Crown Hill Capital Corporation announces merger of Citadel SMaRT Fund with Energy Income Fund

13 Fevereiro 2012 - 5:05PM

PR Newswire (Canada)

CRT.UN & ENI.UN TORONTO, Feb. 15, 2012 /CNW/ - Crown Hill

Capital Corporation ("Crown Hill"), the administrative agent of

Citadel SMaRT Fund (the "Smart Fund") and the manager of Energy

Income Fund (the "Energy Fund", and together with the Smart Fund,

the "Funds") is pleased to announce that, subject to regulatory and

other approvals, Smart Fund will merge (the "Merger") into Energy

Fund on March 23, 2012 (the "Effective Date"). The Merger will be

effected in accordance with the "permitted merger" provisions set

out in Smart Fund's declaration of trust made as of July 19, 2001

and amended and restated as of October 12, 2005. The Merger will be

effected using an exchange ratio calculated as the net asset value

per unit of Citadel SMaRT Fund divided by the net asset value per

unit of Energy Income Fund, each determined as at the close of

trading on the Toronto Stock Exchange ("TSX") on the business day

immediately prior to the Effective Date (the "Exchange Ratio"). The

TSX requires unitholder approval for the Merger, unless an

exemption is applicable, as a condition of acceptance of the

transaction since the units of Energy Income Fund issuable pursuant

to the Merger would represent greater than 25% of the outstanding

units of Energy Income Fund. The rules of the TSX contain an

exemption from the requirement to obtain unitholder approval if the

Independent Review Committees of both the continuing fund and

terminating fund have approved the transaction, the manager of the

continuing fund has determined that the acquisition is consistent

its investment objectives and the number of securities issued or

made issuable by the continuing fund is less than 100% of the

number of securities of the continuing fund issued and outstanding

on a non-diluted basis. The Independent Review Committees of the

Smart Fund and the Energy Fund have approved the Merger and Crown

Hill, in its capacity as manager of the Energy Fund, has determined

that the Merger is consistent with the investment objectives of the

Energy Fund. ENI currently has 8,287,520 units issued and

outstanding. ENI expects to issue approximately 3,829,821

additional units pursuant to the acquisition representing

approximately 46% of the number of ENI units currently issued and

outstanding (or approximately 33% of ENI units on a fully diluted

basis). Investors in Smart Fund will not experience any change in

the total management and advisory fees paid as a result of the

Merger. The Funds will bear none of the costs and expenses of

the Merger. Prior to the Merger, Smart Fund will provide

unitholders who do not wish to become unitholders of Energy Fund

with a redemption right ("Cash Alternative") to have their units

redeemed for an amount in cash equal to 100% of the net asset value

per unit determined on the close of business on March 22, 2012 (the

"Redemption Date"). In order to receive the Cash Alternative,

unitholders of Smart Fund must ensure that their request for

redemption of units is received by no later than the close of

business on March 15, 2012. Please note that if you exercise the

right to receive the Cash Alternative you are not obliged to

exercise such right in respect of all units that you own. Payment

in respect of the Cash Alternative will be made as soon as

practically possible and in any event no later than March 28, 2012.

Unitholders of Smart Fund who do not exercise the right to receive

the Cash Alternative will receive units of Energy Fund in exchange

for their units of Smart Fund. Crown Hill will issue a press

release on March 22, 2012 setting out the exact Exchange Ratio.

Crown Hill believes that the Merger, which is expected to be

implemented on a taxable basis will provide investors with enhanced

liquidity and a lower management expense ratio. In addition,

the Manager believes that the investment strategy and restrictions

in Energy Fund are more appropriate in the current environment and

are more robust for dealing with future changes than that of Smart

Fund and that the investment advisor for the Energy Fund has more

experience investing in the energy sector. Certain statements

contained in this press release may include forward-looking

information with respect to the Fund's operations and future

financial results. Such statements are based on current

expectations, are subject to a number of uncertainties and risks,

and actual results may differ materially from those contained in

such statements. Further information can be found in the

disclosure documents filed by the Fund at www.sedar.com. Citadel

SMaRT Fund CONTACT: Investor Relations department at 416.361.9673

or toll-free at1.877.261.9674.

Copyright

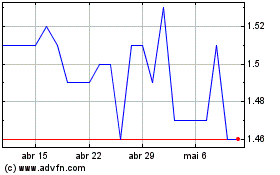

Energy Income (TSX:ENI.UN)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Energy Income (TSX:ENI.UN)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024