Turquoise Hill Resources today announced its financial results for the quarter

ended December 31, 2013. All figures are in US dollars unless otherwise stated.

HIGHLIGHTS

-- Oyu Tolgoi achieved a strong safety performance for 2013 with no

fatalities and an All Injury Frequency Rate of 0.43 per 200,000 hours

worked.

-- Oyu Tolgoi produced approximately 290,000 tonnes of concentrate for 2013

and 76,700 tonnes of copper in concentrates.

-- In 2013, Oyu Tolgoi recorded net revenue of $51.6 million on 26,400

tonnes of concentrate.

-- In March 2014, sales volumes at Oyu Tolgoi began accelerating and

approaching production; as at March 24, 2014, approximately 43,000

tonnes of concentrate has been sold in 2014.

-- During Q4'13, open-pit production increased approximately 81% over Q3'13

as the mine returned to more normal operating levels.

-- Concentrator production rates progressively increased during 2013,

including periods where throughput rates exceeded design.

-- Production at Oyu Tolgoi during Q1'14 has been impacted by various post-

commissioning issues, including failure of the rake blades in the

tailings thickeners, which have been repaired and full production

recommenced on March 24, 2014. In addition, certain post-commissioning

debottlenecking projects have been deferred in order to preserve cash.

-- Oyu Tolgoi is now expected to produce 135,000 to 160,000 tonnes of

copper in concentrates and 600,000 to 700,000 ounces of gold in

concentrates for 2014.

-- Sales contracts have now been signed for 74% and 84% of Oyu Tolgoi's

2014 and 2015 concentrate production respectively, while 40% of

concentrate production is contracted for eight years (subject to

renewals); discussions are ongoing with potential customers to place the

remaining tonnage under long-term agreements at international terms.

-- During Q4'13 and Q1'14, constructive engagement with the Government of

Mongolia continued with the aim of resolving a number of outstanding

shareholder issues and progressing project financing.

-- At the end of 2013, approximately 92% of Oyu Tolgoi's employees were

Mongolian nationals in line with the Investment Agreement requirements.

-- During Q4'13, Oyu Tolgoi signed a two-year collective agreement with the

Oyu Tolgoi Trade Union - a departure from typical 12-month Mongolian

labor agreements.

-- Following a Q4'13 launch, Turquoise Hill successfully closed an

approximate $2.4 billion rights offering in January 2014 and repaid all

outstanding Rio Tinto funding facilities.

-- In 2013, SouthGobi produced approximately 3.1 million tonnes of coal

compared to production of approximately 1.3 million tonnes of coal in

2012.

-- In 2013, SouthGobi sold 3.26 million tonnes of coal at an average

realized selling price of $24.25 per tonne compared to sales of 1.98

million tonnes of coal at an average realized selling price of $47.49

per tonne in 2012.

FINANCIAL RESULTS

In 2013, Turquoise Hill recorded a net loss of $112.0 million ($0.09 per share),

compared to a net loss of $412.1 million ($0.37 per share) in 2012, which was a

decrease of $300.1 million. Results for 2013 included $110.2 million in revenue;

$228.7 million in other income; $14.8 million in interest income; an $87.7

million gain from the change in the fair value of the rights offering derivative

liabilities; a $5.5 million gain from the change in the fair value of

SouthGobi's embedded derivatives; and $335.6 million of net loss attributable to

non-controlling interests. These amounts were offset by $178.2 million in cost

of sales; $27.5 million in exploration and evaluation expenses; $233.2 million

in other operating expenses; $61.3 million in general and administrative

expenses; $30.4 million write-down of accounts receivable and other current

assets; $29.8 million write-down of carrying value of materials and supplies

inventory; $73.6 million write-down of carrying value of property, plant and

equipment; $62.4 million in interest expense; $5.6 million in foreign exchange

losses; a $3.1 million share of loss of significantly influenced investees; a

$99.9 million provision for income and other taxes; and a $80.6 million loss

from discontinued operations.

Turquoise Hill's cash position, on a consolidated basis at December 31, 2013,

was approximately $78.1 million. As at March 26, 2014, Turquoise Hill's

consolidated cash position was approximately $147.0 million.

OYU TOLGOI COPPER-GOLD MINE

First year of production

By the end of Q1'13, construction of the Oyu Tolgoi open-pit mine and

concentrator complex was complete and mine infrastructure was substantially

complete.

Major highlights for 2013 and Q1'14 include the following:

-- Oyu Tolgoi achieved a strong safety performance for 2013 with no

fatalities and an All Injury Frequency Rate of 0.43 per 200,000 hours

worked.

-- In 2013, Oyu Tolgoi produced approximately 290,000 tonnes of

concentrate. The mine produced 76,700 tonnes of copper in concentrates

for 2013 and met production guidance.

-- Throughput and recovery rates improved throughout 2013. During the first

half of 2013, commissioning of the concentrator progressed and

concentrate production ramped up. By Q3'13, the concentrator had

consistently achieved throughput rates above 95% of capacity and by the

end of 2013 was operating at just above design capacity.

-- On July 9, 2013, Oyu Tolgoi commenced the shipping of concentrate.

During Q3'13, Oyu Tolgoi's customers were engaged with Chinese customs

officials to receive the necessary approvals to enable them to collect

purchased concentrate. Sales commenced on October 19, 2013 when the

first customer collected concentrate from the Chinese-border warehouse.

Net revenue for 2013 was $51.6 million on 26,400 tonnes of concentrate.

-- In Q2'13, open-pit production rates were reduced to preserve cash and

better align open-pit production to the needs of the concentrator during

the ramp up period. Open-pit mining resumed during Q3'13 and returned to

more normal operating levels during Q4'13. During Q4'13, open-pit

production increased approximately 81% over Q3'13.

-- On September 1, 2013, Oyu Tolgoi achieved the Commencement of Production

as defined in the October 2009 Investment Agreement between Turquoise

Hill, Rio Tinto and the Government of Mongolia. This resulted in an

increase in the Management Services Payment from 3% to 6% of capital

costs and operating costs incurred by Oyu Tolgoi. The Company and Rio

Tinto have agreed to evenly split the Management Services Payment from

Oyu Tolgoi.

-- On July 28, 2013, Turquoise Hill announced that funding and all work on

the underground development of Oyu Tolgoi would be delayed and on August

13, 2013 development was suspended. All parties are committed to further

construction and development of Oyu Tolgoi subject to resolution of

shareholder issues.

