Western Asset Mortgage Capital Corporation (NYSE: WMC) (“WMC”)

today announced that WMC’s board of directors has determined in

good faith, after consultation with its financial advisors and

outside legal counsel, that the unsolicited proposal from AG

Mortgage Investment Trust, Inc. (NYSE: MITT) (“MITT”) to acquire

WMC is a “Parent Superior Proposal” within the meaning of WMC’s

merger agreement with Terra Property Trust, Inc. (“TPT”).

Under the terms of MITT’s proposal, each outstanding share of

WMC common stock would be converted into the right to receive (i)

1.468 shares of MITT common stock pursuant to a fixed exchange

ratio (subject to adjustment for transaction expenses) and (ii) the

per share portion of a cash payment from MITT’s external manager

equal to the lesser of $7 million or approximately 9.9% of the

aggregate per share merger consideration (any difference between $7

million and the 9.9% cap would be used to benefit the combined

company post-closing by offsetting reimbursable expenses that would

otherwise be payable to MITT’s external manager). Additionally,

MITT’s external manager, which would be the manager of the combined

company, would waive $2.4 million of management fees in the first

year post-closing.

WMC has notified TPT that it intends to terminate their merger

agreement unless WMC receives a revised proposal from TPT by 11:59

p.m. Eastern Time on August 3, 2023 such that the WMC board of

directors determines that MITT’s proposal is no longer a Parent

Superior Proposal, after taking into account all aspects of any

such proposal WMC may receive from TPT.

Consistent with its fiduciary duties, the WMC board of directors

conducted a thorough and rigorous review of the MITT proposal and

the TPT merger agreement before making its determination regarding

MITT’s proposal.

WMC’s merger agreement with TPT remains in full force and

effect, and the WMC board has not withdrawn or modified its

recommendation regarding the pending transaction with TPT. In

accordance with the terms of the merger agreement with TPT,

acceptance of a “Parent Superior Proposal” is subject to matching

rights of TPT. There can be no assurance that the proposal from

MITT will result in a transaction.

Additional Information and Where to Find It

In connection with the proposed merger between WMC and TPT (the

“TPT Merger”), WMC expects to file with the U.S. Securities and

Exchange Commission (the “SEC”) a registration statement on Form

S-4 (the “Registration Statement”) that contains a prospectus of

WMC that will also include a joint proxy statement of WMC and TPT

(the “joint proxy statement/prospectus”). The joint proxy

statement/prospectus will contain important information about WMC,

TPT, the proposed TPT Merger and related matters. WMC and TPT also

expect to file with the SEC other documents regarding the TPT

Merger. STOCKHOLDERS OF WMC AND TPT ARE URGED TO READ THE

REGISTRATION STATEMENT AND THE JOINT PROXY STATEMENT/PROSPECTUS

(INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO AND OTHER

RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED BY WMC AND TPT

WITH THE SEC, AS WELL AS ANY AMENDMENTS AND SUPPLEMENTS TO THESE

DOCUMENTS) CAREFULLY IF AND WHEN THEY BECOME AVAILABLE, BECAUSE

SUCH DOCUMENTS WILL CONTAIN IMPORTANT INFORMATION ABOUT WMC, TPT,

AND THE PROPOSED TPT MERGER AND RELATED MATTERS. Stockholders of

WMC and TPT may obtain free copies of the Registration Statement,

the joint proxy statement/prospectus and all other documents filed

or that will be filed by WMC or TPT with the SEC (if and when they

become available) through the website maintained by the SEC at

http://www.sec.gov. Copies of documents filed with the SEC by WMC

will be made available free of charge on WMC’s website at

http://www.westernassetmcc.com, or by directing a request to its

Investor Relations, Attention: Larry Clark at (310) 622-8223;

email: lclark@finprofiles.com. Copies of documents filed with the

SEC by TPT will be made available free of charge on TPT’s website

at https://www.terrapropertytrust.com, or by directing a request to

its Investor Relations at (212) 257-4666; email:

ir@mavikcapital.com.

This communication is for informational purposes only and shall

not constitute an offer to sell or the solicitation of an offer to

buy any securities or a solicitation of any vote or approval, nor

shall there be any sale of securities in any jurisdiction in which

such offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made, except by

means of a prospectus meeting the requirements of Section 10 of the

Securities Act.

Participants in the Solicitation Relating to the TPT

Merger

WMC, TPT and their respective directors and executive officers,

and certain other affiliates of WMC or TPT may be deemed to be

“participants” in the solicitation of proxies from the stockholders

of WMC and TPT in respect of the proposed TPT Merger. Information

regarding WMC and its directors and executive officers and their

ownership of common stock of WMC can be found in WMC’s definitive

proxy statement filed with the SEC on May 2, 2023, and its most

recent Annual Report filed on Form 10-K for the fiscal year ended

December 31, 2022. Information regarding TPT and its directors and

executive officers and their ownership of common stock of TPT can

be found in TPT’s definitive proxy statement filed with the SEC on

April 26, 2023, and its most recent Annual Report filed on Form

10-K for the fiscal year ended December 31, 2022. Additional

information regarding the interests of such potential participants

will be included in the joint proxy statement/prospectus and other

relevant documents filed with the SEC in connection with the

proposed TPT Merger if and when they become available. These

documents are available free of charge on the SEC’s website and

from WMC or TPT, as applicable, using the sources indicated

above.

