Andrew Peller Limited (TSX:ADW.A)(TSX:ADW.B) (the "Company") announced today its

results for the three months and year ended March 31, 2012. Effective April 1,

2011 the Company began reporting its results under International Financial

Reporting Standards ("IFRS"). For more information relating to the impact of the

transition to IFRS on the Company's reported financial position, financial

performance and cash flows, please refer to the Company's Management Discussion

and Analysis ("MD&A") for the three months and year ended March 31, 2012 which

will be available on the Company's web site and on www.sedar.com by June 26,

2012.

FISCAL 2012 HIGHLIGHTS:

-- Sales up 4.3% on solid performance in majority of trade channels

-- Announce completion of joint venture with Wayne Gretzky Estate Winery

and purchase of consumer-made wine business from Cellar Craft

-- EBITA up 3.5% to $32.7 million

-- Net earnings increase 15.8% to $13.0 million or $0.93 per Class A share

-- Balance sheet and financial position remain strong

"The Canadian wine market remains strong and we continue to experience solid

demand for our high quality product offerings through the majority of our trade

channels, including provincial liquor stores, our network of company-owned

retailers in Ontario, and our award-winning estate wineries," commented John

Peller, President and CEO. "Looking ahead, we are confident we will see

continued growth in both sales and profitability in the years ahead."

Sales for the fourth quarter of fiscal 2012 rose 6.9% to $60.9 million from

$56.9 million in the prior year. For the year ended March 31, 2012 sales rose

4.3% to $276.9 million from $265.4 million last year. Ongoing initiatives to

grow sales of the Company's blended varietal table and premium wines through

provincial liquor boards, the successful introduction of new products, solid

performance from the Company's estate wineries and export sales, and the

positive contribution to sales from recent acquisitions were partially offset by

the impact of the discriminatory levy introduced by the Province of Ontario on

July 1, 2010 on sales of International and Canadian Blended ("ICB") wines sold

through the Company's retail stores and weaker sales of consumer-made wines.

Gross margin was 36.1% of sales for the three months ended March 31, 2012

compared to 38.9% last year. For the year ended March 31, 2012 gross margin was

38.7% of sales compared to 38.9% in the prior year. Gross margin percentage was

negatively affected in fiscal 2012 by the impact of the additional taxation

levied on ICB wines sold through the Company's retail stores, higher costs for

wine purchased on international markets and increased distribution costs, as

well as increased price competition in certain markets during the latter half of

the fiscal year, partially offset by the positive impact of sales of higher

margin products, the strengthening of the Canadian dollar on world currency

markets, and successful cost control initiatives to reduce operating and

packaging expenses. The special levy served to reduce sales and gross margin by

approximately $2.4 million in fiscal 2012 compared to $2.0 million in fiscal

2011. Management believes gross margin will remain in the 37% to 38% range over

the near term.

Selling and administrative expenses increased in fiscal 2012 due to an increase

in sales and marketing investments to grow sales volumes of its products through

increased advertising and promotional initiatives across all trade channels,

investments made to increase tourism at its estate wineries, and certain

one-time costs related to the Company's celebration of its 50th Anniversary. As

a percentage of sales, selling and administrative expenses for the year ended

March 31, 2012 decreased to 26.9% compared to 27.0% in the prior year.

Interest expense during fiscal 2012 declined compared to last year due to a

decrease in short and long-term interest rates partially offset by higher levels

of short-term borrowings.

The Company incurred a non-cash gain in the fourth quarter of fiscal 2012

related to mark-to-market adjustments on an interest rate swap and foreign

exchange contracts aggregating $0.6 million compared to $0.3 million in the

prior year. For the year ended March 31, 2012 the Company incurred a non-cash

gain of $0.3 million compared to $0.1 million last year. The Company has elected

not to apply hedge accounting and accordingly these financial instruments are

reflected in the Company's financial statements at fair value each reporting

period. These instruments are considered to be effective economic hedges and

have enabled management to mitigate the volatility of changing costs and

interest rates.

Other expenses incurred in fiscal 2012 relate to a $0.4 million fair value

adjustment to vines, $0.2 million in carrying costs for the Company's Port Moody

facility which was closed effective December 31, 2005, and a charge of

approximately $0.4 million related to a reassessment of employee payroll taxes

for prior periods. In fiscal 2011 other expenses included a fair value

adjustment to vines of $1.2 million and $0.2 million in ongoing maintenance

costs for the Port Moody facility partially offset by a $0.3 million gain on the

sale of a portion of an Okanagan vineyard.

