Belo Sun Mining Corp. (TSX:BSX) (the "Company" or "Belo Sun") has

completed an updated, independently audited mineral resource

statement for its 100%-owned Volta Grande gold project in Para

State, Brazil. This updated mineral resource statement is based on

results from 94 additional drill holes (22,595 meters of drilling)

which represents results of all the holes completed at the Volta

Grande Project to date.

The results were independently audited by SRK Consulting

(Canada) ("SRK") and represent an important increase in the

measured and indicated categories of Belo Sun's estimated mineral

resources. This mineral resource statement will support the

definitive feasibility study for the development of the Volta

Grande Project as follows (see Table below for mineral resource

estimate details):

-- Measured and Indicated Pit Constrained Mineral Resources of 5.1 Million

Ounces of gold at an average grade of 1.68 g/t Au, which represents an

increase of approximately 10% in these resource categories (from 4.7

Million Ounces) compared with the previous April 2013 update.

-- Inferred Pit Constrained Mineral Resources of 2.4 Million Ounces of gold

at an average grade of 1.69g/t Au; and

-- Underground resources of 14,000 ounces of gold at an average grade of

3.01 g/t Au in the Indicated category and 184,000 ounces at an average

grade of 3.33 g/t Au in the Inferred category.

In response to the findings of the pre-feasibility study, two

higher grade domains were modelled on the basis of geological

interpretation and grade continuity. The modelled high grade zones

can be traced for 540 metres along strike from the surface to a

depth of 300 metres. This approach restricts the spatial influence

of the higher grade gold mineralization, delivering a slightly more

conservative resource model and mitigating the risks associated

with the local impact of high grade intervals. The two high grade

zones contain approximately 424,000 ounces of gold at a grade of

3.09 g/t gold in the Measured and Indicated categories and 1,400

ounces of gold at a grade of 2.52 g/t gold in the Inferred

category.

Mark Eaton, President and CEO of the Company, commented, "This

mineral resource update represents an increase in the measured and

indicated category of one million ounces of gold, when compared

with the December 2012 mineral resource update which was used as

the basis of the May 2013 pre feasibility study. Belo Sun team is

currently using the current mineral resource estimate in the

modeling and mine sequencing for the ongoing definitive feasibility

study."

The mineral resource estimate was reported in compliance with

National Instrument 43-101 guidelines; the corresponding Technical

Report will be filed under the Company's profile on SEDAR in due

course. This is an update incorporating drilling completed since

the previously reported mineral resource estimate that was issued

in April, 2013. This mineral resource statement was calculated

using the same modeling parameters as were used to complete the

April 2013 update. Please note key parameters below. The mineral

resource estimate was completed by the Belo Sun team under

supervision of David Gower, P.Geo, and Carlos Costa, P.Geo. each of

whom is a Qualified Person as defined by National Instrument

43-101. The mineral resource estimate was audited by Dr. Oy

Leuangthong, P.Eng, and Dr. Lars Weiershauser, P.Geo of SRK, both

of whom are Qualified Persons as defined by National Instrument

43-101 and are each independent of Belo Sun.

Some of the more relevant parameters utilized in the current

mineral resource estimate are listed below:

----------------------------------------------------------------------------

Parameter Units

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gold Price US$/Oz $1,400

Cut Off Grade g/t Au 0.5 (OP) 2.0 (UG)

Block Dimensions meters 6 (L) x 6 (W) x 10 (H)

Composite length meters 1.0

----------------------------------------------------------------------------

Ouro Verde Grota Seca South Block Total

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Composites No. 12,752 17,101 639 30,492

----------------------------------------------------------------------------

Holes No. 313 533 108 954

----------------------------------------------------------------------------

Drilling Meters 85,158.52 126,832.41 23,909.04 235,899.97

----------------------------------------------------------------------------

The Audited Mineral Resource Statement(1) for Volta Grande is

presented below:

----------------------------------------------------------------------------

VOLTA GRANDE RESOURCES ESTIMATE MEASURED MEASURED +

(SEP 2013) INDICATED INDICATED INFERRED

----------------------------------------------------------------------------

Ouro Verde Pit

Constrained Tonnes ('000s) 24,036 20,087 44,123 22,602

Grade (g/t Au) 1.78 1.61 1.70 1.48

Ounces ('000s) 1,379 1,037 2,416 1,079

Grota Seca Pit

Constrained Tonnes ('000s) 31,384 15,671 47,055 18,265

Grade (g/t Au) 1.61 1.56 1.59 1.59

Ounces ('000s) 1,620 788 2,408 932

South Block Pit

Constrained Tonnes ('000s) 2,503 2,503 2,921

Grade (g/t Au) 3.06 3.06 3.94

Ounces ('000s) 246 246 370

----------------------------------------------------------------------------

Total Pit

Constrained Tonnes ('000s) 55,420 38,261 93,682 43,788

(0.5 g/t Au cut-

off) Grade (g/t Au) 1.68 1.68 1.68 1.69

Ounces ('000s) 2,999 2,072 5,070 2,381

----------------------------------------------------------------------------

Ouro Verde

Underground Tonnes ('000s) 64 64 831

Grade (g/t Au) 2.66 2.66 3.13

Ounces ('000s) 5 5 84

Grota Seca

Underground Tonnes ('000s) 53 53 695

Grade (g/t Au) 2.88 2.88 3.38

Ounces ('000s) 5 5 75

South Block

Underground Tonnes ('000s) 24 24 193

Grade (g/t Au) 4.24 4.24 4.05

Ounces ('000s) 3 3 25

----------------------------------------------------------------------------

Total Underground Tonnes ('000s) 140 140 1,719

(2.0 g/t Au cut-

off) Grade (g/t Au) 3.01 3.01 3.33

Ounces ('000s) 14 14 184

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Tonnes ('000s) 55,420 38,402 93,822 45,507

TOTAL Grade (g/t Au) 1.68 1.69 1.69 1.75

Ounces ('000s) 2,999 2,085 5,084 2,565

----------------------------------------------------------------------------

(1) Audited mineral resource statement prepared by SRK Consulting (Canada)

Inc. The effective date of the audited mineral resource statement is

October 1, 2013. Mineral resources are not mineral reserves and have not

demonstrated economic viability. All figures have been rounded to

reflect the relative accuracy of the estimates.

Open pit mineral resources are reported at a cut-off grade of 0.5 g/t

gold, and underground mineral resources are reported at a cut- off grade

of 2.0 g/t gold. Cut-off grades are based on a number of parameters and

assumptions including gold price of US$1,400 per troy ounce, 94%

metallurgical gold recovery for weathered and unweathered rock, open pit

mining costs of US$1.41/tonne, process costs of US$11.98/ tonne, General

and Administrative costs of US$2.89/tonne and selling costs (refining,

transport, insurance and environment) of US$13.82 per troy ounce.

Mineral resources are constrained within low, medium and high grade

domains delineated from drilling data within Ouro Verde and Grota Seca.

The quantity and grade of the reported inferred mineral resources are

uncertain in nature and there has been insufficient exploration to

define the inferred mineral resources as indicated or measured mineral

resources and it is uncertain if further exploration will result in

upgrading them to an indicated or measured mineral resource category.

The mineral resources have been classified according to the Canadian

Institute of Mining, Metallurgy and Petroleum Definition Standards for

Mineral Resources and Mineral Reserves (November 2010).

