Computer Modelling Group Ltd. ("CMG" or the "Company") (TSX:CMG) is very pleased

to report our second quarter results for the three and six months ended

September 30, 2013.

SECOND QUARTER HIGHLIGHTS

For the three months ended

September 30,

($ thousands, except per share

data) 2013 2012 $ change % change

----------------------------------------------------------------------------

Annuity/maintenance software

licenses 13,153 12,012 1,141 9%

Perpetual software licenses 1,829 2,671 (842) -32%

Total revenue 17,184 16,073 1,111 7%

Operating profit 8,296 8,032 264 3%

Net income 5,608 5,361 247 5%

Earnings per share - basic 0.15 0.14 0.01 7%

----------------------------------------------------------------------------

For the six months ended September

30,

($ thousands, except per share

data) 2013 2012 $ change % change

----------------------------------------------------------------------------

Annuity/maintenance software

licenses 27,111 25,192 1,919 8%

Perpetual software licenses 4,160 4,741 (581) -12%

Total revenue 35,300 32,539 2,761 8%

Operating profit 17,646 16,137 1,509 9%

Net income 12,689 11,451 1,238 11%

Earnings per share - basic 0.33 0.31 0.02 6%

----------------------------------------------------------------------------

MANAGEMENT'S DISCUSSION AND ANALYSIS

This Management's Discussion and Analysis ("MD&A") for Computer Modelling Group

Ltd. ("CMG," the "Company," "we" or "our"), presented as at November 12, 2013,

should be read in conjunction with the unaudited condensed consolidated

financial statements and related notes of the Company for the three and six

months ended September 30, 2013 and the audited consolidated financial

statements and MD&A for the years ended March 31, 2013 and 2012 contained in the

2013 Annual Report for CMG. Additional information relating to CMG, including

our Annual Information Form, can be found at www.sedar.com. The financial data

contained herein have been prepared in accordance with International Financial

Reporting Standards ("IFRS") and, unless otherwise indicated, all amounts in

this report are expressed in Canadian dollars and rounded to the nearest

thousand.

FORWARD-LOOKING INFORMATION

Certain information included in this MD&A is forward-looking. Forward-looking

information includes statements that are not statements of historical fact and

which address activities, events or developments that the Company expects or

anticipates will or may occur in the future, including such things as investment

objectives and strategy, the development plans and status of the Company's

software development projects, the Company's intentions, results of operations,

levels of activity, future capital and other expenditures (including the amount,

nature and sources of funding thereof), business prospects and opportunities,

research and development timetable, and future growth and performance. When used

in this MD&A, statements to the effect that the Company or its management

"believes", "expects", "expected", "plans", "may", "will", "projects",

"anticipates", "estimates", "would", "could", "should", "endeavours", "seeks",

"predicts" or "intends" or similar statements, including "potential",

"opportunity", "target" or other variations thereof that are not statements of

historical fact should be construed as forward - looking information. These

statements reflect management's current beliefs with respect to future events

and are based on information currently available to management of the Company.

The Company believes that the expectations reflected in such forward-looking

information are reasonable, but no assurance can be given that these

expectations will prove to be correct and such forward-looking information

should not be unduly relied upon.

With respect to forward-looking information contained in this MD&A, we have made

assumptions regarding, among other things:

-- Future software license sales

-- The continued financing by and participation of the Company's partners

in the DRMS project and it being completed in a timely manner

-- Ability to enter into additional software license agreements

-- Ability to continue current research and new product development

-- Ability to recruit and retain qualified staff

Forward-looking information is not a guarantee of future performance and

involves a number of risks and uncertainties, only some of which are described

herein. Many factors could cause the Company's actual results, performance or

achievements, or future events or developments, to differ materially from those

expressed or implied by the forward-looking information including, without

limitation, the following factors which are described in the MD&A of CMG's 2013

Annual Report under the heading "Business Risks":

-- Economic conditions in the oil and gas industry

-- Reliance on key clients

-- Foreign exchange

-- Economic and political risks in countries where the Company currently

does or proposes to do business

-- Increased competition

-- Reliance on employees with specialized skills or knowledge

-- Protection of proprietary rights

Should one or more of these risks or uncertainties materialize, or should

assumptions underlying the forward-looking statements prove incorrect, actual

results, performance or achievement may vary materially from those expressed or

implied by the forward-looking information contained in this MD&A. These factors

should be carefully considered and readers are cautioned not to place undue

reliance on forward-looking information, which speaks only as of the date of

this MD&A. All subsequent forward-looking information attributable to the

Company herein is expressly qualified in its entirety by the cautionary

statements contained in or referred to herein. The Company does not undertake

any obligation to release publicly any revisions to forward-looking information

contained in this MD&A to reflect events or circumstances that occur after the

date of this MD&A or to reflect the occurrence of unanticipated events, except

as may be required under applicable securities laws.

NON-IFRS FINANCIAL MEASURES

This MD&A includes certain measures which have not been prepared in accordance

with IFRS such as "EBITDA", "direct employee costs" and "other corporate costs."

Since these measures do not have a standard meaning prescribed by IFRS, they are

unlikely to be comparable to similar measures presented by other issuers.

Management believes that these indicators nevertheless provide useful measures

in evaluating the Company's performance.

"Direct employee costs" include salaries, bonuses, stock-based compensation,

benefits, commission expenses, and professional development. "Other corporate

costs" include facility-related expenses, corporate reporting, professional

services, marketing and promotion, computer expenses, travel, and other

office-related expenses. Direct employee costs and other corporate costs should

not be considered an alternative to total operating expenses as determined in

accordance with IFRS. People-related costs represent the Company's largest area

of expenditure; hence, management considers highlighting separately corporate

and people-related costs to be important in evaluating the quantitative impact

of cost management of these two major expenditure pools. See "Expenses" heading

for a reconciliation of direct employee costs and other corporate costs to total

operating expenses.

"EBITDA" refers to net income before adjusting for depreciation expense, finance

income, finance costs, and income and other taxes. EBITDA should not be

construed as an alternative to net income as determined by IFRS. The Company

believes that EBITDA is useful supplemental information as it provides an

indication of the results generated by the Company's main business activities

prior to consideration of how those activities are amortized, financed or taxed.

See "EBITDA" heading for a reconciliation of EBITDA to net income.

CORPORATE PROFILE

CMG is a computer software technology company serving the oil and gas industry.

The Company is a leading supplier of advanced processes reservoir modelling

software with a blue chip client base of international oil companies and

technology centers in over 50 countries. The Company also provides professional

services consisting of highly specialized support, consulting, training, and

contract research activities. CMG has sales and technical support services based

in Calgary, Houston, London, Caracas, Dubai, Bogota and Kuala Lumpur. CMG's

Common Shares are listed on the Toronto Stock Exchange ("TSX") and trade under

the symbol "CMG".