Earnings before interest, taxes, amortization, other expenses and gains or

losses on the above mentioned derivative financial instruments ("EBITA") were

$2.5 million for the three months ended March 31, 2012 compared to $3.9 for the

comparable prior year period. For the year ended March 31, 2012 EBITA was $32.7

million compared to $31.5 million last year. Net earnings (loss) excluding gains

on derivative financial instruments and other expenses for the three months

ended March 31, 2012 were $(0.7) million compared to $0.1 million in the prior

year, and $13.7 million for fiscal 2012 compared to $11.7 million last year. The

Company generated a net loss in the fourth quarter of fiscal 2012 of $0.6

million or $0.05 per Class A Share compared to net earnings of $0.4 million or

$0.03 per Class A Share last year. Net earnings for the year ended March 31,

2012 were $13.0 million or $0.93 per Class A Share compared to $11.2 million or

$0.78 per Class A Share in fiscal 2011.

Strong Financial Position

Working capital was $34.9 million at March 31, 2012 compared to $27.6 million at

March 31, 2011. The increase was due primarily to higher inventory due to the

recent strategic alliance with Wayne Gretzky Estate Winery and the acquisition

of the inventory of Cellar Craft International, as well as to support

anticipated future sales growth, partially offset by an increase in bank

indebtedness.

The Company's debt to equity ratio was 0.87:1 at March 31, 2012 compared to

0.85:1 at March 31, 2011. Shareholders' equity as at March 31, 2012 was $120.6

million or $8.43 per common share compared to $114.3 million or $7.99 per common

share as at March 31, 2011. The increase is primarily due to higher net earnings

for the period partially offset by the payment of dividends.

In fiscal 2012 the Company generated cash from operating activities, after

changes in non-cash working capital items, of $7.0 million compared to $23.0

million in the prior year period. Cash flow from operating activities declined

in fiscal 2012 primarily due to the higher levels of inventory accumulated

during the year partially offset by stronger earnings performance. In fiscal

2013, the Company received the $1.0 million from Creemore Springs Brewery Ltd.

due on May 1, 2012 related to the sale of the Company's beer business completed

on May 1, 2010.

Recent Events

During the fourth quarter the Company announced that Peller Estates Icewine had

been selected to form a partnership with Beijing De Long Zhen, one of China's

top wine distributors, to introduce the Company's quality products in the

country. Nationwide placement of Peller Estates vintages has been secured and

Peller Estate's wines will be sold in China's top retailers including the Golden

Resources Mall, Beijing's second largest Shopping Mall with over 6 million

square feet and 230 escalators to transport thousands of shoppers per day.

Also during the quarter Peller Estates announced that its products would be

offered on the international wine listing at the famed Burj Al Arab Hotel in

Dubai, United Arab Emirates. The Burj Al Arab stands 1,053 feet high on an

artificial island protruding out from the famed Jumeirah Beach. Designed to

mimic the sail of an Arabian ship the world famous hotel has quickly become an

iconic landmark of luxury.

In addition, Peller Estates wines are now being offered on all eleven Celebrity

Cruise ships in their world-class dining rooms. Celebrity ships are consistently

ranked among the best on the seas. Guests travelling on voyages that visit

exotic ports from the Galapagos to Alaska will now be able to enjoy Peller

Estates as part of their luxury cruise experience.

Financial Highlights (Unaudited)

(Complete consolidated financial statements to follow)

----------------------------------------------------------------------------

(in $000 except as otherwise stated) Three Months Year

----------------------------------------------------------------------------

For the Period Ended March 31, 2012 2011 2012 2011

----------------------------------------------------------------------------

Sales 60,891 56,940 276,883 265,420

Gross margin 21,953 22,146 107,257 103,262

Gross margin (% of sales) 36.1% 38.9% 38.7% 38.9%

Selling and administrative expenses 19,447 18,201 74,606 71,718

Earnings before interest, taxes,

amortization, unrealized gain (loss)

and other expenses 2,506 3,945 32,651 31,544

Unrealized gain on derivative financial

instruments (553) (291) (257) (117)

Other expenses 463 (125) 1,163 791

Net earnings (loss) (604) 417 13,001 11,223

Earnings (loss) per share - Class A ($0.05) $ 0.03 $ 0.93 $ 0.78

Earnings (loss) per share - Class B ($0.04) $ 0.02 $ 0.81 $ 0.67

Dividend per share - Class A (annual) $ 0.360 $ 0.330

Dividend per share - Class B (annual) $ 0.314 $ 0.288

Cash provided by operations (after

changes in non-cash working capital

items) 6,993 23,019

Working capital 34,869 27,643

Shareholders' equity per share $ 8.43 $ 7.99

----------------------------------------------------------------------------

Gross margin is defined as gross profit, excluding amortization of plant and

equipment used in production as calculated below:

