WCB Resources: Historic Drill Results Upgrade the Misima Island Porphyry Cu Au Ag Project, PNG

14 Janeiro 2014 - 2:22PM

Marketwired Canada

-- significant intervals of copper mineralisation in historic drill holes

associated with upper level porphyry alteration and fracturing are

developed over an area measuring 1,500m by 1,000m

-- drill holes also contain significant byproduct gold and silver credits

which suggest the potential for a high value precious metal rich

concentrate

-- mineralisation is associated with high level porphyry style fracture

stockwork veining and propylitic alteration

-- intersection widths and grades are consistent with halo style

mineralisation interpretation

-- drill hole intersections commence at shallow depth and frequently end in

mineralisation

WCB Resources Ltd ("WCB" or the "Company") (TSX VENTURE:WCB) announces the

following update regarding the recognition of significant copper halo drill

results in historic drilling on the Misima Island Project, PNG. Halo drill

results are considered important in demonstrating project potential and are

routinely used for targeting the deeper higher grade central regions of the

system.

Historic drill testing by Noranda targeting open pittable high grade copper

mineralisation was completed in 1969 to 1972 and from 1977 to 2000 by Misima

Mines Pty Ltd, who targeted open pittable gold and silver. Noranda concluded

that the potential high grade component of the system was at depth whilst Misima

Mines Pty Ltd focussed on the adjacent gold and silver mineralisation. Neither

Noranda nor Misima Mines Pty Ltd drilled the interpreted central core or

potential high grade component of the system. Highlights of these drill programs

reported above a 1000ppm Cu (0.1% Cu) include:

Noranda Drill Holes (no assaying for Au)

-- DD9 98m @ 0.10% Cu from 43 metres

-- DD12 63m @ 0.12% Cu, 8 g/t Ag from 5 metres

-- DD6 94m @ 0.14% Cu from 6 metres

-- DD10 79m @ 0.12% Cu from 122 metres

Misima Mines Pty Ltd Drill Holes

-- PM1351 74m @ 0.53% Cu, 0.38 g/t Au, 15 g/t Ag from 4 metres

-- PM111 66m @ 0.15% Cu, 0.95 g/t Au, 8 g/t Ag from 16 metres

-- RC266 60m @ 0.29% Cu, 0.10 g/t Au, 7 g/t Ag from 12 metres

-- RC270 101m @ 0.30% Cu, 0.24 g/t Au, 35 g/t Ag from 4 metres

-- PM1280 118m @ 0.26% Cu, 0.18 g/t Au, 7 g/t Ag from 4 metres

-- PM1472 168m @ 0.10% Cu, 0.14 g/t Au, 4 g/t Ag from 2 metres

-- PMR 2089 122m @ 0.11% Cu, 0.24 g/t Au, 2 g/t Ag from 32 metres

-- PMR2095 72m @ 0.12% Cu, 0.28 g/t Au, 3 g/t Ag from 46 metres

Numerous modern discoveries of highly significant porphyry Cu Au deposits such

as Ridgeway and Cadia East (Australia), Golpu (PNG), Namosi (Fiji), Elang

(Indonesia), Taca Taca (Argentina) and Caspiche (Chile) have been influenced by

geological factors that have included the recognition of halo or lower grade

mineralisation that typically envelops the central zones. Deep systematic drill

testing beneath this halo geochemistry resulted in the discoveries of these

multi million tonne copper and multi million ounce gold resources.

Results from historic drilling at Misima show a well defined area of halo

intersections measuring 1500m by 1000m. Importantly many of these intersections

commence at shallow depth and end in similar material. This zone is also defined

by systematic Cu, Au and Ag soil anomalism and highly elevated Cu, Au and Ag

channel results. Central to this area is a high order magnetic anomaly

coincident with interpreted magnetite alteration that is yet to be drill tested.

Planned drill testing by WCB will be targeted at the central interpreted higher

grade components of this classic porphyry Cu Au Ag system with planned drill

hole depths of over 1000m.