Forward-Looking Statements

This press release includes “forward-looking statements,” as

such term is defined in Section 27A of the Securities Act and

Section 21E of the Securities Exchange Act of 1934, as amended, and

such statements are intended to be covered by the safe harbor

provided by the same. These forward-looking statements are based on

current assumptions, expectations, and beliefs of WMC and are

subject to a number of trends and uncertainties that could cause

actual results to differ materially from those described in the

forward-looking statements. WMC cannot give any assurance that

these forward-looking statements will be accurate. These

forward-looking statements generally can be identified by use of

forward-looking terminology such as “may,” “will,” “target,”

“should,” “expect,” “attempt,” “anticipate,” “project,” “estimate,”

“intend,” “seek,” “continue,” or “believe,” or the negatives

thereof or other variations thereon or comparable terminology.

Similarly, statements herein that describe certain plans,

expectations, goals, projections, and statements about the proposal

from MITT, the proposed TPT Merger and other statements of

management’s beliefs, intentions or goals also are forward-looking

statements. It is uncertain whether any of the events anticipated

by the forward-looking statements will transpire or occur, or if

any of them do, what impact they will have on the results of

operations and financial condition of the combined company. There

are a number of risks and uncertainties, many of which are beyond

the parties’ control, that could cause actual results to differ

materially from the forward-looking statements included herein,

including, but not limited to, the risk that the discussions with

and the proposal from MITT will not result in a transaction or that

the TPT Merger will not be consummated within the expected time

period or at all; the occurrence of any event, change or other

circumstances that could give rise to the termination of the TPT

merger agreement; the inability to obtain stockholder approvals

relating to the TPT Merger and issuance of shares in connection

therewith or the failure to satisfy the other conditions to

completion of the TPT Merger in a timely manner or at all; risks

related to disruption of management’s attention from ongoing

business operations due to the proposed TPT Merger; the risk that

any announcements relating to the TPT Merger could have adverse

effects on the market price of common stock of WMC; the risk that

the TPT Merger and its announcement could have an adverse effect on

the operating results and businesses of WMC and TPT; the outcome of

any legal proceedings relating to the TPT Merger; the ability to

successfully integrate the businesses following the TPT Merger; the

ability to retain key personnel; conditions in the market for

mortgage-related investments; availability of suitable investment

opportunities; changes in interest rates; changes in the yield

curve; changes in prepayment rates; the availability and terms of

financing; general economic conditions; market conditions;

inflationary pressures on the capital markets and the general

economy; conditions in the market for commercial and residential

loans, securities and other investments; legislative and regulatory

changes that could adversely affect the businesses of WMC or TPT;

risks related to the origination and ownership of loans and other

assets, which are typically short-term loans that are subject to

higher interest rates, transaction costs and uncertainty on loan

repayments; risks relating to any future impact of the COVID-19

pandemic, including the responses of governments and industries, on

the real estate sector; credit risks; servicing-related risks,

including those associated with foreclosure and liquidation; the

state of the U.S. and to a lesser extent, international economy

generally or in specific geographic regions; the general volatility

of the securities markets in which WMC or TPT participate; WMC or

TPT’s ability to maintain their respective qualification as a real

estate investment trust for U.S. federal income tax purposes; and

WMC or TPT’s ability to maintain their respective exemption from

registration under the Investment Company Act of 1940, as amended.

All such factors are difficult to predict, including those risks

set forth in the WMC’s annual reports on Form 10-K, quarterly

reports on Form 10-Q, and current reports on Form 8-K that are

available on its website at http://www.westernassetmcc.com and on

the SEC’s website at http://www.sec.gov, and those risks set forth

in TPT’s annual reports on Form 10-K, quarterly reports on Form

10-Q, and current reports on Form 8-K that are available on TPT’s

website at http://www.terrapropertytrust.com and on the SEC’s

website at http://www.sec.gov. The forward-looking statements

included in this press release are made only as of the date hereof.

Readers are cautioned not to place undue reliance on these

forward-looking statements that speak only as of the date hereof.

WMC undertakes no obligation to update these forward-looking

statements to reflect subsequent events or circumstances, except as

required by applicable law.

About Western Asset Mortgage Capital Corporation

WMC is a real estate investment trust that invests in, finances,

and manages a diverse portfolio of assets consisting of Residential

Whole Loans, Non-Agency RMBS, and to a lesser extent GSE Risk

Transfer Securities, Commercial Loans, Non-Agency CMBS, Agency

RMBS, Agency CMBS, and ABS. The company is externally managed and

advised by Western Asset Management Company, LLC, an investment

advisor registered with the Securities and Exchange Commission and

a wholly-owned subsidiary of Franklin Resources, Inc.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230727650782/en/

Investor Relations Contact Larry Clark Financial

Profiles, Inc. (310) 622-8223 lclark@finprofiles.com

Media Contact Tricia Ross Financial Profiles, Inc. (310)

622-8226 tross@finprofiles.com

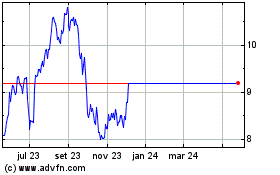

Western Asset Mortgage C... (NYSE:WMC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Western Asset Mortgage C... (NYSE:WMC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024