Attention Business/Financial Editors:

Evertz Technologies Limited (TSX:ET), a global leader in video

infrastructure solutions for production, playout and delivery

systems for television broadcasters, telecom and multi-system

operators, today reported its results for the fourth quarter and

year ended April 30, 2013.

Fiscal 2013 Highlights

-- Record annual revenue of $316.3 million, an 8% increase over prior year

-- Fully diluted earnings per share of $0.88, an increase of 9% as compared

to $0.81 a year ago

-- Continued growth in R&D with a gross investment of $52.9 million

-- Cash and instruments held for trading increased to over $220 million

-- Quarterly dividend increased to $0.16 per share during the year

-- Continued expansion through the completion of a selective acquisition

and the opening of North American and International sales offices

Selected Financial Information

Consolidated Statement of Earnings Data

(in thousands of dollars, except per share amounts)

Q4'13 YE'13 Q4'12 YE'12

------------------------------------------

Revenue $ 65,415 $ 316,305 $ 76,340 $ 293,400

Gross Margin 37,079 181,866 42,783 166,168

Earnings from operations 10,522 86,758 17,474 80,276

Net earnings 8,133 65,163 13,490 59,956

Fully-diluted earnings per

share $ 0.11 $ 0.88 $ 0.18 $ 0.81

Selected Financial Information

Consolidated Balance Sheet Data

(in thousands of dollars)

YE'13 YE'12

--------------------

Cash and instruments held for

trading $ 220,668 $ 185,669

Working capital 352,164 325,677

Total assets 465,307 431,864

Shareholders' equity 406,797 378,417

Revenue

For the quarter ended April 30, 2013, revenues were $65.4

million as compared to revenues of $76.3 million for the quarter

ended April 30, 2012. For the quarter, revenues in the United

States/Canada region were $33.3 million, a decrease of $3.3 million

or 9.1% when compared to the same quarter last year. The

International region had revenues of $32.1 million, as compared to

$39.6 million in the same quarter last year.

For the year ended April 30, 2013, sales were $316.3 million, an

increase of $22.9 million or 7.8% as compared to sales of $293.4

million for the prior year. The United States/Canada region

increased by $23.3 million or 15.6% when compared to the prior

year, and the International region was consistent at $143.1 million

compared to $143.5 million in the prior year.

Gross Margin

For the quarter ended April 30, 2013 gross margin was $37.1

million compared to $42.8 million in the same quarter last year.

Gross margin percentage was approximately 56.7%, up from 56.0% in

the quarter ended April 30, 2012.

For the year ended April 30, 2013, gross margin was $181.9

million as compared to $166.2 million for the year ended April 30,

2012. Gross margin percentage was approximately 57.5% for the year

ended April 30, 2013 up when compared to 56.6% for the prior

year.

Earnings

For the quarter ended April 30, 2013 net earnings were $8.1

million as compared to $13.5 million in the corresponding period

last year.

For the year ended April 30, 2013, net earnings were $65.2

million as compared to $60.0 million in the corresponding period

last year.

For the quarter ended April 30, 2013, earnings per share on a

fully-diluted basis were $0.11 as compared to $0.18 in the same

period in 2012.

For the year ended April 30, 2013, earnings per share on a

fully-diluted basis were $0.88 as compared to $0.81 in the same

period in 2012.

Operating Expenses

For the quarter ended April 30, 2013 selling and administrative

expenses were $14.0 million compared to $12.3 million for the

quarter ended April 30, 2012.

For the year ended April 30, 2013, selling and administrative

expenses were $53.1 million compared to $47.1 million for the year

ended April 30, 2012.

For the quarter ended April 30, 2013 gross research and

development expenses increased by $2.6 million or 20.1% as compared

to the corresponding period in 2012. Gross research and development

expenses represented approximately 23.5% of revenue for the quarter

ended April 30, 2013.

For the year ended April 30, 2013, gross research and

development expenses increased by 19.6% or $8.7 million as compared

to the prior year. Research and development expenses represented

approximately 16.7% of sales.

Liquidity and Capital Resources

The Company's working capital as at April 30, 2013 was $352.2

million as compared to $325.7 million on April 30, 2012.

Cash and instruments held for trading were $220.7 million as at

April 30, 2013 as compared to $185.7 million on April 30, 2012.