Certain mineral resource estimation parameters:

a. The gold mineralization envelopes were modelled into wireframe solids

using a 0.5 g/t Au cut-off grade in fresh and saprolite rocks utilizing

vertical and horizontal sections. 3D shells were generated by linking

horizontal sections each 10m apart.

b. A specific gravity of 2.75 was used for the Grota Seca (GS) and the Ouro

Verde (OV) deposits and 2.77 for the South Block and 1.36 for the

saprolite in both deposits.

c. Estimations are based on original samples capped at 6 - 40 g/t Au

depending on the resource domain.

d. The database for the Ouro Verde Deposit includes 46 historical core

boreholes (8,461 metres) and 267 boreholes (76,698 metres) completed and

assayed by Belo Sun since April 2010.

e. The mineralized zones at the Ouro Verde deposit extend for about 2,400

metres along strike. Eight gold mineralization domains were modelled in

fresh rock, and one saprolite domain was modelled. The gold

mineralization thickness ranges from 2 to 60 metres. The maximum allowed

internal dilution is approximately 3 metres.

f. The database for the Grota Seca Deposit comprises 11 historical reverse

circulation and 129 historical core boreholes (24,730 metres) and 48

reverse circulation and 345 core boreholes (102,103 metres) completed

and assayed by Belo Sun since April 2010 .

g. The mineralized zones at the Grota Seca deposit extend 2,900 metres

along strike. Seven gold mineralization domains were modelled in fresh

rock, and one saprolite domain was modelled. The gold mineralization

thickness ranges from 2 to 70 metres. The maximum allowed internal

dilution is approximately 3 metres.

h. The database for the South Block Deposits comprises 22 historical core

boreholes (3,370 metres and 86 core boreholes (20,539 metres) completed

and assayed by Belo Sun since April 2010.

i. The mineralized zones at the South Block Deposits extend discontinuously

for about 1,900 metres along strike. Three gold mineralization domains

were modelled in fresh rock, and one saprolite domain was modelled. The

gold mineralization thickness ranges from 2 to 16 metres. The maximum

allowed internal dilution is approximately 3 metres.

j. Block model gold grades were estimated using ordinary kriging informed

by 1.0 m capped composites. All estimations are based on a percent block

model with unitary dimension of 6 m E, 6 m N and 10 m elevation rotated

-17 degrees clockwise in the Ouro Verde and Grota Seca deposits and -25

degrees in the South Block.

k. "Open-pit" mineral resources are reported at a cut-off grade of 0.5 g/t

Au. "Underground" mineral resources (outside pit shell) are reported at

a cut-off grade of 2.0 g/t Au.

l. Measured mineral resources include all mineralized blocks within one

time of the variogram range and informed from a minimum of 3 boreholes

in 3 octants.

m. Indicated mineral resources include all mineralized blocks estimated in

the first or second estimation runs (within the variogram range), whose

estimation required a minimum of two drill holes.

n. Inferred mineral resources include all mineralized blocks not classified

as Measured or Indicated in the first and second estimation runs and all

blocks estimated in the third estimation run (twice the variogram

range).

Comparison Between December 2012, April 2013 and October 2013

Mineral Resource Estimates:

----------------------------------------------------------------------------

----------------------------------------------------------------------------

December 2012 (audited) April 2013(unaudited)

-------------------------------------------------------------

Class. Gold Contained Gold Contained

Quantity Grade Gold Quantity Grade Gold

(Ktonnes) (gpt) (Koz) (Ktonnes) (gpt) (Koz)

----------------------------------------------------------------------------

Measured 42,422 1.73 2,356 55,825 1.68 3,021

Indicated 31,360 1.73 1,746 32,307 1.67 1,736

Meas.+Ind. 73,782 1.73 4,103 88,132 1.68 4,757

Inferred 44,246 1.96 2,788 39,633 1.93 2,464

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Percentage Difference April to

October 2013(audited) October 2013

--------------------------------------------------------------

Class. Gold Contained Gold Contained

Quantity Grade Gold Quantity Grade Gold

(Ktonnes) (gpt) (Koz) (Ktonnes) (gpt) (Koz)

----------------------------------------------------------------------------

Measured 55,420 1.68 2,999 -1% 0% -1%

Indicated 38,402 1.69 2,085 19% 1% 20%

Meas.+Ind. 93,822 1.69 5,084 6% 0% 7%

Inferred 45,507 1.75 2,565 15% -9% 4%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Quality Assurance and Quality Control

The scientific and technical information in this press release

has been reviewed and approved by Dr. Oy Leuangthong, P.Eng

(PEO#90563867) of SRK, Carlos Cravo, P.Geo, Project Manager for

Belo Sun and David Gower, P.Geo., an advisor to Belo Sun, who are

Qualified Persons as defined by National Instrument 43-101. Dr.

