Current Report Filing (8-k)

04 Maio 2020 - 5:17PM

Edgar (US Regulatory)

false 0001692819 --12-31 0001692819 2020-04-29 2020-04-29 0001692819 us-gaap:CommonStockMember 2020-04-29 2020-04-29 0001692819 us-gaap:WarrantMember 2020-04-29 2020-04-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 29, 2020

VISTRA ENERGY CORP.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38086

|

|

36-4833255

|

|

(State or other jurisdiction of

incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

6555 Sierra Drive

Irving, TX

|

|

75039

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

(214) 812-4600

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.l4a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240. 14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of Each Class

|

|

Trading

Symbol(s)

|

|

Name of Each Exchange

on Which Registered

|

|

Common stock, par value $0.01 per share

|

|

VST

|

|

New York Stock Exchange

|

|

Warrants

|

|

VST.WS.A

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Information regarding the resignation and re-appointment of directors in connection with the declassification of the Board of Directors (the “Board”) of Vistra Energy Corp. (the “Company”) is incorporated by reference into this Item 5.02 from Item 5.03 below.

|

Item 5.03

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

At the 2020 annual meeting of stockholders held on April 29, 2020 (the “2020 Annual Meeting”), the stockholders of the Company approved an amendment to the Company’s Certificate of Incorporation (the “Charter”) to declassify the Board and instead provide for annual elections of directors beginning with the Company’s 2020 Annual Meeting. Following such approval, the Company filed a Certificate of Amendment to its Charter (the “Charter Amendment”) with the Delaware Secretary of State, which became effective on April 29, 2020. To implement the Charter Amendment, the Board also previously approved an amendment to Article III, Sections 3.3 and 3.4 of the Company’s Restated Bylaws (the “Bylaws”), contingent upon stockholder approval and implementation of the Charter Amendment. This amendment to the Bylaws became effective on April 29, 2020 upon effectiveness of the Charter Amendment.

In order to immediately declassify the Board at the 2020 Annual Meeting following approval of the Charter Amendment, each of the Company’s directors whose term did not expire at the 2020 Annual Meeting tendered his or her resignation from his or her Class II or Class III term, as applicable, contingent and effective upon stockholder approval of the Charter Amendment and completion of the vote to elect directors. As described in Item 5.07, each such director was thereafter elected to the Board to serve for a one-year term until the 2021 annual meeting of stockholders.

Following the filing of the Charter Amendment, on April 29, 2020, the Company also filed a Certificate of Correction to include an inadvertently omitted defined term from the Charter (the “Certificate of Correction”) and a Restated Certificate of Incorporation (the “Restated Charter”) to integrate all prior amendments and restate the Company’s charter in its entirety.

The foregoing summary of the amendments to the Company’s Charter and Bylaws set forth under this Item 5.03 does not purport to be complete and is qualified in its entirety by reference to the complete text of the Restated Charter and Restated Bylaws, which are attached hereto as Exhibits 3.1 and 3.2, respectively.

|

Item 5.07.

|

Submission of Matters to a Vote of Security Holders

|

On April 29, 2020, at the 2020 Annual Meeting, the Company’s stockholders approved the proposals listed below. The final voting results regarding each proposal are set forth in the following tables.

Proposal One – Charter Amendment to Declassify the Board and Provide for Annual Elections of All Directors Commencing with the 2020 Annual Meeting. The stockholders approved the Charter Amendment to declassify the Board beginning with the Company’s 2020 Annual Meeting. The votes cast on Proposal One were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

443,499,318

|

|

|

|

68,469

|

|

|

|

60,101

|

|

|

|

16,814,357

|

|

As a result, the Company filed the Charter Amendment with the Delaware Secretary of State on April 29, 2020, as further described in Item 5.03 of this Current Report.

Proposal Two – Election of Directors – Upon stockholders’ approval of the Charter Amendment, a vote was taken on Proposal Two for the election of directors. Accordingly, no vote was taken on Proposal Three, which would have only applied if the Charter Amendment had not been approved. Voting results for Proposal Two were as follows:

Hilary E. Ackermann:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

443,206,658

|

|

|

|

347,792

|

|

|

|

73,438

|

|

|

|

16,814,357

|

|

Arcilia C. Acosta:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

442,540,558

|

|

|

|

1,011,573

|

|

|

|

75,757

|

|

|

|

16,814,357

|

|

Gavin R. Baiera:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

442,383,495

|

|

|

|

1,171,827

|

|

|

|

72,566

|

|

|

|

16,814,357

|

|

Paul M. Barbas:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

441,779,861

|

|

|

|

1,776,295

|

|

|

|

71,732

|

|

|

|

16,814,357

|

|

Lisa Crutchfield:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

443,214,878

|

|

|

|

339,143

|

|

|

|

73,867

|

|

|

|

16,814,357

|

|

Brian K. Ferraioli:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

431,108,514

|

|

|

|

12,446,652

|

|

|

|

72,722

|

|

|

|

16,814,357

|

|

Scott B. Helm:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

442,505,402

|

|

|

|

1,034,438

|

|

|

|

88,048

|

|

|

|

16,814,357

|

|

Jeff D. Hunter:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

443,145,848

|

|

|

|

409,479

|

|

|

|

72,561

|

|

|

|

16,814,357

|

|

Curtis A. Morgan:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

443,057,001

|

|

|

|

490,231

|

|

|

|

80,656

|

|

|

|

16,814,357

|

|

John R. Sult:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

442,472,815

|

|

|

|

1,081,643

|

|

|

|

73,430

|

|

|

|

16,814,357

|

|

As a result, Hilary E. Ackermann, Arcilia C. Acosta, Gavin R. Baiera, Paul M. Barbas, Lisa Crutchfield, Brian K. Ferraioli, Scott B. Helm, Jeff D. Hunter, Curtis A. Morgan, and John R. Sult were elected to the Board.

Proposal Four – Approval, on an Advisory Basis, of Named Executive Officer Compensation. Voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

Broker Nonvotes

|

|

|

|

426,411,067

|

|

|

|

17,052,046

|

|

|

|

164,775

|

|

|

|

16,814,357

|

|

As a result, the compensation of the named executive officers was approved on an advisory basis.

Proposal Five – Ratification of the Selection of Deloitte & Touche LLP as the Company’s Independent Registered Public Accounting Firm for the Year Ending December 31, 2020. Voting results were as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

For

|

|

|

Against

|

|

|

Abstain

|

|

|

|

457,842,574

|

|

|

|

2,525,402

|

|

|

|

74,269

|

|

As a result, the Company’s selection of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the year ending December 31, 2020 was ratified.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

Dated: May 4, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VISTRA ENERGY CORP.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Yuki Whitmire

|

|

|

|

|

|

Name:

|

|

Yuki Whitmire

|

|

|

|

|

|

Title:

|

|

Vice President, Associate General Counsel and Corporate Secretary

|

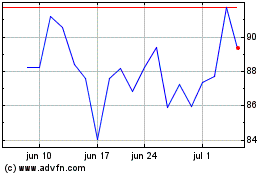

Vistra (NYSE:VST)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Vistra (NYSE:VST)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024