Energy Fuels Enters Into Strategic Relationship Agreement With KEPCO

17 Dezembro 2013 - 6:05PM

Marketwired Canada

Energy Fuels Inc. (NYSE MKT:UUUU)(TSX:EFR) ("Energy Fuels" or the "Company") is

pleased to announce that it has entered into a Strategic Relationship Agreement

(the "SRA") with Korea Electric Power Corporation ("KEPCO"). KEPCO

(NYSE:KEP)(KRX:015760) is the largest electric utility in South Korea,

responsible for 93% of South Korea's electricity generation and the development

of nuclear power projects worldwide. The South Korean government owns a 51%

equity interest in KEPCO. On the 2013 Fortune Global 500 ranking of the world's

largest companies, KEPCO was ranked 235. KEPCO is also a member of the World

Energy Council, the World Nuclear Association and the World Association of

Nuclear Operators. KEPCO is Energy Fuels' largest shareholder, and an affiliate

of KEPCO is Energy Fuels' largest uranium customer, based on FY-2013 deliveries.

Mr. Eun Ho Cheong, KEPCO's Vice President of Overseas Resources Project

Development, is a member of Energy Fuels' board of directors.

The key objectives of the SRA are to establish a long term and strategic

collaborative business relationship and to promote the development of each

company's business. The SRA addresses a number of areas of interest for both

Energy Fuels and KEPCO, including the development of Energy Fuels' Wyoming

projects, KEPCO's seat on the board of directors of Energy Fuels, visitation and

secondment opportunities for KEPCO, and future qualified bidding by Energy Fuels

on uranium concentrate supply contracts for KEPCO and its affiliates.

Within the SRA, Energy Fuels and KEPCO have agreed to cooperate in the

evaluation of a joint development strategy with respect to Energy Fuels' Sheep

Mountain, Gas Hills and/or Juniper Ridge Projects in Wyoming (the "Wyoming

Projects"). As previously announced, Energy Fuels is currently evaluating the

co-development of its Wyoming Projects and is targeting the development of a 2nd

major uranium production center for the Company in the State of Wyoming. Taken

together, these three projects contain approximately 19.3 million tons of

Measured and Indicated Mineral Resources with average grades that range from

0.06% to 0.13% U3O8 containing 40.9 million lbs. of U3O8. Included in these

resource estimates, the Sheep Mountain Project has approximately 7.4 million

tons of Probable Mineral Reserves with an average grade of 0.123% U3O8,

containing 18.4 million lbs. of U3O8. In March 2012, Energy Fuels completed a

Prefeasibility Study ("PFS") for the Sheep Mountain Project only. Under the base

case scenario, the project demonstrated attractive project economics based on a

U3O8 price of US$65 per lb., including 1.5 million lbs. of annual U3O8

production, US$32.31 per lb. operating costs, 42% internal rate of return, and

US$201 million net present value. The Company believes the project economics for

the Sheep Mountain Project may be enhanced by co-developing it with the Gas

Hills and/or Juniper Ridge Projects. The PFS for the Sheep Mountain Project is

filed under Energy Fuels' SEDAR profile. As previously announced, KEPCO was a

party to a strategic venture arrangement with Strathmore Minerals Corp.

("Strathmore") in connection with the development of the Gas Hills Project in

Wyoming. On August 30, 2013, Energy Fuels acquired all of the issued and

outstanding shares of Strathmore by way of a plan of arrangement.

"Entering into this Strategic Relationship Agreement further solidifies Energy

Fuels' close relationship with KEPCO," stated Stephen P. Antony, President and

CEO of Energy Fuels. "I believe that KEPCO is a world-class strategic partner

who recognizes the quality, uniqueness and scalability of Energy Fuels' asset

base. Strengthening our relationship with KEPCO and realizing the benefits of

co-developing our uranium projects in Wyoming were important synergies that

Energy Fuels identified in its acquisition of Strathmore. I believe this

Strategic Relationship Agreement is an important first step towards achieving

those synergies."

Stephen P. Antony, P.E., President & CEO of Energy Fuels, is a Qualified Person

as defined by National Instrument 43-101 and has reviewed and approved the

technical disclosure contained in this news release.