Unaudited (in $000) Three Months Year

----------------------------------------------------------------------------

Period ended March 31, 2012 2011 2012 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gross profit $ 20,804 $ 20,947 $ 102,431 $ 98,595

----------------------------------------------------------------------------

Add: amortization of plant and

equipment used in production 1,149 1,199 4,826 4,667

----------------------------------------------------------------------------

Gross margin $ 21,953 $ 22,146 $ 107,257 $ 103,262

----------------------------------------------------------------------------

Net earnings before other expenses is defined as net earnings before the net

unrealized loss (gain) on financial instruments, and other expenses, all

adjusted by income tax rates as calculated below:

Unaudited (in $000) Three Months Year

----------------------------------------------------------------------------

Period ended March 31, 2012 2011 2012 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net earnings $ (604) $ 417 $ 13,001 $ 11,223

----------------------------------------------------------------------------

Unrealized gain on financial instruments (553) (291) (257) (117)

----------------------------------------------------------------------------

Other expenses 463 (125) 1,163 791

----------------------------------------------------------------------------

Income tax effect on the above 24 80 (245) (214)

----------------------------------------------------------------------------

Net earnings before other expenses $ (670) $ 81 $ 13,662 $ 11,683

----------------------------------------------------------------------------

Andrew Peller Limited ('APL' or the 'Company') is a leading producer and

marketer of quality wines in Canada. With wineries in British Columbia, Ontario,

and Nova Scotia, the Company markets wines produced from grapes grown in

Ontario's Niagara Peninsula, British Columbia's Okanagan and Similkameen

Valleys, and from vineyards around the world. The Company's award-winning

premium and ultra-premium VQA brands include Peller Estates, Trius, Hillebrand,

Thirty Bench, Crush, Sandhill, Calona Vineyards Artist Series, and Red Rooster.

Complementing these premium brands are a number of popularly priced varietal

wine brands including Peller Estates French Cross in the East, Peller Estates

Proprietors Reserve in the West, Copper Moon, XOXO, and Croc Crossing.

Hochtaler, Domaine D'Or, Schloss Laderheim, Royal, and Sommet are our key value

priced wine blends. The Company imports wines from major wine regions around the

world to blend with domestic wine to craft these popularly priced and value

priced wine brands. With a focus on serving the needs of all wine consumers, the

Company produces and markets premium personal winemaking products through its

wholly-owned subsidiary, Global Vintners Inc., the recognized leader in personal

winemaking products. Global Vintners distributes products through over 250

Winexpert and Wine Kitz authorized retailers and franchisees and more than 600

independent retailers across Canada, the United States, the United Kingdom, New

Zealand, and Australia. Global Vintners award-winning premium and ultra-premium

winemaking brands include Selection, Vintners Reserve, Island Mist, Kenridge,

Cheeky Monkey, Ultimate Estate Reserve, Traditional Vintage, and Artful

Winemaker. The Company owns and operates more than 100 well-positioned

independent retail locations in Ontario under the Vineyards Estate Wines, Aisle

43, and WineCountry Vintners store names. The Company also owns Grady Wine

Marketing Inc. based in Vancouver, and The Small Winemaker's Collection Inc.

based in Ontario; both of these wine agencies are importers of premium wines

from around the world and are marketing agents for these fine wines. The Company

has entered into an agreement to market the Wayne Gretzky Estate Winery brands

across Canada. The Company's products are sold predominantly in Canada with a

focus on export sales for its icewine and personal winemaking products. Andrew

Peller Limited common shares trade on the Toronto Stock Exchange (symbols ADW.A

and ADW.B).

The Company utilizes EBITA (defined as earnings before interest, amortization,

unrealized derivative (gain) loss, other expenses, and income taxes). EBITA is

not a recognized measure under IFRS. Management believes that EBITA is a useful

supplemental measure to net earnings, as it provides readers with an indication

of cash available for investment prior to debt service, capital expenditures and

income taxes. Readers are cautioned that EBITA should not be construed as an

alternative to net earnings determined in accordance with IFRS as an indicator

of the Company's performance or to cash flows from operating, investing and

financing activities as a measure of liquidity and cash flows. The Company also

utilizes gross margin (defined as gross profit, excluding amortization). The

Company's method of calculating EBITA and gross margin may differ from the

methods used by other companies and, accordingly, may not be comparable to

measures used by other companies.

