Energy Income Fund Applies to OSC for Cease Trade Order Against Dissident Unitholders

30 Janeiro 2012 - 2:21AM

PR Newswire (Canada)

ENI.UN TORONTO, Jan. 30, 2012 /CNW/ - Crown Hill Capital

Corporation (the "Trustee"), manager and trustee of Energy Income

Fund (the "Fund") announced today that the Fund has filed an

application with the Ontario Securities Commission ("OSC" ) under

section 104 of the Securities Act to address the trading undertaken

in the units of the Fund by a group of dissident unitholders

apparently guided by CIBC Wood Gundy prior to the dissidents

delivering a requisition to hold a unitholder meeting. The Trustee

announced last week that it had concluded that the requisition is

not valid. Trading records show that the dissident unitholder group

acquired nearly its entire announced position of 1.85 million units

since October 25, 2011 for the apparent purpose of requisitioning a

meeting. While acquiring this position, the dissident group did not

disclose it had acquired more than 20% of the Fund's units, well

above the required limit for disclosure. The dissident unitholders

requested a unitholder meeting for the stated purpose of holding a

vote to appoint a new manager and trustee to pursue an undisclosed

agenda. "Our intention is to protect our unitholders from the

apparent unfair and illegal actions of this small group of

dissidents," said Wayne Pushka, President and Chief Executive

Officer of Crown Hill Capital Corporation. "We have applied to the

Ontario Securities Commission on behalf of all unitholders and in

the public interest." The respondents named in the application

include CIBC Wood Gundy, a number of individuals including one of

CIBC Wood Gundy's advisors, Wayne McNeill, and apparent members of

his family, among others (the "individual respondents"). The

Trustee has asked the OSC to determine whether: -- The individual

respondents acted jointly or in concert in acquiring the Fund units

and requisitioning the meeting which would mean they repeatedly

breached the takeover provisions of the Securities Act; -- The

individual respondents failed to comply with the early warning

disclosure requirements of Part XX of the Act; -- While in a

special relationship with the Fund, the individual respondents

traded units when they possessed material information that was not

generally disclosed to the public, contrary to section 76 of the

Act, and; -- The OSC should exercise its public interest

jurisdiction to prevent the individual respondents from taking

advantage of their breaches of Ontario securities laws which, if

permitted, would cause serious damage to the Fund, would be

unfairly prejudicial to, and abusive of, the other unitholders of

the Fund who sold their units to the individual respondents without

knowledge of the proposed takeover, and would be contrary to the

public interest. Specifically, the Trustee is seeking OSC orders:

-- Declaring that the individual respondents have not complied with

the requirements of Part XX of the Act; -- Declaring that the

individual respondents have traded in the units of the Fund,

contrary to section 76 of the Act; -- Cease trading the securities

of the Fund held by the respondents; -- Removing the exemptions

available under Ontario Securities law from the respondents, and;

-- Restraining the respondents from providing a notice of meeting,

proxy circular, or any other form of proxy solicitation to

unitholders of the Fund. The Trustee does not intend to comment

further on this matter while its application is before the Ontario

Securities Commission. Certain statements contained in this news

release constitute forward-looking information within the meaning

of Canadian securities laws. Forward-looking information may relate

to matters disclosed in this press release and to other matters

identified in public filings relating to the Fund, to the future

outlook of the Fund and anticipated events or results and may

include statements regarding the future financial performance of

the Fund. In some cases, forward-looking information can be

identified by terms such as "may", "will", "should", "expect",

"plan", "anticipate", "believe", "intend", "estimate", "predict",

"potential", "continue" or other similar expressions concerning

matters that are not historical facts. Actual results may vary from

such forward-looking information. Energy Income Fund CONTACT: For

further information, please contact Investor Relations

at416.361.9673 or toll-free at 1.877.261.9674. For media, please

contactJohn Lute, Lute & Company, at 416.929.5883.

Copyright

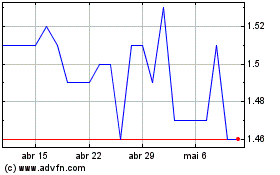

Energy Income (TSX:ENI.UN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Energy Income (TSX:ENI.UN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024