Energy Fuels Inc. (TSX:EFR) ("Energy Fuels" or the "Company") today reported its

financial results for the three and nine months ended June 30, 2013. The

Company's Quarterly Consolidated Financial Statements, along with Management's

Discussion and Analysis, have been filed on the System for Electronic Document

Analysis and Retrieval ("SEDAR") and may be viewed at www.sedar.com. Unless

noted otherwise, all dollar amounts are in US dollars.

Selected Summary Financial Information

----------------------------------------------------------------------------

As at As at

June 30, September 30,

$000's 2013 2012

----------------------------------------------------------------------------

Financial Position:

Working Capital $ 33,785 $ 41,934

Property, plant and equipment $ 127,494 $ 119,524

Total assets $ 207,729 $ 223,844

Total long-term liabilities $ 34,060 $ 37,921

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three months Nine months

ended ended

June 30, June 30,

$000, except per share data 2013 2013

----------------------------------------------------------------------------

Results of Operations:

Total revenues $ 4,954 $ 47,968

Net Income (loss) $ (5,532) $ (13,478)

Basic & diluted net income (loss per share) $ (0.01) $ (0.02)

----------------------------------------------------------------------------

Financial and Operational Highlights for the Quarter-ended June 30, 2013

("Q3-2013"):

-- Sold 50,000 pounds of U3O8, all of which was pursuant to term contracts

at an average realized price of $58.75 per pound.

-- Sold 315,000 pounds of V2O5 at an average realized price of $6.21 per

pound.

-- Production at the White Mesa Mill totaled 511,000 pounds of U3O8 and

490,000 pounds of V2O5. U3O8 production included 95,000 pounds of U3O8

from alternate feed materials and 416,000 pounds of U3O8 from

conventional ore, primarily from the Company's Beaver, Pandora, Arizona

1 and Daneros mines.

-- As of June 30, 2013, the Company had working capital of $33.8 million,

including cash and cash equivalents of $7.9 million, marketable

securities of $0.2 million and 502,000 pounds of uranium concentrate

inventory which, based on spot market prices as of June 30, 2013, had a

market value of $19.9 million.

-- On June 11, 2013, Energy Fuels and Strathmore Minerals Corp.

("Strathmore") entered into a definitive arrangement agreement whereby

Energy Fuels will acquire by way of a plan of arrangement in accordance

with the Business Corporations Act (British Columbia) all of the issued

and outstanding shares of Strathmore (the "Transaction"). The

Transaction is expected to create value for both companies' shareholders

as a result of significant operating synergies as outlined in the May

24, 2013 joint press release. Korea Electric Power Corporation

("KEPCO"), the largest shareholder of both Energy Fuels and Strathmore,

has signed support agreements agreeing to vote their shares of both

companies in favour of the Transaction. The shareholders of Energy Fuels

approved the Transaction at a special meeting held on August 13, 2013.

The shareholders of Strathmore will be asked to approve the Transaction

at a special meeting to be held on August 20, 2013.

-- On June 13, 2013, the Company announced the completion of a Cdn$6.6

million bought deal private placement. A total of 47,380,791 units were

issued at a price of Cdn$0.14 per unit. After strong investor interest,

the offering was increased from the previously announced maximum of

Cdn$5.8 million. Each unit consists of one common share of the Company

and one-half of one common share purchase warrant, entitling the holder

thereof to acquire one common share of the Company at a price of

Cdn$0.19 at any time until June 15, 2015.

Energy Fuels Outlook for the Fiscal Year Ended September 30, 2013 ("FY-2013")

Energy Fuels continues to pursue its corporate strategy which balances prudent,

measured operations during the current uranium price environment, while

concurrently positioning the Company to realize the economic benefits of

anticipated improvements in the price of uranium through select development

expenditures and care and maintenance activities. Energy Fuels believes the

long-term uranium market outlook remains positive (as outlined below in Market

Outlook for FY-2013) and is supported by strong supply and demand fundamentals

within the sector. However, the Company believes that near- to medium- term

uncertainty in the market could lead to continued sluggishness in uranium

prices.

Energy Fuels remains focused on its relatively lower cost sources of production

from its Arizona Strip mines and alternate feed materials. These production

sources, along with the Company's existing uranium concentrate inventories, will

provide Energy Fuels with the U3O8 required for near-term deliveries pursuant to

its term contracts. By doing so, the Company aims to maximize its realized sales

price per pound of U3O8 and minimize its marginal cash cost of production.

