Energy Fuels' CEO Issues Update to Shareholders

03 Abril 2012 - 3:14PM

Marketwired Canada

Energy Fuels Inc. (TSX:EFR) ("Energy Fuels" or the "Company") today issued a

letter updating shareholders after the recent merger with Titan Uranium Inc. The

letter from CEO Stephen Antony is presented in its entirety below:

Dear Shareholders,

With the close of our recent merger with Titan Uranium, we felt this was the

ideal opportunity for Energy Fuels to welcome new shareholders from Titan and to

update our existing shareholders.

This merger marks Energy Fuels' entry into an exclusive club that includes the

largest uranium companies in the United States. In fact, the combined company's

new asset portfolio catapults Energy Fuels from 13th to 3rd among companies with

NI 43-101 compliant resources in the United States. Energy Fuels, as the

surviving company of the merger, will remain focused on developing and expanding

U.S. uranium and vanadium assets and building the first new U.S. uranium mill in

over 30 years. It is also important to note that 82% of the company's resources

are in four development stage projects that are either fully-permitted (the

Whirlwind and Energy Queen Mines) or in the midst of permitting (Sheep Mountain

and Sage Plain).

This strategic merger was clearly an important milestone for Energy Fuels, as it

nearly tripled the company's U.S. based measured and indicated uranium assets to

39.6 lbs. U3O8. This includes 18.4 million lbs. of mineral reserves. In

addition, the company was already one of the nation's largest holders of

vanadium resources at 34.8 million lbs. V2O5.(1)

Last month, a new Preliminary Feasibility Study (PFS) was completed on the Sheep

Mountain Project which Energy Fuels acquired in the merger. The PFS shows robust

project economics with Internal Rates of Return up to 42%. In addition, a

significant portion of the mineral reserve is accessible through open pit mining

techniques, resulting in competitive operating expenses of $32.31 per pound of

uranium.

The license to build the Pinon Ridge Mill was granted in 2011 and remains in

full force while we work with the State of Colorado to defend it from a legal

challenge by a non-governmental organization. Once built, the mill will be the

first uranium mill constructed in the United States in over 30 years. The mill

is being designed to recover both uranium and vanadium from the regions' many

uranium and vanadium mines. It is initially being permitted to process 500 tons

of ore per day, but is designed for expansion to 1,000 tons per day through a

future permitting effort, if market conditions warrant. The mill will utilize

state of the art technology to ensure that both the public and the environment

are protected. In addition, the commissioning of the mill and opening of local

mines will dramatically improve the economy of the area through the creation of

direct and indirect jobs. As a result, the project enjoys overwhelming support

from local communities.

With fully permitted mines, other key projects in permitting, a mill license,

and an experienced management team executing an aggressive western United States

consolidation program, Energy Fuels is well positioned to capitalize on the

resurgence of nuclear power around the World. The lessons of the Fukushima

disaster are being implemented and most nations have reiterated their commitment

to nuclear energy as a clean, affordable, and carbon-free source of base-load

electricity. In fact, according to the Nuclear Energy Institute, there are 65

nuclear reactors under construction around the World, 28 of which are in China,

10 in Russia, and 7 in India. And, in the last two months, the U.S. Nuclear

Regulatory Commission approved licenses to construct and operate two new nuclear

reactors in Georgia and two in South Carolina - the first approvals in the U.S.

in over 30 years. Energy Fuels believes the security of supply for uranium will

become very important for Americans and domestic production will be highly

valued.

Finally, Energy Fuels' merger with Titan brings the expertise of several key

players in the Uranium sector including: Sheldon Inwentash, a key figure in the

Canadian mining capital markets space; Richard Patricio, VP legal & Corporate

Affairs for Pinetree Capital and Mega Uranium; and Larry Goldberg, a chartered

accountant and former CFO for Pinetree Capital and Mega Uranium. These gentlemen

complement our already experienced and accomplished Board of Directors.

In closing, I wish to reiterate that Energy Fuels is making spectacular strides

in achieving our goal of becoming the pre-eminent American conventional uranium

producer. More information is available on Energy Fuels' website

(www.energyfuels.com).

Best regards,

Stephen P. Antony

President & Chief Executive Officer

(1) Indicated Mineral Resource at the Sheep Mountain Project of 12,895,000 tons

at an average grade of 0.12% eU3O8 (30,285,000 lbs. eU3O8). This figure includes

Probable Mineral Reserve of 7,453,000 tons at an average grade of 0.123% eU3O8

(18,365,000 lbs. eU3O8).

Measured & Indicated Mineral Resource on Energy Fuels' Colorado Plateau

properties of 1,951,486 tons at an average grade of 0.24% eU3O8and 0.89% V2O5

(9,371,821 lbs. eU3O8 and 34,862,116 lbs. V2O5).

About Energy Fuels: Energy Fuels Inc. is a uranium and vanadium mineral

development company. The Company recently acquired Titan Uranium Inc., including

the Sheep Mountain Project in the Crooks Gap District of Wyoming. The Company

also received a Final Radioactive Materials License from the State of Colorado

for the proposed Pinon Ridge Uranium and Vanadium Mill in March 2011. The mill

will be the first uranium mill constructed in the United States in over 30

years.

With about 61,000 acres of highly prospective uranium and vanadium properties

located in the states of Colorado, Utah, Arizona, Wyoming, and New Mexico, and

exploration properties in Saskatchewan's Athabasca Basin totaling approximately

32,000 additional acres, the Company has a full pipeline of additional

development prospects. Energy Fuels, through its wholly-owned subsidiaries,

Energy Fuels Resources Corporation, Titan Uranium Inc., and Magnum Uranium

Corp., has assembled this property portfolio along with a first class management

team, including highly skilled technical mining and milling professionals based

in Lakewood and Naturita, Colorado and Kanab, Utah.

This news release contains certain "Forward-Looking Statements" within the

meaning of Section 21E of the United States Securities Exchange Act of 1934, as

amended and "Forward Looking Information" within the meaning of applicable

Canadian securities legislation. All statements, other than statements of

historical fact, included herein are forward-looking statements and

forward-looking information that involve various risks and uncertainties. There

can be no assurance that such statements will prove to be accurate, and actual

results and future events could differ materially from those anticipated in such

statements. Important factors that could cause actual results to differ

materially from the Company's expectations are disclosed in the Company's

documents filed from time-to-time with the British Columbia, Alberta and Ontario

Securities Commissions.

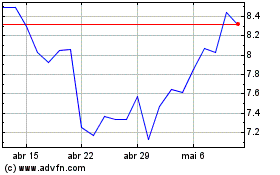

Energy Fuels (TSX:EFR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

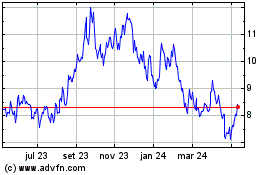

Energy Fuels (TSX:EFR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024