QUARTERLY PERFORMANCE

Fiscal 2012(1) Fiscal 2013(2) Fiscal 2014(3)

($ thousands, unless

otherwise stated) Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2

----------------------------------------------------------------------------

Annuity/maintenance

licenses 12,056 12,497 13,179 12,012 14,004 15,359 13,958 13,153

Perpetual licenses 2,321 3,416 2,070 2,671 1,365 2,300 2,331 1,829

----------------------------------------------------------------------------

Software licenses 14,377 15,913 15,249 14,683 15,369 17,659 16,289 14,982

Professional

services 1,521 1,302 1,216 1,390 1,433 1,620 1,827 2,202

----------------------------------------------------------------------------

Total revenue 15,898 17,215 16,465 16,073 16,802 19,279 18,116 17,184

Operating profit 8,093 9,193 8,105 8,032 8,276 9,877 9,350 8,296

Operating profit (%) 51 53 49 50 49 51 52 48

EBITDA(4) 8,414 9,543 8,423 8,425 8,687 10,294 9,725 8,675

Profit before income

and other taxes 8,184 9,104 8,577 7,703 8,556 10,314 9,999 8,133

Income and other

taxes 2,394 2,484 2,487 2,342 2,437 3,061 2,918 2,525

Net income for the

period 5,790 6,620 6,090 5,361 6,119 7,253 7,081 5,608

Cash dividends

declared and paid 4,079 4,848 9,736 6,020 6,050 6,099 8,841 6,994

----------------------------------------------------------------------------

Per share amounts -

($/share)

Earnings per share -

basic 0.16 0.18 0.16 0.14 0.16 0.19 0.19 0.15

Earnings per share -

diluted 0.15 0.17 0.16 0.14 0.16 0.19 0.18 0.14

Cash dividends

declared and paid 0.11 0.13 0.26 0.16 0.16 0.16 0.23 0.18

----------------------------------------------------------------------------

(1) Q3 and Q4 of fiscal 2012 include $2.6 million and $2.7 million,

respectively, in revenue that pertains to usage of CMG's products in

prior quarters.

(2) Q1, Q2, Q3 and Q4 of fiscal 2013 include $2.1 million, $0.2 million,

$1.8 million and $2.6 million, respectively, in revenue that pertains to

usage of CMG's products in prior quarters.

(3) Q1 and Q2 of fiscal 2014 include $1.2 million and $0.2 million,

respectively, in revenue that pertains to usage of CMG's products in

prior quarters.

(4) EBITDA is defined as net income before adjusting for depreciation

expense, finance income, finance costs, and income and other taxes. See

"Non-IFRS Financial Measures".

Highlights

During the six months ended September 30, 2013, as compared to the same period

of the prior fiscal year, CMG:

-- Increased annuity/maintenance revenue by 8%

-- Increased operating profit by 9%

-- Increased spending on research and development by 16%

-- Increased EBITDA by 9%

-- Realized basic earnings per share of $0.33, representing a 6% increase

Revenue

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Software licenses 14,982 14,683 299 2%

Professional services 2,202 1,390 812 58%

----------------------------------------------------------------------------

Total revenue 17,184 16,073 1,111 7%

----------------------------------------------------------------------------

Software license revenue - % of total revenue 87% 91%

Professional services - % of total revenue 13% 9%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Software licenses 31,271 29,933 1,338 4%

Professional services 4,029 2,606 1,423 55%

----------------------------------------------------------------------------

Total revenue 35,300 32,539 2,761 8%

----------------------------------------------------------------------------

Software license revenue - % of total revenue 89% 92%

Professional services - % of total revenue 11% 8%

----------------------------------------------------------------------------

CMG's revenue is comprised of software license sales, which provide the majority

of the Company's revenue, and fees for professional services.

Total revenue increased by 7% for the three months ended September 30, 2013,

compared to the same period of the previous fiscal year, primarily due to an

increase in professional services.

Total revenue increased by 8% for the six months ended September 30, 2013,

compared to the same period of the previous fiscal years, as a result of

increases in both software license revenue and professional services.

SOFTWARE LICENSE REVENUE

Software license revenue is made up of annuity/maintenance license fees charged

for the use of the Company's software products which is generally for a term of

one year or less and perpetual software license sales, whereby the customer

purchases the current version of the software and has the right to use that

version in perpetuity. Annuity/maintenance license fees have historically had a

high renewal rate and, accordingly, provide a reliable revenue stream while

perpetual license sales are more variable and unpredictable in nature as the

purchase decision and its timing fluctuate with the customers' needs and

budgets. The majority of CMG's customers who have acquired perpetual software

licenses subsequently purchase our maintenance package to ensure ongoing product

support and access to current versions of CMG's software.

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Annuity/maintenance licenses 13,153 12,012 1,141 9%

Perpetual licenses 1,829 2,671 (842) -32%

----------------------------------------------------------------------------

Total software license revenue 14,982 14,683 299 2%

----------------------------------------------------------------------------

Annuity/maintenance as a % of total software

license revenue 88% 82%

Perpetual as a % of total software license

revenue 12% 18%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Annuity/maintenance licenses 27,111 25,192 1,919 8%

Perpetual licenses 4,160 4,741 (581) -12%

----------------------------------------------------------------------------

Total software license revenue 31,271 29,933 1,338 4%

----------------------------------------------------------------------------

Annuity/maintenance as a % of total software

license revenue 87% 84%

Perpetual as a % of total software license

revenue 13% 16%

----------------------------------------------------------------------------

Total software license revenue grew by 2% and 4% in the three and six months

ended September 30, 2013, respectively, compared to the same periods of the

previous fiscal year due to increases in the annuity/maintenance revenue offset

by decreases in perpetual license sales.

CMG's annuity/maintenance license revenue increased by 9% and 8% during the

three and six months ended September 30, 2013, respectively, compared to the

same periods of the previous year. This increase was driven by annuity sales to

new and existing customers as well as an increase in maintenance revenue tied to

perpetual sales generated in the previous fiscal year.

During the three months ended September 30, 2013, all of our regions experienced

growth in annuity/maintenance revenue with the exception of Canada which

remained flat. All of our regions, except South America, experienced growth in

annuity/maintenance revenue during the six months ended September 30, 2013, but

the most significant growth during this period came from the US region.

Our annuity/maintenance revenue is impacted by the revenue recognition from a

long-standing customer for which revenue recognition criteria are fulfilled only

at the time of the receipt of funds (see the discussion about revenue earned in

the current period that pertains to usage of products in prior quarters above

the "Quarterly Software License Revenue" graph). The variability of the amounts

of the payments received and the timing of such payments may skew the comparison

of the recorded annuity/maintenance revenue amounts between periods. During the

current quarter no payments have been received or recorded for this arrangement

which is consistent with the same quarter of the previous year. To provide a

normalized comparison, if we were to remove revenue from this one customer from

the year-to-date recorded revenue, we will notice that the annuity/maintenance

revenue increased by 12%, instead of 8% as compared to the same period of the

previous year. Given our long-term relationship with this customer, and their

on-going use of our licenses, we expect to continue to receive payments from

them; however, the amount and timing are uncertain and will continue to be

recorded on a cash basis, which may introduce some variability in our reported

quarterly annuity/maintenance revenue results.