-- Prior to the development suspension in Q3'13, underground lateral

development at Hugo North had advanced approximately 16 kilometres and

the sinking of Shaft #2 and Shaft #5 had reached approximate depths

below surface of 1,200 metres (91% of its final depth) and 200 metres

(17% of its final depth), respectively. Development of the main

ventilation station was completed during Q3'13.

-- The feasibility study for the expansion of operations at the Oyu Tolgoi

mine is ongoing and expected to be complete in the first half of 2014.

Following completion, the study must be approved by the mine's

shareholders as well as the Mongolian Minerals Council.

-- Sales contracts have now been signed for 74% and 84% of Oyu Tolgoi's

expected 2014 and 2015 concentrate production respectively, while 40% of

concentrate production is contracted for eight years (subject to

renewals). Discussions are ongoing with potential customers to place the

remaining tonnage under long-term agreements at international terms.

-- At the beginning of January 2014, annual negotiations were conducted

with all Oyu Tolgoi customers and 2014 annual treatment and refining

charges were settled at the Far East Benchmark of $92 per tonne of

copper concentrate and 9.2 cents per pound of payable copper.

-- During Q4'13, negotiations with the Oyu Tolgoi Trade Union were

finalized resulting in the signing of a new collective agreement. The

new two-year agreement is a departure from Mongolian labor agreements

which typically are for 12 months. All parties see the new agreement as

a positive step in positioning Oyu Tolgoi for long-term operations.

Final cost for the initial development and construction of Oyu Tolgoi was

approximately $6.2 billion.

Funding of Oyu Tolgoi

In accordance with the Amended and Restated Shareholders' Agreement dated June

8, 2011 (ARSHA), Turquoise Hill is required to fund Oyu Tolgoi's cash

requirements until September 1, 2016, and Oyu Tolgoi must repay all amounts

funded by way of debt, including accrued interest, before it can pay common

share dividends. At December 31, 2013, the aggregate outstanding balance of

loans extended by subsidiaries of the Company to Oyu Tolgoi was $6.8 billion,

including accrued interest of $0.9 billion. These loans bear interest at an

effective annual rate of LIBOR plus 6.5%.

In accordance with the ARSHA, a subsidiary of the Company has funded common

share investments in Oyu Tolgoi on behalf of Erdenes Oyu Tolgoi LLC (Erdenes).

These funded amounts earn interest at an effective annual rate of LIBOR plus

6.5% and are repayable, by Erdenes to a subsidiary of the Company, via a pledge

over Erdenes' share of Oyu Tolgoi common share dividends. Erdenes also has the

right to reduce the outstanding balance by making cash payments. As at December

31, 2013, the cumulative amount of such funding, representing approximately 34%

of invested common share equity, and accrued interest thereon totalled $751.2

million and $110.5 million respectively.

Fourth quarter and full-year 2013 performance

In 2013, Oyu Tolgoi generated revenue of $51.6 million, net of royalties of $3.0

million, on sales of 26,400 tonnes of copper-gold concentrates. Oyu Tolgoi's

breakdown of revenue, net of royalties, by metals in concentrates is as follows:

approximately 6,100 tonnes of copper for $37.6 million, approximately 10,000

ounces of gold for $13.2 million and approximately 36,000 ounces of silver for

$0.8 million. All 2013 revenue from the sale of copper-gold concentrates arose

in Q4'13. Oyu Tolgoi's sales of concentrate are subject to a 5% royalty in

Mongolia. Turquoise Hill's revenues are presented net of royalties.

Oyu Tolgoi recognized cost of sales in 2013 of $49.2 million, which included

direct cash costs of product sold, mine administration cash costs of product

sold, mining plant and equipment depreciation, and depletion of mineral

properties.

Key operational and production metrics for Q4'13 and full-year 2013 are as follows:

Oyu Tolgoi Production Data

All data represents full production and sales on a 100% basis

1H 3Q 4Q 12 Months

2013 2013 2013 2013

----------------------------------------------------------------------------

Open pit material mined 37,925 12,151 21,956 72,032

('000 tonnes)

Ore Treated ('000 tonnes) 4,430 8,052 7,835 20,317

Average mill head grades:

Copper (%) 0.42 0.47 0.49 0.47

Gold (g/t) 0.27 0.36 0.41 0.36

Silver (g/t) 1.31 1.39 1.44 1.39

Copper concentrates produced 50.2 110.3 129.5 290.0

('000 tonnes)

Average concentrate grade 26.1 27.7 25.4 26.4

(% Cu)

Production of metals in

concentrates:

Copper in concentrates 13.1 30.6 32.9 76.7

('000 tonnes)

Gold in concentrates ('000 21 62 74 157

ounces)

Silver in concentrates 85 196 208 489

('000 ounces)

Sales of metals in

concentrates:

Copper in concentrates - - 6.1 6.1

('000 tonnes)

Gold in concentrates ('000 - - 10 10

ounces)

Silver in concentrates - - 36 36

('000 ounces)

Metal recovery (%)

Copper 73.2 81.7 86.4 81.6

Gold 56.7 66.3 71.2 66.1

Silver 47.8 54.9 57.2 54.2

Ramp up of the open pit was slower than expected during Q4'13 due to delays in

recruitment and training and a strong focus on construction of the tailings

storage facility. As a result, material mined during October and November 2013

was below expectation but it returned to near plan during December.

Production rates at the Oyu Tolgoi concentrator progressively increased during

2013, including periods where throughput rates exceeded design. During Q4'13,

the concentrator exceeded nameplate capacity on 31 days. In December 2013, the

concentrator processed 3.0 million tonnes of ore, which was slightly above plan.

Record production was achieved on December 2, 2013 with 122,800 tonnes of ore

processed. Recovery of copper and gold progressively improved during 2013 as the

open-pit mine deepened, feed grades increased and operations normalized.

Infrastructure construction continued throughout 2013. The building of the Oyu

Tolgoi - Gashuun Sukhair road to an existing toll road is ongoing and is

expected to be completed in 2014. The diversion of the Undai River was finished

during Q3'13.

During 2013, additions to property, plant and equipment for the Oyu Tolgoi mine

totalled $641.0 million (2012: $2.6 billion), which included underground

development costs of $459.8 million (2012 $309.1 million). On May 1, 2013, the

Oyu Tolgoi mine's ore processing infrastructure, including the concentrator, was

in the condition and location necessary for its intended use. Therefore, on this

date, costs associated with establishing and commissioning this infrastructure

ceased being capitalized.

