Energy Fuels Inc. and Denison Mines Corp. Execute Definitive Arrangement Agreement

24 Maio 2012 - 9:30AM

Marketwired Canada

NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED

STATES

Energy Fuels Inc. ("Energy Fuels") (TSX:EFR) and Denison Mines Corp. ("Denison")

(TSX:DML)(NYSE Amex:DNN)(NYSE MKT:DNN) are pleased to announce that the

companies have entered into a definitive arrangement agreement (the "Arrangement

Agreement") with respect to the previously announced transaction (the

"Transaction") whereby Energy Fuels will acquire all of the shares of the

subsidiaries holding Denison's U.S. mining assets and operations (the "US Mining

Division") as well as all of the inter-company debt between Denison and the US

Mining Division.

Pursuant to the Arrangement Agreement, Denison and Energy Fuels have agreed to

complete a plan of arrangement (the "Arrangement") in accordance with the

Business Corporations Act (Ontario). Under the Arrangement: (i) Denison will

transfer the US Mining Division and related inter-company debt to Energy Fuels

in exchange for a promissory note and a nominal amount of cash, (ii) Denison

will complete a reorganization of its capital which will include a distribution

of the promissory note to its common shareholders on a pro rata basis, and (iii)

Energy Fuels will repay the promissory note by issuing 425,441,494 of its common

shares to Denison's shareholders. Upon the completion of the Transaction,

Denison's shareholders will receive approximately 1.106 common shares of Energy

Fuels for each common share of Denison owned and will in aggregate own

approximately 66.5% of the issued and outstanding common shares of Energy Fuels.

The Arrangement Agreement contains customary covenants by both parties not to

solicit offers for competing transactions, a right to match any superior

proposal, as well as a reciprocal break fee of Cdn$3.0 million payable upon the

termination of the Arrangement Agreement in certain circumstances.

The completion of the Transaction is subject to satisfaction of certain

customary conditions, including but not limited to, Energy Fuels and Denison

shareholder approval, court and regulatory approvals including acceptance by the

Toronto Stock Exchange and the NYSE MKT exchange and the receipt of third party

approvals and consents. Korea Electric Power Corporation ("KEPCO") has

determined not to exercise its right of first opportunity provided for in the

strategic relationship agreement dated June 15, 2009 among Denison, KEPCO and a

subsidiary of KEPCO.

The shareholders of Energy Fuels and Denison will each be asked to approve the

Transaction at respective special shareholder meetings to be held in late June

2012.

All of the directors and officers of Energy Fuels who hold shares of Energy

Fuels, as well as three of Energy Fuels' other largest shareholders, have

entered into support agreements pursuant to which they have agreed to vote in

favour of the Transaction at Energy Fuels' shareholder meeting. All of the

directors and officers of Denison who hold shares of Denison, as well as two of

Denison's other shareholders, have entered into support agreements pursuant to

which they have agreed to vote in favour of the approval of the Arrangement. In

aggregate, holders of approximately 22.2% of the common shares of Energy Fuels

and approximately 10.7% of the common shares of Denison have entered into

support agreements.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain information contained in this news release, including any information

relating to the Arrangement Agreement and completion of the Transaction between

Energy Fuels and Denison and any other statements regarding Energy Fuels' and

Denison's future expectations, beliefs, goals or prospects constitute

forward-looking information within the meaning of applicable securities

legislation (collectively, "forward-looking statements"). All statements in this

news release that are not statements of historical fact (including statements

containing the words "expects", "does not expect", "plans", "anticipates", "does

not anticipate", "believes", "intends", "estimates", "estimates", "projects",

"potential", "scheduled", "forecast", "budget" and similar expressions) should

be considered forward-looking statements. All such forward-looking statements

are subject to important risk factors and uncertainties, many of which are

beyond Energy Fuels' and Denison's ability to control or predict. A number of

important factors could cause actual results or events to differ materially from

those indicated or implied by such forward-looking statements, including without

limitation: the parties' ability to consummate the Transaction, including the

receipt of shareholder approval, court approval or the regulatory approvals

required for the Transaction may not be obtained on the terms expected or on the

anticipated schedule; the parties' ability to meet expectations regarding the

timing, completion and accounting and tax treatments of the Transaction; the

volatility of the international marketplace; and other risk factors as described

in Energy Fuels' and Denison's most recent annual information forms and annual

and quarterly financial reports.

Energy Fuels and Denison assume no obligation to update the information in this

communication, except as otherwise required by law. Additional information

identifying risks and uncertainties is contained in Energy Fuels' and Denison's

respective filings with the various provincial securities commissions which are

available online at www.sedar.com. Forward-looking statements are provided for

the purpose of providing information about the current expectations, beliefs and

plans of the management of each of Energy Fuels and Denison relating to the

future. Readers are cautioned that such statements may not be appropriate for

other purposes. Readers are also cautioned not to place undue reliance on these

forward-looking statements, that speak only as of the date hereof.

This news release and the information contained herein does not constitute an

offer of securities for sale in the United Sates. The securities have not been

and will not be registered under the United States Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent registration

or an applicable exemption from such registration requirements.

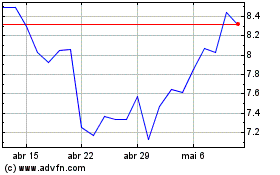

Energy Fuels (TSX:EFR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

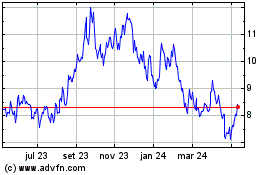

Energy Fuels (TSX:EFR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024