Dividend 15 Split Corp. II Announces Rights Offering

19 Março 2012 - 6:35PM

Marketwired

Dividend 15 Split Corp. II ("the Company") today announced that it

will issue rights ("Rights") to all Class A Shareholders. Each

Class A Shareholder will be entitled to receive one Right for each

Class A Share held as of the record date of March 28, 2012. Four

Rights will entitle the holder to purchase a Unit consisting of one

Class A Share and one Preferred Share for $19.00. The Rights will

expire at 4:00 p.m. (local time) on June 8, 2012, the expiry date.

If all the Rights are exercised the Company will issue

approximately 1,264,750 Units and will receive net proceeds of

$23,499,063. The net proceeds from the subscription of Units will

be used to acquire additional securities in accordance with the

Company's investment objectives. The exercise price is consistent

with current trading prices and accretive to the most recently

published net asset value per Unit. By raising additional cash

through this offering, the Company will be able to capitalize on

certain attractive investment opportunities that may arise over the

next few months. The offering is expected to increase the trading

liquidity of the Company and reduce the management expense

ratio.

Both the Preferred Shares and Class A Shares trade on the

Toronto Stock Exchange (the "TSX") under the symbol "DF.PR.A" and

"DF" respectively. The Rights will be listed on the TSX under the

ticker symbol DF.RT. It is expected that Rights will commence

trading on March 26, 2012 and continue trading until 12:00 noon

(EST) on June 8, 2012.

The Company invests in a portfolio of leading Canadian

dividend-yielding stocks as follows: Bank of Montreal, Bank of Nova

Scotia, Canadian Imperial Bank of Commerce, Royal Bank of Canada,

Toronto-Dominion Bank, National Bank of Canada, CI Financial Corp.,

BCE Inc., Manulife Financial, Enbridge, Sun Life Financial, TELUS

Corporation, The Thomson Corporation, TransAlta Corporation,

TransCanada Corporation. Shares held within the portfolio are

expected to range between 4-8% in weight but may vary at any

time.

Certain statements included in this news release constitute

forward-looking statements, including, but not limited to, those

identified by the expressions "expect", "intend", "will" and

similar expressions to the extent they relate to the Company. The

forward-looking statements are not historical facts but reflect the

Manager's current expectations regarding future results or events.

These forward-looking statements are subject to a number of risks

and uncertainties that could cause actual results or events to

differ materially from current expectations. Although the Manager

believes that the assumptions inherent in the forward-looking

statements are reasonable, forward-looking statements are not

guarantees of future performance and, accordingly, readers are

cautioned not to place undue reliance on such statements due to the

inherent uncertainty therein. The Manager undertakes no obligation

to update publicly or otherwise revise any forward-looking

statement or information whether as a result of new information,

future events or other such factors which affect this information,

except as required by law.

Contacts: Dividend 15 Split Corp. II Investor Relations

416-304-4443 or Toll Free: 1-877-4-Quadra (1-877-478-2372)

www.dividend15.com

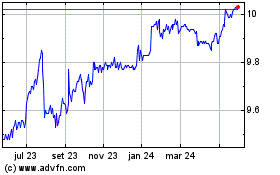

Dividend 15 Split Corp II (TSX:DF.PR.A)

Gráfico Histórico do Ativo

De Mai 2024 até Jun 2024

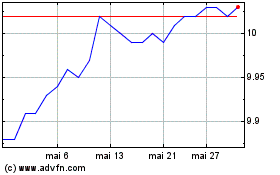

Dividend 15 Split Corp II (TSX:DF.PR.A)

Gráfico Histórico do Ativo

De Jun 2023 até Jun 2024