Energy Fuels Announces Updated Preliminary Feasibility Study and Improved Economics for Sheep Mountain Project

01 Março 2012 - 8:25AM

Marketwired Canada

Energy Fuels Inc. (TSX:EFR) ("Energy Fuels" or the "Company") is pleased to

announce that it has completed an update to the Preliminary Feasibility Study

(PFS), originally reported by the Company's wholly owned subsidiary Titan

Uranium on April 12, 2010, for Energy Fuels' 100% owned Sheep Mountain uranium

project in Fremont County, Wyoming. All currency amounts reported in this

release are quoted in US dollars.

Under the updated PFS, the scenario with the best economics for the Sheep

Mountain Project is the concurrent development of both the underground and open

pit deposits. This option generates a pre-tax Internal Rate of Return (IRR) of

42%, with a Net Present Value (NPV) of $201 million at a 7% discount rate, and

an NPV of $146 million at a 10% discount rate. Initial CAPEX for this option is

$109 million.

Capital considerations could result in Energy Fuels modifying the plan that

produces the highest IRR in favor of an alternative that initially develops the

open pit only, and delays producing the underground deposit until the 5th year

of operations. This alternative would require a much reduced initial capital

investment of $61 million while still providing positive cash flow; and would

generate a pre-tax IRR of 35%, with NPV's of $174 million at a 7% discount rate

and $118 million at a 10% discount rate.

The update to the study was prepared by a group of consultants led by BRS Inc.,

an independent engineering consulting firm based in Riverton, Wyoming, in

collaboration with Western States Mining Consultants and Lyntek Inc. This group

also prepared the original PFS.

Steve Antony, President and CEO of Energy Fuels stated, "The results of this

updated PFS confirm our view that Sheep Mountain can be a highly productive and

profitable project. These economic results are compelling, even in today's

uranium marketplace, and validate the assessment that led to Energy Fuels'

acquisition of Titan Uranium. We are prepared to continue the Sheep Mountain

permitting effort to bring the project online as a producing, conventional

uranium mine as quickly as possible to monetize these returns for our

shareholders."

Highlights for the most favorable scenario include:

- PFS estimates are based on estimated capital and operating costs for a uranium

mine, utilizing both conventional open pit and underground mining methods and

heap leach recovery, with a maximum annual capacity of 1.5 million lbs. U3O8

- The financial model is based on a long term uranium price of $65.00/lb. based

on historical average prices over the last three years, and supported by

published reports of securities analysts.

- Updated Probable Mineral Reserve of 7,453,000 tons at an average grade of

0.123% eU3O8, containing 18,365,000 lbs. eU3O8, compared to the originally

reported (April 12, 2010) 6,393,000 tons at an average grade of 0.111% eU3O8,

containing 14,186,000 lbs. eU3O8; an increase of 29.6% in Probable Mineral

Reserve over the previous PFS.

- Initial mine life: 15 years, compared to the originally reported 11 years.

- Open pit stripping ratio: 8.1 Bank Cubic Yards per pound mined.

- Estimated capital cost: $109 million including allowances for contingency and

risk, compared to the originally reported $118 million;

- Estimated operating cost: $32.31 per pound recovered, as compared to the

originally reported $28.67 per pound recovered;

- Estimated pre-tax Net Present Value (NPV) at a 7% discount rate: $201 million,

as compared to the originally reported $101 million;

- Estimated pre-tax Internal Rate of Return (IRR): 42%, as compared to the

originally reported 25%

- Estimated pre-tax payback period: 3 years, at a discount rate of 5%, as

compared to the originally reported 5 years at the same discount rate

Pre-tax NPV and IRR Sensitivities:

--------------------------------------------------------------------

Alternative 1 - Open Pit and Underground

--------------------------------------------------------------------

Common Start

--------------------------------------------------------------------

Selling Price (USD/pound)

--------------------------------------------------------------------

Discount Rate $60 $65 $70

--------------------------------------------------------------------

NPV 5% (Million $) $ 202 $ 249 $ 296

--------------------------------------------------------------------

NPV 7% (Million $) $ 161 $ 201 $ 240

--------------------------------------------------------------------

NPV 10% (Million $) $ 115 $ 146 $ 176

--------------------------------------------------------------------

Pre-Tax IRR 36% 42% 48%

--------------------------------------------------------------------

In summary, the primary changes in the updated PFS resulting in these much

improved economics are:

-- Use of a $65/lb. selling price rather than the $60/lb. price used

originally

-- Open pit pounds nearly doubled, based on the increased Probable Mineral

Reserve

-- Mine life was extended by 4 years with the expanded Probable Mineral

Reserve

-- Average grade for the project increased by 11%, from 0.111% to 0.123%

These results update an original Preliminary Feasibility Study prepared by BRS,

Inc. on April 8, 2010. An updated Preliminary Feasibility Study supporting these

results will be filed on SEDAR within 45 days of this release.

Douglas L. Beahm, PE, PG and Registered Member of the SME, Principal Engineer of

BRS, Inc. is an independent Qualified Person as defined by National Instrument

43-101 and has reviewed and approved the content of this press release.

About Energy Fuels: Energy Fuels Inc. is a uranium and vanadium mineral

development company. The Company recently acquired Titan Uranium Inc., including

the Sheep Mountain Project in the Crooks Gap District of Wyoming. The Company

also received a Final Radioactive Materials License from the State of Colorado

for the proposed Pinon Ridge Uranium and Vanadium Mill in March 2011. The mill

will be the first uranium mill constructed in the United States in over 30

years.

With about 61,000 acres of highly prospective uranium and vanadium properties

located in the states of Colorado, Utah, Arizona, Wyoming, and New Mexico, and

exploration properties in Saskatchewan's Athabasca Basin totaling approximately

32,000 additional acres, the Company has a full pipeline of additional

development prospects. Energy Fuels, through its wholly-owned subsidiaries,

Energy Fuels Resources Corporation, Titan Uranium Inc., and Magnum Uranium

Corp., has assembled this property portfolio along with a first class management

team, including highly skilled technical mining and milling professionals based

in Lakewood and Naturita, Colorado and Kanab, Utah.

This news release contains certain "Forward-Looking Statements" within the

meaning of Section 21E of the United States Securities Exchange Act of 1934, as

amended and "Forward Looking Information" within the meaning of applicable

Canadian securities legislation. All statements, other than statements of

historical fact, included herein are forward-looking statements and

forward-looking information that involve various risks and uncertainties. There

can be no assurance that such statements will prove to be accurate, and actual

results and future events could differ materially from those anticipated in such

statements. Important factors that could cause actual results to differ

materially from the Company's expectations are disclosed in the Company's

documents filed from time-to-time with the British Columbia, Alberta and Ontario

Securities Commissions.

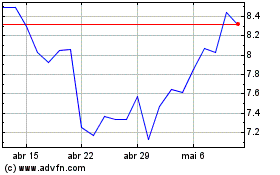

Energy Fuels (TSX:EFR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

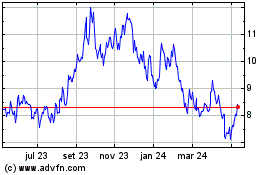

Energy Fuels (TSX:EFR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024