Vestis Announces Quarterly Cash Dividend

19 Agosto 2024 - 10:00AM

Business Wire

Vestis (NYSE: VSTS) today announced that its Board of Directors

has approved a quarterly cash dividend of $0.035 per share of

common stock. The dividend is payable to shareholders of record at

the close of business on September 13, 2024, and is expected to be

paid on October 3, 2024. The amount and timing of any future

dividend payment is subject to the approval of the Company's Board

of Directors.

About Vestis™

Vestis is a leader in the B2B uniform and workplace supplies

category. Vestis provides uniform services and workplace supplies

to a broad range of North American customers from Fortune 500

companies to locally owned small businesses across a broad set of

end sectors. The Company’s comprehensive service offering primarily

includes a full-service uniform rental program, floor mats, towels,

linens, managed restroom services, first aid supplies, and

cleanroom and other specialty garment processing.

Forward-Looking Statements

This press release contains “forward-looking statements” within

the meaning of the securities laws. All statements that reflect our

expectations, assumptions or projections about the future, other

than statements of historical fact, are forward-looking statements,

including, without limitation, forecasts relating to discussions of

future operations and financial performance and statements

regarding our strategy for growth, future product development,

regulatory approvals, competitive position and expenditures. In

some cases, forward-looking statements can be identified by words

such as “outlook,” “anticipate,” “continue,” “estimate,” “expect,”

“will be,” “believe,” “well positioned,” “mobilized,” “on track,”

“opportunities,” and other words and terms of similar meaning or

the negative versions of such words. These forward-looking

statements are subject to risks and uncertainties that may change

at any time, and actual results or outcomes may differ materially

from those that we expected. Forward-looking statements are not

guarantees of future performance and are subject to risks,

uncertainties, and changes in circumstances that are difficult to

predict including, but not limited to: unfavorable economic

conditions; increases in fuel and energy costs; the failure to

retain current customers, renew existing customer contracts and

obtain new customer contracts; natural disasters, global

calamities, climate change, pandemics, strikes and other adverse

incidents; increased operating costs and obstacles to cost recovery

due to the pricing and cancellation terms of our support services

contracts; a determination by our customers to reduce their

outsourcing or use of preferred vendors; risks associated with

suppliers from whom our products are sourced; challenge of

contracts by our customers; our expansion strategy and our ability

to successfully integrate the businesses we acquire and costs and

timing related thereto; currency risks and other risks associated

with international operations; our inability to hire and retain key

or sufficient qualified personnel or increases in labor costs;

continued or further unionization of our workforce; liability

resulting from our participation in multiemployer-defined benefit

pension plans; liability associated with noncompliance with

applicable law or other governmental regulations; laws and

governmental regulations including those relating to the

environment, wage and hour and government contracting; increases or

changes in income tax rates or tax-related laws; new

interpretations of or changes in the enforcement of the government

regulatory framework; a cybersecurity incident or other disruptions

in the availability of our computer systems or privacy breaches;

stakeholder expectations relating to environmental, social and

governance considerations; the expected benefits of the separation

from Aramark and the risk that conditions to the separation will

not be satisfied; the risk of increased costs from lost synergies;

retention of existing management team members as a result of the

separation from Aramark; reaction of customers, employees and other

parties to the separation from Aramark, and the impact of the

separation on our business; our leverage and ability to meet debt

obligations; any failure by Aramark to perform its obligations

under the various separation agreements entered into in connection

with the separation and distribution; a determination by the IRS

that the distribution or certain related transactions are taxable;

and the and the timing and occurrence (or non-occurrence) of other

transactions, events and circumstances which may be beyond our

control. The above list of factors is not exhaustive or necessarily

in order of importance. For additional information on identifying

factors that may cause actual results to vary materially from those

stated in forward-looking statements, see Vestis’ filings with the

Securities and Exchange Commission. Any forward-looking statement

speaks only as of the date on which it is made, and we assume no

obligation to update or revise such statement, whether as a result

of new information, future events or otherwise, except as required

by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819501259/en/

Investors Michael Aurelio, CFA 470-653-5015

michael.aurelio@vestis.com

Media Danielle Holcomb 470-716-0917

danielle.holcomb@vestis.com

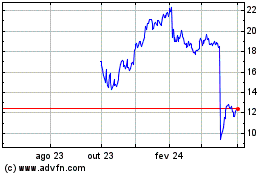

Vestis (NYSE:VSTS)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

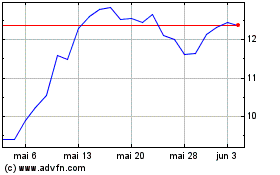

Vestis (NYSE:VSTS)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024