We can observe from the table below that the exchange rates between the US and

Canadian dollars during the three and six months ended September 30, 2013,

compared to the same periods of the previous fiscal year, had only a slight

positive impact on our reported annuity/maintenance revenue.

Perpetual license sales decreased by 32% for the three months ended September

30, 2013, compared to the same period of the previous fiscal year, due to

decreases in Canada, the US and the Eastern Hemisphere offset by growth in

perpetual sales generated by South America.

Perpetual license sales decreased by 12% for the six months ended September 30,

2013, compared to the same period of the previous fiscal year, due to decreases

in Canada and the US offset by growth in perpetual sales generated by the

Eastern Hemisphere.

Software licensing under perpetual sales is a significant part of CMG's

business, but may fluctuate significantly between periods due to the uncertainty

associated with the timing and the location where sales are generated. For this

reason, even though we expect to achieve a certain level of aggregate perpetual

sales on an annual basis, we expect to observe fluctuations in the quarterly

perpetual revenue amounts throughout the fiscal year.

We can observe from the table below that the exchange rates between the US and

Canadian dollars during the three and six months ended September 30, 2013,

compared to the same periods of the previous fiscal year, had only a slight

positive impact on our reported perpetual license revenue.

The following table summarizes the US dollar denominated revenue and the

weighted average exchange rate at which it was converted to Canadian dollars:

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

US dollar annuity/maintenance license

sales US$ 8,767 6,938 1,829 26%

Weighted average conversion rate 1.012 1.005

----------------------------------------------------------------------------

Canadian dollar equivalent CDN$ 8,874 6,972 1,902 27%

----------------------------------------------------------------------------

US dollar perpetual license sales US$ 1,750 1,905 (155) -8%

Weighted average conversion rate 1.045 1.007

----------------------------------------------------------------------------

Canadian dollar equivalent CDN$ 1,829 1,918 (89) -5%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

US dollar annuity/maintenance license

sales US$ 18,108 15,576 2,532 16%

Weighted average conversion rate 1.010 1.001

----------------------------------------------------------------------------

Canadian dollar equivalent CDN$ 18,295 15,598 2,697 17%

----------------------------------------------------------------------------

US dollar perpetual license sales US$ 3,761 3,251 510 16%

Weighted average conversion rate 1.029 1.002

----------------------------------------------------------------------------

Canadian dollar equivalent CDN$ 3,869 3,257 612 19%

----------------------------------------------------------------------------

The following table quantifies the foreign exchange impact on our software

license revenue:

For the three months ended September Incremental Foreign

30, 2013 Q2 2013 License Exchange Q2 2014

($ thousands) Balance Growth Impact Balance

----------------------------------------------------------------------------

Annuity/maintenance license sales 12,012 1,077 64 13,153

Perpetual license sales 2,671 (910) 68 1,829

----------------------------------------------------------------------------

Total software license revenue 14,683 167 132 14,982

----------------------------------------------------------------------------

For the six months ended September 30, Incremental Foreign

2013 Q2 2013 License Exchange Q2 2014

($ thousands) Balance Growth Impact Balance

----------------------------------------------------------------------------

Annuity/maintenance license sales 25,192 1,758 161 27,111

Perpetual license sales 4,741 (682) 101 4,160

----------------------------------------------------------------------------

Total software license revenue 29,933 1,076 262 31,271

----------------------------------------------------------------------------

REVENUE BY GEOGRAPHIC SEGMENT

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Annuity/maintenance revenue

Canada 5,452 5,473 (21) 0%

United States 2,957 2,549 408 16%

South America 1,566 1,172 394 34%

Eastern Hemisphere(1) 3,178 2,818 360 13%

----------------------------------------------------------------------------

13,153 12,012 1,141 9%

----------------------------------------------------------------------------

Perpetual revenue

Canada - 753 (753) -100%

United States - 258 (258) -100%

South America 414 - 414 100%

Eastern Hemisphere 1,415 1,660 (245) -15%

----------------------------------------------------------------------------

1,829 2,671 (842) -32%

----------------------------------------------------------------------------

Total software license revenue

Canada 5,452 6,226 (774) -12%

United States 2,957 2,807 150 5%

South America 1,980 1,172 808 69%

Eastern Hemisphere 4,593 4,478 115 3%

----------------------------------------------------------------------------

14,982 14,683 299 2%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Annuity/maintenance revenue

Canada 10,882 10,413 469 5%

United States 6,121 4,942 1,179 24%

South America 3,898 4,334 (436) -10%

Eastern Hemisphere(1) 6,210 5,503 707 13%

----------------------------------------------------------------------------

27,111 25,192 1,919 8%

----------------------------------------------------------------------------

Perpetual revenue

Canada 291 1,314 (1,023) -78%

United States 427 662 (235) -35%

South America 490 483 7 1%

Eastern Hemisphere 2,952 2,282 670 29%

----------------------------------------------------------------------------

4,160 4,741 (581) -12%

----------------------------------------------------------------------------

Total software license revenue

Canada 11,173 11,727 (554) -5%

United States 6,548 5,604 944 17%

South America 4,388 4,817 (429) -9%

Eastern Hemisphere 9,162 7,785 1,377 18%

----------------------------------------------------------------------------

31,271 29,933 1,338 4%

----------------------------------------------------------------------------

(1) Includes Europe, Africa, Asia and Australia.

During the three months ended September 30, 2013, on a geographic basis, total

software license sales increased across all regions with the exception of the

Canadian market which experienced an overall decrease of 12%, compared to the

same period of the previous fiscal year.

During the six months ended September 30, 2013, on a geographic basis, total

software license sales increased by 17% and 18% in the US and South America,

respectively, while Canada and South America experienced decreases of 5% and 9%,

respectively.

The Canadian market (representing 36% of year-to-date total software revenue)

remained flat in annuity/maintenance revenue during the three months ended

September 30, 2013. Even though we have experienced revenue growth during the

quarter due to increased license usage by our existing large clients, and due to

the addition of several new accounts, these increases have been offset due to a

few clients cancelling their projects or experiencing financial difficulties

which has reduced or eliminated their need for licenses. However, our

diversified geographic profile enables us to take advantage of opportunities

internationally which offsets the impact of market softening in any particular

region. On a year-to-date basis, annuity/maintenance revenue in Canada

experienced a 5% growth, compared to the same period of the previous year, and

our expectation is that our existing and, in particular, our large clients will

continue renewing and increasing their usage of our products. Perpetual sales

were lower during the three and six months ended September 30, 2013, compared to

the same period of the previous year, due to the fluctuations inherent in the

perpetual revenue stream. Historically, the Canadian market has been strong in

generating recurring annuity/maintenance revenue as evidenced by the quarterly

year-over-year increases of 37%, 37%, 38% and 10% recorded during Q2 2013, Q3

2013, Q4 2013, and Q1 2014, respectively. During the second quarter of the

current fiscal year, we recorded comparable revenue to the second quarter of the

previous fiscal year due to the reasons described above.