Q1'14 operational outlook

Some sales volumes previously expected during Q1'14 were deferred into Q2'14 and

Q3'14 due to technical issues at two of Oyu Tolgoi's receiving smelters. Also,

sales were slower than expected during January and February 2014 but began to

accelerate during March 2014 and approached production. As at March 24, 2014,

approximately 43,000 tonnes of concentrate has been sold in 2014. During Q2'14,

sales are expected to increase and match production. During the second half of

2014, Oyu Tolgoi is expected to begin a drawdown of inventory. Oyu Tolgoi will

monitor production levels and only if necessary, match them to meet customer

requirements, with the goal of returning to more normal levels of inventory by

the end of 2014.

As previously disclosed, Q1'14 production has been impacted by various

post-commissioning issues including the failure of the rake blades in the

tailings thickeners. This resulted in a shutdown of one line, approximately 50%

feed rate, for seven weeks. Repairs to the rakes have been completed and full

production recommenced on March 24, 2014. In addition, certain

post-commissioning debottlenecking projects have been deferred in order to

preserve cash.

Turquoise Hill now expects Oyu Tolgoi to produce 135,000 to 160,000 tonnes of

copper in concentrates and 600,000 to 700,000 ounces of gold in concentrates for

2014.

In February 2014, Oyu Tolgoi signed two agreements that are expected to provide

the mine with additional liquidity. On February 20, 2014, Oyu Tolgoi signed a

$126 million non-revolving copper concentrate prepayment agreement with one of

its customers whereby Oyu Tolgoi can request the customer to prepay up to 80% of

the provisional value of copper concentrate produced but not yet delivered. On

February 24, 2014, Oyu Tolgoi signed an unsecured $200 million revolving credit

facility with two banks.

Discussions with the Government of Mongolia

Turquoise Hill, Rio Tinto and the Government of Mongolia continue to work

together with the aim of resolving outstanding shareholder issues and finalizing

project finance for further development of the underground mine at Oyu Tolgoi.

Progress is being made and some matters have been resolved. All parties remain

committed to further development of Oyu Tolgoi.

While discussions remain constructive, it may not be possible to resolve the

shareholder issues until the underground feasibility study has been completed,

reviewed and approved by all parties and all necessary permits have been

received. The feasibility study is expected to be completed in the first half of

2014.

If agreement on outstanding shareholder issues is deferred until after the

completion and approval of the feasibility study, the project finance will not

be able to be closed prior to the current expiry of the lender commitments on

March 31, 2014. In this event, the shareholders will consider requesting an

extension of the commitments from the project finance lenders and finalization

of the Oyu Tolgoi project financing may be deferred to the second half of 2014.

2013 Oyu Tolgoi Technical Report

On March 25, 2013, the 2013 Oyu Tolgoi Technical Report (2013 OTTR) was

released. The 2013 OTTR was reviewed by independent qualified persons. The 2013

OTTR is the current Technical Report for the Oyu Tolgoi mine and related

projects. Disclosure of a scientific or technical nature in the Annual

Information Form in respect of the 2013 OTTR was prepared by the following

qualified persons: Bernard Peters, B. Eng. (Mining), FAusIMM of OreWin Pty Ltd.

("OreWin"), formerly of AMC Consultants Pty Ltd. ("AMC"), who was responsible

for the overall preparation of the report and the mineral reserve estimate of

the report; as well as the preparation of the geotechnical sections and the

sections related to and including processing; and Sharron Sylvester, B.Sc

Geology, MAIG (RPGeo), of OreWin; also formerly of AMC; who was responsible for

preparation of the mineral resources estimate of the report; both of whom are

"qualified persons" for the purposes of National Instrument 43-101.

Highlights of the 2013 OTTR include the following:

-- The OTTR revised phase-two capital estimate of $5.1 billion is based on

the concentrator operating at its initial capacity of 100,000 tonnes per

day and includes an expansion to the back end of the concentrator to

process the high grade underground ore. Ore is initially fed from the

Southern Oyu open pit mine, which is subsequently displaced with the

more valuable Hugo North Lift 1 underground ore.

-- The peak production rate from the underground has increased from an

expected 85,000 tonnes per day to an expected 95,000 tonnes per day.

-- The 2013 OTTR excludes the power plant and concentrator expansion to

160,000 tonnes per day outlined in the 2012 Integrated Development and

Operations Plan Technical Report (IDOP).

-- A decision to expand the concentrator to also process full production

from the open pit mine does not need to be made at this time. Prior to

this decision point, the Company will continue to evaluate and optimize

options for resource development.

-- The 100,000 tonne reserve case does not include construction of a power

station; capital and operating costs have been adjusted to reflect

purchases from a third party Mongolia based power provider.

-- The case supporting the mineral reserve has extended from 27 to 43 years

as concentrator production has been assumed to remain at 100,000 tonnes

per day.

-- The average cash cost after gold and silver credits for the first ten

years of production is expected to be $0.89 per pound of copper. The

increase relative to the 2012 IDOP ten-year average cash cost was

primarily a result of incorporating higher third party power costs

compared to a dedicated power station. This increase in power costs

resulted in a large increase in processing costs and a smaller increase

in mining costs. Higher general and administration costs also contribute

to the increase in average cash cost.

-- Overall, the Company estimates that there has been a 30% increase in the

direct capital cost to construct the underground mine. The remainder of

the increase in the phase-two capital estimate, after adjusting for

scope changes, is primarily driven by an increase in contingencies,

contractor costs and owner execution costs.

-- The independently prepared 2013 OTTR states that the ongoing work being

undertaken on the feasibility study may result in opportunities to

improve the economics through cost reductions and optimizations of the

mine plan. Oyu Tolgoi plans to complete a focused and structured review

of the feasibility study work to support future capital approvals.

-- The 2013 OTTR reserves and resources show an increase from previous

years. The 2013 OTTR states that the deposits contain a currently

identified estimated resource of 45.8 billion pounds of contained copper

and 24.9 million ounces of contained gold in the measured and indicated

mineral resource categories and 54.6 billion pounds of contained copper

and 36.8 million ounces of contained gold in the inferred category. The

reasonable prospects analysis identified a reduction in cut-off grade,

which was the predominant factor for the change in resources relative to

reporting in previous years. The mineral reserves state 26.5 billion

pounds recovered copper and 12.9 million ounces recovered gold,

increases of 4.4% in recovered copper and 4.3% in recovered gold over

the 2012 IDOP mineral reserve. The increase in reserves is a result of

re-optimization of the mine designs. Mineral resources are inclusive of

mineral reserves.