During the quarter-ended March 31, 2013, the Company determined that it could

realize production efficiencies by milling its entire stockpile of conventional

ore during Q3-2013, and therefore the Company completed the processing of

essentially all stockpiled ore in June 2013. The Company's stockpile of

conventional ore is currently being replenished with mined ore from its Arizona

1 and Pinenut mines (Pinenut commenced production in July 2013), and the Company

currently expects to resume conventional ore processing during the second half

of FY-2014. The processing of alternate feed materials is currently expected to

continue through the remainder of FY-2013 and into the fiscal year ended

September 30, 2014 ("FY 2014"). Mining activities are expected to continue on

the Arizona Strip at the Arizona 1 and Pinenut mines for the remainder of

FY-2013 and into FY-2014.

Energy Fuels expects improvements in the uranium price over the medium to

long-term and is maintaining, and selectively growing, its asset base in a

manner that positions the Company to realize the associated economic benefits of

a higher uranium price. At the same time, the Company is regularly monitoring

market conditions and adjusting growth plans accordingly. Consistent with this

strategy, Energy Fuels expects to complete the acquisition of Strathmore on

August 28th, 2013. Energy Fuels believes the Transaction will result in

significant value creation for the shareholders of both companies, through

numerous synergies between the companies' assets in the Colorado Plateau

district and in Wyoming. In addition, the Transaction offers the Company the

opportunity to further its relationship with KEPCO, including the appointment of

a director, nominated by KEPCO, to join Energy Fuels' board of directors. Energy

Fuels believes that KEPCO is a global leader in the nuclear power sector.

Following the closing of the Transaction, Energy Fuels also looks forward to

working with Sumitomo Corporation of Japan, Strathmore's joint venture partner

at the Roca Honda uranium project ("Roca Honda") in New Mexico. Roca Honda is

one of the largest and highest grade uranium development projects in the US.

Energy Fuels believes that operational synergies can be realized by utilizing

Energy Fuels' White Mesa Mill to process ore from Roca Honda, thereby negating

the need to permit and develop a new uranium mill in New Mexico.

Development of the Canyon mine in Arizona continued through Q3-2013. Permitting

at the Sheep Mountain Project also continued through Q3-2013, advancing a second

potential major production center for the Company. Following the closing of the

acquisition of Strathmore, Energy Fuels will evaluate the co-development of

Sheep Mountain in conjunction with Strathmore's Gas Hills and Juniper Ridge

uranium projects in Wyoming. Energy Fuels is confident that operational

synergies can be realized through this co-development strategy. The Company is

also pursuing potential new supplies of alternate feed materials for the White

Mesa Mill (which carry no mining costs), and will continue to evaluate

additional toll milling and/or ore purchase agreements with third-parties who

own uranium properties within trucking distance of the White Mesa Mill. Energy

Fuels will also continue to evaluate growth through accretive acquisitions.

As outlined below, Energy Fuels provides the following updated outlook for

FY-2013 and provides the following outlook for uranium sales and production for

the quarter-ended September 30, 2013 ("Q4-2013"):

-- FY-2013 Sales: As previously announced, the Company expects to sell

997,000 pounds of U3O8 during FY-2013, of which 957,000 pounds is

expected to be sold under term contracts and the

remainder sold into the spot market. Vanadium sales are estimated to be

1,537,000 pounds of V2O5, or equivalent in the form of ferrovanadium,

during FY-2013.

-- Q4-2013 Sales: The Company expects to sell 257,000 pounds U3O8 during

Q4-2013, all of which will be sold pursuant to term contracts.

-- FY-2013 Production: The Company expects to produce approximately

1,150,000 pounds of U3O8 during FY-2013, from both conventional ore and

alternate feed sources. Conventional ore production includes ore mined

from the Beaver, Pandora, Arizona 1 and Daneros mines. Given the

processing of

Beaver and Pandora ores, Energy Fuels also anticipates production of

1,537,000 pounds of V2O5 in FY-2013.

-- Q4-2013 Production: The Company expects to produce 125,000 pounds of

U3O8 during Q4-2013, sourced from alternate feed materials.

-- FY-2013 Mining Activities: As previously announced, mining on the

Arizona Strip is expected to continue during FY-2013 at the Arizona 1

and Pinenut mines. Effective October 17, 2012, the Company placed the

Daneros and Beaver mines on standby. In addition, the Pandora mine was

placed on standby in December 2012.

-- FY-2013 Project Development: Energy Fuels plans to selectively invest in

high priority development projects and maintain general permitting and

exploration activities during FY-2013. During Q3-2013, the Company

continued development of the Canyon mine in Arizona. The Company

anticipates development expenditures at the Canyon mine to be $3.9

million to $4.4 million during FY-2013. In addition, Energy Fuels

continued permitting activities at the Sheep Mountain Project in Wyoming

during Q3-2013, at an anticipated cost of approximately $1.1 million

during FY-2013. The Company expects other permitting and exploration

expenditures to be approximately $1.8 million for FY-2013.

