Current Report Filing (8-k)

19 Julho 2019 - 6:09PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 15, 2019

VISTRA ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38086

|

|

36-4833255

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

6555 Sierra Drive

Irving, TX

|

|

75039

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(214)

812-4600

(Registrant’s telephone number, including area code)

N/A

(Former name or

former address, if changed since last report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17

CFR

240.l4a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR 240.

14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13e-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of Each Exchange

on Which Registered

|

|

Common stock, par value $0.01 per share

|

|

VST

|

|

New York Stock Exchange

|

|

Warrants

|

|

VST.WS.A

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of

1933 (§230.405 of this chapter) or Rule

12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

Emerging growth company ☐

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Accounts Receivable Facility Amendments

On

July 15, 2019, TXU Energy Receivables Company LLC (“TXU Receivables”), a wholly owned subsidiary of TXU Energy Retail Company LLC (“TXU Retail”), and Vistra Operations Company LLC (“Vistra Operations

”)

entered into (i) an amendment (the “RPA Amendment”) to the Receivables Purchase Agreement dated as of August 21, 2018 (as amended, supplemented or otherwise modified from time to time, the “RPA”) among TXU Receivables,

as seller, TXU Retail, as servicer, Vistra Operations, as performance guarantor, certain purchaser agents and purchasers named therein and Credit Agricole Corporate and Investment Bank, as administrator (the “Administrator”), which amends

certain provisions, including (x) increasing the commitment of the purchasers to purchase interests in the receivables under the RPA from $450 million to $600 million until the settlement date in November 2019 (in order to align with

the peak retail season), after which the commitment of the purchasers will revert to $450 million and (y) extending the term of the accounts receivable facility (the “Facility”) until July 13, 2020, and (ii) an

amendment (the “PSA Amendment” and together with the RPA Amendment, the “Receivables Amendments”), which amends certain provisions relating to the receivables financed under the Facility.

A copy of the PSA Amendment is included as Exhibit 4.1 to this Current Report and is incorporated herein by reference. A copy of the RPA Amendment is included

as Exhibit 4.2 to this Current Report and is incorporated herein by reference. The above description of the Receivables Amendments does not purport to be complete and is qualified in its entirety by reference to the full text of each Receivables

Amendment.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an

Off-Balance

Sheet Arrangement of a Registrant.

|

The information contained in Item 1.01

concerning the Company’s direct financial obligations under the headings “Accounts Receivable Facility Amendments” in Item 1.01 of this Current Report is incorporated by reference herein.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

|

|

|

|

|

Exhibit

No.

|

|

Description

|

|

|

|

|

4.1

|

|

Third Amendment to Purchase and Sale Agreement, dated as of July

15, 2019, among TXU Energy Retail Company LLC and other originators named therein and TXU Energy Receivables Company LLC, as purchaser.

|

|

|

|

|

4.2

|

|

Third Amendment to Receivables Purchase Agreement, dated as of July

15, 2019, among TXU Energy Receivables Company LLC, as seller, TXU Energy Retail Company LLC, as servicer, Vistra Operations Company LLC, as performance guarantor, certain purchaser agents and purchasers named therein and Credit Agricole Corporate and Investment

Bank, as administrator.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Vistra Energy Corp.

|

|

|

|

|

|

Dated: July 19, 2019

|

|

|

|

/s/ Kristopher E. Moldovan

|

|

|

|

|

|

Name:

|

|

Kristopher E. Moldovan

|

|

|

|

|

|

Title:

|

|

Senior Vice President and Treasurer

|

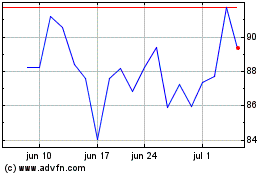

Vistra (NYSE:VST)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Vistra (NYSE:VST)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024