Mawson West Announces Q1 Financial and Operating Results

15 Maio 2014 - 10:49AM

Marketwired Canada

Mawson West Limited (TSX:MWE) ("Mawson West" or "the Company") is pleased to

announce it has released its financial results and related Management's

Discussion and Analysis (MD&A) incorporating the three months ("the Quarter" or

"Q1") to 31 March 2014.

Highlights:

-- Copper sales of 1,138 tonnes and silver sales of 39,446 ounces

-- Revenue of US$6.8 million

-- Cash of US$23.0 million at the end of the Quarter (following debt

retirement of US$7.5m, US$5.2m of Dikulushi tax payments and continued

investment in Kapulo long lead items)

-- Subsequent to the Quarter end, executed offtake arrangement with

Trafigura Pte Ltd ("Trafigura")

-- Trafigura offtake arrangement included a prepayment facility of US$50.0

million, which was fully drawn-down in April 2014.

Mawson West Chief Executive Bruce McFadzean said: "During the Quarter we

continued to focus on production from the Dikulushi underground operation,

having transitioned from processing high grade open pit material in the previous

quarter. Given this transition, we experienced a scheduled reduction in our

copper and silver output.

"However as we continue to ramp up production from the Dikulushi underground

mine we remain confident of realising our FY 2014 production target of 7-9k

tonnes of copper in concentrate. In addition, underground exploration drilling

currently underway has the potential to significantly increase the underground

resource at Dikulushi, extending the life of mine beyond Q3 2014.

"It was very pleasing to announce, subsequent to the end of the Quarter, Mawson

West had secured with Trafigura an offtake agreement and a US$50 million

prepayment facility. Executing such an agreement enables us to complete the

remaining development of our Kapulo project and we now expect to commence

commissioning in Q4 2014, bringing on projected annualized production of 20k

tonnes of copper in concentrate.

"With continued production from Dikulushi and the Kapulo development advancing

towards production Mawson West remains strongly positioned for growth."

Conference Call

Mawson West will host a Q1 results conference call on Tuesday 20, May 2014 at

10.00am (North American Eastern Standard Time) (1.00pm London; 10.00pm Perth;

12.00am Sydney).

Chief Executive Officer and Managing Director, Bruce McFadzean, and Chief

Financial Officer, Mark Di Silvio will discuss the Company's financial and

operating results for the Quarter, followed by questions from analysts and

shareholders.

Dial in details for the conference call have been provided on page three (3) of

this announcement.

Key highlights of the Quarter include:

Financial

-------------------------------

(in thousands of US dollars except as

otherwise noted) Three months ended March 31

-------------------------------

2014 2013

----------------------------------------------------------------------------

Revenue 6,810 44,482

Gross profit/(loss) (1,070) 18,074

Profit/(Loss) after income tax (4,761) 11,949

Earnings (Loss) per Share (basic) (cents) (1) (2.9) 6.4

Realised copper price ($/tonne) 6,993 7,893

Copper sales (tonnes) 1,138 4,698

C1 cost per pound ($) 3.47 0.31

----------------------------------------------------------------------------

Operational

-- Processing of Dikulushi underground ore commenced in mid-February as the

Dikulushi underground mine continued to ramp up. Underground mining is

expected to extend production from the Dikulushi operation until at

least Q3 2014 while providing the opportunity for Mawson West to

evaluate additional underground mining potential.

-- A total of 9,957 tonnes of ore was hauled at an average grade of 3.65%

copper and 72g/t silver.

-- Production for the Quarter totalled 879 tonnes of copper in concentrate

and 65,863 ounces of silver in concentrate.

-- C1(1) costs were US$3.47 per pound of copper in concentrate produced

(US$3.65 excluding silver credit) during the Quarter.

Development

-- Construction activities at the Kapulo project continued during the

Quarter with further orders of long lead items placed. As at the end of

the Quarter, cumulative construction expenditure totalled US$80.8

million (including owner's costs but before evaluation, pre-stripping

and funding costs), with forecast total construction expenditure of

US$124 million. Commissioning is expected for Q4 2014.

Exploration and Resource Definition

-- A total of US$0.9 million was spent on exploration and resource

definition during the Quarter.

-- Resource definition drilling to target upgrades to the Dikulushi

underground deposit commenced during the Quarter.

-- Exploration prospects in both Dikulushi and Kapulo districts were ranked

and prioritised, with detailed programs for the 2014 field season

finalised. Field work is scheduled to accelerate mid-year, following the

end of the wet season.

(1) The term "C1 cost" is a non-IFRS financial performance measure reported in

this MD&A. See "Non-IFRS Financial Measures" on page 12.

Subsequent Events

-- In April 2014, Mawson West announced that it had entered into an offtake

agreement, through its 90% owned subsidiary Anvil Mining Congo SARL

("AMC"), with Trafigura to sell 100% of the copper concentrate produced

at the Dikulushi and Kapulo mines for a period of 48 months from the

commencement of commercial production at Kapulo. As part of the offtake

arrangements Trafigura provided a prepayment facility of US$50.0

million, which was fully drawn-down in April 2014.

-- Mr. Louis Rozman resigned as a Non-Executive Director on April 4, 2014.

-- Mr. Mark Hohnen and Ms. Susie Corlett were appointed as Non-Executive

Directors of the Company on April 5, 2014.

Conference Call

Interested parties may access the conference call by using the following dial-in

numbers.

-- Canada 1866 307 0658

-- United States 1866 307 0659

-- United Kingdom 0808 238 9067

-- Australia 1800 153 721

-- New Zealand 0800 442 709

-- International Toll 612 8212 8333

Participant PIN Code: 29244#

Dial-in access details for other countries can be obtained from the below web

address:

http://www.arkadin.com/beamon/ITFS/ANZ_Jan_2013.pdf.

Please connect approximately 10 minutes prior to the beginning of the call.

A recorded playback of the conference call can be accessed from the below web

address after the event:

http://www.mawsonwest.com/irm/content/webcasts.aspx?RID=317.

FOR FURTHER INFORMATION PLEASE CONTACT:

Mawson West Limited

Bruce McFadzean

Chief Executive Officer and Managing Director

+61 8 9485 9800

bmcfadzean@mawsonwest.com

Mawson West Limited

Mark Di Silvio

Chief Financial Officer

+61 8 9485 9800

mdisilvio@mawsonwest.com

MAGNUS Investor Relations

Kusal Meemeduma

+61 2 8999 1010

kmeemeduma@magnus.net.au

Roth Investor Relations Inc.

Michelle Roth

+1 732 792 2200

michelleroth@rothir.com

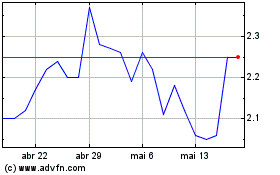

Arizona Metals (TSX:AMC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Arizona Metals (TSX:AMC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025