About Energy Fuels

Energy Fuels is currently America's largest conventional uranium producer,

supplying approximately 25% of the uranium produced in the United States. Energy

Fuels operates the White Mesa Mill, which is the only conventional uranium mill

currently operating in the U.S. The mill is capable of processing 2,000 tons per

day of uranium ore and has a licensed capacity of over 8 million lbs. of U3O8

per year. Energy Fuels has projects located throughout the Western U.S.,

including producing mines and mineral properties in various stages of permitting

and development. The Company's common shares are listed on the Toronto Stock

Exchange under the trading symbol "EFR" and on the NYSE MKT under the trading

symbol "UUUU".

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain "Forward-Looking Information" and

"Forward-Looking Statements" within the meaning of applicable Canadian and

United States securities legislation, which may include, but is not limited to,

statements with respect to the future financial or operating performance of the

Company and its projects, the objectives of the SRA, the possibility of

establishing a joint development strategy on the Wyoming Projects with KEPCO,

the possibility of developing a 2nd production center in Wyoming, and the

completion of feasibility studies, economic assessments and mineral resource

estimates. Generally, these forward-looking statements can be identified by the

use of forward-looking terminology such as "promote", "expects" "does not

expect", "is expected", "estimates", "anticipates", "does not anticipate", or

"believes", or variations of such words and phrases, or state that certain

actions, events or results "may", "could", or "will be taken", "be achieved" or

"have the potential to". All statements, other than statements of historical

fact, herein are considered to be forward-looking statements. Forward-looking

statements involve known and unknown risks, uncertainties and other factors

which may cause the actual results, performance or achievements of the Company

to be materially different from any future results, performance or achievements

express or implied by the forward-looking statements. Factors that could cause

actual results to differ materially from those anticipated in these

forward-looking statements are described under the caption "Risk Factors" in the

Company's Annual Information Form dated December 20, 2012, which is available

for review on the System for Electronic Document Analysis and Retrieval at

www.sedar.com. Forward-looking statements contained herein are made as of the

date of this news release, and the Company disclaims, other than as required by

law, any obligation to update any forward-looking statements whether as a result

of new information, results, future events, circumstances, or if management's

estimates or opinions should change, or otherwise. There can be no assurance

that forward-looking statements will prove to be accurate, as actual results and

future events could differ materially from those anticipated in such statements.

Accordingly, the reader is cautioned not to place undue reliance on

forward-looking statements.

Cautionary Note to US Investors Concerning Estimates of Measured and Indicated

Resources and Probable Mineral Reserves

While the terms "measured mineral resource," "indicated mineral resource", and

"probable mineral reserves" are recognized and required by Canadian regulations,

they are not defined terms under standards in the United States and normally are

not permitted to be used in reports and registration statements filed with the

United States Securities and Exchange Commission (the "SEC"). As such,

information contained in this news release concerning descriptions of

mineralization and resources under Canadian standards may not be comparable to

similar information made public by U.S. companies in SEC filings. With respect

to "indicated mineral resource" there is a great amount of uncertainty as to

their existence and a great uncertainty as to their economic and legal

feasibility. It cannot be assumed that all or any part of an "indicated mineral

resource" will ever be upgraded to a higher category. Investors are cautioned

not to assume that any part or all of mineral deposits in these categories will

ever be converted into reserves.

FOR FURTHER INFORMATION PLEASE CONTACT:

Energy Fuels Inc.

Curtis H. Moore

Investor Relations

(303) 974-2140 or Toll Free: 1-888-864-2125

investorinfo@energyfuels.com

www.energyfuels.com

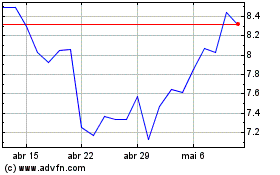

Energy Fuels (TSX:EFR)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

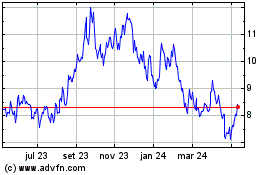

Energy Fuels (TSX:EFR)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024