Cash provided by operations was $11.3 million for the quarter

ended April 30, 2013 as compared to $8.0 million for the quarter

ended April 30, 2012. Before taking into account taxes and the

changes in non-cash working capital, the Company generated $11.8

million from operations for the quarter ended April 30, 2013

compared to $18.2 million for the same period last year.

Cash provided by operations was $89.6 million for the 2013

fiscal year as compared to cash provided by operations of $66.6

million for the 2012 fiscal year. Before taking into account taxes

and the changes in non-cash working capital, the Company generated

$78.6 million from operations for fiscal 2013 as compared to $73.0

million for fiscal 2012.

The Company used $3.9 million in investing activities largely a

result of purchases in capital assets of $4.1 million during the

quarter ended April 30, 2013, compared to $1.6 million in capital

assets purchased for the quarter ended April 30, 2012.

The Company invested $3.8 million net of cash in a technology

based company and $11.0 million on the purchase of capital assets

for the year ended April 30, 2013, compared to $16.6 million in

capital assets purchased for the year ended April 30, 2012.

For the quarter ended April 30, 2013, the Company used cash in

financing activities of $11.4 million which was principally a

result of the payment of dividends of $11.8 million offset by the

issuance of capital stock of $0.6 million.

For the year ended April 30, 2013, the Company used cash in

financing activities of $40.1 million as a result of the payment of

dividends of $42.9 million, repurchase of capital stock costing

$4.2 million offset by the issuance of share capital of $8.0

million.

Shipments and Backlog

Purchase order backlog at the end of May 2013 was in excess of

$35 million and shipments during the month of May 2013 were $19

million.

Dividend Declared

Evertz Board of Directors declared a dividend on June 12, 2013

of $0.16 per share.

The dividend is payable to shareholders of record on June 21,

2013 and will be paid on or about June 28, 2013.

Selected Consolidated Financial Information

(Unaudited)

(in thousands of dollars, except earnings per share and share data)

---------------------------------------------------------------------------

Three month periods Twelve month periods

ended ended

April 30, April 30,

---------------------------------------------------------------------------

2013 2012 2013 2012

---------------------------------------------------------------------------

Revenue $ 65,415 $ 76,340 $ 316,305 $ 293,400

Cost of goods sold 28,336 33,557 134,439 127,232

---------------------------------------------------------------------------

Gross margin 37,079 42,783 181,866 166,168

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Gross margin % 56.7% 56.0% 57.5% 56.6%

---------------------------------------------------------------------------

Expenses

Selling and administrative 13,988 12,320 53,106 47,118

General 1,076 2,110 5,366 6,788

Research and development 15,349 12,782 52,851 44,200

Investment tax credits (3,609) (2,562) (13,178) (9,872)

Foreign exchange (gain) loss (247) 659 (3,037) (2,342)

---------------------------------------------------------------------------

26,557 25,309 95,108 85,892

---------------------------------------------------------------------------

10,522 17,474 86,758 80,276

Finance income 807 488 2,383 1,915

Finance costs (290) (55) (559) (197)

Other income and expenses (8) 403 264 (154)

---------------------------------------------------------------------------

Earnings before income taxes 11,031 18,310 88,846 81,840

---------------------------------------------------------------------------

Provision for income taxes

Current 2,536 3,865 21,816 21,669

Deferred 362 955 1,867 215

---------------------------------------------------------------------------

2,898 4,820 23,683 21,884

---------------------------------------------------------------------------

Net earnings for the period 8,133 13,490 65,163 59,956

---------------------------------------------------------------------------

Net earnings attributable to

non-controlling interest 23 110 573 416

---------------------------------------------------------------------------

Net earnings attributable to

shareholders 8,110 13,380 64,590 59,540

---------------------------------------------------------------------------

Net earnings for the period 8,133 13,490 65,163 59,956

---------------------------------------------------------------------------

Earnings per share

Basic $ 0.11 $ 0.19 $ 0.88 $ 0.81

Diluted $ 0.11 $ 0.18 $ 0.88 $ 0.81

---------------------------------------------------------------------------

Selected Consolidated Financial Information

(Unaudited)

(in thousands of dollars, except earnings per share and share data)