The US market (representing 21% of year-to-date total software revenue)

experienced significant growth in annuity/maintenance license sales, in

comparison to other regions, during the three and six months ended September 30,

2013, compared to the same periods of the previous fiscal year, driven by sales

to new and existing customers. Perpetual license sales were lower during the

three and six months ended September 30, 2013, compared to the same period of

the previous year. We continue to experience successive increases in the

annuity/maintenance license sales in the US as evidenced by the quarterly

year-over-year increases of 24%, 32%, 20% and 32% recorded during Q2 2013, Q3

2013, Q4 2013, and Q1 2014 respectively. This double-digit growth trend has

continued into the second quarter of the current fiscal year with the recorded

increase of 16%.

South America (representing 14% of year-to-date total software revenue)

experienced an increase of 34% in annuity/maintenance license sales during the

three months ended September 30, 2013, compared to the same period of the

previous fiscal year, mainly due to increased sales to existing clients. South

America experienced a decrease of 10% in annuity/maintenance license sales

during the six months ended September 30, 2013, compared to the same period of

the previous fiscal year; however, the decrease was caused by the variability of

the amounts recorded from a customer for which revenue is recognized only when

cash is received (see the discussion about revenue earned in the current period

that pertains to usage of products in prior quarters above the "Quarterly

Software License Revenue" graph). To provide a normalized comparison, if we were

to exclude the amounts received from this customer from the year-to-date

annuity/maintenance revenue of the current and the previous fiscal years, we

would notice that the annuity/maintenance revenue grew by 17% in the six months

ended September 30, 2013. The South American region also experienced an increase

in perpetual sales during the second quarter of the current year compared to the

second quarter of the previous year while perpetual license sales remained

relatively flat for the six months ended September 30, 2013, as compared to the

same period of the previous fiscal year.

Eastern Hemisphere (representing 29% of the year-to-date total software revenue)

grew annuity/maintenance license sales by 13% during both the three and six

months ended September 30, 2013, compared to the same periods of the previous

fiscal year, due to increased license usage by our significant customers in the

region. Compared to other regions, Eastern Hemisphere achieved the highest

growth in perpetual license revenue during the six months ended September 30,

2013, compared to the same period of the previous year.

Movements in perpetual sales across regions are indicative of the unpredictable

nature of the timing and location of perpetual license sales. Overall, our

recurring annuity/maintenance revenue base continues to experience growth. We

will continue to focus our efforts on increasing our license sales to both

existing and new customers, and we will endeavor to continue expanding our

market share globally.

As footnoted in the Quarterly Performance table, in the normal course of

business, CMG may complete the negotiation of certain annuity/maintenance

contracts and/or fulfill revenue recognition requirements within a current

quarter that includes usage of CMG's products in prior quarters. This situation

particularly affects contracts negotiated with countries that face increased

economic and political risks leading to revenue recognition criteria being

satisfied only at the time of the receipt of cash. The dollar magnitude of such

contracts may be significant to the quarterly comparatives of our

annuity/maintenance revenue stream and, to provide a normalized comparison, we

specifically identify the revenue component where revenue recognition is

satisfied in the current period for products provided in previous quarters.

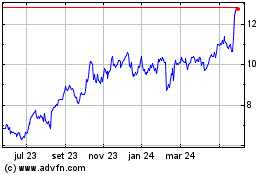

QUARTERLY SOFTWARE LICENSE REVENUE ($THOUSANDS)

To view accompanying graph, visit the following link:

http://media3.marketwire.com/docs/CMG-Q2-2013-License-Revenue.pdf.

DEFERRED REVENUE

$ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Deferred revenue at:

March 31 25,289 21,693 3,596 17%

June 30 22,014 18,779 3,235 17%

September 30 19,346 18,241 1,105 6%

----------------------------------------------------------------------------

CMG's deferred revenue consists primarily of amounts for pre-sold licenses. Our

annuity/maintenance revenue is deferred and recognized on a straight-line basis

over the life of the related license period, which is generally one year or

less. Amounts are deferred for licenses that have been provided and revenue

recognition reflects the passage of time.

The increase in deferred revenue year-over-year as at September 30, June 30 and

March 31 is reflective of the growth in annuity/maintenance license sales. The

variation within the year is due to the timing of renewals of annuity and

maintenance contracts that are skewed to the beginning of the calendar year

which explains the decrease in deferred revenue balance at the end of the first

quarter and second quarter (June 30 and September 30, respectively) compared to

the fiscal year-end (March 31).

Deferred revenue at September 30, 2013 increased by 6% compared to the same

period of the prior fiscal year. This increase is lower than the increases of

17% recorded in the previous two quarters due to the timing of the renewal of

one significant contract. In the previous fiscal year, this contract was renewed

and included in our second quarter's deferred revenue balance, whereas in the

current fiscal year, the renewal is expected to be completed during the third

quarter. To provide a normalized comparison, if we were to include this renewal

in the current quarter's deferred revenue balance, we would notice that the

deferred revenue would have increased by 12% at September 30, 2013 compared to

the same period of the previous fiscal year.

PROFESSIONAL SERVICES REVENUE

CMG recorded professional services revenue of $2.2 million for the three months

ended September 30, 2013, representing an increase of $0.8 million, compared to

the same period of the previous fiscal year, due to both an increase in project

activities by our clients and due to entering into a large consulting agreement

with one of our clients which, we expect, will contribute to the professional

services revenue during the current fiscal year. Professional services for the

six months ended September 30, 2013 amounted to $4.0 million, representing an

increase of $1.4 million, compared to the same period of the previous fiscal

year, which again resulted from entering into a large consulting agreement with

one of our clients in the current fiscal year.

Professional services revenue consists of specialized consulting, training, and

contract research activities. CMG performs consulting and contract research

activities on an ongoing basis, but such activities are not considered to be a

core part of our business and are primarily undertaken to increase our knowledge

base and hence expand the technological abilities of our simulators in a funded

manner, combined with servicing our customers' needs. In addition, these

activities are undertaken to market the capabilities of our suite of software

products with the ultimate objective to increase software license sales. Our

experience is that consulting activities are variable in nature as both the

timing and dollar magnitude of work are dependent on activities and budgets

within client companies.

Expenses

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Sales, marketing and professional services 3,837 3,592 245 7%

Research and development 3,418 3,028 390 13%

General and administrative 1,633 1,421 212 15%

----------------------------------------------------------------------------

Total operating expenses 8,888 8,041 847 11%

----------------------------------------------------------------------------

Direct employee costs(1) 7,188 6,491 697 11%

Other corporate costs 1,700 1,550 150 10%

----------------------------------------------------------------------------

8,888 8,041 847 11%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Sales, marketing and professional services 7,486 7,555 (69) -1%

Research and development 6,890 5,925 965 16%

General and administrative 3,278 2,922 356 12%

----------------------------------------------------------------------------

Total operating expenses 17,654 16,402 1,252 8%

----------------------------------------------------------------------------

Direct employee costs(1) 14,308 13,086 1,222 9%

Other corporate costs 3,346 3,316 30 1%

----------------------------------------------------------------------------

17,654 16,402 1,252 8%

----------------------------------------------------------------------------

(1) Includes salaries, bonuses, stock-based compensation, benefits and

commissions.