Andrew Peller Limited common shares trade on the Toronto Stock Exchange (symbols

ADW.A and ADW.B).

FORWARD-LOOKING INFORMATION

Certain statements in this news release may contain "forward-looking statements"

within the meaning of applicable securities laws, including the "safe harbour

provision" of the Securities Act (Ontario) with respect to Andrew Peller Limited

( the "Company") and its subsidiaries. Such statements include, but are not

limited to, statements about the growth of the business in light of the

Company's recent acquisitions; its launch of new premium wines; sales trends in

foreign markets; its supply of domestically grown grapes; and current economic

conditions. These statements are subject to certain risks, assumptions, and

uncertainties that could cause actual results to differ materially from those

included in the forward-looking statements. The words "believe", "plan",

"intend", "estimate", "expect" or "anticipate" and similar expressions, as well

as future or conditional verbs such as "will", "should", "would", and "could"

often identify forward-looking statements. We have based these forward-looking

statements on our current views with respect to future events and financial

performance. With respect to forward-looking statements contained in this news

release, the Company has made assumptions and applied certain factors regarding,

among other things: future grape, glass bottle and wine prices; its ability to

obtain grapes, imported wine, glass, and its ability to obtain other raw

materials; fluctuations in the U.S./Canadian dollar exchange rates; its ability

to market products successfully to its anticipated customers; the trade balance

within the domestic Canadian wine market; market trends; reliance on key

personnel; protection of its intellectual property rights; the economic

environment; the regulatory requirements regarding producing, marketing,

advertising, and labeling its products; the regulation of liquor distribution

and retailing in Ontario; and the impact of increasing competition.

These forward-looking statements are also subject to the risks and uncertainties

discussed in this news release, in the "Risk Factors" section and elsewhere in

the Company's MD&A and other risks detailed from time to time in the publicly

filed disclosure documents of Andrew Peller Limited which are available at

www.sedar.com. Forward-looking statements are not guarantees of future

performance and involve risks, uncertainties, and assumptions which could cause

actual results to differ materially from those conclusions, forecasts, or

projections anticipated in these forward-looking statements. Because of these

risks, uncertainties and assumptions, you should not place undue reliance on

these forward-looking statements. The Company's forward-looking statements are

made only as of the date of this news release, and except as required by

applicable law, the Company undertakes no obligation to update or revise these

forward-looking statements to reflect new information, future events or

circumstances or otherwise.

Andrew Peller Limited

Consolidated Balance Sheet

(Unaudited)

For the years ended March 31

----------------------------------------------------------------------------

(in thousands of Canadian dollars, except per share amounts)

March 31, March 31, April 1,

2012 2011 2010

Assets

Current assets

Accounts receivable $ 24,937 $ 23,390 $ 22,902

Inventories 110,256 94,692 88,818

Current portion of biological assets 881 759 615

Prepaid expenses and other assets 1,338 818 1,818

Income taxes recoverable - - 1,327

------------------------------------

137,412 119,659 115,480

Property, plant and equipment 84,490 84,744 85,133

Biological assets 12,556 11,950 12,395

Intangibles 13,621 14,170 14,775

Goodwill 37,473 37,473 37,473

------------------------------------

$ 285,552 $ 267,996 $ 265,256

------------------------------------

------------------------------------

Liabilities

Current liabilities

Bank indebtedness $ 57,495 $ 48,758 $ 48,877

Accounts payable and accrued

liabilities 37,118 33,883 28,229

Dividends payable 1,252 1,148 1,197

Income taxes payable 40 1,000 -

Current portion of derivative

financial instruments 1,272 1,894 1,922

Current portion of long-term debt 5,366 5,333 6,158

------------------------------------

102,543 92,016 86,383

Long-term debt 41,456 42,720 47,633

Long-term derivative financial

instruments 1,943 1,578 1,667

Post-employment benefit obligations 7,151 5,565 5,414

Other long-term liabilities - - 600

Deferred income taxes 11,907 11,820 9,879

------------------------------------

165,000 153,699 151,576

------------------------------------

Shareholders' Equity

Capital stock 7,026 7,026 7,375

Retained earnings 113,526 107,271 106,305

------------------------------------

120,552 114,297 113,680

------------------------------------

$ 285,552 $ 267,996 $ 265,256

------------------------------------

------------------------------------

Commitments

The above statements should be read in conjunction with the entire consolidated

financial statements and notes.