Oyu Tolgoi workforce

Employment at Oyu Tolgoi continues to focus on utilizing Mongolian men and women

and developing their skills through established training programs. As at

December 31, 2013, Oyu Tolgoi had 2,830 employees and approximately 92% were

Mongolian nationals. This is in line with the Investment Agreement requirement

that 90% of Oyu Tolgoi's employees must be Mongolian nationals. Additionally,

the number of Mongolians in senior leadership roles increased during 2013 with

the appointment of a number of individuals to the Oyu Tolgoi executive

management team. Mongolians now occupy nearly 50% of all superintendent and

specialist-level positions and over 35% of manager/principal roles.

Development and exploration drilling continued in Q4'13

In 2013, Oyu Tolgoi's exploration strategy is focused on developing a project

pipeline prioritized in areas that can impact the current development of the Oyu

Tolgoi orebodies, seeking low-cost development options with the potential to

directly impact the value of current operations and continuing development of

legacy datasets to enable future discovery. There was also a reduction of

drilling compared to previous years as emphasis shifted to data compilation, 3D

modelling and interpretation to generate the next series of prioritized targets.

In Q3'13, encouraging drill results were reported from a Hugo West target. There

was further shallow exploration of the Hugo West target in Q4'13 and Q1'14.

An infill drilling program at Hugo North Lift #1 was completed during 2013 and

is being incorporated into an updated Hugo North resource model. This new Hugo

North resource model will be used for the 2014 feasibility study.

During Q4'13, exploration drilling continued with 4,830 metres of surface

diamond drilling completed by up to three drill rigs on the Oyu Tolgoi mining

licence. OTD1770, located to the west of the Hugo South deposit and 380 metres

south from OTD1769, was drilled to test the continuation of mineralization to

the southwest of the Hugo South deposit and also test a magneto-telluric

geophysical anomaly. OTD1770 has intersected quartz monzodiorite intruded by

narrow basalt and andesite dikes. Drilling to date indicates a potential

exploration target within the Hugo West area with moderate grade mineralization

continuing over the 380 metre strike length that has been tested.

Drilling of OTD1771 took place during Q4'13 to test for continued mineralization

of the Hugo West target. OTD1771 showed a continuity of mineralization within

the Hugo West target to the south, albeit at weakening grades and reduced

intercept thickness.

Twelve shallow drillholes were completed during the quarter targeting the Hugo

West shallow exploration target. Copper and gold assay results have been

received and are shown in the table below. The initial logging and assays

indicate that the Hugo West shallow target is potentially a low-grade open

pitable exploration target that requires additional drilling to delineate the

target. The Hugo West shallow target is hosted predominantly in quartz

monzodiorite and ignimbrite.

SOUTHGOBI RESOURCES

Sales and operations at the Ovoot Tolgoi coal mine

Operations resumed at the Ovoot Tolgoi coal mine on March 22, 2013 after having

been fully curtailed since the end of Q2'12.

In 2013, SouthGobi's revenue was $58.6 million compared to $78.1 million in

2012. SouthGobi sold 3.26 million tonnes of coal at an average realized selling

price of $24.25 per tonne compared to sales of 1.98 million tonnes of coal at an

average realized selling price of $47.49 per tonne in 2012. Revenue decreased

primarily due to lower average realized selling prices for SouthGobi's coal

products. Following the softening of coal markets in mid-2012, the coal markets

in China continued to be challenging in 2013 with certain coal price indices in

China reaching four year lows during the year. The decrease in average realized

selling prices for SouthGobi's coal products was partially offset by higher

sales volumes in 2013 compared to 2012.

Turquoise Hill's revenue is presented net of royalties. SouthGobi is subject to

a base royalty in Mongolia of 5% on all export coal sales. In addition,

effective January 1, 2011, SouthGobi is subject to an additional sliding scale

royalty of up to 5%. The royalty is calculated using a set reference price per

tonne published monthly by the Government of Mongolia. Based on the reference

prices for 2013, SouthGobi was subject to an average 7% royalty based on a

weighted average reference price of $65.81 per tonne. SouthGobi's effective

royalty rate for 2013, based on SouthGobi's average realized selling price of

$24.25 per tonne, was 19% or $4.53 per tonne compared to 15% or $7.12 per tonne

in 2012.

In 2013, SouthGobi produced 3.06 million tonnes of raw coal with a strip ratio

of 2.76 compared to production of 1.33 million tonnes of raw coal with a strip

ratio of 2.52 in 2012. The increase in production was primarily due to the

restart of operations following the curtailment of SouthGobi's mining operations

in the last three quarters of 2012.

Cost of sales was $129.0 million in 2013, compared to $155.4 million in 2012.

Cost of sales comprises the direct cash costs of product sold, mine

administration cash costs of product sold, costs related to idled mine assets,

coal inventory write-downs, mining plant and equipment depreciation, depletion

of mineral properties and share-based compensation expense. As a result of the

recommencement of mining operations at the Ovoot Tolgoi mine on March 22, 2013,

costs related to idled mine assets decreased in 2013. However, the 2013

production plan did not fully utilize SouthGobi's existing mine fleet,

therefore, costs related to idled mine assets continued to be incurred

throughout 2013. In 2013, cost of sales included $30.4 million of costs related

to idled mine assets (2012: $53.0 million) and $38.0 million of coal inventory

write-downs (2012: $25.5 million).

Processing infrastructure

Dry Coal Handling Facility (DCHF)

Following an extensive review that commenced in Q4'13, SouthGobi concluded that

it does not plan to either complete or use the DCHF at the Ovoot Tolgoi mine in

the foreseeable future. This conclusion constituted an indicator of impairment

and SouthGobi performed an impairment assessment of the DCHF. As a result of the

impairment assessment, SouthGobi recorded a $66.9 million non-cash impairment to

reduce the carrying value of the DCHF, including related materials and supplies

inventories, to its fair value. A probability-weighted discounted cash flow

model, with a discount rate of 10.4%, was used to estimate the DCHF's fair

value. The DCHF had a carrying value of $78.1 million prior to the impairment

assessment. Subsequent to the impairment charge, the DCHF's carrying value was

$11.2 million at December 31, 2013.