CMG's total operating expenses increased by 11% and 8% for the three and six

months ended September 30, 2013, respectively, compared to the same periods of

the previous fiscal year, due to increases in both direct employee costs and

other corporate costs.

DIRECT EMPLOYEE COSTS

As a technology company, CMG's largest area of expenditure is for its people.

Approximately 81% of the total operating expenses in the six months ended

September 30, 2013 related to staff costs, compared to 80% recorded in the

comparative period of last year. Staffing levels for the current fiscal year

grew in comparison to the previous fiscal year to support our continued growth.

At September 30, 2013, CMG's staff complement was 185 employees and consultants,

up from 167 employees as at September 30, 2012. Direct employee costs increased

during the three and six months ended September 30, 2013, compared to the same

periods of the previous fiscal year, due to staff additions, increased levels of

compensation, and related benefits.

OTHER CORPORATE COSTS

Other corporate costs increased by 10% for the three months ended September 30,

2013, compared to the same period of the previous fiscal year, mainly due to

increased computing costs.

Other corporate costs increased by 1% for the six months ended September 30,

2013, compared with the same period of the previous fiscal year, mainly due to

increased computing costs in the six months ended September 30, 2013 offset by

the inclusion of the costs associated with CMG's biennial technical symposium in

the six months ended September 30, 2012.

RESEARCH AND DEVELOPMENT

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Research and development (gross) 3,935 3,487 448 13%

SR&ED credits (517) (459) (58) 13%

----------------------------------------------------------------------------

Research and development 3,418 3,028 390 13%

----------------------------------------------------------------------------

Research and development as a % of total

revenue 20% 19%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Research and development (gross) 7,955 6,872 1,083 16%

SR&ED credits (1,065) (947) (118) 12%

----------------------------------------------------------------------------

Research and development 6,890 5,925 965 16%

----------------------------------------------------------------------------

Research and development as a % of total

revenue 20% 18%

----------------------------------------------------------------------------

CMG maintains its belief that its strategy of growing long-term value for

shareholders can only be achieved through continued investment in research and

development. CMG works closely with its customers to provide solutions to

complex problems related to proven and new advanced recovery processes.

The above research and development costs include CMG's share of joint research

and development costs associated with the DRMS project of $1.0 million and $2.1

million for the three and six months ended September 30, 2013, respectively

(2012 - $0.7 million and $1.5 million). See discussion under "Commitments, Off

Balance Sheet Items and Transactions with Related Parties."

The increases of 13% and 16% in our gross spending on research and development

for the three and six months ended September 30, 2013, respectively, demonstrate

our continued commitment to advancement of our technology which is the focal

part of our business strategy.

Research and development costs, net of research and experimental development

("SR&ED") credits, increased by 13% and 16% during the three and six months

ended September 30, 2013, respectively, compared to the same periods of the

previous fiscal year, due to increased employee compensation costs and costs

associated with computing resources.

We also had an increase in SR&ED credits driven mainly by the increases in our

direct employee costs as well as the increase in hours spent on projects

eligible for SR&ED credits.

DEPRECIATION

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Depreciation of property and equipment,

allocated to:

Sales, marketing and professional services 103 119 (16) -13%

Research and development 226 226 - 0%

General and administrative 50 48 2 4%

----------------------------------------------------------------------------

Total depreciation 379 393 (14) -4%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Depreciation of property and equipment,

allocated to:

Sales, marketing and professional services 203 217 (14) -6%

Research and development 452 406 46 11%

General and administrative 99 88 11 13%

----------------------------------------------------------------------------

Total depreciation 754 711 43 6%

----------------------------------------------------------------------------

Depreciation in the three and six months ended September 30, 2013 was relatively

flat as compared to the same periods in the previous fiscal year.

Finance Income and Costs

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Interest income 162 131 31 24%

----------------------------------------------------------------------------

Finance income 162 131 31 24%

----------------------------------------------------------------------------

Net foreign exchange loss (325) (460) 135 -29%

----------------------------------------------------------------------------

Finance costs (325) (460) 135 -29%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Interest income 319 276 43 16%

Net foreign exchange gain 167 - 167 100%

----------------------------------------------------------------------------

Total finance income 486 276 210 76%

----------------------------------------------------------------------------

Net foreign exchange loss - (133) 133 -100%

----------------------------------------------------------------------------

Finance costs - (133) 133 -100%

----------------------------------------------------------------------------

Interest income increased in the three and six months ended September 30, 2013,

compared to the same periods of the prior fiscal year, mainly due to investing

larger cash balances.

CMG is impacted by the movement of the US dollar against the Canadian dollar as

approximately 71% (2012 - 65%) of CMG's revenue for the six months ended

September 30, 2013 is denominated in US dollars, whereas only approximately 25%

(2012 - 23%) of CMG's total costs are denominated in US dollars.

CDN$ to US$ At June 30 At September 30 Six month trailing average

----------------------------------------------------------------------------

2011 1.0370 0.9626 1.0252

2012 0.9813 1.0166 0.9977

2013 0.9513 0.9723 0.9670

----------------------------------------------------------------------------

CMG recorded a net foreign exchange loss of $0.3 million for the three months

ended September 30, 2013, compared to a $0.5 million foreign exchange loss

recorded in the same period of the previous fiscal year, due to a strengthening

of the Canadian dollar during the quarter which contributed negatively to the

valuation of our US-denominated working capital.

CMG recorded a net foreign exchange gain of $0.2 million for the six months

ended September 30, 2013, compared to a $0.1 million foreign exchange loss

recorded in the same period of the previous fiscal year, as the net foreign

exchange loss recorded in the three months ended September 30, 2013 was offset

by the $0.5 million foreign exchange gain recorded in the three months ended

June 30, 2013.

Income and Other Taxes

CMG's effective tax rate for the six months ended September 30, 2013 is

reflected as 30.0% (2012 - 29.7%), whereas the prevailing Canadian statutory tax

rate is now 25.0%. This difference is primarily due to a combination of the

non-tax deductibility of stock-based compensation expense and the benefit of

foreign withholding taxes being realized only as a tax deduction as opposed to a

tax credit.

The benefit recorded in CMG's books on the SR&ED investment tax credit program

impacts deferred income taxes. The investment tax credit earned in the current

fiscal year is utilized by CMG to reduce income taxes otherwise payable for the

current fiscal year and the federal portion of this benefit bears an inherent

tax liability as the amount of the credit is included in the subsequent year's

taxable income for both federal and provincial purposes. The inherent tax

liability on these investment tax credits is reflected in the year the credit is

earned as a non-current deferred tax liability and then, in the following fiscal

year, is transferred to income taxes payable.