Leuangthong is independent from Belo Sun. The exploration program

is directly supervised by Mr. Carlos Cravo, P.Geo., Belo Sun's

Project Manager. Belo Sun's procedures for handling drill core

comprise initial description and logging into a Microsoft Access

database. Mineralized, suspected mineralized or unmineralized

intervals in the drill holes are described in detail and marked for

sampling. Core is then cut in half with the right-hand portion of

the core put into plastic sample bags and sealed. The left-hand

portion is returned to the core box and is stored for future

reference or study. Assay standard and "blank" samples are inserted

every 20th sample. These samples are then delivered to ACME Labs

sample preparation facility at the Project site. The assay samples

are then fine-crushed to better than 80% passing 10 mesh screens,

with an assay pulp split of up to 1,000 grams pulverized to better

than 85% passing 200 mesh screen. Samples are assayed at ACME Labs

in Santiago, Chile, using a 50 gram fire assay procedure with

atomic absorption spectrometry finish. Belo Sun implements

analytical quality control measures that include the use of control

samples (blanks reference material, duplicates). Those procedures

were audited by SRK and found to be consistent with generally

recognized international industry best practices for

pre-development exploration projects.

Cautionary Statement on Forward Looking Information

This press release contains "forward-looking information" within

the meaning of applicable Canadian securities legislation.

Forward-looking information includes, without limitation, mineral

resource estimates regarding the impact of drill results and

mineral resources estimate on the Company, the projected economics

of the project, and the Company's understanding of the project;

statements with respect to the development potential and timetable

of the project; the estimation of mineral resources; realization of

mineral resource estimates; the timing and amount of estimated

future exploration; costs of future activities; capital and

operating expenditures; success of exploration activities; currency

exchange rates; government regulation of mining operations; and

environmental risks. Generally, forward-looking information can be

identified by the use of forward-looking terminology such as

"plans", "expects" or "does not expect", "is expected", "budget",

"scheduled", "estimates", "forecasts", "intends", "anticipates" or

"does not anticipate", or "believes", or variations of such words

and phrases or state that certain actions, events or results "may",

"could", "would", "might" or "will be taken", "occur" or "be

achieved". Forward-looking information is subject to known and

unknown risks, uncertainties and other factors that may cause the

actual results, level of activity, performance or achievements of

the Company to be materially different from those expressed or

implied by such forward-looking information, including risks

inherent in the mining industry and risks described in the public

disclosure of the Company which is available under the profile of

the Company on SEDAR at www.sedar.com and on the Company's website

at www.belosun.com. Although the Company has attempted to identify

important factors that could cause actual results to differ

materially from those contained in forward-looking information,

there may be other factors that cause results not to be as

anticipated, estimated or intended. There can be no assurance that

such information will prove to be accurate, as actual results and

future events could differ materially from those anticipated in

such statements. Accordingly, readers should not place undue

reliance on forward-looking information. The Company does not

undertake to update any forward-looking information, except in

accordance with applicable securities laws.

Contacts: Belo Sun Mining Corp. Mark Eaton President and CEO

(416) 309-2137 www.belosun.com

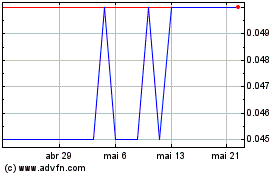

Belo Sun Mining (TSX:BSX)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

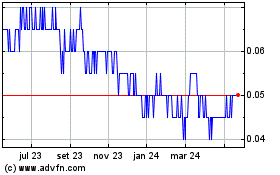

Belo Sun Mining (TSX:BSX)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024