The first phase of the DCHF project comprised a coal rotary breaker intended to

reduce screening costs and improve yield recoveries. On February 13, 2012,

SouthGobi announced the successful commissioning of the coal rotary breaker. The

Ovoot Tolgoi mine operations were curtailed during Q2'12 and resumed on March

22, 2013. SouthGobi has not operated the coal rotary breaker since its announced

commissioning. The second phase of the DCHF project included the installation of

dry air separation modules and covered load out conveyors with fan stackers to

take processed coals to stockpiles and enable more efficient blending. In 2012,

SouthGobi announced the suspension of the completion of the DCHF project to

minimize uncommitted capital expenditures and preserve SouthGobi's financial

resources. On November 14, 2013, SouthGobi announced that it was conducting a

review of the DCHF project and its contribution to SouthGobi's product strategy.

The review of the DCHF project was completed in Q1'14. SouthGobi continues to

focus on preserving its financial resources and has assessed, using updated

operating cost assumptions and estimates, that it currently has the adequate

equipment and capacity to efficiently meet its commercial objectives and execute

its product strategy without the use of the DCHF. The use of mobile screens at

stockpile areas closer to the pits has enabled SouthGobi to realize a cost

benefit compared to hauling the coal to the central DCHF and operating the

rotary breaker. This provides a lower cost solution without adversely impacting

the coal quality of the coal planned to be mined over the next year. As coal

markets improve and production from the Ovoot Tolgoi mine increases in line with

its anticipated annual capacity of 9 million tonnes run-of-mine production,

SouthGobi will review the use of the DCHF as part of its existing assets and

continue developing beneficiation capabilities to maximize value from its

product.

Wet Washing Facility

In 2011, SouthGobi entered into an agreement with Ejin Jinda, a subsidiary of

China Mongolia Coal Co. Ltd. to toll-wash coals from the Ovoot Tolgoi mine. The

agreement has a duration of five years from commencement of the contract and

provides for an annual wet washing capacity of approximately 3.5 million tonnes

of input coal. The facility is located approximately 10km inside China from the

Shivee Khuren Border Crossing, approximately 50km from the Ovoot Tolgoi mine.

Ejin Jinda will charge SouthGobi a single toll washing fee which will cover

their expenses, capital recovery and profit. Ejin Jinda will also transport coal

from the Ovoot Tolgoi mine to the wet washing facility under a separate

transportation agreement. Pursuant to the terms of the agreement, SouthGobi

prepaid $33.6 million of toll washing fees in 2011.

To date, commercial operations at the wet washing facility have not commenced.

SouthGobi identified the results of a trial sample from the wet washing facility

and the delay in starting the commercial operations at the wet washing facility

as indicators of impairment for the prepaid toll washing fees which are part of

the contract with Ejin Jinda. Based on updated estimates and assumptions related

to wash yields from the facility, a $30.2 million impairment loss on the $33.6

million of prepaid toll washing fees was recorded in Q4'13.

SouthGobi's objective continues to be the implementation of an effective and

profitable wet washing solution, and SouthGobi is cooperating with Ejin Jinda in

reviewing the utilization of the wet washing facility.

Governmental and regulatory investigations

SouthGobi is subject to investigations by Mongolia's Independent Authority

against Corruption (the "IAAC") and the Mongolian State Investigation Office

(the "SIA") regarding allegations against SouthGobi and some of its former

employees. The IAAC investigation concerns possible breaches of Mongolia's

anti-corruption laws, while the SIA investigation concerns possible breaches of

Mongolia's money laundering and taxation laws.

While the IAAC investigation into allegations of possible breaches of Mongolian

anti-corruption laws has been suspended, SouthGobi has not received formal

notice that the IAAC investigation is completed. The IAAC has not formally

accused any current or former SouthGobi employees of breach of Mongolia's

anti-corruption laws.

A report issued by the experts appointed by the SIA on June 30, 2013 and again

in January 2014 has recommended that the accusations of money laundering as

alleged against SouthGobi's three former employees be withdrawn. However, to

date, SouthGobi has not received notice or legal document confirming such

withdrawal as recommended by the experts appointed by the SIA.

A third investigation ordered by the SIA and conducted by the National Forensic

Center ("NFC") into alleged violations of Mongolian taxation law was concluded

at the end of January 2014. SouthGobi has received notice that the report with

conclusions of the investigations by the NFC have been provided to the

Prosecutor General of Mongolia. The Prosecutor General may undertake criminal

actions against the three former employees for alleged violations of taxation

laws and SouthGobi may be held liable as "civil defendant" as a result of these

alleged criminal actions. These actions could result in the investigation case

being imminently transferred to a Court of Justice under the relevant Mongolian

law. The likelihood or consequences of such an outcome or any civil action taken

against SouthGobi are uncertain and unclear at this time but could include

financial or other penalties, which could be material, and which could have a

material adverse effect on SouthGobi and the Company.

Turquoise Hill disputes and will vigorously defend itself against any civil or

criminal actions. At this point, the three former employees remain designated as

"accused" in connection with the allegations of tax evasion, and continue to be

subject to a travel ban. SouthGobi remains designated as a "civil defendant" in

connection with the tax evasion allegations, and may potentially be held

financially liable for the alleged criminal misconduct of its former employees

under Mongolian Law.

The SIA also continues to enforce administrative restrictions, which were

initially imposed by the IAAC investigation, on certain of SouthGobi's Mongolian

assets, including local bank accounts, in connection with its continuing

investigation of these allegations. While the orders restrict the use of

in-country funds pending the outcome of the investigation, they are not expected

to have a material impact on Turquoise Hill's activities in the short term,

although they could create potential difficulties for Turquoise Hill in the

medium to long term. Turquoise Hill will continue to take all appropriate steps

to protect its ability to conduct its business activities in the ordinary course

Internal investigations

Through SouthGobi's Audit Committee (comprised solely of independent directors)

(the SouthGobi Audit Committee), SouthGobi has conducted an internal

investigation into possible breaches of law, internal corporate policies and

codes of conduct arising from the allegations which have been raised. The

SouthGobi Audit Committee has had the assistance of independent legal counsel in

connection with its investigation.

The Chair of the SouthGobi Audit Committee has also participated in a tripartite

committee, comprised of the Audit Committee Chairs of SouthGobi and the Company

and a representative of Rio Tinto, which focused on the investigation of a

number of those allegations, including possible violations of anti-corruption

laws. Independent legal counsel and forensic accountants assisted this committee

with its investigation. The tripartite committee substantially completed the

investigative phase of its activities during Q3'13. SouthGobi continues to

cooperate with the IAAC, SIA and with Canadian and United States government and

regulatory authorities that are monitoring the Mongolian investigations. It is

possible that these authorities may subsequently conduct their own review or

investigation or seek further information from SouthGobi. Pending further

reviews or questions from any of such government or regulatory authorities, the

tripartite committee has been stood down and investigations have been paused.