Market Outlook for FY-2013

Near- to medium-term uncertainty continues to lead to sluggishness in the

uranium market. However, despite low contract volumes, uranium prices were

relatively stable during Q3-2013. According to price data from TradeTech, the

uranium term price remained at $57.00/lb., while the spot price of uranium

dropped $2.70/lb. from $42.25/lb. at the end of the prior quarter, to close on

June 30 at $39.55/lb. Although the spot price dropped to $35.00/lb on July 31,

it has since rebounded to $35.75 as of August 9, 2013. TradeTech's long-term

price indicator dropped from $57.00/lb to $54.00/lb during that same period. The

continued shutdown of Japanese reactors and the resulting build-up in

inventories and lack of demand are largely responsible for this continued market

sluggishness. The anticipated restart of those reactors is expected to be an

important catalyst to the market.

In spite of the near- to medium-term uncertainty in the market, long-term demand

fundamentals within the uranium sector remain strong. China, Russia, India,

South Korea, the U.S., the UAE and Brazil continue to construct nuclear power

plants. The World Nuclear Association reports that there are now 68 nuclear

reactors under construction, an increase of 2 units from the prior quarter, and

478 nuclear reactors planned or proposed. The 68 reactors under construction

will require about 100 million lbs. of U3O8 for initial cores and an additional

35 million lbs. of U3O8 annually, once they are generating. China and India plan

to begin operation at eight nuclear reactors this year.

Although long-term fundamentals continue to be strong, Energy Fuels believes

near-to medium- term uncertainty could continue to lead to sluggishness in the

market, particularly during the summer months, when market activity is typically

low. However, despite the challenging industry environment, Energy Fuels

believes it is well positioned to execute the Company's business plan, and to be

able to respond rapidly and aggressively to improved uranium prices.

Stephen P. Antony, P.E., President & CEO of Energy Fuels, is a Qualified Person

as defined by National Instrument 43-101 and has reviewed and approved the

technical disclosure contained in this document.

About Energy Fuels: Energy Fuels is America's largest conventional uranium

producer, supplying approximately 25% of the uranium produced in the U.S., and

is also a significant producer of vanadium. The Company operates the White Mesa

Mill, which is the only conventional uranium mill currently operating in the

U.S., capable of processing 2,000 tons per day of uranium ore. Energy Fuels has

projects located throughout the Western U.S., including producing mines and

mineral properties in various stages of permitting and development.

This news release contains certain "Forward-Looking Statements" within the

meaning of Section 21E of the United States Securities Exchange Act of 1934, as

amended and "Forward Looking Information" within the meaning of applicable

Canadian securities legislation, which may include, but is not limited to,

statements with respect to the future financial or operating performance of the

Company and its projects. Generally, these forward-looking statements can be

identified by the use of forward-looking terminology such as "plans", "expects"

"does not expect", "is expected", "is likely", "budget" "scheduled",

"estimates", "forecasts", "intends", "anticipates", "does not anticipate", or

"believes", or variations of such words and phrases, or state that certain

actions, events or results "may", "could", "would", "might" or "will be taken",

"occur", "be achieved" or "have the potential to". All statements, other than

statements of historical fact, included herein are generally considered to be

forward-looking statements. Forward-looking statements involve known and unknown

risks, uncertainties and other factors which may cause the actual results,

performance or achievements of the Company to be materially different from any

future results, performance or achievements express or implied by the

forward-looking statements. Factors that could cause actual results to differ

materially from those anticipated in these forward-looking statements are

described under the caption "Risk Factors" in the Company's Annual Information

Form dated December 20, 2012, which is available for view on the System for

Electronic Document Analysis and Retrieval at www.sedar.com. Forward-looking

statements contained herein are made as of the date of this news release and the

Company disclaims, other than as required by law, any obligation to update any

forward-looking statements whether as a result of new information, results,

future events, circumstances, or if management's estimates or opinions should

change, or otherwise. There can be no assurance that forward-looking statements

will prove to be accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking statements.

FOR FURTHER INFORMATION PLEASE CONTACT:

Energy Fuels Inc.

Curtis Moore

Investor Relations

(303) 974-2140 or Toll free: 1-888-864-2125

investorinfo@energyfuels.com

www.energyfuels.com

Energy Fuels (TSX:EFR)

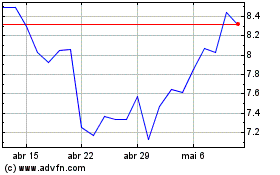

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

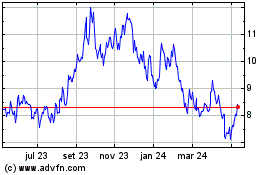

Energy Fuels (TSX:EFR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024