They will be available through the Investor Relations section of

www.andrewpeller.com or at www.sedar.com by June 26, 2012.

Andrew Peller Limited

Consolidated Statements of Earnings

(Unaudited)

For the years ended March 31

----------------------------------------------------------------------------

(in thousands of Canadian dollars, except per share amounts)

2012 2011

Sales $276,883 $265,420

Cost of goods sold 169,626 162,158

Amortization of plant and equipment used in production 4,826 4,667

---------------------

Gross profit 102,431 98,595

Selling and administration 74,606 71,718

Amortization of equipment and intangibles used in

selling and administration 3,026 2,925

Interest 5,354 6,673

---------------------

Operating earnings 19,445 17,279

Net unrealized gains on derivative financial

instruments (257) (117)

Other expenses 1,163 791

---------------------

Earnings before income taxes 18,539 16,605

---------------------

Provision for income taxes

Current 4,841 3,223

Future 697 2,159

---------------------

5,538 5,382

---------------------

Net earnings for the year $ 13,001 $ 11,223

---------------------

---------------------

Net earnings per share

Basic and diluted

Class A shares $ 0.93 $ 0.78

---------------------

---------------------

Class B shares $ 0.81 $ 0.67

---------------------

---------------------

The above statements should be read in conjunction with the entire consolidated

financial statements and notes.

They will be available through the Investor Relations section of

www.andrewpeller.com or at www.sedar.com by June 26, 2012.

Andrew Peller Limited

Consolidated Statements of Comprehensive Income

(Unaudited)

For the years ended March 31

--------------------------------------------------------

(in thousands of Canadian dollars)

2012 2011

Net earnings for the year $ 13,001 $ 11,223

Net actuarial losses on post-employment benefit plans (2,347) (837)

Deferred income taxes 610 218

--------------------

Other comprehensive loss for the year (1,737) (619)

--------------------

Net comprehensive income for the year $ 11,264 $ 10,604

--------------------

--------------------

The above statements should be read in conjunction with the entire consolidated

financial statements and notes.

They will be available through the Investor Relations section of

www.andrewpeller.com or at www.sedar.com by June 26, 2012.

Andrew Peller Limited

Consolidated Statements of Cash Flows

(Unaudited)

For the years ended March 31

----------------------------------------------------------------------------

(in thousands of Canadian dollars)

2012 2011

Cash provided by (used in)

Operating activities

Net earnings for the year $ 13,001 $ 11,223

Adjustments for

Loss (gain) on disposal of property and

equipment 203 (96)

Amortization of plant, equipment and intangible

assets 7,852 7,592

Impairment of intangibles 200 -

Interest expense 5,354 6,673

Provision for income taxes 5,538 5,382

Revaluation of biological assets - net of

insurance recovery 412 831

Post-employment benefits (761) (686)

Net unrealized loss on derivative financial

instruments (257) (117)

Interest paid (5,520) (6,601)

Income taxes paid (5,801) (896)

----------------------

20,221 23,305

Change in non-cash working capital items related to

operations (13,228) (286)

----------------------

6,993 23,019

----------------------

Investing activities

Proceeds from disposal of property, plant and

equipment and vine biological assets 27 1,488

Purchase of property and equipment and vine

biological assets (7,272) (8,093)

Purchase of intangibles (1,395) (101)

Acquisition of businesses (600) (825)

----------------------

(9,240) (7,531)

----------------------

Financing activities

Increase (decrease) in bank indebtedness 8,737 (119)

Issuance of long-term debt 50,263 -

Repayment of long-term debt (50,944) (5,333)

Deferred financing costs (904) -

Dividends paid (4,905) (4,787)

Repurchase of Class A Shares - (5,249)

----------------------

2,247 (15,488)

----------------------

Increase in cash during the year - -

Cash - Beginning of year - -

----------------------

Cash - End of year $ - $ -

----------------------

----------------------

The above statements should be read in conjunction with the entire consolidated

financial statements and notes.

They will be available through the Investor Relations section of

www.andrewpeller.com or at www.sedar.com by June 26, 2012.

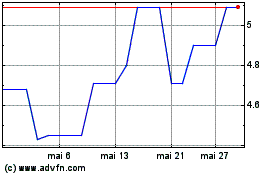

Andrew Peller (TSX:ADW.B)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Andrew Peller (TSX:ADW.B)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025