The investigations referred to above could result in one or more Mongolian,

Canadian, United States or other governmental or regulatory agencies taking

civil or criminal action against SouthGobi, its affiliates or its current or

former employees. The likelihood or consequences of such an outcome are unclear

at this time but could include financial or other penalties, which could be

material, and which could have a material adverse effect on Turquoise Hill.

SouthGobi, through its Board of Directors and new management, has taken a number

of steps to address issues noted during the investigations and to focus ongoing

compliance by employees with all applicable laws, internal corporate policies

and codes of conduct, and with SouthGobi's disclosure controls and procedures

and internal controls over financial reporting.

Withdrawal of Notice of Investment Dispute

On August 22, 2013, SouthGobi announced that it had withdrawn the Notice of

Investment Dispute in recognition of the fact that the dispute was resolved

following the grant of three pre-mining agreements ("PMAs") on August 14, 2013

relating to the Zag Suuj Deposit and certain areas associated with the Soumber

Deposit, and the earlier grant of a PMA on January 18, 2013 pertaining to the

Soumber Deposit. Each of the PMAs was granted and executed by MRAM in accordance

with Mongolian law.

Board of Directors and management changes

In 2013, SouthGobi announced the appointment of Bertrand Troiano as its Chief

Financial Officer, Brett Salt as its Chief Commercial Officer and Enkh-Amgalan

Sengee as President and Executive Director of SouthGobi Sands LLC, SouthGobi's

wholly-owned subsidiary. Brett Salt resigned as a Non-Executive Director of

SouthGobi following his appointment as Chief Commercial Officer. Bold Baatar was

appointed as a Non-Executive Director of SouthGobi in 2013.

Class action lawsuit

On or about January 6, 2014, Siskinds LLP, a Canadian law firm, filed a proposed

class action lawsuit in Canada against SouthGobi, certain former and current

directors and officers of SouthGobi and SouthGobi's former auditor, Deloitte

LLP, relating to the decision by SouthGobi's board of directors in November 2013

to restate SouthGobi's 2011 and 2012 financial statements.

The plaintiff seeks leave to bring a claim under applicable Canadian securities

legislation and seeks certification of a class action with respect to a class of

persons who purchased shares of SouthGobi between March 30, 2011 and November 7,

2013, alleging that the financial reporting of SouthGobi during that period

contained misrepresentations giving rise to liability at common law and under

applicable Canadian securities legislation. The proposed class action also seeks

general damages against all defendants. Assuming that leave is granted, the

action is certified as a class proceeding, and there is a finding of liability,

the actual quantum of damages will depend upon the evidence which is adduced in

the court proceedings.

SouthGobi disputes and will vigorously defend itself against these claims

through independent Canadian litigation counsel retained by SouthGobi and the

other defendants for this purpose. Due to the inherent uncertainties of

litigation, it is not possible to predict the final outcome of the proposed

class action lawsuit or determine the amount of any potential losses, if any.

However, in the opinion of Turquoise Hill, at December 31, 2013 a provision for

this matter is not required.

CORPORATE ACTIVITIES

Changes to the Company's Board of Directors

On February 20, 2013, the Company's Board of Directors accepted the resignation

of director Andrew Harding and appointed Jean-Sébastien Jacques to the board.

Directors Livia Mahler and Peter Meredith, nominees of Robert Friedland, did not

stand for re-election at the Company's Annual Meeting of Shareholders held on

May 10, 2013, as a result of changes in Mr. Friedland's holdings in the Company.

Additionally, Dan Larsen, a Rio Tinto nominee, did not stand for re-election.

Rio Tinto nominated Virginia Flood in his place and she was appointed to the

Company's board on May 10, 2013.

On September 17, 2013, Mr. Jacques resigned from the Company's board. On October

7, 2013, the Company appointed Rowena Albones to the board replacing Mr.

Jacques.

Directors Virginia Flood, Isabelle Hudon, Warren Goodman and Charles Lenegan

will not stand for re-election at the Company's 2014 Annual Meeting of

Shareholders. Turquoise Hill's Articles of Amendment currently provide that the

number of directors will be a minimum of three and a maximum of 14. In

accordance with the terms of the 2012 Memorandum of Agreement, Rio Tinto and

Turquoise Hill agreed that until the earlier of January 18, 2014 and the date

the Company ceased to be a reporting issuer, a majority of the directors on the

board would be "independent" under the applicable securities laws. Of the seven

persons nominated for election at the 2014 Annual Meeting of Shareholders, four

are independent directors.

Rio Tinto short-term funding package

On June 28, 2013, the Company entered into an agreement with majority

shareholder Rio Tinto for a non-revolving bridge facility for up to $225 million

maturing on August 12, 2013 (Short-Term Bridge Facility). Interest on amounts

advanced to the Company under the Short-Term Bridge Facility was at LIBOR plus

5%. The Company applied the proceeds from the sale of its 50% interest in

Altynalmas Gold to repay in full the $224.8 million principal then outstanding

on the Short-Term Bridge Facility.

On August 7, 2013, the Company signed a binding term sheet with Rio Tinto for a

new bridge facility (New Bridge Facility) and the facility was finalized on

August 23, 2013. Under the New Bridge Facility, Rio Tinto provided the Company

with a secured $600 million bridge funding facility. The New Bridge Facility had

a front end fee of $6 million, an interest rate of LIBOR plus 5% per annum on

drawn amounts and a commitment fee of 2% per annum on undrawn amounts. The

facility was used initially to refinance any amounts outstanding under the

Short-Term Bridge Facility and thereafter used for the continued ramp up of

phase one of the Oyu Tolgoi mine development.

Under the terms of the New Bridge Facility, in the event that the Oyu Tolgoi

project financing funds were not available by December 31, 2013 to repay the

$600 million New Bridge Facility and the $1.8 billion interim funding facility,

the Company would be obligated to launch a rights offering, with a standby

commitment from Rio Tinto the proceeds of which would be used to repay both

facilities.

Turquoise Hill rights offering

On November 26, 2013, the Company filed a final prospectus outlining the details

of a rights offering that was expected to raise approximately $2.4 billion in

gross proceeds. To allow for completion of the rights offering, the Company and

Rio Tinto agreed to amend the 2013 Memorandum of Agreement and extend the latest

date by which the rights offering must be completed to January 13, 2014 and,

correspondingly, extended the maturity dates of the Interim Funding Facility and

New Bridge Facility to the earlier of the second business day following the

rights offering closing date and January 15, 2014.