Operating Profit and Net Income

For the three months ended September 30, $ %

($ thousands, except per share amounts) 2013 2012 change change

----------------------------------------------------------------------------

Total revenue 17,184 16,073 1,111 7%

Operating expenses (8,888) (8,041) (847) 11%

----------------------------------------------------------------------------

Operating profit 8,296 8,032 264 3%

Operating profit as a % of total revenue 48% 50%

----------------------------------------------------------------------------

Net income for the period 5,608 5,361 247 5%

Net income for the period as a % of total

revenue 33% 33%

----------------------------------------------------------------------------

Basic earnings per share ($/share) 0.15 0.14 0.01 7%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands, except per share amounts) 2013 2012 change change

----------------------------------------------------------------------------

Total revenue 35,300 32,539 2,761 8%

Operating expenses (17,654) (16,402) (1,252) 8%

----------------------------------------------------------------------------

Operating profit 17,646 16,137 1,509 9%

Operating profit as a % of total revenue 50% 50%

----------------------------------------------------------------------------

Net income for the period 12,689 11,451 1,238 11%

Net income for the period as a % of total

revenue 36% 35%

----------------------------------------------------------------------------

Earnings per share ($/share) 0.33 0.31 0.02 6%

----------------------------------------------------------------------------

Operating profit as a percentage of total revenue for the three months ended

September 30, 2013 was at 48% compared to 50% recorded in the same period of the

previous fiscal year. While our total revenue grew by 7% during this period of

time, our operating expenses grew by 11%, having a negative impact on our

operating profit. The slight decrease in operating profit as a percentage of

total revenue is due to the fluctuations inherent in our perpetual revenue

stream given that more perpetual license revenue was recorded during the second

quarter of the previous year, compared to the same quarter of the current year.

Operating profit as a percentage of revenue for the six months ended September

30, 2013 remained flat at 50% as compared to the same period of the previous

fiscal year.

Net income for the period as a percentage of revenue was consistent at 33% for

the three months ended September 30, 2013, compared to the same period of the

previous fiscal year.

Net income for the period as a percentage of revenue increased to 36% for the

six months ended September 30, 2013, compared to 35% for the same period of the

previous fiscal year.

We have continued to maintain our profitability by focusing our efforts on

increasing effectively controlling our operating costs. Managing these variables

will continue to license sales while, at the same time, be imperative to our

future success.

EBITDA

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Net income for the period 5,608 5,361 247 5%

Add (deduct):

Depreciation 379 393 (14) -4%

Finance income (162) (131) (31) 24%

Finance costs 325 460 (135) -29%

Income and other taxes 2,525 2,342 183 8%

----------------------------------------------------------------------------

EBITDA 8,675 8,425 250 3%

----------------------------------------------------------------------------

EBITDA as a % of total revenue 50% 52%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Net income for the period 12,689 11,451 1,238 11%

Add (deduct):

Depreciation 754 711 43 6%

Finance income (486) (276) (210) 76%

Finance costs - 133 (133) -100%

Income and other taxes 5,443 4,829 614 13%

----------------------------------------------------------------------------

EBITDA 18,400 16,848 1,552 9%

----------------------------------------------------------------------------

EBITDA as a % of total revenue 52% 52%

----------------------------------------------------------------------------

EBITDA increased by 3% and 9% for the three and six months ended September 30,

2013, compared to the same periods of the previous fiscal year. This increase

provides further indication of our ability to keep growing our license sales

while effectively managing costs in relation to this base.

EBITDA as a percent of total revenue for the three months ended September 30,

2013 decreased to 50% as compared to 52% recorded in the same period of the

previous fiscal year. This slight decrease is due to the fluctuations inherent

in our perpetual revenue stream.

EBITDA as a percent of total revenue for the six months ended September 30, 2013

remained consistent with the same period of the previous fiscal year at 52%.

Liquidity and Capital Resources

For the three months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Cash, beginning of period 63,112 51,535 11,577 22%

Cash flow from (used in):

Operating activities 2,903 3,537 (634) -18%

Financing activities (2,242) (3,456) 1,214 -35%

Investing activities (28) (922) 894 -97%

----------------------------------------------------------------------------

Cash, end of period 63,745 50,694 13,051 26%

----------------------------------------------------------------------------

For the six months ended September 30, $ %

($ thousands) 2013 2012 change change

----------------------------------------------------------------------------

Cash, beginning of period 59,419 55,374 4,045 7%

Cash flow from (used in):

Operating activities 12,740 10,198 2,542 25%

Financing activities (8,161) (13,519) 5,358 -40%

Investing activities (253) (1,359) 1,106 -81%

----------------------------------------------------------------------------

Cash, end of period 63,745 50,694 13,051 26%

----------------------------------------------------------------------------

OPERATING ACTIVITIES

Cash flow generated from operating activities decreased by $0.6 million in the

three months ended September 30, 2013, compared to the same period of last year,

mainly as a result of an increase in the deferred revenue balance offset by the

positive effect on the timing difference of when trade payables and accrued

liabilities are recorded and paid.

Cash flow generated from operating activities increased by $2.5 million in the

six months ended September 30, 2013, compared to the same period of last year,

mainly due to the increase in net income for the period, the timing difference

of when the sales are made and when the resulting receivables are collected, the

positive effect on the timing difference of when income taxes are recorded and

paid offset by the change in trade payables and accrued liabilities and deferred

revenue balances.

FINANCING ACTIVITIES

Cash used in financing activities during the three and six months ended

September 30, 2013 decreased by $1.2 million and $5.4 million, respectively,

compared to the same period of last year, due to receiving higher proceeds from

the issuance of Common Shares. In addition, in the first quarter of the previous

fiscal year, CMG spent $1.6 million on buying back Common Shares.

During the six months ended September 30, 2013, CMG employees and directors

exercised options to purchase 755,000 Common Shares, which resulted in cash

proceeds of $7.7 million (2012 - 459,000 options exercised to purchase Common

Shares which resulted in cash proceeds of $3.8 million).

In the six months ended September 30, 2013, CMG paid $15.8 million in dividends,

representing the following quarterly dividends:

($ per share) Q1 Q2

----------------------------------------------------------------------------

Dividends declared and paid 0.18 0.18

Special dividend declared and paid 0.05 -

----------------------------------------------------------------------------

Total dividends declared and paid 0.23 0.18

----------------------------------------------------------------------------

In the six months September 30, 2012, CMG paid $15.8 million in dividends,

representing the following quarterly dividends:

($ per share) Q1 Q2

----------------------------------------------------------------------------

Dividends declared and paid 0.16 0.16

Special dividend declared and paid 0.10 -

----------------------------------------------------------------------------

Total dividends declared and paid 0.26 0.16

----------------------------------------------------------------------------

On November 12, 2013, CMG announced the payment of a quarterly dividend of $0.18

per share on CMG's Common Shares. The dividend will be paid on December 13, 2013

to shareholders of record at the close of business on December 6, 2013.

Over the past 10 years, we have consistently raised our total annual dividend

and paid out a special dividend at the end of each fiscal year as determined by

our corporate performance. In recognition of the importance of a more regular

income stream to our shareholders, as reported in fiscal 2012 Management's

Discussion and Analysis, we decided to increase the relative proportion of

dividends paid quarterly and lower the amount paid as a special annual dividend

beginning in fiscal 2013. The above table demonstrates this increase in the

regular quarterly dividend which amounted to $0.18 per share in Q1 and Q2 of

fiscal 2014 compared to $0.16 per share in Q1 and Q2 of fiscal 2013.