Cameron Switzer, President and CEO said "The development of these high order

halo style results over such a large area further support the WCB interpretation

that the Misima target represents a Tier 1 porphyry Cu Au Ag target. This data

when combined with the previously released systematic data including soils,

channels, magnetics and mapping further upgrade the prospectivity and potential.

WCB will be drilling deep holes aimed at defining orebodies not geochemistry. In

addition this is only one of our exciting targets. The board and management

believe that this is an exciting transition phase for WCB and one which has the

potential to deliver enormous growth potential for all investors."

Exploration Summary

The Misima Island Project (EL1747) is located in the same terrain and geological

region that includes the giant deposits of Grasberg, Ok Tedi, Wafi-Golpu, Lihir,

Porgera and Panguna. Past production on Misima Island totals 4.0M ounces of gold

and 20M ounces of silver. An inferred mineral resource of 1.57M ounces of gold

and 8.5M ounces of silver was recently defined. The NI 43-011 Technical Report

detailing the resource is available on SEDAR and the Company's website.

Documentation relating to drilling by Noranda and Misima Mines Pty Ltd is also

available in 43-101 Report.

Systematic exploration by WCB has defined three (3) highly significant prospects

within the project. These include the:

a. Misima Porphyry Prospect: A large 1100m by 800m high order soil Cu Au

anomaly supported by highly significant channel sample results in a zone

of upper level porphyry style alteration, multiphase veining and intense

fracturing. Aeromagnetic data support a large zone of magnetite

alteration under this zone which has not been drill tested. Halo drill

holes with broad Cu Au intersections also envelop the area over a 1500m

by 1000m area.

b. Umuna Zone. An inferred resource of 1.57M ounces of gold and 8.5M ounces

of silver has been defined along the Umuna zone where previous drill

testing had been completed. Further extensions to this system at depth

and along strike are observed. Most recently highly significant channel

sample results were released for the Misima North area, 2km to the NW

and along strike of the resource boundary.

c. Quartz Mountain: Defined by multiple large high order Mo-Au-Pb-Zn soil

anomalies associated with silica - albite - sericite - carbonate

alteration. Three zones of spatially separated hydrothermal brecciation

have highly elevated gold and silver values with historical open pit

production from this area totaling and estimated 250,000 ounces. Larger

hydrothermal breccia's are also observed along with a large ovate

magnetic high interpreted as magnetite alteration. Geological

interpretation suggests that this area has potential for porphyry style

mineralisation.

WCB's future program is aimed at drill testing these targets to where

appropriate to depths of over 1000m.

Umuna Zone Resource

The initial Inferred Mineral Resource is reported in accordance with National

Instrument 43-101 for the Umuna Zone. The mineral resource estimate was

developed by Richard W Lewis of Lewis Mineral Resource Consulting Pty Ltd under

the independent guidance and supervision of AMC Consultants Pty Ltd ("AMC"). The

resource is constrained by geological and grade domains and is incorporated

within a conceptual open pit with results being reported at an USD$1,100 per oz

gold price.

The Umuna Zone Inferred Mineral Resource comprises:

GRADE METAL

Cut-Off Tonnes

Material g/t Au (1,000,000) Au g/t Ag g/t Au (000 oz) Ag (000 oz)

----------------------------------------------------------------------------

Oxide 0.36 7.0 0.8 14 170 3,100

----------------------------------------------------------------------------

Fresh 0.50 36.1 1.2 4.7 1,400 5,400

----------------------------------------------------------------------------

TOTAL 43 1.1 6.1 1,570 8,500

----------------------------------------------------------------------------

Notes

-----

1. Rounding may cause apparent computational errors

2. Cut-off based on USD$1,100 per oz Au

3. Mineral Resources that are not Mineral Reserves do not have

demonstrated economic viability. As there are no Measured or Indicated

Resources, there cannot be any Mineral Reserves at this time. There can

be no assurances that an inferred mineral resource will ever be updated

to an indicted or measured mineral resource.