On January 13, 2014, Turquoise Hill successfully closed the rights offering and

confirmed gross proceeds of approximately $2.4 billion. The Company used the net

proceeds from the rights offering to repay all amounts outstanding under its

$1.8 billion Interim Funding Facility and its secured $600 million New Bridge

Facility with Rio Tinto, and the remaining proceeds were used for the continued

funding and development of the Oyu Tolgoi mine, working capital, general

administrative expenses and other corporate expenses.

Upon the closing of the offering, Turquoise Hill issued a total of 1,006,116,602

new common shares, which represented 100% of the maximum number of common shares

available under the rights offering. Approximately 99.3% of the shares were

issued in the basic subscription of the rights offering with the balance having

been issued in the additional subscription. Rio Tinto exercised all of its

rights under the basic subscription and did not participate in the additional

subscription of the rights offering, which was available to all shareholders who

fully participated in the basic subscription. Because the offering was

over-subscribed, Rio Tinto was not required to purchase any shares under its

standby commitment. As a result of the rights offering, Rio Tinto's stake in

Turquoise Hill remained unchanged at 50.8% of the outstanding common shares.

Class action lawsuits

On December 13 and 18, 2013, two putative securities class action lawsuits were

filed in the United States District Court for the Southern District of New York

against the Company and certain of its officers and directors. The lawsuits seek

to recover damages resulting from alleged misstatements about Turquoise Hill's

financial performance and business prospects arising from revisions to its

recognition of revenue on SouthGobi's coal sales, as disclosed on November 8,

2013. The Company believes the complaints are without merit and will vigorously

defend against the lawsuits. In the opinion of the Company, at December 31, 2013

a provision for this matter is not required.

QUALIFIED PERSON

Disclosure of a scientific or technical nature in this MD&A in respect of the

Oyu Tolgoi mine was prepared under the supervision of Bernard Peters

(responsibility for overall preparation and mineral reserves), B. Eng. (Mining),

FAusIMM (201743), employed by OreWin Pty Ltd as Technical Director - Mining and

Kendall Cole-Rae (responsibility for mineral resources, geology and

exploration), B.Sc. (Geology), SME (4138633), employed by Rio Tinto as a

Principal Geologist. Each of these individuals is a "qualified person" as that

term is defined in NI 43-101.

SELECTED QUARTERLY DATA

($ in millions of dollars, Quarter Ended

except per share information)

--------------------------------------------

Dec-31 Sep-30 Jun-30 Mar-31

2013 2013 2013 2013

--------------------------------------------

Revenue

Copper-gold concentrate $ 51.6 $ 0.0 $ 0.0 $ 0.0

Coal 32.4 15.7 6.1 4.4

--------------------------------------------

Total revenue $ 84.0 $ 15.7 $ 6.1 $ 4.4

--------------------------------------------

Net income (loss) from

continuing operations

attributable to parent $ 134.3 ($84.8) ($77.8) ($40.4)

Income (loss) from discontinued

operations attributable to

parent 4.1 (9.3) (27.6) (10.5)

--------------------------------------------

Net (loss) income attributable

to parent $ 138.4 ($94.1) ($105.4) ($50.9)

--------------------------------------------

Basic income (loss) per share

attributable to parent

Continuing operations $ 0.10 ($0.07) ($0.06) ($0.03)

Discontinued operations $ 0.01 ($0.01) ($0.02) ($0.01)

--------------------------------------------

Total $ 0.11 ($0.08) ($0.08) ($0.04)

--------------------------------------------

Diluted (loss) income per share

attributable to parent

Continuing operations $ 0.10 ($0.07) ($0.06) ($0.03)

Discontinued operations $ 0.01 ($0.01) ($0.02) ($0.01)

--------------------------------------------

Total $ 0.11 ($0.08) ($0.08) ($0.04)

--------------------------------------------

Dec-31 Sep-30 Jun-30 Mar-31

2012 2012 2012 2012

--------------------------------------------

Revenue

Copper-gold concentrate $ 0.0 $ 0.0 $ 0.0 $ 0.0

Coal 1.3 3.8 46.6 26.5

--------------------------------------------

Total revenue $ 1.3 $ 3.8 $ 46.6 $ 26.5

--------------------------------------------

Net (loss) income from

continuing operations

attributable to parent ($144.0) $ 125.5 ($263.5) ($63.4)

Loss from discontinued

operations attributable to

parent (1.0) (13.3) (22.8) (29.6)

--------------------------------------------

Net (loss) income attributable

to parent ($145.0) $ 112.2 ($286.3) ($93.0)

--------------------------------------------

Basic (loss) income per share

attributable to parent

Continuing operations ($0.11) $ 0.11 ($0.25) ($0.06)

Discontinued operations $ 0.00 ($0.01) ($0.02) ($0.03)

--------------------------------------------

Total ($0.11) $ 0.10 ($0.27) ($0.09)

--------------------------------------------

Diluted (loss) income per share

attributable to parent

Continuing operations ($0.11) $ 0.11 ($0.25) ($0.06)

Discontinued operations $ 0.00 ($0.01) ($0.02) ($0.03)

--------------------------------------------

Total ($0.11) $ 0.10 ($0.27) ($0.09)

--------------------------------------------

About Turquoise Hill Resources

Turquoise Hill Resources (NYSE: TRQ) (NASDAQ: TRQ) (TSX: TRQ) is an

international mining company focused on copper, gold and coal mines in the Asia

Pacific region. The Company's primary operation is its 66% interest in the Oyu

Tolgoi copper-gold-silver mine in southern Mongolia. Turquoise Hill also holds a

56% interest in Mongolian coal miner SouthGobi Resources (TSX: SGQ) (HKSE:

1878).

Follow us on Twitter @TurquoiseHillRe

Forward-looking statements

Certain statements made herein, including statements relating to matters that

are not historical facts and statements of the Company's beliefs, intentions and

expectations about developments, results and events which will or may occur in

the future, constitute "forward-looking information" within the meaning of

applicable Canadian securities legislation and "forward-looking statements"

within the meaning of the "safe harbor" provisions of the U.S. Private

Securities Litigation Reform Act of 1995. Forward-looking information and

statements relate to future events or future performance, reflect current

expectations or beliefs regarding future events and are typically identified by

words such as "anticipate", "could", "should", "expect", "seek", "may",

"intend", "likely", "plan", "estimate", "will", "believe" and similar

expressions suggesting future outcomes or statements regarding an outlook. These

include, but are not limited to, statements respecting anticipated business

activities; planned expenditures; corporate strategies; and other statements

that are not historical facts.