Based on our expectation of solid profitability and cash-generating ability

driven by the predictability of our software revenue base and effective

management of costs, we are cautiously optimistic that the company is well

positioned for future growth which will enable us to continue to pay quarterly

dividends.

On April 16, 2012, the Company announced a Normal Course Issuer Bid ("NCIB")

commencing on April 18, 2012 to purchase for cancellation up to 3,416,000 of its

Common Shares. During the year ended March 31, 2013, a total of 91,000 Common

Shares were purchased at market price for a total cost of $1,551,000.

On April 29, 2013, the Company announced a NCIB commencing on May 1, 2013 to

purchase for cancellation up to 3,538,000 of its Common Shares. During the six

months ended September 30, 2013, no Common Shares were purchased.

INVESTING ACTIVITIES

CMG's current needs for capital asset investment relate to computer equipment

and office infrastructure costs, all of which will be funded internally. During

the six months ended September 30, 2013, CMG expended $0.3 million on property

and equipment additions, primarily composed of computing equipment, and has a

capital budget of $1.8 million for fiscal 2014.

LIQUIDITY AND CAPITAL RESOURCES

At September 30, 2013, CMG has $63.7 million in cash, no debt, and has access to

just over $0.8 million under a line of credit with its principal banker.

During the six months ended September 30, 2013, 4,838,000 shares of CMG's public

float were traded on the TSX. As at September 30, 2013, CMG's market

capitalization based upon its September 30, 2013 closing price of $24.10 was

$937.1 million.

Commitments, Off Balance Sheet Items and Transactions with Related Parties

The Company is the operator of the DRMS research and development project (the

"DRMS Project"), a collaborative effort with its partners Shell International

Exploration and Production BV ("Shell") and Petroleo Brasileiro S.A.

("Petrobras"), to jointly develop the newest generation of reservoir and

production system simulation software. The project has been underway since 2006

and, with the ongoing support of the participants, it is expected to continue

until ultimate delivery of the software. The Company's share of costs associated

with the project is estimated to be $5.5 million ($2.6 million net of overhead

recoveries) for fiscal 2014. CMG plans to continue funding its share of the

project costs associated with the development of the newest generation reservoir

simulation software system from internally generated cash flows.

CMG has very little in the way of other ongoing material contractual obligations

other than for pre-sold licenses which are reflected as deferred revenue on its

statement of financial position, and contractual obligations for office leases

which are estimated as follows: 2014 - $1.0 million; 2015 to 2016 - $2.0 million

per year; and 2017 - $1.0 million.

Business Risks and Critical Accounting Estimates

These remain unchanged from the factors detailed in CMG's 2013 Annual Report.

Changes in Accounting Policies

Except as disclosed below, the accounting policies, presentation and methods of

computation remain unchanged from those detailed in CMG's 2013 Annual Report.

The following new standards and interpretations have been adopted as detailed

below:

-- IFRS 10 Consolidated Financial Statements

Replaces the guidance in IAS 27 Consolidated and Separate Financial

Statements and SIC-12 Consolidation - Special Purpose Entities, and

provides a single model to be applied in the control analysis for all

investees, including entities that currently are special purpose

entities in the scope of SIC-12. The Company adopted IFRS 10 for the

annual period beginning on April 1, 2013. The adoption of IFRS 10 did

not have a material impact on the condensed consolidated interim

financial statements.

-- IFRS 11 Joint Arrangements

Under IFRS 11, joint arrangements are classified as either joint

operations or joint ventures. IFRS 11 replaces the guidance in IAS 31

Interest in Joint Ventures, and essentially carves out of previous

jointly controlled entities, those arrangements which although

structured through a separate vehicle, such separation is ineffective

and the parties to the arrangement have rights to the assets and

obligations for the liabilities and are accounted for as joint

operations in a fashion consistent with jointly controlled

assets/operations under IAS 31. In addition, under IFRS 11, joint

ventures must now use the equity method of accounting. The Company

adopted IFRS 11 for the annual period beginning on April 1, 2013. The

adoption of IFRS 11 did not have a material impact on the condensed

consolidated interim financial statements.

-- IFRS 12 Disclosure of Interests in Other Entities

Contains the disclosure requirements for entities that have interests in

subsidiaries, joint arrangements, associates and/or unconsolidated

structured entities. The Company adopted IFRS 12 for the annual period

beginning on April 1, 2013. The adoption of IFRS 12 did not have a

material impact on the condensed consolidated interim financial

statements.

-- IFRS 13 Fair Value Measurement

Replaces the fair value measurement guidance contained in individual

IFRSs with a single source of fair value measurement guidance. It

defines fair value as the price that would be received to sell an asset

or paid to transfer a liability in an orderly transaction between market

participants at the measurement date, i.e. an exit price. The standard

also establishes a framework for measuring fair value and sets out

disclosure requirements for fair value measurement to provide

information that enables financial statement users to assess the methods

and inputs used to develop fair value measurements and, for recurring

fair value measurements that use significant unobservable inputs (Level

3), the effect of the measurements on profit or loss or other. The

Company adopted IFRS 13 prospectively for the interim and annual periods

beginning on April 1, 2013. The adoption of IFRS 13 did not have a

material impact on the condensed consolidated interim financial

statements other than the inclusion of certain fair value disclosures

which were previously applicable to annual financial statements only.

-- Amendments to IAS 1 Presentation of Financial Statements

Require an entity present separately the items of other comprehensive

income that may be reclassified to profit or loss in the future from

those that would never be reclassified to profit or loss. The Company

adopted the amendments for the annual period beginning on April 1, 2013.

As the amendments only required changes in the presentation of items in

other comprehensive income, the new standard did not have a material

impact on the condensed consolidated interim financial statements.

-- Amendments to IFRS 7 Offsetting Financial Assets and Liabilities

Contains new disclosure requirements for offset financial assets and

liabilities and netting arrangements. The Company adopted the amendments

for the interim and annual periods beginning on April 1, 2013. The

amendments to IFRS 7 did not have a material impact on the condensed

consolidated interim financial statements.

Accounting Standards and Interpretations Issued But Not Yet Effective

The following standards and interpretations have not been adopted by the Company

as they apply to future periods:

Nature of impending

change in accounting Impact on CMG's

Standard/Interpretation policy financial statements

----------------------------------------------------------------------------

IFRS 9 Financial IFRS 9 (2009) replaces The mandatory effective

Instruments the guidance in IAS 39 date of IFRS 9 (2010),

Financial Instruments: which supersedes IFRS 9

In November 2009 the Recognition and (2009), has been left

IASB issued IFRS 9 Measurement, on the open by the IASB. Early

Financial Instruments classification and adoption is permitted.