Qualified Persons

Exploration at the Misima Project is supervised by Cameron Switzer, President

and CEO, who is the Qualified Person under NI 43-101. All geochemical

information for the Company's projects is obtained and reported under a quality

assurance and quality control (QA/QC) program which includes the usage of

Standard Operating Procedures and the insertion of Certified Geochemical

Standards. Rock chip samples are collected under the supervision of company

geologists in accordance with standard industry practice. Samples are dispatched

via commercial transport to an accredited laboratory in Brisbane, Australia for

analysis. Results are routinely examined by a suitably qualified geologist to

ensure laboratory performance meets required standards.

Drill hole results are reported above a 500ppm Cu cut and include internal

dilution intervals of up to 4m.

Mr. Cameron Switzer, BSc (Hons), MAIG (3384), MAUSIMM (112798), President and

Chief Executive Officer of WCB Resources, is a qualified person as defined by

National Instrument 43-101. He is responsible for quality control of exploration

undertaken by WCB. Mr. Switzer has reviewed and approved the technical

information in this release.

About WCB Resources

WCB is an aggressive minerals exploration and development company that brings

together a strong, interdisciplinary, and proven management team with the

ability to take a project from discovery right through to operation.

WCB's strategy is to build shareholder value through acquisition, exploration

and development of copper gold projects. This strategy is being developed by a

synthesis of WCB's core skills in project evaluation, structured acquisition,

exploration and project development and operations, areas where WCB directors

and executives have significant experience.

We believe that our capabilities and experience, combined with an efficient

corporate structure, provide tremendous potential upside for investors. WCB is

focussed on the exploration and development of the Tier 1 Misima Island Project

in Papua New Guinea.

On behalf of the Board of Directors

Cameron Switzer, President and Chief Executive Officer

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term

is defined in the policies of the TSX Venture Exchange) accepts responsibility

for the adequacy or accuracy of this release.

Forward Looking Statements: This news release includes certain statements that

may be deemed "forward-looking statements". All statements in this release,

other than statements of historical facts, including, without limitation,

statements potential mineralization, the estimation of mineral resources, the

realization of mineral resource estimates, interpretation of prior exploration

and potential exploration results, the timing and success of exploration

activities generally, the timing and results of future resource estimates,

permitting time lines, metal prices and currency exchange rates, availability of

capital, government regulation of exploration operations, environmental risks,

reclamation, title, and future plans and objectives of the company are

forward-looking statements that involve various risks and uncertainties.

Although the Company believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are not

guarantees of future performance and actual results or developments may differ

materially from those in the forward-looking statements. Forward- looking

statements are based on a number of material factors and assumptions. Factors

that could cause actual results to differ materially from those in

forward-looking statements include failure to obtain necessary approvals in

respect of a transaction, unsuccessful exploration results, changes in project

parameters as plans continue to be refined, results of future resource

estimates, future metal prices, availability of capital and financing on

acceptable terms, general economic, market or business conditions, risks

associated with operating in foreign jurisdictions, uninsured risks, regulatory

changes, defects in title, availability of personnel, materials and equipment on

a timely basis, accidents or equipment breakdowns, delays in receiving

government approvals, unanticipated environmental impacts on operations and

costs to remedy same, and other exploration or other risks detailed herein and

from time to time in the filings made by the company with securities regulators.

Mineral exploration and development of mines is an inherently risky business.

Accordingly the actual events may differ materially from those projected in the

forward -looking statements. For more information on the Company, investors

should review their annual filings that are available at www.sedar.com. Neither

TSX Venture Exchange nor its Regulation Services Provider (as that term is

defined in the policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

The Company relies on litigation protection for "forward looking" statements.

Actual results could differ materially from those described in the news release

as a result of numerous factors, some of which are outside the control of the

Company.

FOR FURTHER INFORMATION PLEASE CONTACT:

WCB Resources Ltd

Cameron Switzer

cswitzer@wcbresources.com

WCB Resources Ltd

Shaun Maskerine

smaskerine@wcbresources.com

Ironstone Capital Corp.

Lee Bowles

Investor Relations

416 941 1253

lbowles@ironstonecapital.ca

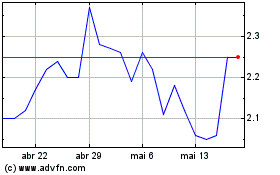

Arizona Metals (TSX:AMC)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Arizona Metals (TSX:AMC)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024