Forward-looking statements and information are made based upon certain

assumptions and other important factors that, if untrue, could cause the actual

results, performance or achievements of the Company to be materially different

from future results, performance or achievements expressed or implied by such

statements or information. Such statements and information are based on numerous

assumptions regarding present and future business strategies and the environment

in which the Company will operate in the future, including the price of copper,

gold and silver, anticipated capital and operating costs, anticipated future

production and cash flows, the ability to complete the disposition of certain of

its non-core assets, the ability and timing to complete project financing and/or

secure other financing on acceptable terms, and the evolution of discussions

with the Government of Mongolia on a range of issues including the

implementation of the Investment Agreement, project development costs, operating

budgets, management fees and governance and the existence or filing of legal

proceedings against the Company and its officers and directors. Certain

important factors that could cause actual results, performance or achievements

to differ materially from those in the forward-looking statements and

information include, among others, copper, gold and silver price volatility,

discrepancies between actual and estimated production, mineral reserves and

resources and metallurgical recoveries, mining operational and development

risks, litigation risks, regulatory restrictions (including environmental

regulatory restrictions and liability), activities by governmental authorities,

currency fluctuations, the speculative nature of mineral exploration, the global

economic climate, dilution, share price volatility, competition, loss of key

employees, additional funding requirements, capital and operating costs for the

construction and operation of the Oyu Tolgoi mine and defective title to mineral

claims or property. Although the Company has attempted to identify important

factors that could cause actual actions, events or results to differ materially

from those described in forward-looking statements and information, there may be

other factors that cause actions, events or results not to be as anticipated,

estimated or intended. All such forward-looking information and statements are

based on certain assumptions and analyses made by the Company's management in

light of their experience and perception of historical trends, current

conditions and expected future developments, as well as other factors management

believes are appropriate in the circumstances. These statements, however, are

subject to a variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those projected in the

forward-looking information or statements.

With respect to specific forward-looking information concerning the construction

and development of the Oyu Tolgoi mine, the Company has based its assumptions

and analyses on certain factors which are inherently uncertain. Uncertainties

and assumptions include, among others: the timing and cost of the construction

and expansion of mining and processing facilities; the impact of the decision

announced by the Company to delay the funding and development of the Oyu Tolgoi

underground mine pending resolution of outstanding issues with the Government of

Mongolia associated with the development and operation of the Oyu Tolgoi mine

and to satisfy all conditions precedent to the availability of Oyu Tolgoi

Project Financing; the impact of changes in, changes in interpretation to or

changes in enforcement of, laws, regulations and government practices in

Mongolia; the availability and cost of skilled labour and transportation; the

availability and cost of appropriate smelting and refining arrangements; the

obtaining of (and the terms and timing of obtaining) necessary environmental and

other government approvals, consents and permits; the availability of funding on

reasonable terms; the timing and availability of a long-term power source for

the Oyu Tolgoi mine; delays, and the costs which would result from delays, in

the development of the underground mine (which could significantly exceed those

projected in the 2013 Oyu Tolgoi Technical Report); projected copper, gold and

silver prices and demand; and production estimates and the anticipated yearly

production of copper, gold and silver at the Oyu Tolgoi mine.

The cost, timing and complexities of mine construction and development are

increased by the remote location of a property such as the Oyu Tolgoi mine. It

is common in new mining operations and in the development or expansion of

existing facilities to experience unexpected problems and delays during

development, construction and mine start-up. Additionally, although the Oyu

Tolgoi mine has achieved commercial production, there is no assurance that

future development activities will result in profitable mining operations. In

addition, funding and development of the underground component of the Oyu Tolgoi

mine have been delayed until matters with the Government of Mongolian can be

resolved and a new timetable agreed. These delays can impact project economics.

The Company's MD&A also contains references to estimates of mineral reserves and

mineral resources. The estimation of reserves and resources is inherently

uncertain and involves subjective judgments about many relevant factors. The

mineral resource estimates contained therein are inclusive of mineral reserves.

Further, mineral resources that are not mineral reserves do not have

demonstrated economic viability. The accuracy of any such estimates is a

function of the quantity and quality of available data, and of the assumptions

made and judgments used in engineering and geological interpretation (including

future production from the Oyu Tolgoi mine, the anticipated tonnages and grades

that will be achieved or the indicated level of recovery that will be realized),

which may prove to be unreliable. There can be no assurance that these estimates

will be accurate or that such mineral reserves and mineral resources can be

mined or processed profitably. See the discussion under the headings "Language

Regarding Reserves and Resources" and "Note to United States Investors

Concerning Estimates of Measured, Indicated and Inferred Resources" in the

Company's MD&A filed on SEDAR and EDGAR.

Readers are cautioned not to place undue reliance on forward-looking information

or statements. By their nature, forward-looking statements involve numerous

assumptions, inherent risks and uncertainties, both general and specific, which

contribute to the possibility that the predicted outcomes will not occur. Events

or circumstances could cause the Company's actual results to differ materially

from those estimated or projected and expressed in, or implied by, these

forward-looking statements. Important factors that could cause actual results to

differ from these forward-looking statements are included in the "Risk Factors"

section in the Company's Annual Information Form dated as of March 26, 2014 in

respect of the year ended December 31, 2013 (the "AIF").

Readers are further cautioned that the list of factors enumerated in the "Risk

Factors" section of the AIF that may affect future results is not exhaustive.

When relying on the Company's forward-looking information and statements to make

decisions with respect to the Company, investors and others should carefully

consider the foregoing factors and other uncertainties and potential events.

Furthermore, the forward-looking information and statements herein are made as

of the date hereof and Turquoise Hill does not undertake any obligation to

update or to revise any of the included forward-looking information or

statements, whether as a result of new information, future events or otherwise,

except as required by applicable law. The forward-looking information and

statements contained herein are expressly qualified by the cautionary statement.

FOR FURTHER INFORMATION PLEASE CONTACT:

Contacts

Investors

Jessica Largent

Office: +1 604 648 3957

Email: jessica.largent@turquoisehill.com

Media

Tony Shaffer

Office: +1 604 648 3934

Email: tony.shaffer@turquoisehill.com

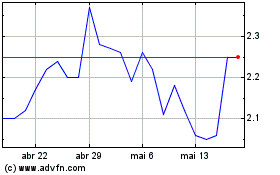

Arizona Metals (TSX:AMC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Arizona Metals (TSX:AMC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025