tredegar (NYSE:TG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025