---------------------------------------------------------------------------

April 30, April 30, April 30,

2013 2012 2011

---------------------------------------------------------------------------

Assets

Current assets

Cash and cash equivalents $ 208,658 $ 173,665 $ 175,835

Instruments held for trading 12,010 12,004 16,190

Trade and other receivables 57,087 61,806 52,732

Inventories 111,619 109,211 106,422

Income tax receivable 7,233 11,695 2,014

---------------------------------------------------------------------------

$ 396,607 $ 368,381 $ 353,193

---------------------------------------------------------------------------

Assets held for sale $ 3,781 $ 3,781 $ -

---------------------------------------------------------------------------

Property, Plant and Equipment $ 46,637 $ 41,190 37,627

Goodwill 17,724 17,507 17,467

Intangible assets 558 1,005 2,224

---------------------------------------------------------------------------

$ 465,307 $ 431,864 $ 410,511

---------------------------------------------------------------------------

Liabilities

Current liabilities

Trade and other payables $ 36,237 $ 37,034 $ 21,814

Provisions 1,104 809 1,235

Deferred revenue 6,712 4,460 3,664

Current portion of long term debt 390 401 451

---------------------------------------------------------------------------

$ 44,443 $ 42,704 $ 27,164

Long term debt $ 1,539 $ 1,875 $ 2,493

Deferred taxes 9,590 7,331 7,095

---------------------------------------------------------------------------

$ 55,572 $ 51,910 $ 36,752

---------------------------------------------------------------------------

Equity

Capital stock $ 81,453 $ 67,458 $ 58,882

Share based payment reserve 10,727 14,320 13,762

Accumulated other comprehensive (loss)

income (1,063) (906) 440

Retained earnings 315,680 297,545 299,125

---------------------------------------------------------------------------

$ 314,617 $ 296,639 $ 299,565

Total equity attributable to shareholders 406,797 378,417 372,209

Non-controlling interest 2,938 1,537 1,550

---------------------------------------------------------------------------

409,735 379,954 373,759

---------------------------------------------------------------------------

$ 465,307 $ 431,864 $ 410,511

---------------------------------------------------------------------------

Forward-Looking Statements

The report contains forward-looking statements reflecting

Evertz's objectives, estimates and expectations. Such forward

looking statements use words such as "may", "will", "expect",

"believe", "anticipate", "plan", "intend", "project", "continue"

and other similar terminology of a forward-looking nature or

negatives of those terms.

Although management of the Company believes that the

expectations reflected in such forward-looking statements are

reasonable, all forward-looking statements address matters that

involve known and unknown risks, uncertainties and other factors.

Accordingly, there are or will be a number of significant factors

which could cause the Company's actual results, performance or

achievements, or industry results to be materially different from

any future results performance or achievements expressed or implied

by such forward-looking statements.

Conference Call

The Company will hold a conference call with financial analysts

to discuss the results on June 12, 2013 at 5:00 p.m. (EDT). Media

and other interested parties are invited to join the conference

call in listen-only mode. The conference call may be accessed by

dialing 1-416-849-6166 or toll-free (North America)

1-866-250-6267.

For those unable to listen to the live call, a rebroadcast will

also be available until July 11, 2013. The rebroadcast can be

accessed at 1-416-915-1035 or toll-free 1-866-245-6755. The pass

code for the rebroadcast is 672047.

About Evertz

Evertz Technologies Limited (TSX:ET) designs, manufactures and

markets video and audio infrastructure solutions for the

television, telecommunications and new-media industries. The

Company's solutions are purchased by content creators,

broadcasters, specialty channels and television service providers

to support their increasingly complex multi-channel digital and

high definition television ("HDTV") broadcast environments and by

telecommunications and new-media companies. The Company's products

allow its customers to generate additional revenue while reducing

costs through the more efficient signal routing, distribution,

monitoring and management of content as well as the automation of

previously manual processes.

Contacts: Evertz Technologies Limited Anthony Gridley Chief

Financial Officer (905) 335 7580ir@evertz.com

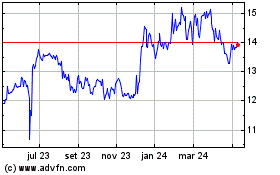

Evertz Technologies (TSX:ET)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

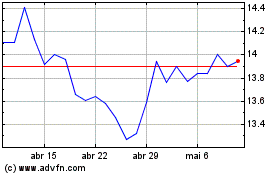

Evertz Technologies (TSX:ET)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024