(IFRS 9 (2009)), and in measurement of financial The Company will

October 2010 the IASB assets. The Standard determine when to adopt

published amendments to eliminates the existing IFRS 9 (2010) when the

IFRS 9 (IFRS 9 (2010)). IAS 39 categories of IASB has determined the

On July 24, 2013 the held to maturity, mandatory effective date

IASB tentatively decided available-for-sale and and finalised the

to defer the mandatory loans and receivable. impairment and

effective date of IFRS classification and

9. The mandatory Financial assets will be measurement

effective date will be classified into one of requirements.

left open pending the two categories on

finalisation of the initial recognition: The Company does not

impairment and expect IFRS 9 (2010) to

classification and - financial assets have a material impact

measurement measured at amortized on the financial

requirements. cost; or statements. The

- financial assets classification and

measured at fair value. measurement of the

Company's financial

Gains and losses on assets and liabilities

remeasurement of is not expected to

financial assets change under IFRS 9

measured at fair value (2010) because of the

will be recognized in nature of the Company's

profit or loss, except operations and the types

that for an investment of financial assets that

in an equity instrument it holds.

which is not held-for-

trading, IFRS 9

provides, on initial

recognition, an

irrevocable election to

present all fair value

changes from the

investment in other

comprehensive income

(OCI). The election is

available on an

individual share-by-

share basis. Amounts

presented in OCI will

not be reclassified to

profit or loss at a

later date.

IFRS 9 (2010) added

guidance to IFRS 9

(2009) on the

classification and

measurement of financial

liabilities, and this

guidance is consistent

with the guidance in IAS

39 expect as described

below.

Under IFRS 9 (2010), for

financial liabilities

measured at fair value

under the fair value

option, changes in fair

value attributable to

changes in credit risk

will be recognized in

OCI, with the remainder

of the change recognized

in profit or loss.

However, if this

requirement creates or

enlarges an accounting

mismatch in profit or

loss, the entire change

in fair value will be

recognized in profit or

loss. Amounts presented

in OCI will not be

reclassified to profit

or loss at a later date.

IFRS 9 (2010) also

requires derivative

liabilities that are

linked to and must be

settled by delivery of

an unquoted equity

instrument to be

measured at fair value,

whereas such derivative

liabilities are measured

at cost under IAS 39.

IFRS 9 (2010) also added

the requirements of IAS

39 for the derecognition

of financial assets and

liabilities to IFRS 9

without change.

----------------------------------------------------------------------------

Amendments to IAS 32, The amendments to IAS 32 The Company intends to

Offsetting Financial clarify that an entity adopt the amendments to

Assets and Liabilities currently has a legally IAS 32 in its financial

enforceable right to statements for the

In December 2011, the set-off if that right annual period beginning

IASB published is: April 1, 2014. The

Offsetting Financial Company does not expect

Assets and Financial - not contingent on a the amendments to have a

Liabilities and issued future event; and material impact on the

new presentation - enforceable both in financial statements.

requirements in IAS 32 the normal course of

Financial Instruments: business and in the

Presentation. event of default,

insolvency or bankruptcy

The effective date for of the entity and all

the amendments to IAS 32 counterparties.

is annual periods

beginning on or after The amendments to IAS 32

January 1, 2014. These also clarify when a

amendments are to be settlement mechanism

applied retrospectively. provides for net

settlement or gross

settlement that is

equivalent to net

settlement.

----------------------------------------------------------------------------

Amendments to IAS 36, The amendments to IAS 36 The Company intends to

Impairment of Assets clarify IASB's original adopt the amendments to

intention to require: IAS 36 in its financial

In May 2013, the IASB statements for the

published Recoverable - the disclosure of the annual period beginning

Amount Disclosures for recoverable amount of April 1, 2014. The

Non-Financial Assets impaired assets; and Company does not expect

detailing narrow scope - additional disclosures the amendments to have a

amendments to IAS 36 about the measurement of material impact on the

Impairment of Assets. the recoverable amount financial statements.

of impaired assets when

The effective date for the recoverable amount

the amendments to IAS 36 is based on fair value

is annual periods less costs of disposal,

beginning on or after including the discount

January 1, 2014. These rate when a present

amendments are to be value technique is used

applied retrospectively to measure the

and earlier adoption is recoverable amount.

permitted for periods

when IFRS 13 is applied.

----------------------------------------------------------------------------

Outstanding Share Data

The following table represents the number of Common Shares and options outstanding:

As at November 12, 2013

(thousands)

----------------------------------------------------------------------------

Common Shares 38,901

Options 3,227

----------------------------------------------------------------------------

On July 13, 2005, CMG adopted a rolling stock option plan which allows the

Company to grant options to its employees and directors to acquire Common Shares

of up to 10% of the outstanding Common Shares at the date of grant. Based upon

this calculation, at November 12, 2013, CMG could grant up to 3,890,000 stock

options.

Disclosure Controls and Procedures and Internal Control over Financial Reporting

Management is responsible for establishing and maintaining disclosure controls

and procedures ("DC&P") and internal control over financial reporting ("ICFR")

as defined under National Instrument 52-109. These controls and procedures were

reviewed and the effectiveness of their design and operation was evaluated in

fiscal 2013 in accordance with the COSO control framework. The evaluation

confirmed the effectiveness of DC&P and ICFR at March 31, 2013. During our

fiscal year 2014, we continue to monitor and review our controls and procedures.

During the six months ended September 30, 2013, there have been no significant

changes to the Company's ICFR that have materially affected, or are reasonably

likely to materially affect, the company's ICFR.

Outlook

Our annuity/maintenance revenue stream continued to grow during the first six

months of fiscal 2014 with a recorded increase of 8%, compared to the same

period of the previous fiscal year. Over 80% of our software license revenue is

derived from our annuity and maintenance contracts, and with a strong renewal

rate, we expect to see continued growth in this revenue base. We have

experienced increased usage by our existing large clients as well as added new

accounts during the quarter. Year-to-date, the most notable growth was

experienced in the US and the Eastern Hemisphere.

Our geographical diversification allows us to take advantage of opportunities

internationally, and we will continue to extend our reach globally and focus our

efforts on sustaining high renewal rates as well as increasing the number of

licenses sold to both existing and new customers.

Although professional services are not the primary source of our revenue, we

were able to grow this business by $1.4 million in the first six months of

fiscal 2014 as compared to the same period of the prior fiscal year.

Our profit margin continued to hold strong, demonstrating our continuous

commitment to effectively manage our corporate costs. For the six months ended

September 30, 2013, our EBITDA represented 52% of our total revenue, remaining

consistent with the same period of the previous fiscal year.

CMG continues to focus its resources on the development, enhancement and

deployment of simulation software tools relevant to the challenges and

opportunities facing its diverse customer base. We strive to invest 20% of our

top line towards continuous improvement of our product features as well as

development of new capabilities in order to maintain our technological

distinction and take advantage of new opportunities. We will continue fostering

value-based, long-term relationships with our clients while helping them solve

problems associated with hydrocarbon recovery, with an emphasis on the advanced

recovery processes, which are increasing in complexity and where our products

continue to gain increasing importance. With the growth in unconventional

hydrocarbon and enhanced oil recovery ("EOR") projects around the globe, we are

seeing an increase in the use of reservoir simulation software by reservoir

engineers. This growth in simulation use has been reflected in the number and

types of projects being simulated and the amount of simulation done on each

project. More recently, the North American market is seeing an increased

opportunity in shale gas and liquids which use complex recovery processes that

necessitate the use of simulation.

One of the instrumental parts of our success includes training programs which we